Free Sfn 11302 PDF Template

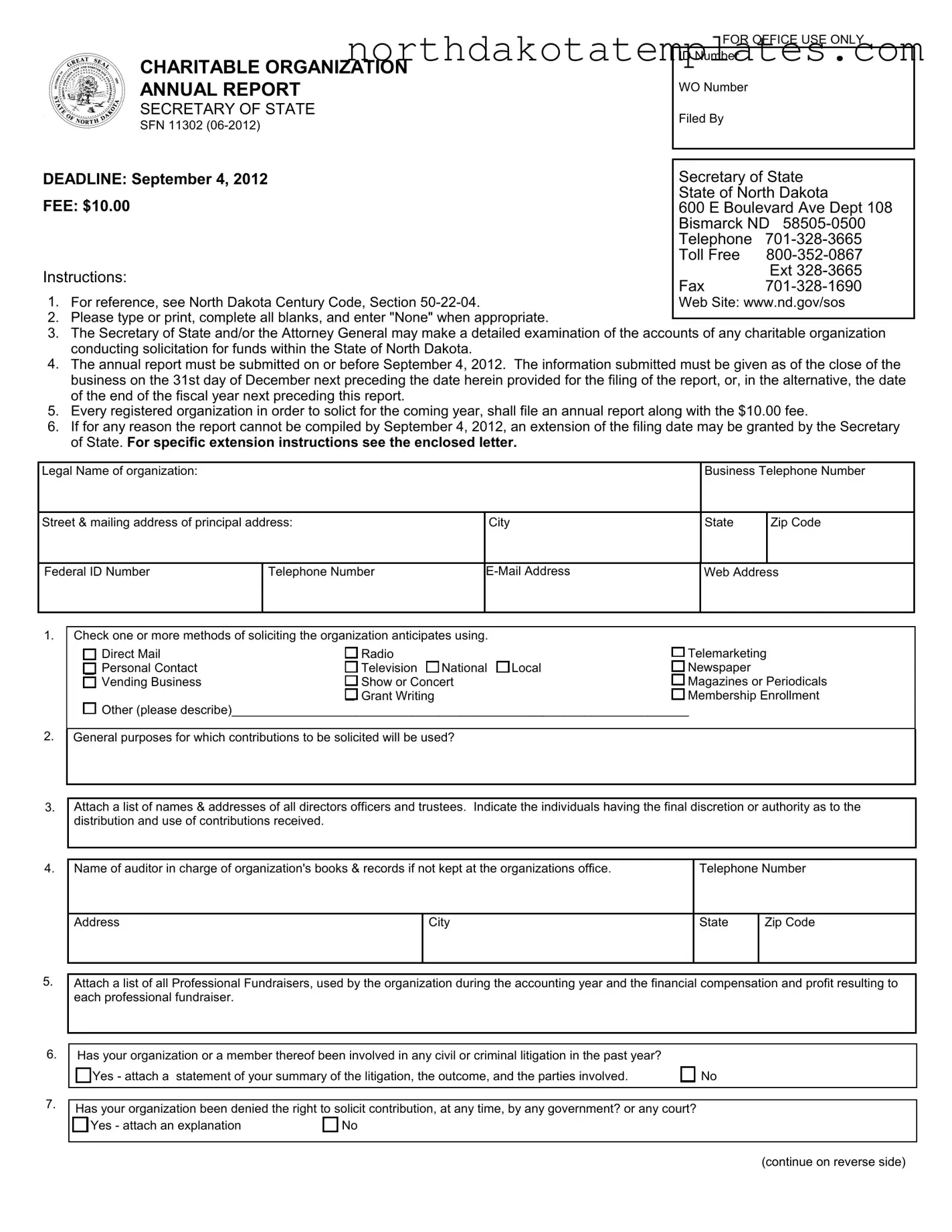

The SFN 11302 form is a critical document for charitable organizations operating in North Dakota. It serves as the annual report required by the Secretary of State, ensuring that organizations remain compliant with state regulations. Each charity must file this report by September 4, along with a $10 fee. The form collects essential information, including the organization’s legal name, contact details, and a list of directors and trustees. It also requires organizations to disclose their methods of soliciting contributions, the general purposes for which funds will be used, and any involvement in civil or criminal litigation over the past year. Financial transparency is a key aspect of the SFN 11302; organizations must provide detailed revenue and expenditure statements reflecting their fiscal activities. This includes itemized accounts of contributions, grants, and program service revenue, as well as expenses related to program services, solicitation, and management costs. By completing this form accurately, charitable organizations not only comply with legal requirements but also promote trust and accountability within the community.

Common PDF Documents

Nd Tax Calculator - The Nd St form is used for reporting sales, use, and gross receipts tax in North Dakota.

The Arizona Bill of Sale form serves as a vital document for individuals involved in property transactions. For those looking to navigate the process smoothly, an informative guide on the complete Arizona bill of sale requirements can be found here.

Sfn2023 - The ESPB will review your application after submission.

Similar forms

- Form 990: This is an annual reporting return that tax-exempt organizations must file with the IRS. Like the SFN 11302, it requires detailed financial information about the organization, including revenue and expenditures. Both forms aim to provide transparency regarding the financial activities of charitable organizations.

- ADP Pay Stub: The smarttemplates.net/fillable-adp-pay-stub form is crucial for recording an employee's earnings and deductions accurately, providing a reliable means for both employers and employees to ensure proper financial management.

- Charitable Organization Registration Form: This form is often required when an organization first registers to solicit donations. Similar to the SFN 11302, it collects essential information about the organization, including its purpose and leadership, ensuring compliance with state regulations.

- Annual Financial Report: Many states require organizations to submit an annual financial report, which outlines income, expenses, and financial position. This document serves a similar purpose to the SFN 11302 by ensuring that organizations maintain financial accountability and transparency.

