Free Sfn 41216 PDF Template

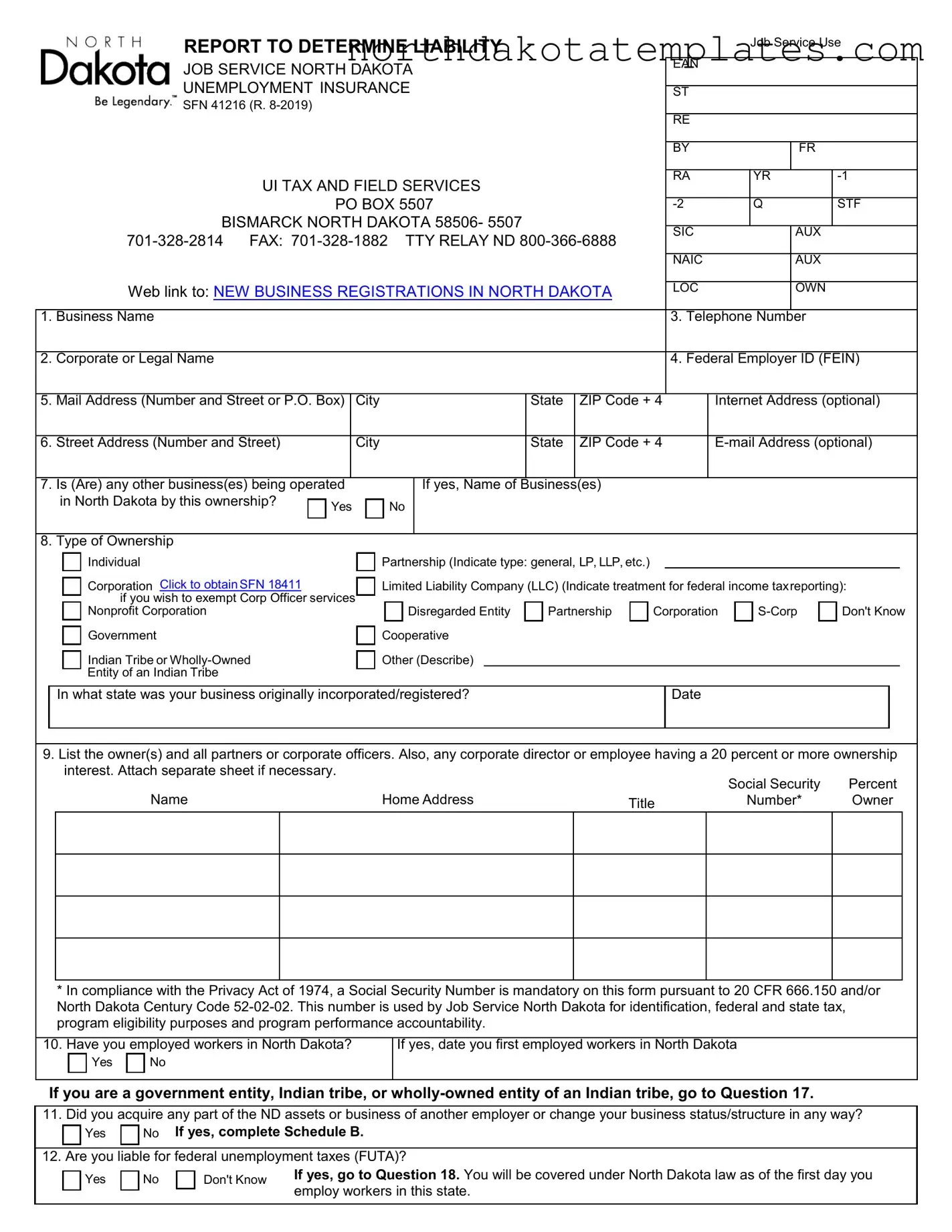

The SFN 41216 form, officially titled "Report to Determine Liability," is a crucial document utilized by Job Service North Dakota to assess the unemployment insurance liability of businesses operating within the state. This form is specifically designed for new businesses or existing entities that may have changed their operational status. It collects essential information, including the business name, ownership structure, and details about employees. Businesses must disclose whether they have previously employed workers in North Dakota and provide information about their workforce, including any corporate officers or partners with significant ownership stakes. The form also addresses specific scenarios, such as acquisitions of other businesses and the employment of temporary or leased workers. By gathering this information, Job Service North Dakota can determine the appropriate unemployment insurance coverage and tax obligations for the business. Completing the SFN 41216 accurately is vital, as it ensures compliance with state laws and facilitates access to necessary resources and support for employers and employees alike.

