Free Sfn 13100 PDF Template

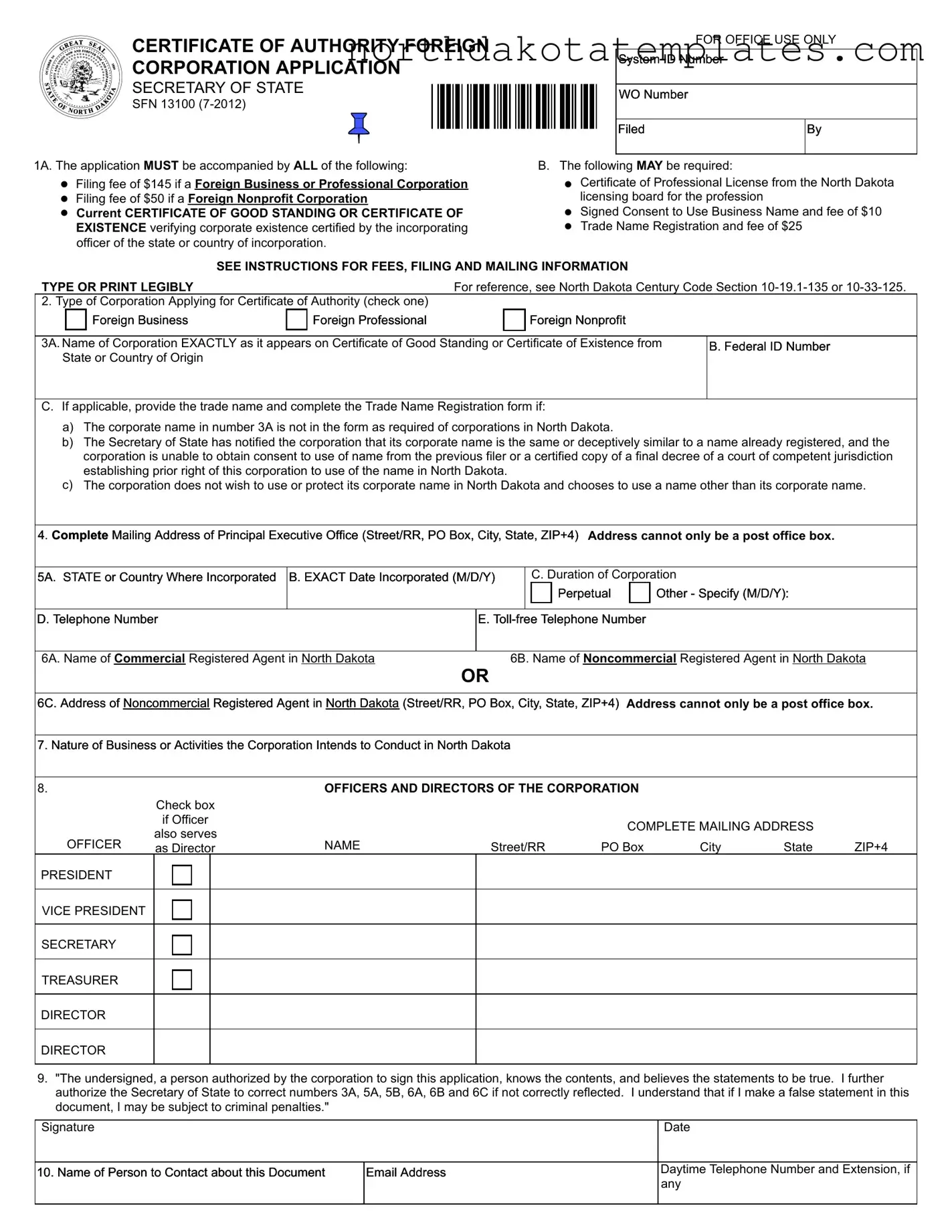

The SFN 13100 form, also known as the Certificate of Authority for Foreign Corporations, is a crucial document for foreign entities wishing to conduct business in North Dakota. This application must be submitted to the Secretary of State and includes specific requirements that must be met for approval. A filing fee is required, which varies based on the type of corporation: $145 for foreign business or professional corporations and $50 for foreign nonprofit corporations. Additional documentation may also be necessary, such as a current Certificate of Good Standing or Certificate of Existence from the corporation's state of incorporation, and, if applicable, a Certificate of Professional License from the North Dakota licensing board. The form requires detailed information, including the corporation's name as it appears on the Certificate of Good Standing, the state or country of incorporation, and the nature of business activities intended in North Dakota. Furthermore, the corporation must appoint a registered agent in North Dakota, who can be either a commercial or noncommercial entity. Accurate completion of the form is essential, as any discrepancies may lead to delays or rejection of the application. This form serves as a key step for foreign corporations to legally operate within the state, ensuring compliance with North Dakota's regulations.

Common PDF Documents

Nd Ems Association - Fields for cause and impact analysis help in understanding the factors surrounding the incident.

For individuals engaging in transactions, the use of a "simple bill of sale" is advisable to ensure a clear understanding between the seller and buyer, securing the details and conditions of ownership transfer efficiently. For more information, visit our simple bill of sale resource.

North Dakota Nonresident Filing Requirements - The form details specific tax rate schedules that apply based on the amount of taxable income.

Similar forms

-

Certificate of Good Standing: This document verifies that a corporation is authorized to conduct business in its home state. Similar to the SFN 13100 form, it confirms the corporation's existence and compliance with state regulations.

-

Articles of Incorporation: This foundational document establishes a corporation's existence. Like the SFN 13100, it requires specific information about the corporation, including its name and purpose.

-

Foreign Qualification Application: This form is used by corporations to register in a state other than where they were incorporated. It parallels the SFN 13100 in that both applications seek permission to operate in a new jurisdiction.

