Free Sfn 12011 PDF Template

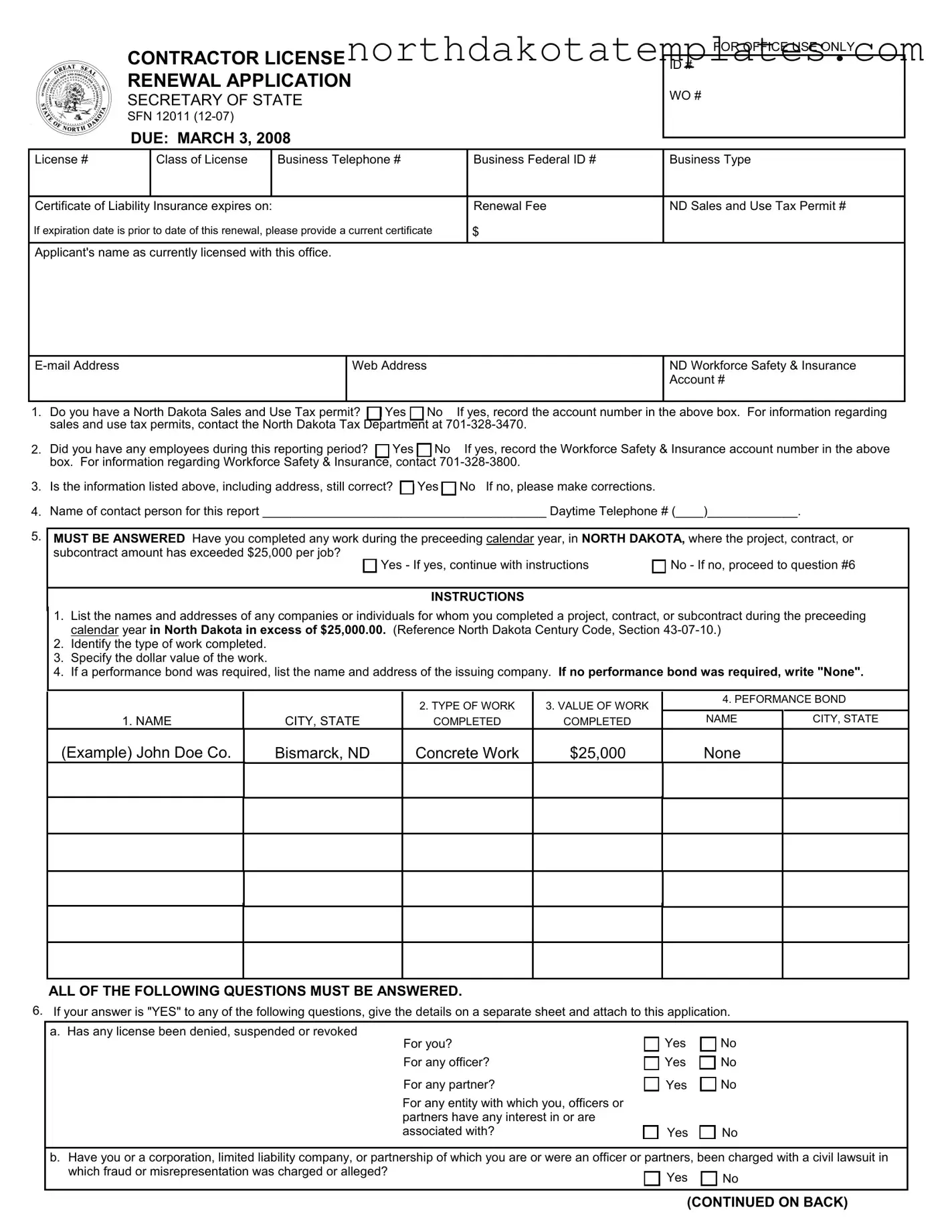

The SFN 12011 form is essential for contractors seeking to renew their licenses in North Dakota. This application must be completed and submitted by the specified deadline, which is crucial to avoid penalties and ensure compliance with state regulations. The form requires detailed information about the contractor's business, including the license class, business type, and federal ID number. Additionally, applicants must provide proof of liability insurance, confirm tax permit status, and disclose any significant work completed in the previous year that exceeds $25,000. Specific questions address prior legal issues, including license denials or criminal charges, which must be answered truthfully. Failure to comply with these requirements can lead to revocation of the license. Timely submission is vital; if the application is not filed by the deadline, a penalty fee will apply, and after June 2, 2008, contractors will need to apply for a new license altogether. Understanding the implications of this form is critical for maintaining legal standing and operational continuity in the contracting business.

Common PDF Documents

Society for Neuroscience - Ensuring that all patients are correctly identified simplifies the enrollment evaluation process.

When preparing for the future, it's vital to consider important documents like the detailed Last Will and Testament framework that outlines your final wishes, ensuring clarity and reducing potential conflicts among heirs. You can find more information on how to effectively create this essential legal document at the editable Last Will and Testament form.

How to Start an Llc in North Dakota - Double-check the name requirements to avoid complications during filing.

Similar forms

- Contractor License Application: Similar to the SFN 12011 form, this document is used to apply for a new contractor license. It requires similar information about the applicant's business, including contact details and insurance certificates.

- Business License Renewal Application: This document is used by businesses to renew their operating licenses. Like the SFN 12011, it requires verification of business information and may include questions about compliance with local regulations.

- Sales Tax Permit Application: This form is needed for businesses to collect sales tax. It shares similarities with the SFN 12011 in that it requires the applicant to provide business identification numbers and details about business activities.

- Employer Identification Number (EIN) Application: This form is essential for businesses to obtain a tax ID. Both forms require information about the business structure and ownership, making them similar in their purpose of establishing legal business identity.