Common PDF Documents

Neuroscience Conference 2023 - Each form can only address one debtor and one lienholder at a time.

For those seeking to better understand their earnings and deductions, the ADP Pay Stub form provides essential insights and transparency. Additionally, resources available at OnlineLawDocs.com can help employees navigate these important documents, fostering clarity in financial planning and compliance with legal standards.

Sfn 53763 - Veterans may claim preferences by attaching relevant documentation.

Nd Tax Forms - Double-check all numbers for accuracy before submitting the form.

Similar forms

The SFN 41216 form is used to determine liability for unemployment insurance in North Dakota. It shares similarities with other documents that serve similar purposes in different contexts. Below are four documents that are similar to the SFN 41216 form:

- Form 940: This is the Employer's Annual Federal Unemployment (FUTA) Tax Return. Like the SFN 41216, it requires information about the employer's business and its employees, specifically regarding unemployment tax obligations. Both forms assess whether the employer is liable for unemployment taxes.

- Form W-2: This is the Wage and Tax Statement provided to employees. Similar to the SFN 41216, it includes details about wages paid and taxes withheld. Both forms are essential for reporting employment information for tax purposes.

- Articles of Incorporation Form: To establish a corporation, ensure you have the necessary paperwork with our comprehensive Articles of Incorporation form details for compliance and accuracy.

- Form 941: This is the Employer's Quarterly Federal Tax Return. It requires employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Like the SFN 41216, it helps determine tax liabilities related to employment.

- State Unemployment Insurance (SUI) Registration Form: This form is used by employers to register for state unemployment insurance. Similar to the SFN 41216, it gathers information about the business and its employees to establish liability for state unemployment taxes.

How to Use Sfn 41216

Completing the SFN 41216 form is an important step in ensuring that your business is properly registered for unemployment insurance in North Dakota. After filling out the form, you will need to submit it to Job Service North Dakota for processing. Make sure to provide accurate information, as this will help facilitate a smooth review of your application.

- Business Name: Enter the name of your business as it appears on legal documents.

- Corporate or Legal Name: Fill in the official name of your business entity, if different from the business name.

- Telephone Number: Provide a contact number where you can be reached.

- Federal Employer ID (FEIN): Input your FEIN, which is required for tax purposes.

- Mail Address: Enter your mailing address, including street number, city, state, and ZIP code.

- Street Address: If different from your mailing address, provide the physical location of your business.

- Internet Address: Optionally, include your business website URL.

- Other Businesses: Indicate whether you operate any other businesses in North Dakota. If yes, list their names.

- Type of Ownership: Select the appropriate ownership type from the options provided.

- State of Incorporation: Specify the state where your business was originally incorporated or registered.

- Owner(s) and Officers: List the names, addresses, and titles of owners, partners, or corporate officers, including their Social Security Numbers.

- Employment History: Answer whether you have employed workers in North Dakota and provide the date of first employment if applicable.

- Acquisition of Assets: Indicate if you have acquired any part of another employer's business and complete Schedule B if yes.

- Federal Unemployment Taxes: Answer whether you are liable for FUTA.

