Free Sfn 2872 PDF Template

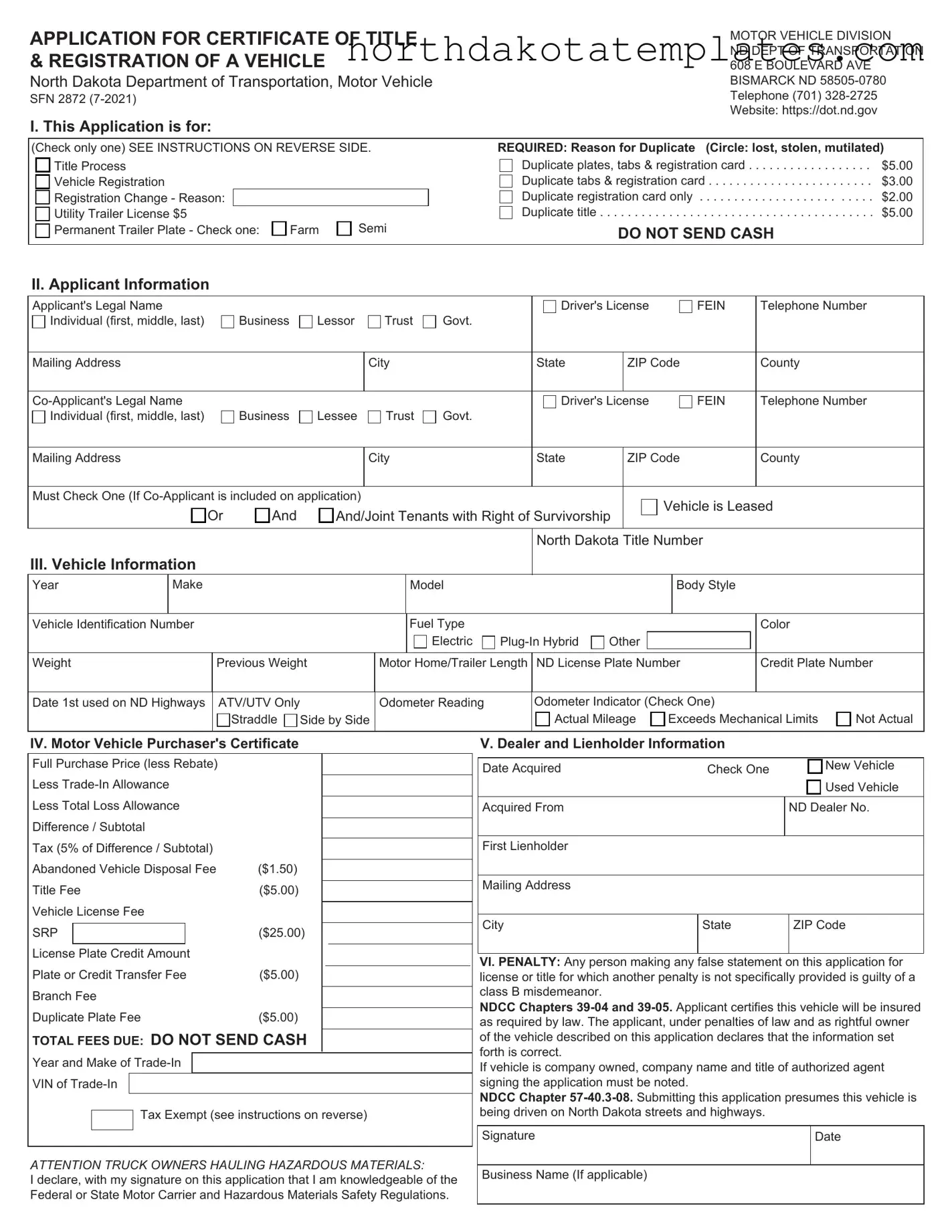

The SFN 2872 form is a crucial document for vehicle owners in North Dakota, serving multiple purposes related to vehicle registration and title applications. This form allows individuals to apply for a certificate of title and registration for their vehicles, whether they are new purchases, duplicates, or changes in ownership. It includes sections for applicant information, vehicle details, and specific reasons for the application, such as lost or stolen titles. Fees associated with the application vary depending on the type of request, including costs for duplicate titles, registration, and utility trailer licenses. Importantly, the form also requires applicants to certify that their vehicle will be insured as mandated by law. Additionally, there are stipulations regarding penalties for false statements, ensuring that all information provided is accurate and truthful. Understanding the SFN 2872 form is essential for navigating the registration process smoothly and legally.

