Blank North Dakota Small Estate Affidavit Template

In North Dakota, when a loved one passes away, the process of settling their estate can feel overwhelming, especially for those left behind. The Small Estate Affidavit form serves as a valuable tool for individuals dealing with estates that fall below a certain value threshold. This form simplifies the probate process, allowing heirs to access and distribute assets without the lengthy and often complicated court proceedings typically associated with larger estates. By utilizing the Small Estate Affidavit, individuals can affirm their relationship to the deceased and claim property, such as bank accounts or personal belongings, directly. The form requires specific information, including the value of the estate and details about the deceased, ensuring that the process remains transparent and straightforward. Understanding how to properly complete and file this affidavit can significantly ease the burden during a difficult time, providing a clear pathway to accessing necessary assets while honoring the memory of the deceased.

Browse More Templates for North Dakota

Nda Templates - It's crucial to identify the scope of information covered by the NDA.

Understanding the nuances of the ADP Pay Stub form is crucial for both employees and employers, as it not only outlines earnings and deductions but also plays a significant role in income verification. For more detailed insights and resources about this important document, you can visit toptemplates.info/adp-pay-stub.

How to Create an Employee Handbook - Discover our attendance policy and expectations regarding punctuality.

Similar forms

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person when there is no will. It serves a similar purpose in identifying rightful beneficiaries.

- Probate Petition: A probate petition initiates the legal process of distributing a deceased person's estate. Like the Small Estate Affidavit, it aims to ensure proper distribution of assets, but it typically involves court oversight.

- Bill of Sale: This document records the transfer of ownership of an asset, serving as vital evidence of the transaction. For more information on creating a smarttemplates.net Bill of Sale form, visit our site.

- Will: A will outlines how a person's assets should be distributed after their death. While a Small Estate Affidavit can simplify the process for smaller estates, both documents serve to direct asset distribution.

- Trust Document: A trust document establishes a legal entity to hold and manage assets. Similar to a Small Estate Affidavit, it can facilitate the transfer of assets outside of probate, though it is generally more complex.

- Letters of Administration: These letters are issued by the court to appoint an administrator for an estate. They provide authority to manage the estate, akin to the powers granted by a Small Estate Affidavit.

- Transfer on Death Deed: This deed allows property to be transferred directly to a beneficiary upon the owner's death. Like the Small Estate Affidavit, it simplifies the transfer process, avoiding probate for certain assets.

How to Use North Dakota Small Estate Affidavit

After gathering the necessary information and documents, you are ready to fill out the North Dakota Small Estate Affidavit form. This form allows you to claim property from a deceased person’s estate without going through the lengthy probate process. Follow these steps carefully to ensure that your form is completed correctly.

- Obtain the Form: Download or request a copy of the North Dakota Small Estate Affidavit form from the appropriate state or county office.

- Fill in Your Information: At the top of the form, enter your full name, address, and contact information. This identifies you as the person making the claim.

- Provide Decedent’s Information: Next, fill in the name of the deceased individual, along with their date of death and last known address.

- List the Estate’s Assets: Clearly describe the assets you are claiming. Include details such as account numbers, property addresses, or descriptions of personal property.

- State the Value: For each asset listed, provide an estimated value. This helps establish that the total value of the estate falls within the small estate limits set by North Dakota law.

- Affirm Your Relationship: Indicate your relationship to the deceased. This could be a spouse, child, sibling, or another relative, as this establishes your right to claim the estate.

- Sign the Affidavit: At the bottom of the form, sign your name and date it. This signature verifies that the information you provided is accurate to the best of your knowledge.

- Notarization: Arrange for a notary public to witness your signature. They will need to stamp the document, confirming that you signed it in their presence.

- Submit the Form: Once completed and notarized, submit the affidavit to the appropriate county office or court where the deceased lived. Keep copies for your records.

After submitting the form, the county office will review it. If everything is in order, you will be able to access the assets listed in the affidavit. Make sure to follow up if you do not hear back within a reasonable timeframe.

Dos and Don'ts

When completing the North Dakota Small Estate Affidavit form, it's essential to ensure that you follow the correct procedures. Here are some important dos and don'ts to keep in mind:

- Do ensure that the total value of the estate does not exceed the limit set by North Dakota law, which is currently $50,000 for personal property.

- Do provide accurate information about the deceased, including their full name, date of death, and last known address.