-

Trade Name Registration: When a corporation wants to operate under a name different from its legal name, this registration is necessary. It aligns with the SFN 13100 by ensuring that the name used is officially recognized.

-

Arizona Bill of Sale: The Arizona Bill of Sale form is a legal document that records the sale of personal properties, such as vehicles or firearms, in the state of Arizona. It provides concrete evidence of the transfer of ownership, ensuring that all the details regarding the transaction are documented accurately and completely. To securely and efficiently complete your sale or purchase, consider filling out the form by clicking the button below. For more information, visit All Arizona Forms.

-

Business License Application: This document is required to legally operate a business in many areas. Like the SFN 13100, it typically requires detailed information about the business and its owners.

-

Certificate of Existence: Similar to the Certificate of Good Standing, this document confirms that a corporation is in good standing with the state. It supports the SFN 13100 by providing proof of the corporation's legitimacy.

-

Annual Report: This document updates the state on a corporation's activities and status. It is related to the SFN 13100 as both involve ongoing compliance with state requirements to maintain corporate status.

How to Use Sfn 13100

Filling out the SFN 13100 form is an essential step for foreign corporations seeking to conduct business in North Dakota. After completing the form, it must be submitted along with the required fees and supporting documents to the Secretary of State's office. Ensure that all information is accurate and complete to avoid delays in processing.

- Gather required documents: Ensure you have a current certificate of good standing or certificate of existence, along with the appropriate filing fee ($145 for foreign business/professional corporations or $50 for foreign nonprofit corporations).

- Complete Section 1A: Indicate the filing fee and attach the required documents, including any necessary certificates or licenses.

- Fill in Section 2: Check the box for the type of corporation (Foreign Business, Foreign Professional, or Foreign Nonprofit).

- Complete Section 3A: Enter the corporation's name exactly as it appears on the certificate of good standing or certificate of existence.

- Provide the Federal ID Number in Section 3B, if applicable.

- If necessary, fill out Section 3C with the trade name and complete the Trade Name Registration form if the corporate name does not meet North Dakota requirements.