- Certificate of Liability Insurance: While not an application form, this document is often required alongside the SFN 12011. Both emphasize the importance of insurance coverage in protecting the business and its clients.

-

Articles of Incorporation: This form is essential for starting a corporation in Florida, requiring details such as the corporation's name and directors. For more details, visit All Florida Forms.

- Performance Bond Application: This document ensures that a contractor can complete a project as promised. Like the SFN 12011, it involves the submission of financial information and proof of compliance with industry standards.

- Worker's Compensation Insurance Application: This form is necessary for businesses with employees. It parallels the SFN 12011 in that both require details about the business's workforce and insurance coverage.

- State Business Registration Form: This form registers a business with the state. It requires similar foundational information about the business, including its name, address, and ownership structure, akin to the SFN 12011.

- Occupational License Application: For certain professions, this form is necessary to operate legally. It shares the same goal of ensuring compliance with state laws and regulations, similar to the SFN 12011.

- Annual Report Filing: This document is often required for corporations and LLCs to report their financial status. It is similar to the SFN 12011 in that it requires updated information about the business and its operations.

How to Use Sfn 12011

After gathering the necessary information, proceed to fill out the SFN 12011 form carefully. Ensure all details are accurate to avoid delays in processing your application. Follow the steps outlined below to complete the form.

- Enter your Contractor License Renewal Application details at the top of the form, including your ID number, license number, and class of license.

- Provide your Business Telephone number, Business Federal ID number, and Business Type.

- Record the expiration date of your Certificate of Liability Insurance.

- List your ND Sales and Use Tax Permit number if applicable. If you have a permit, indicate "Yes" and write the account number in the designated box.

- Answer whether you had any employees during the reporting period. If yes, provide your Workforce Safety & Insurance Account number.

- Confirm if the information listed is correct. If not, make the necessary corrections.

- Provide the name of the contact person for this report along with their daytime telephone number.

- Answer the critical question regarding work completed in North Dakota exceeding $25,000. If yes, proceed to the next steps; if no, skip to question 6.