Common PDF Documents

Nd Tax Forms - Consult the official website for any updates or changes to tax regulations.

Sfn 50645 - The information will impact your ability to work in nursing roles going forward.

The Florida Articles of Incorporation form is a document required for establishing a corporation within the state. It outlines the basic information needed to register the business with the Florida Department of State, such as the corporation’s name, address, and the names of its directors. Filing this form is the first official step in creating a recognized business entity in Florida. For more information, you can visit floridaforms.net/blank-articles-of-incorporation-form/.

Nd Trailer Registration - Understanding each section of the form is vital for both parties involved in the sale.

Similar forms

SFN 18609 - Damage Disclosure Statement: This form is used to disclose any damage on vehicles that are less than nine years old. Like the SFN 2872, it requires accurate information about the vehicle's condition.

SFN 2475 - Purchaser's Certification: This document is for buyers to certify the details of their purchase, including lienholder information. It shares the need for complete and truthful information, similar to the SFN 2872.

- ADP Pay Stub Form: Essential for employees, this document provides a transparent record of earnings, taxes, and deductions, facilitating financial planning and legal compliance through reliable information, as highlighted by resources like OnlineLawDocs.com.

SFN 3004 - Mobile Home Title Application: This form is used for the title application of mobile homes. It requires detailed vehicle information, just like the SFN 2872, but focuses on mobile homes instead of motor vehicles.

SFN 53658 - Manufactured Home Title Application: Similar to the SFN 3004, this form applies to manufactured homes. It also requires specific details about the vehicle, mirroring the information needed in the SFN 2872.

SFN 18085 - Tribal Vehicle Title Application: This form is used for vehicles owned by tribal members. It, too, requires complete information about the vehicle and owner, akin to the SFN 2872.

SFN 2880 - Repossession Application: This document is used when a vehicle is repossessed. It requires detailed information about the vehicle and the repossession process, similar to the requirements of the SFN 2872.

How to Use Sfn 2872

Once you have gathered all the necessary information, you can proceed to fill out the SFN 2872 form. This application is essential for obtaining a certificate of title and registration for your vehicle in North Dakota. Follow the steps carefully to ensure that your application is complete and accurate.

- Choose the type of application: In Section I, check only one box that corresponds to your reason for applying, such as duplicate title or vehicle registration.

- Fill out applicant information: In Section II, provide your legal name, mailing address, and telephone number. If there is a co-applicant, include their information as well.

- Provide vehicle information: In Section III, fill out all applicable details about your vehicle, including year, make, model, and Vehicle Identification Number (VIN).

- Complete the purchaser's certificate: In Section IV, indicate the full purchase price and other relevant details. Include any applicable fees such as the abandoned vehicle disposal fee and title fee.

- Include dealer and lienholder information: If applicable, provide the details of the dealer and any lienholders in Section V.

- Sign and date the application: Make sure to sign the form with your legal signature and date it in the designated area.

- Check for tax exemptions: If you believe you qualify for a tax exemption, fill out Section VII with the appropriate exemption number.

- Complete the damage disclosure statement: If your vehicle is less than nine years old, complete the SFN 18609 Damage Disclosure Statement and submit it with your application.

Dos and Don'ts

When filling out the SFN 2872 form for the application of a certificate of title and registration of a vehicle, it is essential to follow certain guidelines to ensure a smooth process. Here are five things to do and five things to avoid:

- Do: Carefully read the instructions provided on the reverse side of the form.

- Do: Complete all sections of the form accurately, ensuring that all required information is included.

- Do: Double-check the vehicle identification number (VIN) and other vehicle information for accuracy.

- Do: Sign and date the application to validate your submission.

- Do: Include the correct payment for any fees associated with the application.

- Don't: Leave any sections blank; incomplete forms may be rejected.

- Don't: Use cash when submitting your application; payments should be made via check or money order.

- Don't: Forget to provide your legal name and contact information as it appears on your identification.

- Don't: Submit false information, as this can lead to serious legal consequences.

- Don't: Overlook the requirement for a damage disclosure statement if applicable.