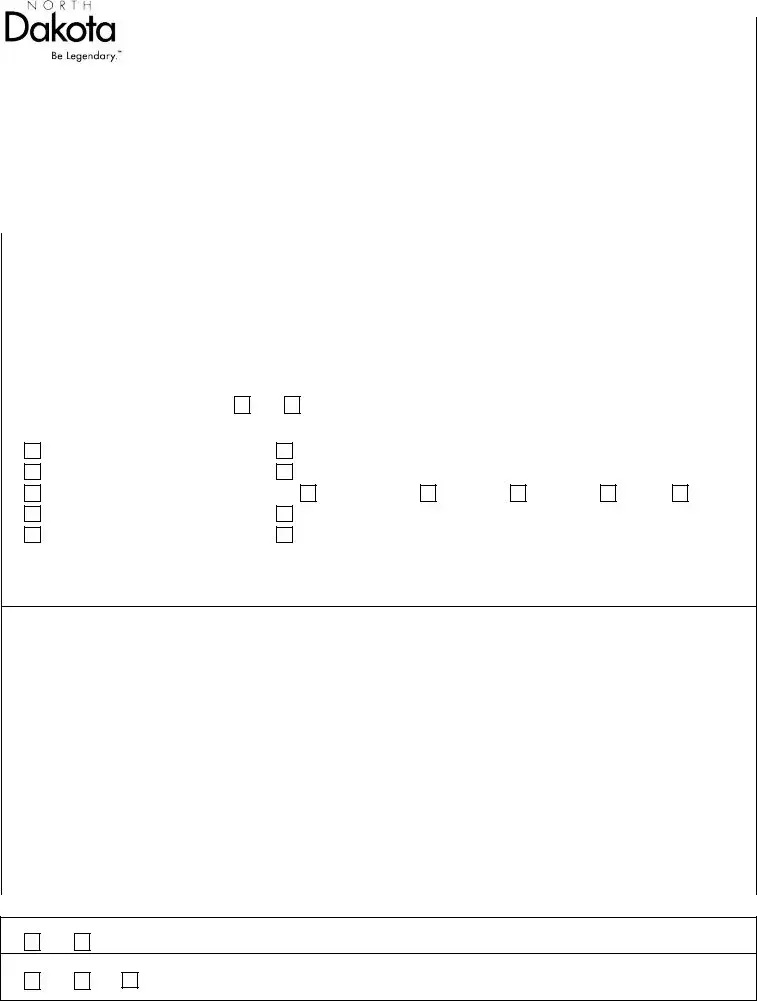

- Nonprofit Status: If applicable, indicate your nonprofit status and submit your exemption letter.

- Wages Paid: Enter the total wages paid in North Dakota for each quarter of the current and preceding year.

- Employment Numbers: Answer questions about your employment numbers during the specified periods.

- Voluntary Coverage: Indicate if you wish to become voluntarily covered under unemployment insurance.

- Government Entities: Complete the section if applicable and select a benefit financing option.

- Independent Contractors: Answer whether you have individuals performing services who are not considered employees.

- Temporary Workers: State if your business provides temporary or leased workers to clients.

- Business Activity Description: Provide a detailed description of your business activities and the percentage of sales from each.