- List the names and addresses of companies or individuals for whom you completed work exceeding $25,000 in the past year.

- Identify the type of work completed for each project.

- Specify the dollar value of the work for each entry.

- If a performance bond was required, list the name and address of the issuing company. If not, write "None".

- Answer all subsequent questions regarding license status, lawsuits, bankruptcy, and criminal charges. Provide details on a separate sheet if necessary.

- Sign and date the application. Ensure that the signature is from the owner, partner, or authorized officer.

- Calculate the total fees due, including any penalties if applicable. Make checks payable to the Secretary of State.

- Submit the completed form via fax or mail to the designated address. If faxing, include the Credit Card Payment Authorization if applicable.

Dos and Don'ts

When filling out the SFN 12011 form for contractor license renewal, there are important dos and don'ts to keep in mind. Following these guidelines can help ensure a smooth application process.

- Do double-check all pre-printed information for accuracy before submitting.

- Do ensure that your certificate of liability insurance is current and on file.

- Do answer all questions honestly, especially those regarding past licenses or legal issues.

- Do provide any required documentation, such as a current certificate or additional sheets for detailed answers.

- Don't submit the form late; be aware of the March 3 deadline to avoid penalties.

- Don't forget to sign the application; an unsigned form will not be processed.

- Don't ignore the need for additional licenses or permits that may be required by law.

Document Example

CONTRACTOR LICENSE RENEWAL APPLICATION

SECRETARY OF STATE

SFN 12011

DUE: MARCH 3, 2008

FOR OFFICE USE ONLY

ID #

WO #

License # |

Class of License |

|

Business Telephone # |

|

|

Business Federal ID # |

Business Type |

|||

|

|

|

|

|

|

|

|

|

|

|

Certificate of Liability Insurance expires on: |

|

|

|

|

|

Renewal Fee |

ND Sales and Use Tax Permit # |

|||

If expiration date is prior to date of this renewal, please provide a current certificate |

|

$ |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Applicant's name as currently licensed with this office. |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||

|

|

|

Web Address |

|

|

ND Workforce Safety & Insurance |

||||

|

|

|

|

|

|

|

|

|

|

Account # |

|

|

|

|

|

|

|

||||

1. |

Do you have a North Dakota Sales and Use Tax permit? |

Yes |

No |

If yes, record the account number in the above box. For information regarding |

||||||

|

sales and use tax permits, contact the North Dakota Tax Department at |

|

||||||||

2. |

Did you have any employees during this reporting period? |

Yes |

No |

If yes, record the Workforce Safety & Insurance account number in the above |

||||||

|

box. For information regarding Workforce Safety & Insurance, contact |

|

||||||||

3. |

Is the information listed above, including address, still correct? |

Yes |

No If no, please make corrections. |

|

||||||

4. |

Name of contact person for this report _________________________________________ Daytime Telephone # (____)_____________. |

|||||||||

5.

MUST BE ANSWERED Have you completed any work during the preceeding calendar year, in NORTH DAKOTA, where the project, contract, or subcontract amount has exceeded $25,000 per job?

Yes - If yes, continue with instructions |

No - If no, proceed to question #6 |

INSTRUCTIONS

1.List the names and addresses of any companies or individuals for whom you completed a project, contract, or subcontract during the preceeding calendar year in North Dakota in excess of $25,000.00. (Reference North Dakota Century Code, Section

2.Identify the type of work completed.

3.Specify the dollar value of the work.

4.If a performance bond was required, list the name and address of the issuing company. If no performance bond was required, write "None".

|

|

2. TYPE OF WORK |

3. VALUE OF WORK |

4. PEFORMANCE BOND |

|

|

|

|

|

||

1. NAME |

CITY, STATE |

COMPLETED |

COMPLETED |

NAME |

CITY, STATE |

(Example) John Doe Co. |

Bismarck, ND |

Concrete Work |

$25,000 |

None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALL OF THE FOLLOWING QUESTIONS MUST BE ANSWERED.