- State Fundraising Registration Form: This form is necessary for organizations that engage in fundraising activities. Like the SFN 11302, it requires information on how funds will be solicited and used, ensuring that organizations adhere to legal requirements when raising money.

- IRS Form 1023: This form is used to apply for recognition of exemption under Section 501(c)(3) of the Internal Revenue Code. While it is more focused on the initial application for tax-exempt status, it shares similarities with the SFN 11302 in that both require comprehensive information about the organization’s structure and intended use of funds.

How to Use Sfn 11302

Filling out the SFN 11302 form is essential for organizations looking to solicit contributions in North Dakota. Ensure that all required information is accurate and complete to avoid delays or issues with your submission. Follow the steps below to fill out the form correctly.

- Obtain the SFN 11302 form. You can find it on the North Dakota Secretary of State's website or request a copy via phone.

- Type or print clearly in all sections. Complete every blank and write "None" where applicable.

- Enter the Legal Name of the Organization in the designated field.

- Provide the Business Telephone Number and the Street & Mailing Address of the principal office.

- Fill in the City, State, and Zip Code.

- Input the Federal ID Number, Telephone Number, E-Mail Address, and Web Address.

- Check one or more methods of solicitation that your organization will use, such as Direct Mail or Telemarketing.

- Describe the General Purposes for which contributions will be solicited.

- Attach a list of names and addresses of all directors, officers, and trustees.

- Indicate individuals with final authority over the distribution of contributions.

- Provide the name and contact information for the auditor in charge of the organization’s records.

- List all Professional Fundraisers used during the accounting year, along with their financial compensation.

- Answer whether your organization or a member has been involved in civil or criminal litigation in the past year. If yes, attach a statement.

- Indicate if your organization has ever been denied the right to solicit contributions by any government or court. Attach an explanation if applicable.

- Provide the fiscal year end date for your organization.

- Complete the REVENUE section with itemized support and revenue statements.

- Fill out the EXPENDITURES section with itemized expense statements.

- Sign and date the form, certifying that the information is true and complete.

