Blank North Dakota Transfer-on-Death Deed Template

The North Dakota Transfer-on-Death Deed form is an essential tool for property owners who wish to ensure a smooth transition of their real estate to beneficiaries after their passing. This legal document allows individuals to transfer ownership of property without the need for probate, simplifying the process for heirs. By filling out this form, property owners can designate one or more beneficiaries who will automatically receive the property upon their death. Importantly, the deed does not affect the owner's rights during their lifetime; they can sell, mortgage, or otherwise manage the property as they see fit. Additionally, the Transfer-on-Death Deed can be revoked or amended at any time before the owner's death, offering flexibility and peace of mind. Understanding the nuances of this form is crucial for anyone looking to secure their property for future generations while avoiding the complexities often associated with estate planning.

Browse More Templates for North Dakota

Nd Notary - The document helps ensure compliance with state requirements.

The Florida Articles of Incorporation form is essential for establishing a corporation within the state. It outlines the basic information needed to register the business with the Florida Department of State, such as the corporation’s name, address, and the names of its directors. For more details on this crucial document, you can refer to https://floridaforms.net/blank-articles-of-incorporation-form. Filing this form is the first official step in creating a recognized business entity in Florida.

South Dakota Small Estate Affidavit - Some states may impose additional requirements for filing the Small Estate Affidavit.

Similar forms

A Transfer-on-Death Deed (TOD Deed) allows an individual to transfer real estate to a beneficiary upon their death without going through probate. This document shares similarities with several other legal documents. Here are four such documents:

- Will: A will specifies how a person’s assets should be distributed after their death. Like a TOD Deed, it allows individuals to designate beneficiaries, but a will must go through probate, while a TOD Deed does not.

- Living Trust: A living trust is a legal arrangement where assets are placed into a trust during a person's lifetime. Similar to a TOD Deed, a living trust allows for the direct transfer of property upon death, avoiding the probate process.

- Beneficiary Designation Forms: These forms are often used for financial accounts and life insurance policies. They allow individuals to name beneficiaries directly, much like a TOD Deed does for real estate, ensuring a smooth transfer upon death.

- California Bill of Sale: This document is essential for recording the transfer of ownership for items within California, providing necessary details such as item description and sale amount. For further details, check All California Forms.

- Joint Tenancy with Right of Survivorship: This arrangement allows co-owners to inherit each other’s share of property automatically upon death. Similar to a TOD Deed, it bypasses probate, providing a direct transfer of ownership to the surviving co-owner.

How to Use North Dakota Transfer-on-Death Deed

After completing the North Dakota Transfer-on-Death Deed form, you will need to ensure it is properly signed and notarized. Following that, the deed should be recorded with the appropriate county office to be legally effective.

- Obtain the North Dakota Transfer-on-Death Deed form from a reliable source.

- Fill in the name of the property owner(s) in the designated section.

- Provide the address and legal description of the property being transferred.

- List the name(s) of the beneficiary or beneficiaries who will receive the property upon the owner's death.

- Include the date on which the deed is being executed.

- Sign the form in the presence of a notary public.

- Have the notary public complete their section, verifying your identity and signature.

- Make copies of the completed and notarized deed for your records.

- Submit the original deed to the appropriate county recorder's office for filing.

Dos and Don'ts

When filling out the North Dakota Transfer-on-Death Deed form, there are important steps to take and common mistakes to avoid. Here’s a helpful list:

- Do ensure that you clearly identify the property you wish to transfer.

- Do provide the full legal names of all beneficiaries.

- Do sign the form in the presence of a notary public.

- Do file the completed deed with the county recorder's office.

- Do keep a copy of the deed for your records.

- Don't leave out any required information on the form.

- Don't use nicknames or abbreviations for beneficiaries' names.

- Don't forget to date the form when signing.

- Don't assume that verbal instructions are sufficient; everything must be in writing.

- Don't delay in filing the deed after it is completed.