6. If your answer is "YES" to any of the following questions, give the details on a separate sheet and attach to this application.

a. Has any license been denied, suspended or revoked |

Yes |

No |

For you? |

||

For any officer? |

Yes |

No |

For any partner? |

Yes |

No |

For any entity with which you, officers or |

|

|

partners have any interest in or are |

|

|

associated with? |

Yes |

No |

b. Have you or a corporation, limited liability company, or partnership of which you are or were an officer or partners, been charged with a civil lawsuit in

which fraud or misrepresentation was charged or alleged? |

Yes |

No |

|

(CONTINUED ON BACK)

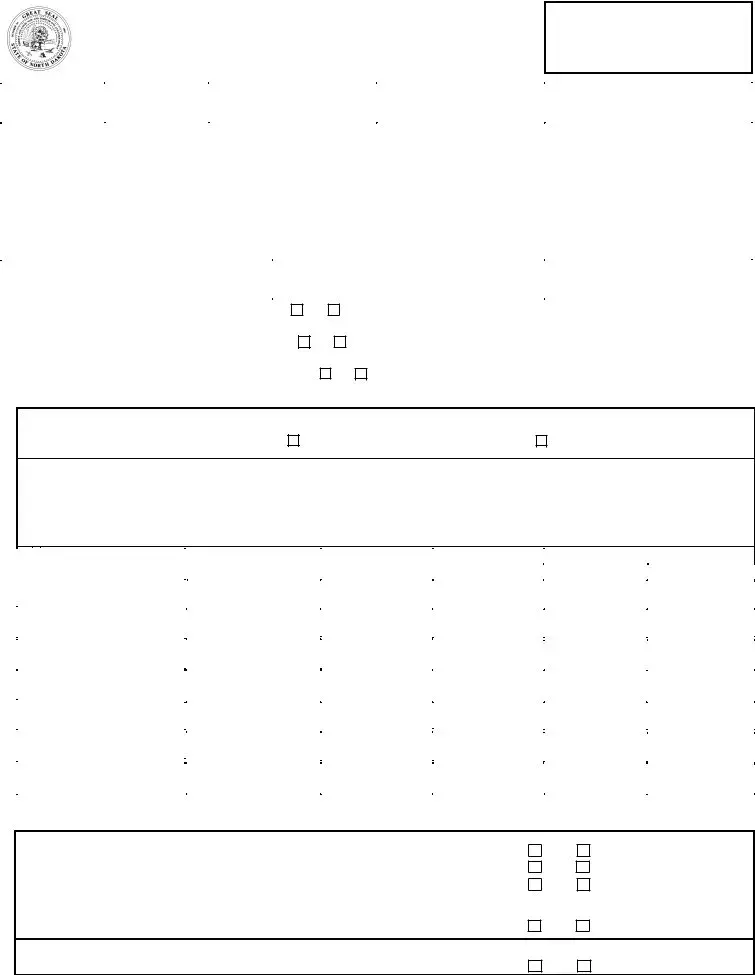

SFN 12011

c.Have you or a corporation, limited liability company, or partnership of which you are or were an officer or partner, been involved in or initiated bankruptcy or insolvency proceedings during the past five years?

Yes

No

d.Are there any judgments, arbitration awards, mechanics liens or federal or state tax liens against you, or a corporation, limited liability company, or partnership of which you are an officer or partner, in North Dakota or elsewhere?

Yes

No

e. Has the applicant, or officers or partners of the applicant been charged with or convicted of a felony or misdemeanor within the last five years?

Yes

No If Yes, indicate the date, name of the individual charged or convicted, city, state, disposition, and whether a felony or misdemeanor. (This includes ALL crimes, including nonsufficient funds checks, no account checks, and DUIs.)

No If Yes, indicate the date, name of the individual charged or convicted, city, state, disposition, and whether a felony or misdemeanor. (This includes ALL crimes, including nonsufficient funds checks, no account checks, and DUIs.)