- Submit the completed form along with the $10.00 fee to the Secretary of State's office by the deadline.

Dos and Don'ts

When filling out the SFN 11302 form, it is essential to approach the task with care and attention to detail. Here are some important guidelines to follow:

- Do type or print clearly to ensure all information is legible.

- Do complete all blanks on the form, using "None" where applicable.

- Do submit the report by the deadline of September 4, 2012, to avoid penalties.

- Do provide accurate financial information reflecting your organization’s fiscal year end.

- Don't leave any sections of the form blank unless instructed otherwise.

- Don't forget to attach the required lists of directors, officers, and any professional fundraisers.

- Don't submit the form without signing it, as an unsigned form may be rejected.

- Don't hesitate to seek clarification if you are unsure about any part of the form.

Following these guidelines will help ensure that your submission is complete and accurate, which is vital for maintaining compliance and supporting your organization's mission.

Document Example

|

FOR OFFICE USE ONLY |

||

CHARITABLE ORGANIZATION |

ID Number |

|

|

|

|

||

ANNUAL REPORT |

WO Number |

|

|

SECRETARY OF STATE |

Filed By |

|

|

SFN 11302 |

|

||

|

|

||

|

|

||

|

|

||

DEADLINE: September 4, 2012 |

Secretary of State |

||

FEE: $10.00 |

State of North Dakota |

||

600 E Boulevard Ave Dept 108 |

|||

|

Bismarck ND |

||

|

Telephone |

||

|

Toll Free |

||

Instructions: |

|

Ext |

|

Fax |

|||

|

|||

1. For reference, see North Dakota Century Code, Section |

Web Site: www.nd.gov/sos |

||

2.Please type or print, complete all blanks, and enter "None" when appropriate.

3.The Secretary of State and/or the Attorney General may make a detailed examination of the accounts of any charitable organization conducting solicitation for funds within the State of North Dakota.

4.The annual report must be submitted on or before September 4, 2012. The information submitted must be given as of the close of the business on the 31st day of December next preceding the date herein provided for the filing of the report, or, in the alternative, the date of the end of the fiscal year next preceding this report.

5.Every registered organization in order to solict for the coming year, shall file an annual report along with the $10.00 fee.

6.If for any reason the report cannot be compiled by September 4, 2012, an extension of the filing date may be granted by the Secretary of State. For specific extension instructions see the enclosed letter.

Legal Name of organization:

Business Telephone Number

Street & mailing address of principal address:

City

State

Zip Code

Federal ID Number

Telephone Number

Web Address

1.

2.

3.

4.

Check one or more methods of soliciting the organization anticipates using. |

|

|

|

|

||||||

|

|

Direct Mail |

|

Radio |

|

|

|

|

Telemarketing |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

||||

|

|

Personal Contact |

|

Television |

|

National |

|

Local |

|

Newspaper |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

Vending Business |

|

Show or Concert |

|

|

|

Magazines or Periodicals |

||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

Grant Writing |

|

|

|

|

Membership Enrollment |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

Other (please describe)__________________________________________________________________

Other (please describe)__________________________________________________________________

General purposes for which contributions to be solicited will be used?

Attach a list of names & addresses of all directors officers and trustees. Indicate the individuals having the final discretion or authority as to the distribution and use of contributions received.

Name of auditor in charge of organization's books & records if not kept at the organizations office. |

Telephone Number |

||

|

|

|

|

Address |

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

5.

Attach a list of all Professional Fundraisers, used by the organization during the accounting year and the financial compensation and profit resulting to each professional fundraiser.

6.

Has your organization or a member thereof been involved in any civil or criminal litigation in the past year? |

|

Yes - attach a statement of your summary of the litigation, the outcome, and the parties involved. |

No |

7.

Has your organization been denied the right to solicit contribution, at any time, by any government? or any court?

Yes - attach an explanation |

|

No |

(continue on reverse side)

SFN 11302

ANNUAL REPORTING INFORMATION (This information must be listed on this report form.)