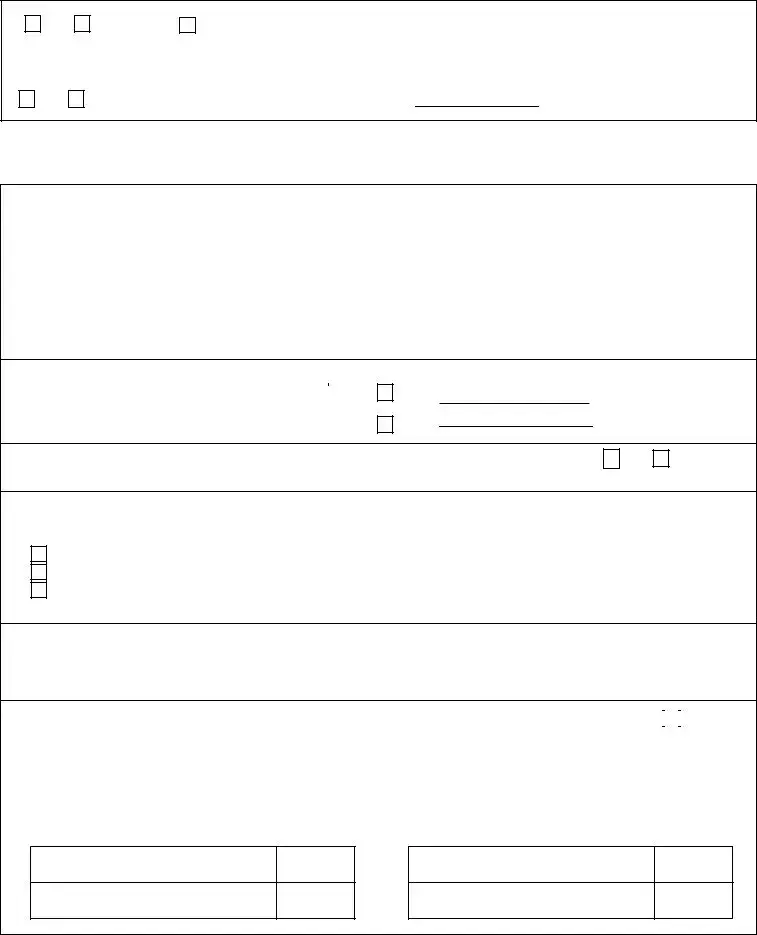

- Business Locations: List addresses where employees work and indicate if the locations are permanent or temporary.

- Authorized Representative: Include the name and title of the person authorized to represent your business.

- Certification: Sign and date the form, certifying that all information provided is true and accurate.

Dos and Don'ts

When filling out the SFN 41216 form, it's important to follow specific guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do double-check all entries for accuracy before submission.

- Do provide a valid Social Security Number for identification purposes.

- Do clearly indicate the type of ownership of your business.

- Do attach any necessary documents, such as IRS exemption letters for nonprofit organizations.

- Do answer all questions honestly and completely.

- Don't leave any required fields blank; ensure all applicable sections are filled out.

- Don't estimate wages; provide actual figures for accuracy.

- Don't forget to sign and date the form before submission.

- Don't submit the form without reviewing it for any possible errors.

Document Example

REPORT TO DETERMINE LIABILITY

Job Service Use

|

JOB SERVICE NORTH DAKOTA |

|

|

|

EAN |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

UNEMPLOYMENT INSURANCE |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

ST |

|

|

|

|

|

|

|||||||

|

SFN 41216 (R. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BY |

|

|

FR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UI TAX AND FIELD SERVICES |

|

|

|

RA |

|

YR |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

PO BOX 5507 |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

Q |

STF |

||||||||||

|

BISMARCK NORTH DAKOTA 58506- 5507 |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

SIC |

|

|

AUX |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAIC |

|

|

AUX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Web link to: NEW BUSINESS REGISTRATIONS IN NORTH DAKOTA |

|

LOC |

|

|

OWN |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1. Business Name |

|

|

|

|

|

|

|

|

|

3. Telephone Number |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

2. Corporate or Legal Name |

|

|

|

|

|

|

|

|

|

4. Federal Employer ID (FEIN) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

5. Mail Address (Number and Street or P.O. Box) |

|

City |

|

|

|

State |

ZIP Code + 4 |

Internet Address (optional) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

6. Street Address (Number and Street) |

|

|

City |

|

|

|

State |

ZIP Code + 4 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7. Is (Are) any other business(es) being operated |

|

|

If yes, Name of Business(es) |

|

|

|

|

|

|

|

|

||||||

|

in North Dakota by this ownership? |

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. Type of Ownership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual |

|

|

|

Partnership (Indicate type: general, LP, LLP, etc.) |

|

|

|

|

|

|

|

|

||||

|

Corporation Click to obtainSFN 18411 |

|

|

|

Limited Liability Company (LLC) (Indicate treatment for federal income taxreporting): |

||||||||||||

|

if you wish to exempt Corp Officer services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Nonprofit Corporation |

|

|

|

Disregarded Entity |

Partnership |

Corporation |

Don't Know |

|||||||||

|

Government |

|

|

|

Cooperative |

|

|

|

|

|

|

|

|

|

|

||

|

Indian Tribe or |

|

|

|

Other (Describe) |

|

|

|

|

|

|

|

|

|

|

||

|

Entity of an Indian Tribe |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

In what state was your business originally incorporated/registered? |

|

|

|

Date |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. List the owner(s) and all partners or corporate officers. Also, any corporate director or employee having a 20 percent or more ownership

interest. Attach separate sheet if necessary. |

|

|

Social Security |

Percent |

|

|

|

|

|

||

Name |

Home Address |

Title |

Number* |

Owner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* In compliance with the Privacy Act of 1974, a Social Security Number is mandatory on this form pursuant to 20 CFR 666.150 and/or North Dakota Century Code

10. Have you employed workers in North Dakota? |

If yes, date you first employed workers in North Dakota |

||||

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

If you are a government entity, Indian tribe, or

11. Did you acquire any part of the ND assets or business of another employer or change your business status/structure in any way?