7.North Dakota Century Code, Section

The undersigned, who is 18 years of age or older, hereby certifies that all payroll taxes (including North Dakota income tax and premiums for workforce safety & insurance and unemployment insurance) due and payable on the day of this application have been submitted and that all of the information provided on the renewal application is true and complete.

Signature of Owner*, Partner, or Authorized Officer |

Date |

*If a sole proprietorship business structure, a spouse is not authorized to sign on behalf of the owner.

FEES:

|

|

|

|

|

|

|

|

TOTAL PAYABLE |

|

NEW LICENSE |

|

CONTRACTOR LICENSE |

RENEWAL FEES |

PENALTY FEES |

|

AFTER MARCH 3 AND |

|||

FEES |

|

|

|

|

|

|

|

ON OR BEFORE JUNE 2 |

|

|

|

|

|

|

|

|

|

|

|

Fee $300.00 |

Class A |

for contracts over |

$250,000 |

Fee $60.00 |

Additional $45.00 |

|

Total |

$105.00 |

|

Fee $200.00 |

Class B |

for contracts up to |

$250,000 |

Fee $40.00 |

Additional $30.00 |

|

Total |

$ 70.00 |

|

Fee $150.00 |

Class C |

for contracts up to |

$ |

120,000 |

Fee $30.00 |

Additional $22.50 |

|

Total |

$ 52.50 |

Fee $ 50.00 |

Class D |

for contracts up to |

$ |

50,000 |

Fee $10.00 |

Additional $ 7.50 |

|

Total |

$ 17.50 |

|

|

|

|

|

|

|

|

|

|

INSTRUCTIONS:

1.The provisions for contractor licensing are found in Chapter

2.The renewal deadline for a contractor's license is March 3, 2008. If not renewed by that date, the current contractor's license automatically expires and completing any work over $2,000 per job would be in violation of

3.If the license renewal application is filed after the deadline, state law requires the payment of a penalty fee. This penalty fee must be submitted along with the renewal application and renewal fee at the time the late application is filed. The penalty fees are listed above.

4.Contractor license renewal applications will not be accepted after June 2, 2008. After that date, a previously licensed contractor must submit an application for a new license and pay the appropriate new contractor license fees.

5.If the

6.By law, a contractor's license cannot be renewed unless a copy of the contractor's current certificate of liability insurance is on file with the Secretary of State's office. A new certificate is not needed if the

7.Questions #5 and #6 must be answered with either a yes or no. If yes, provide the requested information. Use more sheets, if necessary.

8.The renewal application must be signed by the owner, partner, or authorized officer. If the renewal application contains false information, the contractor's license is subject to revocation under the provisions of state law.

9.Checks for renewal and penalty fees must be made payable to the Secretary of State. The Secretary of State accepts VISA, Master Card, and Discover charge cards. If you wish to pay by credit card, complete the enclosed charge card authorization.

10.In addition to a contractor's license, you may need to obtain other licenses or permits as required by law (for example, including but not limited to the State Electrical Board and the State Plumbing Board).

FAX FILING: A document and Credit Card Payment Authorization may be faxed to

MAILING INSTRUCTIONS: Send the completed renewal application to:

Secretary of State

State of North Dakota

600 E Boulevard Ave Dept 108

Bismarck ND

Telephone:

File Breakdown

| Fact Name | Details |

|---|---|

| Form Purpose | The SFN 12011 form is used for renewing contractor licenses in North Dakota. |

| Submission Deadline | The renewal application must be submitted by March 3, 2008, to avoid penalties. |

| Governing Law | This form is governed by Chapter 43-07 of the North Dakota Century Code. |

| Penalty Fees | Late submissions incur penalty fees, which vary based on the class of license. |

| Insurance Requirement | A current certificate of liability insurance must be on file for renewal. |

Common mistakes

Filling out the SFN 12011 form for contractor license renewal can be straightforward, but many applicants make common mistakes that can lead to delays or complications. One frequent error is failing to provide accurate contact information. Applicants often neglect to double-check their business telephone number or email address, which can hinder communication from the Secretary of State's office.