Document Example

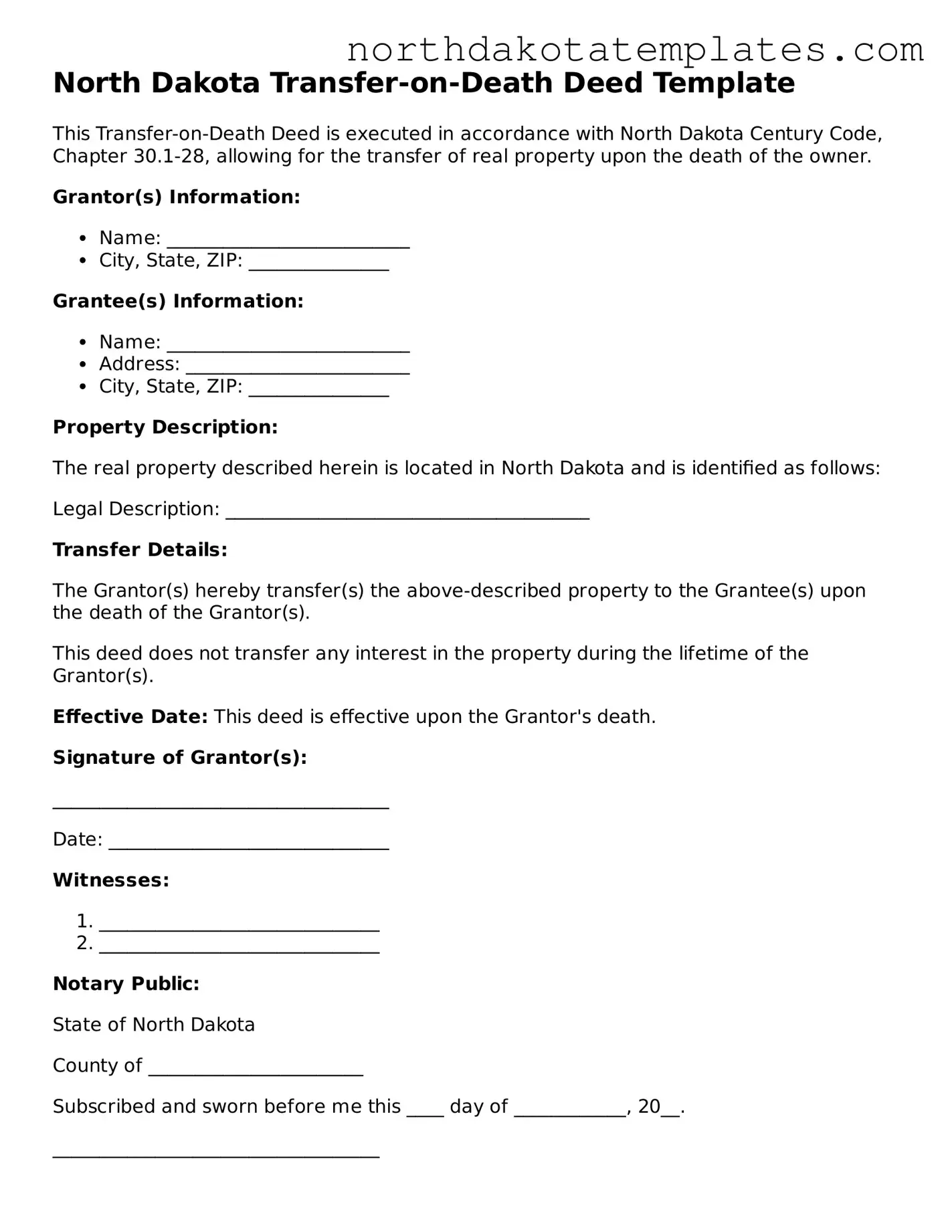

North Dakota Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with North Dakota Century Code, Chapter 30.1-28, allowing for the transfer of real property upon the death of the owner.

Grantor(s) Information:

- Name: __________________________

- City, State, ZIP: _______________

Grantee(s) Information:

- Name: __________________________

- Address: ________________________

- City, State, ZIP: _______________

Property Description:

The real property described herein is located in North Dakota and is identified as follows:

Legal Description: _______________________________________

Transfer Details:

The Grantor(s) hereby transfer(s) the above-described property to the Grantee(s) upon the death of the Grantor(s).

This deed does not transfer any interest in the property during the lifetime of the Grantor(s).

Effective Date: This deed is effective upon the Grantor's death.