Yes

No If yes, complete Schedule B.

12. Are you liable for federal unemployment taxes (FUTA)?

Yes

No

Don't Know |

If yes, go to Question 18. You will be covered under North Dakota law as of the first day you |

|

employ workers in this state. |

||

|

SFN 41216

Page 2 of 4

13. Are you a nonprofit organization exempt from income taxes under Section 501(c)(3), IRS Code?

Yes

No - Go to #14

Applied For - Go to #14

If yes, complete this section and submit a copy of your exemption letter from the IRS to Job Service North Dakota. You need not complete sections 14 and 15.

As a nonprofit organization, have you employed four or more persons during 20 weeks of any calendar year in any state?

Yes

No - Go to #16 If yes, date the 20th week was first reached.

When answering Questions 14 and 15, include as employees all

-this does not apply to corporations or limited liability companies. This exclusion applies to partnerships only if the worker has an exempting relationship with each partner.

14. Enter the amount of wages you have paid in North Dakota (do not estimate or include wages earned but not paid):

|

Jan. 1 to March 31 |

April 1 to June 30 |

July 1 to Sept. 30 |

Oct. 1 to Dec. 31 |

|

|

|

|

|

|

|

Current |

|

|

|

|

|

Year |

$ |

$ |

$ |

$ |

|

Preceding |

$ |

$ |

$ |

$ |

|

Year |

|||||

|

|

|

|

||

Prior |

$ |

$ |

$ |

$ |

|

Year |

|||||

|

|

|

|

||

Year |

$ |

$ |

$ |

$ |

15. During the 20 weeks of any calendar year, have you employed:

a. |

One or more persons in general employment? |

|

Yes |

|

|||

|

|

|

Yes |

|

|

|

|

b. |

Ten or more persons in agricultural employment? |

|

|

|

|

|

|

If yes, date the 20th week was first reached.

No

No

16.If it is determined that you are not now liable for coverage, do you want to become covered voluntarily? See NDCC

Voluntary coverage is not available if you answered no to question #10

Yes

No

17.Complete this section only if you are a governmental entity, Indian tribe or

Select one of the following benefit financing options: (see NDCC

Reimbursement of benefit payments attributable to employment with your organization.

Payment of taxes on your quarterly taxable payroll at the rate applicable for new employers.

Advanced reimbursements at a percent of your quarterly total payroll to be redetermined annually.

Will default to Payment of Taxes: 1) if not completed and/or 2) if you have not provided an IRS exemption letter.

18. Have any individuals you do not consider employees performed services for you in North Dakota? |

|

Yes |

|

No |

|

|

|||

|

|

|

||

If yes, give reasons for excluding them and indicate number of persons involved. |

|

|

|

|

|

|

|

|

19. |

Does any part of your business activity include the provision of "temporary" or "leased" workers to a client company? |

|

Yes |

|

No |

|

|

|

|

|

|

20. |

Give a specific description of your business activity in North Dakota. |

|

|

|

|

Enter on separate lines the principal product or activities of your firm. Following each item, list the percentage of sales value or receipts received from the product or activity; i.e., retail men's clothing, electrical

%

%

%

%

SFN 41216

Page 3 of 4

21.Business Locations: Enter the North Dakota addresses from which your employees work and indicate if the location is permanent or temporary. If you do not maintain an office in North Dakota, enter the employee's address.

Address |

City |

State ZIP Code |

Telephone |

Permanent Temporary |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Remarks:

22.

Name of Authorized Representative |

Title |

Telephone Number |

Fax Number |

|

|

|

|

Name of Individual Completing Form

Title

Telephone Number

Date

I certify the information on SFN 41216, Report to Determine Liability, is true and accurate.

Job Service is an equal opportunity employer/program provider.

Auxiliary aids and services are available upon request to individuals with disabilities.