Document Example

APPLICATION FOR CERTIFICATE OF TITLE & REGISTRATION OF A VEHICLE

North Dakota Department of Transportation, Motor Vehicle

SFN 2872

MOTOR VEHICLE DIVISION

ND DEPT OF TRANSPORTATION 608 E BOULEVARD AVE BISMARCK ND

I. This Application is for:

(Check only one) SEE INSTRUCTIONS ON REVERSE SIDE. |

|

|

|

|

|

|

REQUIRED: Reason for Duplicate |

(Circle: lost, stolen, mutilated) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

Title Process |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Duplicate plates, tabs & registration card |

$5.00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

Vehicle Registration |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Duplicate tabs & registration card |

$3.00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

Registration Change - Reason: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Duplicate registration card only |

. . . . . . . . . . . . . . . . . . . . . . . . . |

$2.00 |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

Utility Trailer License $5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Duplicate title |

$5.00 |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

Permanent Trailer Plate - Check one: |

|

|

|

Farm |

|

|

Semi |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DO NOT SEND CASH |

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

II. Applicant Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Applicant's Legal Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Driver's License |

|

|

|

|

|

FEIN |

Telephone Number |

|

||||||||||||||||||||||

|

|

|

|

Individual (first, middle, last) |

|

|

|

|

Business |

|

Lessor |

|

|

|

|

Trust |

|

|

Govt. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

State |

|

ZIP Code |

|

|

County |

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Driver's License |

|

|

|

|

|

FEIN |

Telephone Number |

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

Individual (first, middle, last) |

|

|

|

|

Business |

|

Lessee |

|

|

|

|

Trust |

|

|

Govt. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

State |

|

ZIP Code |

|

|

County |

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Must Check One (If |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle is Leased |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Or |

|

And |

|

|

|

|

|

|

And/Joint Tenants with Right of Survivorship |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North Dakota Title Number |

|

|

|

|

|

|

|

|

||||||||||||||||

III. Vehicle Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Year |

|

Make |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Model |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Body Style |

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Vehicle Identification Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fuel Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Color |

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electric |

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weight |

|

|

|

|

|

Previous Weight |

|

|

|

Motor Home/Trailer Length |

ND License Plate Number |

|

|

Credit Plate Number |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Date 1st used on ND Highways |

|

ATV/UTV Only |

|

|

|

|

|

|

|

|

|

|

|

|

Odometer Reading |

|

|

|

Odometer Indicator (Check One) |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Straddle |

|

|

|

Side by Side |

|

|

|

|

|

|

|

|

|

|

|

|

|

Actual Mileage |

|

|

Exceeds Mechanical Limits |

|

|

Not Actual |

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IV. Motor Vehicle Purchaser's Certificate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

V. Dealer and Lienholder Information |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Full Purchase Price (less Rebate) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date Acquired |

|

|

|

|

|

|

|

|

|

|

Check One |

New Vehicle |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Less |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Used Vehicle |

|||||||||||

|

Less Total Loss Allowance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquired From |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ND Dealer No. |

|

||||||||||||||||||||||||||

|

Difference / Subtotal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Tax (5% of Difference / Subtotal) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Lienholder |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Abandoned Vehicle Disposal Fee |

($1.50) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Title Fee |

|

|

|

|

|

($5.00) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Vehicle License Fee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

SRP |

|

|

|

|

|

|

|

|

|

|

($25.00) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

State |

|

|

ZIP Code |

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

License Plate Credit Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VI. PENALTY: Any person making any false statement on this application for |

|||||||||||||||||||||||||||||||||||||||||||

|

Plate or Credit Transfer Fee |

($5.00) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

license or title for which another penalty is not specifically provided is guilty of a |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Branch Fee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

class B misdemeanor. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NDCC Chapters |

||||||||||||||||||||||||||||||||||||||

|

Duplicate Plate Fee |

|

|

|

|

|

($5.00) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

as required by law. The applicant, under penalties of law and as rightful owner |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

TOTAL FEES DUE: DO NOT SEND CASH |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of the vehicle described on this application declares that the information set |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Year and Make of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

forth is correct. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If vehicle is company owned, company name and title of authorized agent |

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

VIN of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

signing the application must be noted. |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NDCC Chapter |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

Tax Exempt (see instructions on reverse) |

|

|

|

|

|

|

|

|

|

|

being driven on North Dakota streets and highways. |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

ATTENTION TRUCK OWNERS HAULING HAZARDOUS MATERIALS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

Business Name (If applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

I declare, with my signature on this application that I am knowledgeable of the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