Another common mistake involves the omission of necessary account numbers. For example, if an applicant has a North Dakota Sales and Use Tax permit, they must include the account number. Leaving this section blank may raise questions and slow down the renewal process.

Some individuals also overlook the requirement to update their information. If any details, such as the business address or ownership structure, have changed since the last application, it is essential to make those corrections on the form. Failing to do so can result in delays or even denial of the renewal.

Additionally, answering questions incorrectly can lead to problems. For instance, applicants must answer whether they have completed any work exceeding $25,000 in the past year. If they answer "No" but have actually completed such work, it could lead to serious legal implications.

Another area where mistakes are common is in the financial disclosures. Applicants need to list the names and addresses of companies for whom they completed significant projects. Missing this information or providing incomplete details can result in the form being returned for correction.

It's also crucial to remember that all questions must be answered, especially those regarding past legal issues. Some applicants might skip these questions or provide vague responses, which can be problematic. Transparency is key in this section, as any discrepancies can jeopardize the application.

Moreover, the signature section is often a source of confusion. Applicants must ensure that the form is signed by the appropriate person, whether it's the owner, partner, or authorized officer. A spouse cannot sign on behalf of a sole proprietor, and failing to adhere to this requirement can invalidate the application.

Another mistake is related to payment. Applicants should ensure that the renewal and any applicable penalty fees are included with the application. Missing or incorrect payments can lead to processing delays or additional penalties.

Lastly, applicants sometimes forget to attach necessary documents, such as a current certificate of liability insurance. This document is mandatory for the renewal process. If the insurance certificate is not on file, the renewal will not be processed, leading to further complications.

FAQ

1. What is the purpose of the SFN 12011 form?

The SFN 12011 form is used for renewing a contractor's license in North Dakota. This form ensures that contractors continue to meet the requirements set by the state to operate legally. It collects essential information such as business details, insurance certificates, and any significant work completed in the previous year.

2. When is the renewal deadline for the contractor's license?

The renewal deadline for the contractor's license is March 3, 2008. If a contractor fails to renew by this date, their license will automatically expire. This means that they would be unable to legally complete any work exceeding $2,000 per job until the license is renewed.

3. What happens if I miss the renewal deadline?

If the renewal application is filed after the deadline, a penalty fee is required along with the renewal fee. The specific penalty fees vary depending on the class of the license. Furthermore, applications will not be accepted after June 2, 2008, necessitating a new license application if renewal is not completed in time.

4. Is a certificate of liability insurance required for renewal?

Yes, a current certificate of liability insurance must be on file with the Secretary of State's office for the renewal application to be accepted. If the expiration date on the pre-printed information is later than the renewal application date, a new certificate is not necessary.

5. What information do I need to provide about my work completed in the previous year?

If you have completed any projects in North Dakota where the contract amount exceeded $25,000, you must provide details such as the names and addresses of the clients, the type of work performed, and the dollar value of the work. This information is crucial for compliance with state regulations.

6. What if my business information has changed since my last application?

If any of the pre-printed information on the renewal application is incorrect, you should cross out the incorrect details and write in the correct information. Initialing the changes is also necessary to ensure that the updated information is recognized.

7. Can I submit my renewal application via fax?

Yes, the renewal application can be faxed to 701-328-1690, along with a Credit Card Payment Authorization. However, it is important to note that faxing does not expedite the processing of the application by the Secretary of State's office.

8. What payment methods are accepted for renewal fees?

The Secretary of State accepts checks made payable to their office, as well as credit card payments through VISA, MasterCard, and Discover. If opting to pay by credit card, it is necessary to complete the enclosed charge card authorization form included with the application.