- In Section 4, provide the complete mailing address of the principal executive office, ensuring it includes street address, city, state, and ZIP+4.

- Complete Section 5A: Indicate the state or country where the corporation is incorporated.

- Fill in Section 5B with the exact date of incorporation.

- Specify the duration of the corporation in Section 5C (perpetual or other).

- Provide the telephone number in Section 5D and a toll-free number in Section 5E, if applicable.

- In Section 6A, name the commercial registered agent in North Dakota. If using a noncommercial registered agent, provide the name in Section 6B or the address in Section 6C.

- Describe the nature of business in Section 7, detailing the activities the corporation intends to conduct in North Dakota.

- Complete Section 8 with the names and addresses of all officers and directors of the corporation.

- In Section 9, the authorized person must sign and date the application, confirming the truthfulness of the statements.

- Fill in Section 10 with the contact person's name, email address, and daytime telephone number for any inquiries.

Dos and Don'ts

When completing the SFN 13100 form, there are several important considerations to keep in mind. Below is a list of actions to take and avoid.

- Do ensure that the application is accompanied by the appropriate filing fee based on the type of corporation.

- Do provide a current certificate of good standing or certificate of existence, certified within the last 90 days.

- Do type or print all information legibly to avoid processing delays.

- Do include the exact name of the corporation as it appears on the certificate from the state of incorporation.

- Don't use a post office box as the only address for the principal executive office.

- Don't forget to sign and date the application; an unsigned application will be rejected.

Document Example

|

|

|

|

CERTIFICATE OF AUTHORITY FOREIGN |

|

|

|

|

|

|

|

|

|

|

|

|

FOR OFFICE USE ONLY |

|||||||||||

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

System ID Number |

|

|||||||||||

|

|

|

|

CORPORATION APPLICATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

SECRETARY OF STATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WO Number |

|

||

|

|

|

|

SFN 13100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Filed |

By |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1A. The application MUST be accompanied by ALL of the following: |

|

|

|

|

|

B. The following MAY be required: |

|

|||||||||||||||||||||

|

Filing fee of $145 if a Foreign Business or Professional Corporation |

|

|

|

|

|

|

|

Certificate of Professional License from the North Dakota |

|||||||||||||||||||

|

Filing fee of $50 if a Foreign Nonprofit Corporation |

|

|

|

|

|

|

|

|

licensing board for the profession |

|

|||||||||||||||||

|

Current CERTIFICATE OF GOOD STANDING OR CERTIFICATE OF |

|

|

|

|

|

|

|

Signed Consent to Use Business Name and fee of $10 |

|||||||||||||||||||

|

|

EXISTENCE verifying corporate existence certified by the incorporating |

|

|

|

|

|

|

|

Trade Name Registration and fee of $25 |

|

|||||||||||||||||

|

|

officer of the state or country of incorporation. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

SEE INSTRUCTIONS FOR FEES, FILING AND MAILING INFORMATION |

|

|||||||||||||||||||||||

|

TYPE OR PRINT LEGIBLY |

|

|

|

|

For reference, see North Dakota Century Code Section |

||||||||||||||||||||||

|

2. Type of Corporation Applying for Certificate of Authority (check one) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

Foreign Business |

|

Foreign Professional |

|

|

|

|

Foreign Nonprofit |

|

|||||||||||||||||

3A. Name of Corporation EXACTLY as it appears on Certificate of Good Standing or Certificate of Existence from State or Country of Origin

B. Federal ID Number

C.If applicable, provide the trade name and complete the Trade Name Registration form if:

a)The corporate name in number 3A is not in the form as required of corporations in North Dakota.

b)The Secretary of State has notified the corporation that its corporate name is the same or deceptively similar to a name already registered, and the corporation is unable to obtain consent to use of name from the previous filer or a certified copy of a final decree of a court of competent jurisdiction establishing prior right of this corporation to use of the name in North Dakota.

c)The corporation does not wish to use or protect its corporate name in North Dakota and chooses to use a name other than its corporate name.