- Do list all assets clearly, including bank accounts, vehicles, and any other property that is part of the estate.

- Do sign the affidavit in front of a notary public to validate the document.

- Don't omit any debts or liabilities that the estate may owe, as these must be accounted for in the affidavit.

- Don't forget to check for any additional requirements specific to your county, as local rules may vary.

By following these guidelines, you can navigate the process more smoothly and ensure that the affidavit is completed correctly.

Document Example

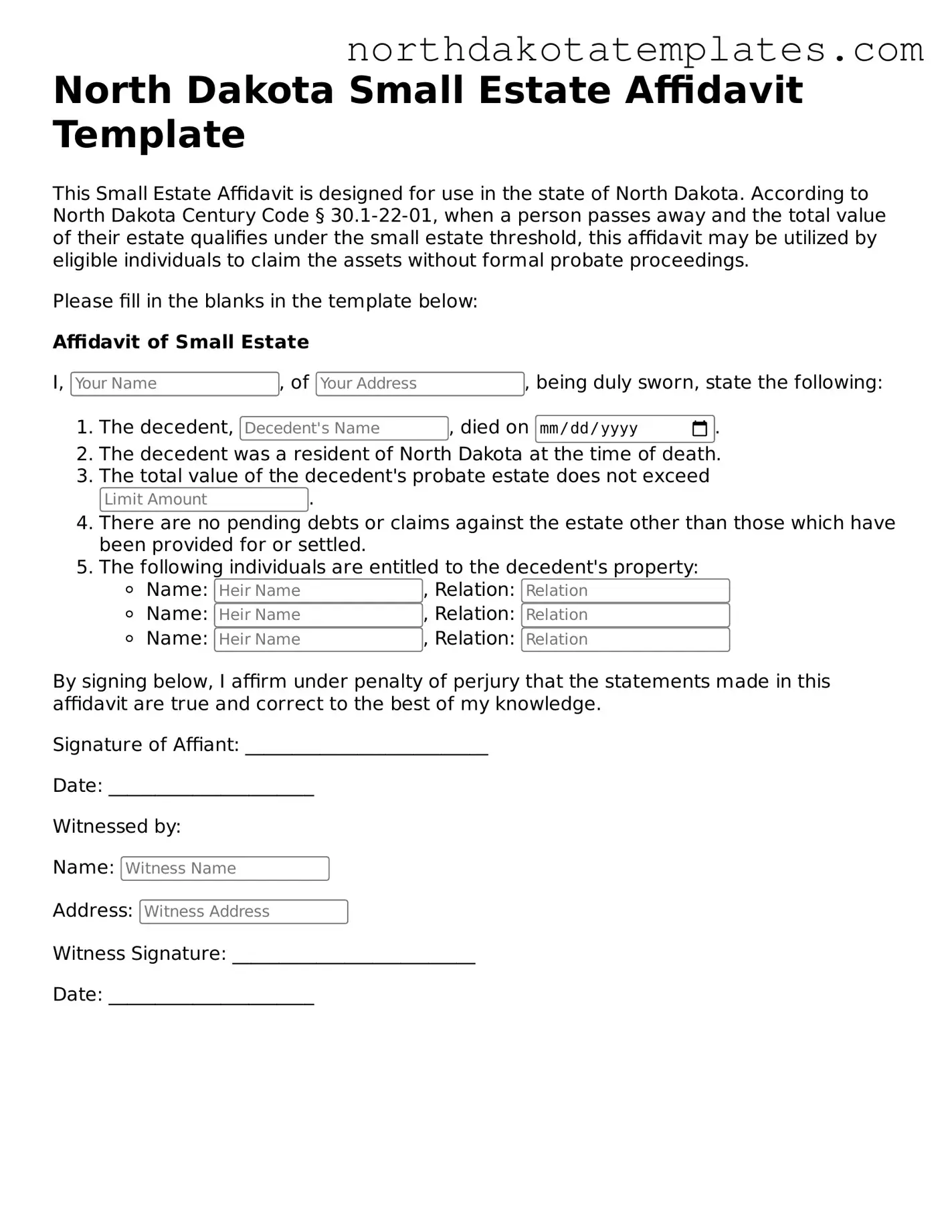

North Dakota Small Estate Affidavit Template

This Small Estate Affidavit is designed for use in the state of North Dakota. According to North Dakota Century Code § 30.1-22-01, when a person passes away and the total value of their estate qualifies under the small estate threshold, this affidavit may be utilized by eligible individuals to claim the assets without formal probate proceedings.

