Free Sfn 58701 PDF Template

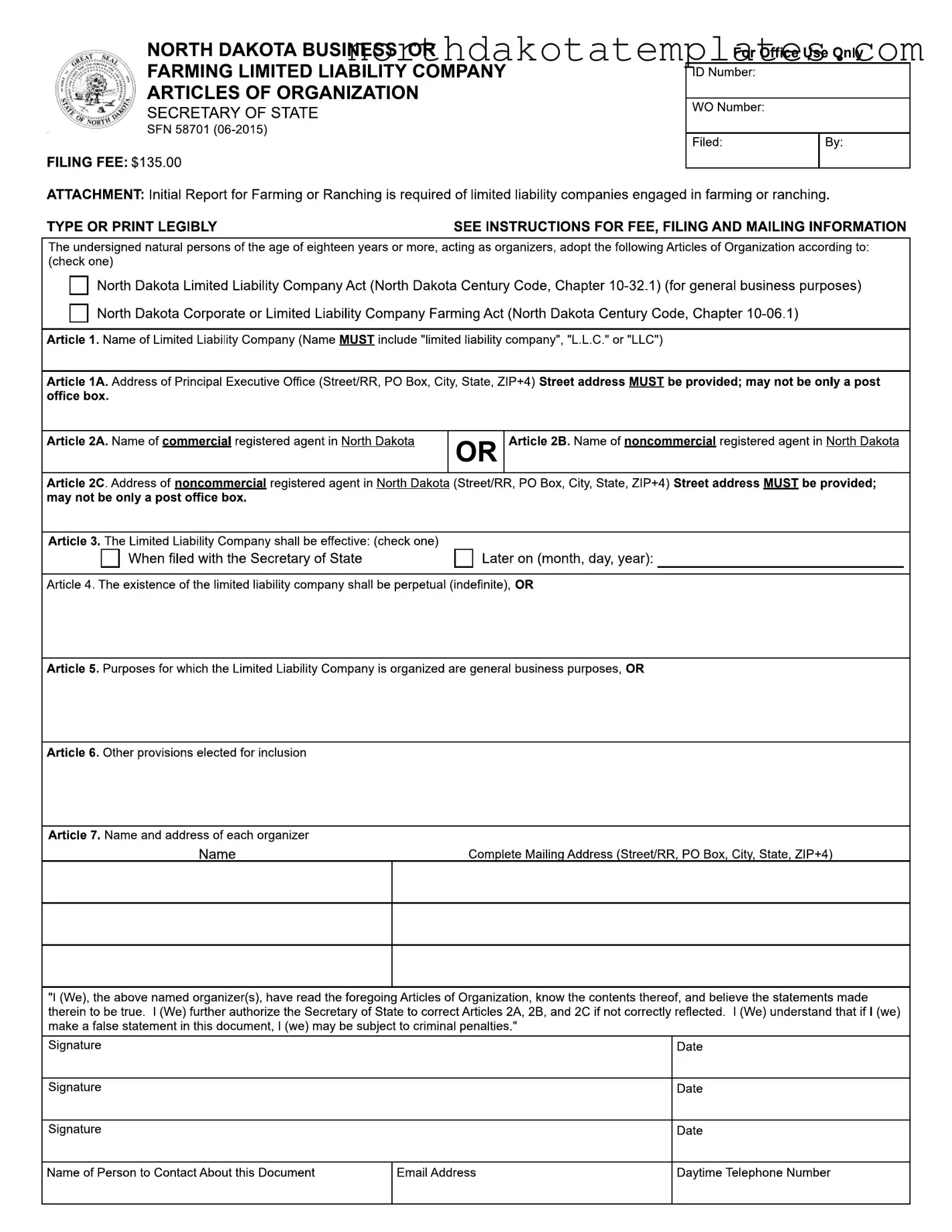

The SFN 58701 form is a crucial document for individuals or groups looking to establish a Limited Liability Company (LLC) in North Dakota, whether for general business purposes or specifically for farming or ranching activities. This form, officially titled "North Dakota Business or Farming Limited Liability Company Articles of Organization," serves as the foundational legal instrument for creating an LLC. It requires essential information such as the name of the LLC, which must include "limited liability company," "L.L.C.," or "LLC," as well as the address of the principal executive office. Additionally, the form mandates the designation of a registered agent, either commercial or noncommercial, who will serve as the official point of contact for the LLC. The filing fee for submitting this form is $135, and if the chosen name closely resembles an existing registered name, an additional fee may apply. It is important to note that the form must be accompanied by an Initial Report for Farming or Ranching if the LLC is engaged in such activities. By filing the SFN 58701, organizers can ensure that their business is recognized and protected under North Dakota law, enabling them to operate with the benefits of limited liability.