4.Complete Mailing Address of Principal Executive Office (Street/RR, PO Box, City, State, ZIP+4) Address cannot only be a post office box.

5A. STATE or Country Where Incorporated

B. EXACT Date Incorporated (M/D/Y)

C. Duration of Corporation

|

Perpetual |

|

Other - Specify (M/D/Y): |

D. Telephone Number |

|

E. |

|

|

|

6A. Name of Commercial Registered Agent in North Dakota |

|

6B. Name of Noncommercial Registered Agent in North Dakota |

|

OR |

|

6C. Address of Noncommercial Registered Agent in North Dakota (Street/RR, PO Box, City, State, ZIP+4) Address cannot only be a post office box.

7. Nature of Business or Activities the Corporation Intends to Conduct in North Dakota

8. |

Check box |

OFFICERS AND DIRECTORS OF THE CORPORATION |

|

|

|

|||

|

|

|

|

|

|

|

||

|

if Officer |

|

|

COMPLETE MAILING ADDRESS |

|

|||

|

also serves |

|

|

|

||||

OFFICER |

NAME |

Street/RR |

PO Box |

City |

State |

ZIP+4 |

||

as Director |

||||||||

PRESIDENT

VICE PRESIDENT

SECRETARY

TREASURER

DIRECTOR

DIRECTOR

9."The undersigned, a person authorized by the corporation to sign this application, knows the contents, and believes the statements to be true. I further authorize the Secretary of State to correct numbers 3A, 5A, 5B, 6A, 6B and 6C if not correctly reflected. I understand that if I make a false statement in this document, I may be subject to criminal penalties."

Signature |

|

Date |

|

|

|

10. Name of Person to Contact about this Document |

Email Address |

Daytime Telephone Number and Extension, if |

|

|

any |

|

|

|

SFN 13100

CERTIFICATE OF AUTHORITY FOREIGN CORPORATION APPLICATION

No foreign corporation may transact business, or conduct affairs, in North Dakota, OR obtain any license or permit required by North Dakota law, until the corporation has obtained a Certificate of Authority from the Secretary of State.

Instructions: The following numbered instructions correspond to the numbers on the form.

1A. The application for Certificate of Authority MUST be accompanied by ALL of the following before the Certificate of Authority can be issued:

FILING FEE of $145 if a foreign business or professional corporation, OR $50 if a foreign nonprofit corporation.

(Checks must be payable to "Secretary of State" and must be for U.S. negotiable funds. Payment may also be made by credit card using Visa, MasterCard, or Discover.)

Current certificate of good standing or certificate of existence verifying corporate existence certified by the incorporating officer of the state or country of incorporation. A copy of the Articles of Incorporation is not acceptable. The certificate must have been certified within 90 days of the date of application.

1B. The application for Certificate of Authority MAY BE REQUIRED to be accompanied by the following:

If applicant is a foreign professional corporation, it must submit a Certificate of Professional License from the North Dakota licensing board for the profession verifying that the practitioners of the corporation have been licensed to provide the professional service.

A signed Consent to Use Business Name AND fee of $10 when the corporation is already aware of a conflict with its corporate name.

Trade Name Registration AND fee of $25 when the corporation assumes a name, other than its corporate name, for use in North Dakota.

2.Indicate whether the application is being submitted for a Certificate of Authority for a foreign business corporation, a foreign professional corporation, or a foreign nonprofit corporation.

3A. Provide the correct corporate name as incorporated in the state or country of organization. Punctuation, spaces, and abbreviations must be consistent with those in the name on the certificate from the incorporating officer of the state or country where incorporated. If the name in number 3A is not the same as reflected on the Certificate of Good Standing or Certificate of Existence, the name will be corrected by the Secretary of State when the document is received.