Please fill in the blanks in the template below:

Affidavit of Small Estate

I, , of , being duly sworn, state the following:

- The decedent, , died on .

- The decedent was a resident of North Dakota at the time of death.

- The total value of the decedent's probate estate does not exceed .

- There are no pending debts or claims against the estate other than those which have been provided for or settled.

- The following individuals are entitled to the decedent's property:

- Name: , Relation:

- Name: , Relation:

- Name: , Relation:

By signing below, I affirm under penalty of perjury that the statements made in this affidavit are true and correct to the best of my knowledge.

Signature of Affiant: __________________________

Date: ______________________

Witnessed by:

Name:

Address:

Witness Signature: __________________________

Date: ______________________

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The North Dakota Small Estate Affidavit allows individuals to claim assets of a deceased person without going through probate, provided the estate meets certain criteria. |

| Eligibility | The total value of the estate must be less than $50,000, excluding real estate, for the affidavit to be used. |

| Governing Law | This form is governed by North Dakota Century Code § 30.1-23-01 through § 30.1-23-04. |

| Filing Process | The completed affidavit must be filed with the appropriate county office, and it may need to be presented to financial institutions or other entities holding the deceased's assets. |

Common mistakes

Filling out the North Dakota Small Estate Affidavit form can be a straightforward process, but many individuals make common mistakes that can lead to delays or complications. One frequent error is failing to provide accurate information about the decedent. It is essential to include the full legal name, date of death, and last known address. Omitting any of these details can result in the affidavit being rejected.

Another mistake involves misunderstanding the eligibility requirements for using the Small Estate Affidavit. Some people assume they can use the affidavit for any estate, but this is not the case. The estate must meet specific criteria, such as the total value of the assets being below a certain threshold. Ignoring these limits can lead to unnecessary complications.

Many individuals also neglect to sign the affidavit in the presence of a notary public. This step is crucial, as a notarized signature adds legitimacy to the document. Without proper notarization, the affidavit may not be accepted by financial institutions or courts.

Inaccurate asset valuation is another common pitfall. People often underestimate or overestimate the value of the decedent's assets. It is vital to conduct a thorough assessment to ensure that the values reported are accurate. Misrepresentation of asset value can lead to legal issues down the line.

Additionally, some individuals fail to list all the decedent's debts and liabilities. The Small Estate Affidavit requires a full disclosure of any outstanding debts. Neglecting to include this information can create problems for heirs and may result in legal repercussions.

Lastly, individuals often overlook the importance of providing supporting documentation. While the affidavit itself is a key document, it must be accompanied by relevant paperwork, such as death certificates and proof of asset ownership. Failing to include these documents can delay the process and create additional hurdles.

FAQ

What is the North Dakota Small Estate Affidavit form?

The North Dakota Small Estate Affidavit is a legal document that allows individuals to claim assets of a deceased person without going through the full probate process. This form is designed for estates that meet specific criteria, typically when the total value of the estate is below a certain threshold. By using this affidavit, heirs or beneficiaries can simplify the process of transferring ownership of the deceased's assets, making it more efficient and less costly.

Who is eligible to use the Small Estate Affidavit in North Dakota?

To use the Small Estate Affidavit, the estate must generally have a total value that does not exceed $50,000, excluding certain types of property like real estate. Eligible individuals typically include the surviving spouse, children, or other close relatives of the deceased. It is important to ensure that all necessary conditions are met before filing the affidavit, as ineligible estates may still require full probate proceedings.

How do I complete and file the Small Estate Affidavit?

Completing the Small Estate Affidavit involves filling out the form with accurate information about the deceased and their assets. The affidavit must include details such as the names of the heirs, the value of the estate, and a declaration that the estate qualifies for the small estate process. Once completed, the affidavit should be signed in front of a notary public. After notarization, file the affidavit with the appropriate court in the county where the deceased lived. It is advisable to keep copies for personal records.

What happens after I file the Small Estate Affidavit?

After filing the Small Estate Affidavit, the court will review the document to ensure it meets all requirements. If everything is in order, the court will issue an order confirming the affidavit. This order allows you to collect the deceased’s assets, such as bank accounts or personal property, without further legal complications. It is essential to notify financial institutions and other relevant parties of the court's decision to facilitate the transfer of assets smoothly.