Common PDF Documents

Neuroscience Conference 2023 - Clear descriptions of the animals can prevent disputes during the process.

North Dakota Nonresident Filing Requirements - Additional income sources may need to be specified, such as lump-sum distributions or financial institution income.

While the specific details of the Asurion F-017-08 MEN form are currently unavailable, accessing resources related to its use, such as the Asurion F-017-08 MEN form, can provide valuable insights for those needing to navigate the associated procedures effectively.

North Dakota Nonresident Filing Requirements - The residency status of beneficiaries, whether they are resident or non-resident, must be indicated on the form.

Similar forms

-

Articles of Incorporation: Similar to the SFN 58701 form, Articles of Incorporation are used to establish a corporation. Both documents require information about the business name, purpose, and registered agent, and both are filed with the Secretary of State.

-

Operating Agreement: An Operating Agreement outlines the management structure and operating procedures of an LLC. Like the SFN 58701, it is essential for defining roles and responsibilities within the company, ensuring clarity among members.

-

Bylaws: Bylaws govern the internal management of a corporation, much like how the SFN 58701 governs an LLC. Both documents establish rules for meetings, voting, and other operational aspects to maintain order and compliance.

- California Employment Verification Form: This crucial document ensures compliance with state and federal laws, confirming an employee's eligibility to work. For further details, refer to the Proof of Employment Letter.

-

Business License Application: This document is required for legally operating a business in a specific jurisdiction. Similar to the SFN 58701, it typically requires information about the business structure, ownership, and purpose.

-

Certificate of Good Standing: This certificate confirms that a business is legally registered and compliant with state regulations. Like the SFN 58701, it is often necessary for various business transactions and can be requested from the Secretary of State.

How to Use Sfn 58701

Once you have gathered all the necessary information, you can proceed to fill out the SFN 58701 form. This form is essential for establishing a limited liability company (LLC) in North Dakota, whether for general business or farming purposes. Ensure that you complete each section accurately and legibly to avoid delays in processing.

- Begin by entering the name of your limited liability company in Article 1. Make sure it includes "limited liability company," "L.L.C.," or "LLC."

- In Article 1A, provide the complete address of your principal executive office. Remember, this must not be just a post office box.

- For Article 2A, indicate the name of your commercial registered agent in North Dakota. If you do not have one, you will need to appoint a noncommercial registered agent.

- In Article 2B, list the name of your noncommercial registered agent if applicable.

- Complete Article 2C with the address of the noncommercial registered agent, ensuring it is a physical address and not just a post office box.

- In Article 3, check the box to indicate whether the LLC will be effective upon filing or at a later date.

- For Article 4, state whether the LLC will have perpetual existence or if it will be limited in duration.

- In Article 5, specify the purposes for which the LLC is organized, whether for general business or farming.

- If you have any other provisions to include, write them in Article 6.

- List the names and addresses of each organizer in Article 7. Ensure that all organizers sign the form, affirming the truth of the information provided.

- Provide the name of a contact person regarding this document, along with their email address and daytime telephone number.

- Finally, pay the filing fee of $135. Make checks payable to "Secretary of State" or use a credit card if applicable.

After completing the form, review all entries for accuracy. It is crucial to ensure that all required sections are filled out correctly before submitting the form to the Secretary of State. If you are filing for an LLC engaged in farming or ranching, remember to include the Initial Report for Farming or Ranching as an attachment.

Dos and Don'ts

When filling out the SFN 58701 form, there are important guidelines to follow. Below is a list of things you should and shouldn't do:

- Do type or print legibly to ensure clarity.

- Do include the full name of the limited liability company, ensuring it contains "limited liability company," "L.L.C.," or "LLC."

- Do provide a complete address for the principal executive office, which cannot be just a post office box.

- Do check the appropriate box to indicate whether the company is organized for general business or farming purposes.

- Don't use a name that is the same as or deceptively similar to another registered organization without obtaining consent.

- Don't forget to include the filing fee of $135 when submitting the form.