3B. While the federal ID number is not required to be disclosed, a corporation's Federal ID number is helpful for maintaining accurate records. Please provide, if you have one.

PRIVACY: In compliance with N.D.C.C. Section

3C. Provide a trade name if the corporation cannot use its corporate name because:

a)The corporate name is not in the form as required of a corporation in North Dakota. The name must be expressed letters or characters in the English language as those letters or characters appear in the American Standard Cod for Information Interchange (ASCII) table.

The name of a foreign business corporation must also include the word "corporation", "incorporated", "company", or "limited", or an abbreviation of one of these words. If a foreign corporation's name does not contain one of these words or abbreviations, the corporation must elect one to be used in North Dakota. The application must be rejected if an election is not made and the corporate name in 3A. is not in compliance with this requirement. (For reference, see N.D.C.C. Sections

b)The corporate name may not include such words as "bank", "banker", "banking", "trust", or "trust company", or any other word or words of like import unless the application is supported by a written approval for the use from the North Dakota Department of Financial Institutions. These words are preserved by North Dakota law for use by the Bank of North Dakota, state and national banks, and trust companies. Contact information:

ND Dept. of Financial Institutions 2000 Schafer St Ste G Bismarck ND

c)The North Dakota Secretary of State has notified the corporation that its corporate name is the same as or deceptively similar to a name already registered and the corporation is unable to obtain consent to use of name from the previous filer or a certified copy of a final decree of a court of competent jurisdiction establishing prior right of this corporation to use of the name in North Dakota.

North Dakota law provides that a corporate name may not be the same as, or deceptively similar to, a name previously registered with the Secretary of State. The name may be used if the corporation obtains a court decree or signed consent to use of name that is submitted with a fee of $10. A form for Consent to Use Business Name is prescribed by the Secretary of State. If consent to use of name cannot be obtained, a trade name (DBA) must be elected.

d)The corporation does not wish to use or protect its corporate name in North Dakota and chooses to use a trade name instead.

TRADE NAMES: A corporation may choose to use any trade name (DBA) in addition to its corporate name in North Dakota. The trade name must be registered with the Secretary of State. However, the trade name should not be provided in number 3C., except as described above. Instead, complete and attach the Trade Name Registration and fee of $25 for each assumed name. Contact the Secretary of State's office for the Trade Name Registration form.

4.A complete address of the corporation's principal executive office is required.

A complete address must include a street or rural address, a post office box (if applicable), the city, state, and ZIP code plus

5A. Identify the state or country in which the corporation is incorporated. If the state or country of origin in number 5A. is not the same as reflected on the Certificate of Good Standing or Certificate of Existence, the state or country will be corrected by the Secretary of State when the document is received.

5B. Provide the EXACT date (month, day AND year) when the corporation was incorporated. This date must correspond to the date if specified in the Certificate of Good Standing or Certificate of Existence. If the date in 5B. is not the same as reflected on the Certificate of Good Standing or Certificate of Existence, the date will be corrected by the Secretary of State when the document is received.

5C. Identify whether the corporation is incorporated with "perpetual" existence or provide the specific date on which it is to be dissolved.

5D. The telephone number of the corporation's principal executive office is required.

SFN 13100

CERTIFICATE OF AUTHORITY FOREIGN CORPORATION APPLICATION

5E. Provide a

A foreign corporation must continuously maintain a commercial or noncommercial registered agent and address in North Dakota. A foreign corporation cannot serve itself as its registered agent.

A commercial registered agent must be registered as a commercial registered agent with the North Dakota Secretary of State. The appointed agent can verify their status as a commercial registered agent from their acknowledged filing and from the list of commercial registered agents maintained on the Secretary of State's website at www.nd.gov/sos.

A noncommercial registered agent may be one of the following:

a)An individual residing in North Dakota,

b)A domestic or foreign corporation, or

c)A domestic or foreign limited liability company.