Federal or State Motor Carrier and Hazardous Materials Safety Regulations. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SFN 2872

Page 2 of 2

(CONTINUATION OF MOTOR VEHICLE PURCHASER'S CERTIFICATE)

If vehicle is exempt from tax, enter number corresponding to exemption in Section IV. (front of this form)

1. Gift from: |

|

Spouse |

|

|

Parent(s) |

|

Child |

|

|

Sibling(s) |

|

|

Grandparent(s) |

|

|

Grandchild |

|

|

|

|

|

Gift to (Specify relationship between ALL NEW owners

2.Joint Tenants with Right of Survivorship and now vehicle is being put in one name only

3.Inheritance

4. Change of name by: |

|

|

|

|

|

|

|

|

|

Marriage |

|

Adoption |

|

Court Order |

|||

5.Vehicle acquired through a lease purchase agreement (Check one)

A. If tax was paid on the total lease consideration, tax is due on the lease buyout amount.

A. If tax was paid on the total lease consideration, tax is due on the lease buyout amount.

B. If tax was paid on the full purchase price and you have been in possession of the vehicle over one year, no tax is due.

B. If tax was paid on the full purchase price and you have been in possession of the vehicle over one year, no tax is due.

C. If tax was paid on the full purchase price and you have been in

C. If tax was paid on the full purchase price and you have been in  possession of the vehicle for less than one year, tax is due on the lease buyout amount.

possession of the vehicle for less than one year, tax is due on the lease buyout amount.

6.State Fleet

7. Lien change

8. Interstate carriers

9.Tax paid to state that grants reciprocity to North Dakota (Proof required)

10.Public Transportation provided under contract with NDDOT

11.Dealer resale - USED vehicle

12.Dealer resale - NEW vehicle

13.Tribal (SFN 18085 required)

14.Disabled American Veteran or Former Prisoner of War - Letter of Eligibility from the Department of Veteran's Affairs is required

15.Nonprofit senior citizens' or mobility impaired persons' corporation owned vehicle used for the transportation of the elderly or disabled

16.Mobility impaired person(s) purchasing specially equipped vehicle

17.Homemade vehicle

18. |

Newly formed |

|

|

Partnership |

|

Corporation |

(Check One) |

|

|

Date formed: |

|

|

|

|

|

||

|

|

|

|

|

|

|||

19. |

Dissolved |

|

|

|

Partnership |

|

Corporation |

(Check One) |

|

|

|

||||||

|

|

|

||||||

|

Date dissolved: |

|

|

|

|

|

||

|

|

|

|

|

|

|||

20.Parochial or private

21.Assembled vehicles by motor vehicle dealer (SFN 21859 required)

22.Transfer into family trust

23. Military home of record: |

|

Entry |

|

Discharge (SFN 17147 required) |

24.Mobile Home (SFN 3004 required) or Manufactured Home (SFN 53658 required)

25.North Dakota political subdivisions

26.Repossession (SFN 2880 required)

27.

28.Total loss settlement or Salvaged

29. Other - Specify

30. Spousal Transfer due to Divorce (copy of divorce decree required)

VIII. Damage Disclosure NDCC

The damage disclosure law includes passenger cars, trucks, pickup trucks, motorcycles, and motor homes that are less than nine years old. It EXCLUDES all trailers,

If applicable, please submit SFN 18609 Damage Disclosure Statement with this application. Any person who makes a false statement on this form is guilty of a Class A Misdemeanor.

Instructions:

SECTION NO.

I. Check the type of application you are submitting (check only one).

II.Complete applicant information in FULL for each owner.

III.Complete ALL applicable vehicle information. Odometer reading required on all vehicles 2011 and newer.

IV. Complete ALL applicable purchaser's certificate information.

•Abandoned vehicle disposal fee of $1.50 is due on all new and

•Title fee is $5.00.

•Enter license fee and pay applicable plate credit using the appropriate fee schedule.

•If applying plate credit, enter $5.00 plate transfer fee.

•If a trade allowance, year, make, and VIN are required.

•Enter the appropriate tax exemption number if an exemption for tax is claimed (see tax exemptions Section VII).

V.Complete ALL applicable dealer and lienholder information. If needing to add a second lienholder complete SFN 2475 Part 3: Purchaser's Certification and Application to include all lienholders.