Signature of Grantor(s):

____________________________________

Date: ______________________________

Witnesses:

- ______________________________

- ______________________________

Notary Public:

State of North Dakota

County of _______________________

Subscribed and sworn before me this ____ day of ____________, 20__.

___________________________________

Notary Public Signature

My Commission Expires: ____________

Document Specifics

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows an individual to transfer real property to a beneficiary upon the individual's death without going through probate. |

| Governing Law | The Transfer-on-Death Deed in North Dakota is governed by North Dakota Century Code § 47-19.5. |

| Revocability | This deed can be revoked at any time during the grantor's lifetime, allowing flexibility in estate planning. |

| Requirements | The deed must be signed by the grantor and recorded with the county recorder to be effective. |

Common mistakes

Filling out the North Dakota Transfer-on-Death Deed form can be a straightforward process, but mistakes are common. One prevalent error occurs when individuals fail to include all necessary information about the property. This includes not only the legal description but also the correct address. Omitting or incorrectly stating this information can lead to complications in the future.

Another mistake involves the designation of beneficiaries. Some people mistakenly think they can name multiple beneficiaries without specifying how the property should be divided. It is crucial to clearly outline whether the property will be shared equally or in specific proportions to avoid potential disputes among heirs.

Many individuals overlook the importance of signing and dating the form correctly. The deed must be signed by the owner(s) in the presence of a notary public. Failing to follow these requirements can render the deed invalid. Additionally, forgetting to date the document can create confusion about when the transfer is intended to take effect.

People often neglect to record the deed with the appropriate county office after it has been completed and notarized. Recording the deed is essential for ensuring that the transfer is legally recognized. Without this step, the intended transfer may not be enforceable, leaving the property subject to probate.

Some individuals also misunderstand the implications of revoking a Transfer-on-Death Deed. While it is possible to revoke the deed at any time before the owner’s death, the process must be executed properly. Failing to follow the correct procedures can lead to confusion and unintended consequences regarding property ownership.

Lastly, a common oversight involves not consulting with a legal professional. While the form may seem simple, the laws governing property transfers can be complex. Seeking guidance can help avoid mistakes and ensure that the deed is filled out correctly, ultimately protecting the owner’s wishes.

FAQ

What is a Transfer-on-Death Deed in North Dakota?

A Transfer-on-Death Deed (TODD) is a legal document that allows a property owner to designate one or more beneficiaries to receive their real estate upon their death. This deed enables the property to transfer directly to the beneficiaries without going through probate, simplifying the process and potentially saving time and costs for the heirs.

Who can create a Transfer-on-Death Deed?

In North Dakota, any individual who is at least 18 years old and legally competent can create a Transfer-on-Death Deed. The property owner must hold title to the real estate and have the authority to transfer it. It is important to ensure that the deed is properly executed to be valid.

How do I complete a Transfer-on-Death Deed?

To complete a Transfer-on-Death Deed, you will need to fill out a specific form that includes details such as the property owner's name, the legal description of the property, and the names of the beneficiaries. After filling out the form, it must be signed in the presence of a notary public. It is advisable to keep a copy of the signed deed for your records and to provide a copy to the beneficiaries.

Does a Transfer-on-Death Deed need to be recorded?

Yes, in North Dakota, a Transfer-on-Death Deed must be recorded with the county recorder’s office where the property is located. Recording the deed ensures that it is part of the public record and that the beneficiaries' rights to the property are protected. It is recommended to record the deed as soon as possible after execution.

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked at any time before the property owner's death. To revoke the deed, the owner must execute a new deed that explicitly states the revocation or file a formal revocation document with the county recorder's office. It is essential to follow the proper legal procedures to ensure that the revocation is valid.

What happens if the beneficiary predeceases the property owner?

If a beneficiary named in a Transfer-on-Death Deed passes away before the property owner, the transfer of property will not occur to that beneficiary. Instead, the property will typically pass to the deceased beneficiary's heirs, unless the deed specifies otherwise. It is advisable to regularly review and update the deed to reflect any changes in circumstances or intentions.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, transferring property through a Transfer-on-Death Deed does not trigger immediate tax consequences for the property owner. However, beneficiaries may be subject to capital gains tax when they sell the property. It is wise to consult with a tax professional to understand any potential tax implications and to ensure compliance with tax regulations.