A corporation or limited liability company appointed as a noncommercial registered agent must be registered with the Secretary of State, be in good standing, and have a business address in North Dakota. If a corporation or limited liability company is named as a noncommercial registered agent, provide the correct name of the organization.

Seek the approval of the party before naming them as the commercial or noncommercial registered agent. Proof of the approval is not required to be filed with the Secretary of State.

6A. If a commercial registered agent is being appointed, provide the correct name as registered with the North Dakota Secretary of State. If the name in number 6A. is not the same as registered by the commercial registered agent, or is incorrectly provided in 6B., the name will be corrected by the Secretary of State when the document is received.

OR

6B. If a noncommercial registered agent is being appointed, provide the correct name. If another corporation or limited liability company is appointed as registered agent and the name of that organization in number 6B. is not the same as registered, or is incorrectly provided in 6A., the name will be corrected by the Secretary of State when the document is received.

6C. If a noncommercial registered agent is being appointed, provide the complete address in North Dakota which may not be only a post office box. Leave this line blank if a commercial registered agent is appointed. If a commercial registered agent is named in 6A. and an address is provided in 6C., the address will be removed by the Secretary of State.

7.Describe the specific purpose or nature of business the corporation intends to transact in North Dakota.

If the corporation is involved in the business of insurance, clearly define that the corporation is a business corporation selling or servicing insurance products. A corporation that actually backs the claims may not be required to file this application.

8.This section must reflect names and complete addresses of all officers and directors. (See definition of complete mailing address in item 4.)

9.The application must be signed and dated by a person authorized to sign on behalf of the corporation.

10.Provide the name, email address, daytime telephone number, and extension, if any, of a contact person if this office has any questions or needs additional information. The email address is not disclosed to the public; this information is privatized in accordance with N.D.C.C. Section

ASSISTANCE: If assistance is required to complete the application, call the Secretary of State at

FAX FILING: The document and Credit Card Payment Authorization may be faxed to

EMAIL: Email is not a secure utility for the transmission of private information or credit card authorizations. DO NOT EMAIL YOUR DOCUMENT TO THE SECRETARY OF STATE.

Telephone: |

Toll Free: |

Fax: |

Web Site: www.nd.gov/sos |

ANNUAL REPORTS: An annual report is required in the year following that in which the Certificate of Authority is issued. An annual report of a foreign business or professional corporation is due on May 15. The annual report of a foreign nonprofit corporation is due on February 1. The registered agent will be notified when the annual report is due.

CREDIT CARD PAYMENT AUTHORIZATION

SECRETARY OF STATE

SFN 51478

(All items required to complete transaction)

Name

Amount Authorized

Telephone Number

Address

City

State

ZIP Code

|

|

|

VISA |

|

|

MasterCard |

|

Discover |

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Account Number |

|

|

|

|

|

|

|

|

|

|

|

|

CSC |

Card Expires |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number * |

Month |

|

|

Year |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Signature (Required by Credit Card Companies)

Date

* (CSC is the

File Breakdown

| Fact Name | Details |

|---|---|

| Filing Fees | A fee of $145 is required for foreign business or professional corporations. For foreign nonprofit corporations, the fee is $50. |

| Certificate Requirement | The application must include a current Certificate of Good Standing or Certificate of Existence from the state or country of incorporation, certified within the last 90 days. |

| Type of Corporation | Applicants must specify whether they are applying for a foreign business, professional, or nonprofit corporation. |

| Registered Agent | A foreign corporation must maintain a registered agent in North Dakota, which can be either commercial or noncommercial. |

| Governing Law | This form is governed by North Dakota Century Code Sections 10-19.1-135 and 10-33-125. |

| Annual Reports | After obtaining the Certificate of Authority, an annual report is required. For business or professional corporations, it is due on May 15; for nonprofit corporations, it is due on February 1. |

Common mistakes

Filling out the SFN 13100 form can be a straightforward process, but several common mistakes can lead to delays or rejections. One significant error is failing to include the required filing fee. The form specifies a fee of $145 for foreign business or professional corporations and $50 for foreign nonprofit corporations. Omitting this payment will result in the application being returned.