REPORT TO DETERMINE LIABILITY |

Complete Schedule B only if you answered “yes” to question 11 on |

SCHEDULE B - SUCCESSORSHIP QUESTIONNAIRE |

form SFN 41216, Report to Determine Liability |

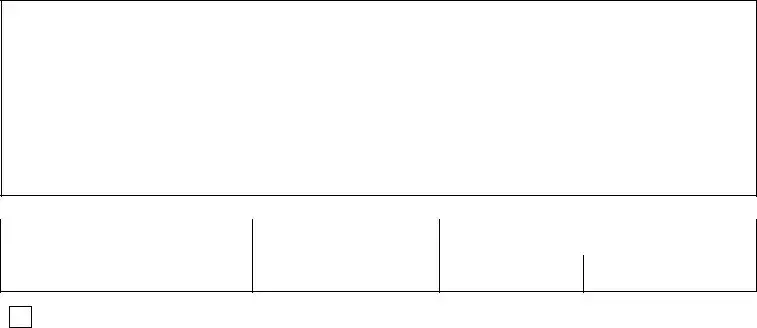

Successorship Reporting Requirement. If you acquired all or part of the organization, business, trade, or assets of another employer and will continue essentially the same business activity, you must provide the following information. If you made multiple acquisitions, you must file a separate Schedule B for each acquisition. Submit the completed Schedule B(s) along with Form SFN 41216, Report to Determine Liability, to Job Service North Dakota.

PART 1: CURRENT/NEW OWNER INFORMATION

Name

UI Account Number |

|

|

Federal Employer Identification Number |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART 2: FORMER OWNER INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Former Owner's Name (required) |

|

|

Former Owner's UI Number or FEIN, if known |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate Name or DBA |

|

|

|

|

|

|

|

|

|

|

Area Code and Telephone Number |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Street Address (not a P.O. Box) |

|

|

City |

|

|

|

|

|

|

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART 3: ACQUISITION INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percent Acquired |

Date Acquired |

|

1. |

Did you acquire all, part or none of the former owner's assets? |

|

|

All |

|

Part |

|

|

None |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percent Acquired |

Date Acquired |

|

2. |

Did you acquire all, part or none of the former owner's workforce? |

|

|

All |

|

Part |

|

|

None |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Did you acquire all, part or none of the former owner's North |

|

|

|

|

|

|

|

|

|

Percent Acquired |

Date Acquired |

|

|

|

All |

|

Part |

|

|

None |

|

|

|

|||

|

Dakota trade (customers/accounts)? |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Did you acquire all, part or none of the former owner's North |

|

|

|

|

|

|

|

|

|

Percent Acquired |

Date Acquired |

|

|

|

All |

|

Part |

|

|

None |

|

|

|

|||

|

Dakota business (products/services)? |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Was the North Dakota business being operated at the time of the |

|

|

|

|

|

|

|

|

|

|

|

Date (MM, DD, YYYY) |

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|||

|

acquisition? If no, enter the date it was closed by the former owner. |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Are you continuing the North Dakota business you acquired? |

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Is your North Dakota business substantially owned or controlled in |

|

|

|

|

|

|

|

|

|

|

|

|

|

any way by the same interests that owned or controlled the former |

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

business? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

Will the previous business/account continue in business in North |

|

|

Yes |

|

No |

|

|

|

Don't Know |

|

||

|

|

|

|

|

|

|

|||||||

|

Dakota? |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

If eligible, do you wish to continue the experience rating established |

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

by the acquired/previous business? |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you do and are assigned your predecessor's tax rate, your new account will also be chargeable for any benefits payable to your |

||||||||||||

|

predecessor's workers. |

|

|

|

|

|

|

|

|

|

|

|

|

|

If you do not answer this question and it is determined that you are a liable employer, you will receive the rate normally assigned to new employers; it will |

||||||||||||

|

not include the predecessor's history. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NDCC

Name of Owner/Officer

Title

Telephone Number

Date

I certify the information on SFN 41216, Schedule B, is true and accurate.

Go to the bottom of page 3 to submit the form.

Notice: Wage and other confidential information collected from employers as part of the unemployment insurance process may be requested and utilized for other governmental purposes, including, but not limited to, verification of eligibility under other government programs as required by law.