VI. Application must be signed with applicant's legal signature and dated.

VII. Applicable tax exemptions.

VIII. Damage Disclosure statement SFN 18609 must be completed for all vehicles less than nine (9) model years old.

File Breakdown

| Fact Name | Details |

|---|---|

| Purpose of the Form | The SFN 2872 form is used to apply for a certificate of title and registration of a vehicle in North Dakota. |

| Fees | Fees for processing include $5.00 for a duplicate title, $3.00 for vehicle registration, and $2.00 for a duplicate registration card. |

| Applicant Information | Applicants must provide their legal name, mailing address, and contact information. This applies to both the primary applicant and any co-applicants. |

| Vehicle Details | Information about the vehicle must be included, such as the year, make, model, and vehicle identification number (VIN). |

| Tax Exemptions | Several tax exemptions are available, including those for gifts, inheritances, and certain nonprofit organizations. Specific documentation may be required. |

| Legal Compliance | Falsifying information on this application can result in penalties, including a Class B misdemeanor under North Dakota law. |

Common mistakes

Filling out the SFN 2872 form can be a straightforward process, but many individuals encounter challenges that can lead to mistakes. One common error is failing to check the appropriate box in Section I to indicate the reason for the application. It is essential to select only one option, whether it is for a duplicate title, registration, or other reasons. Neglecting this step can result in delays or even rejection of the application.

Another frequent mistake involves incomplete applicant information. In Section II, applicants must provide full details, including legal names, addresses, and contact numbers. Omitting any of this information can hinder the processing of the application. It is crucial to ensure that all fields are filled accurately to avoid unnecessary complications.

Many applicants also overlook the importance of providing accurate vehicle information in Section III. This includes details such as the Vehicle Identification Number (VIN), make, model, and year of the vehicle. Errors or omissions in this section can lead to problems in registering the vehicle or obtaining a title, potentially causing legal issues down the line.

Odometer readings are another area where mistakes often occur. Section III requires the odometer reading for vehicles manufactured in 2011 or later. Failing to provide this reading, or entering it incorrectly, can lead to legal ramifications, as it is essential for tracking mileage and ensuring compliance with state regulations.

In Section IV, applicants must accurately report the purchase price and any applicable fees. A common oversight is not including the correct tax information or failing to calculate the total fees due. This can result in the application being returned for correction, causing delays in obtaining the title or registration.

Additionally, many individuals neglect to sign and date the application in Section VI. A signature is a legal affirmation that the information provided is accurate. Without it, the application may be deemed incomplete, leading to further delays in processing.

Another mistake involves misunderstanding tax exemptions. In Section VII, applicants must enter the appropriate exemption number if claiming a tax exemption. Failing to do so, or entering the wrong number, can result in unexpected fees or complications with the application.

Lastly, applicants often forget to include the Damage Disclosure Statement (SFN 18609) for vehicles that are less than nine years old. This statement is crucial for compliance with state laws regarding vehicle damage disclosure. Omitting this document can lead to penalties and additional requirements to complete the application process.

FAQ

What is the purpose of the SFN 2872 form?

The SFN 2872 form is used to apply for a certificate of title and registration of a vehicle in North Dakota. This form allows individuals or businesses to request duplicate titles, registration cards, or license plates. It also serves to update vehicle information or transfer ownership.

What information is required to complete the SFN 2872 form?

Applicants must provide personal information, including their legal name, mailing address, and contact details. Vehicle details such as year, make, model, and Vehicle Identification Number (VIN) are also necessary. Additionally, the form requires information about any lienholders and the reason for the application, such as requesting a duplicate title or updating registration.

What fees are associated with the SFN 2872 form?

Several fees may apply depending on the type of request. For example, a duplicate title costs $5.00, while a duplicate registration card is $2.00. If you need duplicate plates or tabs, the fee is $5.00. It’s important to check the specific fees for your application type and ensure that payment is included, as cash should not be sent.

How do I submit the SFN 2872 form?

The completed SFN 2872 form can be submitted to the North Dakota Department of Transportation's Motor Vehicle Division. You can send it by mail to their address in Bismarck or, in some cases, submit it in person at a local office. Make sure to include all required documentation and payment to avoid delays.

What should I do if I make a mistake on the SFN 2872 form?

If you notice an error after submitting the form, contact the North Dakota Department of Transportation as soon as possible. Depending on the nature of the mistake, they may guide you on how to correct it or advise you to resubmit the form. Always ensure that all information is accurate to prevent complications with your vehicle registration.