Another frequent mistake involves the Certificate of Good Standing or Certificate of Existence. This document must be current and certified by the incorporating officer of the state or country of incorporation. If it is older than 90 days or not properly certified, the application will not be processed.

Many applicants neglect to provide the corporation's name exactly as it appears on the Certificate of Good Standing. Inconsistencies in punctuation, spacing, or abbreviations can lead to automatic corrections by the Secretary of State, which may cause confusion or further issues.

Additionally, the mailing address of the principal executive office is often incomplete. The form requires a full address that includes a street address and cannot consist solely of a post office box. Failure to provide a complete address can hinder communication and the processing of the application.

Another mistake is related to the registered agent. If a commercial registered agent is appointed, the name must match what is registered with the Secretary of State. If the name is incorrect or if a noncommercial registered agent is mistakenly listed, the application will face delays.

Some applicants overlook the necessity of specifying the nature of the business activities intended to be conducted in North Dakota. Providing vague or incomplete descriptions can lead to questions from the Secretary of State's office, further complicating the application process.

It is crucial for the person signing the application to be authorized to do so. If an unauthorized individual signs, the application may be deemed invalid. Proper authorization ensures that the application is legitimate and can be processed without issues.

Lastly, applicants often forget to provide contact information for someone who can answer questions about the application. Including a name, email address, and phone number is essential for the Secretary of State to reach out if further information is needed.

FAQ

What is the SFN 13100 form?

The SFN 13100 form is the application for a Certificate of Authority for foreign corporations wishing to conduct business in North Dakota. This form must be completed and submitted to the Secretary of State along with required documentation and fees.

What documents are required to accompany the SFN 13100 form?

To successfully submit the SFN 13100 form, applicants must include several documents. These include a filing fee of $145 for foreign business or professional corporations, or $50 for foreign nonprofit corporations. Additionally, a current certificate of good standing or certificate of existence, certified by the incorporating officer of the state or country of incorporation, is required. This certificate must be dated within 90 days of the application. Other documents may include a Certificate of Professional License, consent to use a business name, and trade name registration, depending on the corporation's circumstances.

What is the filing fee for the SFN 13100 form?

The filing fee for the SFN 13100 form varies based on the type of corporation. A foreign business or professional corporation must pay a fee of $145, while a foreign nonprofit corporation is required to pay a fee of $50. Additional fees may apply for trade name registration and consent to use a business name.

What happens if the corporate name does not comply with North Dakota requirements?

If the corporate name provided does not meet North Dakota's naming requirements, the Secretary of State will correct it upon receipt of the application. The name must include specific terms such as "corporation," "incorporated," or similar abbreviations. If the name is similar to an already registered name, the corporation must either obtain consent or choose a trade name for use in the state.

Can a foreign corporation serve itself as its registered agent in North Dakota?

No, a foreign corporation cannot serve itself as its registered agent in North Dakota. It must maintain a commercial or noncommercial registered agent with a physical address in the state. This agent is responsible for receiving legal documents on behalf of the corporation.

What is the purpose of the Certificate of Authority?

The Certificate of Authority allows a foreign corporation to legally transact business in North Dakota. Without this certificate, the corporation cannot conduct affairs or obtain necessary licenses or permits required by state law.

When are annual reports due for foreign corporations?

After obtaining the Certificate of Authority, foreign corporations must file annual reports. For foreign business or professional corporations, the report is due on May 15. For foreign nonprofit corporations, the report is due on February 1. The registered agent will be notified when the annual report is due.

How can assistance be obtained for completing the SFN 13100 form?

If assistance is needed while completing the SFN 13100 form, individuals can contact the Secretary of State's office at 701-328-2904. They can provide guidance and answer any questions regarding the application process.