File Breakdown

| Fact Name | Description |

|---|---|

| Form Purpose | The SFN 41216 form is used to determine liability for unemployment insurance in North Dakota. |

| Governing Laws | This form is governed by the North Dakota Century Code, specifically NDCC 52-02-02 and NDCC 52-05-03(2). |

| Required Information | Employers must provide details such as business name, ownership type, and employment history in North Dakota. |

| Submission Details | Completed forms must be submitted to Job Service North Dakota at the specified address in Bismarck. |

Common mistakes

When completing the SFN 41216 form, individuals often make several common mistakes that can lead to delays or complications in processing their information. One major error is failing to provide the correct business name. It is essential to ensure that the name listed matches the official name registered with the state. Inaccuracies here can result in confusion and may hinder the ability to verify the business's legal status.

Another frequent mistake involves omitting the Federal Employer Identification Number (FEIN). This number is crucial for tax identification purposes and is mandatory for the form. If an applicant does not have a FEIN, they should apply for one before submitting the form. Without this number, the processing of the application can be significantly delayed.

Additionally, many applicants do not accurately report the employment history in North Dakota. Specifically, they might answer "No" to whether they have employed workers without considering part-time or temporary employees. The form requires a thorough understanding of what constitutes employment, and failing to include all relevant workers can lead to incorrect liability determinations.

People also often neglect to provide complete contact information for the business and its representatives. This includes ensuring that telephone numbers and addresses are accurate and up-to-date. Incomplete or incorrect contact information can prevent Job Service North Dakota from reaching out for clarifications or additional information, further complicating the process.

Finally, many individuals do not take the time to review the entire form before submission. Skimming through can lead to overlooked sections or unchecked boxes, which can result in an incomplete application. Taking a moment to carefully review all entries can save time and prevent the need for resubmission.

FAQ

What is the SFN 41216 form used for?

The SFN 41216 form, also known as the Report to Determine Liability, is used by businesses in North Dakota to report information that helps determine their liability for unemployment insurance. It collects essential details about the business, including ownership, employment history, and financial information. This helps Job Service North Dakota assess whether the business is subject to unemployment insurance taxes.

Who needs to fill out the SFN 41216 form?

Any business operating in North Dakota that has employees or plans to hire employees must complete this form. This includes various types of ownership structures such as corporations, partnerships, limited liability companies (LLCs), and nonprofit organizations. If a business has previously operated in North Dakota or has acquired another business, they may also need to submit this form.

What information is required on the SFN 41216 form?

The form requires several key pieces of information. This includes the business name, legal structure, Federal Employer Identification Number (FEIN), contact information, and details about the ownership. Additionally, it asks about employment history, wages paid, and whether the business has acquired assets from another employer. Accurate and complete information is crucial for determining liability.

What if my business is a nonprofit organization?

If your business is a nonprofit organization exempt from income taxes under Section 501(c)(3) of the IRS Code, you must still complete the SFN 41216 form. However, you will need to submit a copy of your IRS exemption letter. Nonprofits that have employed four or more persons during any 20 weeks in a calendar year must also provide additional details about their employment history.

How do I report wages on the SFN 41216 form?

The form includes sections where you will report the total amount of wages paid in North Dakota for specific quarters. You should not estimate these amounts. Instead, provide the actual wages paid from January 1 to December 31 of the current year and the preceding year. This information is necessary for calculating unemployment insurance contributions.

What happens if I answer "yes" to acquiring another business?

If you indicate that you have acquired another business or its assets, you will need to complete Schedule B, which collects more detailed information about the acquisition. This includes the name of the former owner, the percentage of assets acquired, and whether you are continuing the business. It is essential to provide accurate information to avoid penalties related to unemployment insurance rates.

Can I voluntarily cover my business for unemployment insurance?

If you determine that your business is not currently liable for unemployment insurance but would like to have coverage, you can opt for voluntary coverage. However, this option is not available if you have not employed workers in North Dakota. If you wish to pursue this, you will need to indicate your choice on the form.

Where do I submit the completed SFN 41216 form?

Once you have completed the SFN 41216 form, it should be submitted to Job Service North Dakota. The mailing address is provided on the form, and it is essential to ensure that all required sections are filled out accurately before submission. This helps to prevent delays in processing your information.