Document Example

File Breakdown

| Fact Name | Description |

|---|---|

| Form Purpose | The SFN 58701 form is used to file Articles of Organization for a Limited Liability Company (LLC) in North Dakota. |

| Filing Fee | The filing fee for submitting the SFN 58701 form is $135. An additional fee of $10 applies if a name is similar to an existing registered name. |

| Governing Laws | The form is governed by the North Dakota Limited Liability Company Act (N.D.C.C. Chapter 10-32.1) and the North Dakota Corporate or Limited Liability Company Farming Act (N.D.C.C. Chapter 10-06.1). |

| Organizer Requirements | Organizers must be natural persons aged eighteen years or older to file the form. |

| Address Requirements | The principal executive office address must be provided and cannot be solely a post office box. |

| Registered Agent | An LLC must maintain a commercial or noncommercial registered agent in North Dakota, which cannot be the LLC itself. |

| Perpetual Existence | The form allows for the LLC to have perpetual existence unless otherwise specified in the Articles of Organization. |

| Initial Report Requirement | If the LLC is engaged in farming or ranching, an Initial Report for Farming or Ranching must be attached to the SFN 58701 form. |

Common mistakes

Completing the SFN 58701 form can be a straightforward process, but several common mistakes can lead to delays or complications. One of the most frequent errors is failing to include the required designation in the name of the Limited Liability Company (LLC). The name must include "limited liability company," "L.L.C.," or "LLC." Omitting this critical information can result in the rejection of the application.

Another mistake involves the address of the principal executive office. Many applicants mistakenly provide only a post office box. The form explicitly states that a street address must be included. Providing an incomplete address can hinder official communications and lead to potential legal issues down the line.

Additionally, some individuals neglect to check the appropriate box indicating the governance under which the LLC is formed. If the box is left unchecked, the LLC will automatically be classified for general business purposes, which may not align with the applicant's actual intentions. This oversight can complicate matters, especially if the LLC is intended for farming or ranching.

Furthermore, applicants often overlook the requirement for a registered agent. The form necessitates the appointment of either a commercial or noncommercial registered agent with a valid address in North Dakota. Failing to designate a registered agent can result in the inability to receive important legal documents, which could have serious ramifications for the LLC.

Lastly, it is essential to ensure that all signatures are present on the form. Missing a signature can lead to immediate rejection. Each organizer must sign the document, affirming that they have read and understand the contents. This step is crucial for the legitimacy of the application and compliance with state regulations.

FAQ

What is the purpose of the SFN 58701 form?

The SFN 58701 form is used to establish a Limited Liability Company (LLC) in North Dakota. This form allows individuals to formally organize their business, whether for general business purposes or specifically for farming or ranching activities. By filing this form with the Secretary of State, the LLC gains legal recognition and protection under North Dakota law.

What are the filing fees associated with the SFN 58701 form?

The filing fee for the SFN 58701 form is $135. If the chosen name for the LLC is the same as or deceptively similar to an existing name registered with the Secretary of State, an additional fee of $10 is required for each Consent to Use of Business Name. Payments can be made via check or credit card, ensuring that checks are made payable to the "Secretary of State."

What information is required in the Articles of Organization?

When completing the Articles of Organization, you must provide the name of the LLC, which must include "limited liability company," "L.L.C.," or "LLC." Additionally, you need to include the address of the principal executive office, the names of the registered agents, and the purpose of the LLC. It's also essential to indicate whether the LLC will be effective immediately upon filing or at a later date.

Do I need to attach anything to the SFN 58701 form?

If the LLC is engaged in farming or ranching, an Initial Report for Farming or Ranching must be attached to the SFN 58701 form. This report is necessary for compliance with North Dakota regulations regarding agricultural businesses. You can obtain this report from the Secretary of State's website or by contacting their office directly.

What is a registered agent, and why do I need one?

A registered agent is an individual or business designated to receive legal documents and official communications on behalf of the LLC. North Dakota law requires that every LLC maintain a registered agent with a physical address in the state. This agent can be either a commercial registered agent or a noncommercial registered agent, such as an individual or another business entity. It is important to choose someone reliable, as they will be the point of contact for legal matters.

What happens if I provide false information on the SFN 58701 form?

Providing false information on the SFN 58701 form can lead to serious consequences, including potential criminal penalties. The organizers of the LLC must ensure that all statements made in the form are accurate and truthful. If any discrepancies are found, it could jeopardize the LLC's formation and legal standing.