8.The financial information in items 9 and 10 should reflect the fiscal year end of your organization. If the fiscal year ends on December 31st, the year end should be December 31, 2011. If the fiscal year ends prior to September 1st, the year end should be that month, day, 2012. If the fiscal year ends on or after September 1st, the year end should be that month, day, 2011.

Provide the fiscal year end for your organization

Provide the fiscal year end for your organization

9.REVENUE: Specific and itemized support and revenue statements disclosing direct public support in North Dakota from solicitation, indirect public support, government grants, program service revenue, and any other revenue from NORTH DAKOTA. Unless the information is not reasonably available, in which case the charitable organization may, with the approval of the Secretary of State, provide a reasonable estimate of the required information by completing SFN 59569.

a. |

Contributions |

$ |

|

|

|

b. |

Trust Funds |

$ |

|

|

|

c. |

Gifts, Bequests |

$ |

|

|

|

d. |

Grants (exclude government grants) |

$ |

|

|

|

e. |

Government Grants |

$ |

|

|

|

f. |

Interest from Investments |

$ |

|

|

|

g. Other (please identify) |

$ |

|

|

|

|

|

TOTAL REVENUE |

$ |

|

|

|

10.EXPENDITURES: Specific and itemized expense statements disclosing program services, public information expenditures, payments to affiliates, management costs and salaries paid in NORTH DAKOTA. Unless the information is not reasonably available, in which case the charitable organization may, with the approval of the Secretary of State, provide a reasonable estimate of the required information by completing SFN 59569.

a. Program services means the amount thereof given to the charitable purpose represented. |

$ |

|

|

|

|

b. Solicitation Expenses |

$ |

|

|

|

|

c. Total compensation, including salaries, fees, bonuses, fringe benefits, severance payments, and deferred |

$ |

|

|

compensation paid to employees by the charitable organization and all its affiliated organizations. |

|

|

|

|

|

|

|

d. Rent |

$ |

|

|

|

|

e. Public Education |

$ |

|

|

|

|

f. |

Accounting Services |

$ |

|

|

|

g. Fundraising: |

$ |

|

|

|

|

h. Funds or properties transferred out of state with an explanation as to recipient and purpose, unless the information |

|

|

|

is not reasonably available, in which case the charitable organization may, with the approval of the Secretary of |

$ |

|

State, provide a reasonable estimate of the amounts transferred. |

|

|

|

|

i. |

Other (please identify) |

$ |

|

|

|

|

TOTAL EXPENDITURES |

$ |

|

|

|

I certify the statements made herein to be true and complete, and are made for the purpose of complying with the requirements of North Dakota Century Code, Section

Applicant's Signature and Title |

Date |

File Breakdown

| Fact Name | Fact Description |

|---|---|

| Governing Law | The SFN 11302 form is governed by the North Dakota Century Code, Section 50-22-04. |

| Filing Deadline | The annual report must be submitted by September 4, 2012. |

| Filing Fee | A fee of $10.00 is required to accompany the submission of the form. |

| Financial Reporting | Organizations must provide detailed financial information reflecting their fiscal year end. |

| Solicitation Methods | Organizations must indicate the methods they plan to use for soliciting contributions. |

| Extension Policy | If unable to meet the deadline, organizations may request an extension from the Secretary of State. |

Common mistakes

Filling out the SFN 11302 form can be a straightforward process, but many people make common mistakes that can lead to delays or even rejection of their application. One of the most frequent errors is failing to complete all the required fields. It’s essential to read through the form carefully and ensure that every section is filled out completely. If a particular section does not apply, simply write "None" instead of leaving it blank. This small detail can save a lot of time and prevent unnecessary back-and-forth communication.

Another common mistake is miscalculating the fiscal year end date. The form requires specific details about your organization’s financial year, and it’s crucial to accurately reflect this information. If your fiscal year ends on December 31, 2011, for example, be sure to indicate that clearly. Misunderstanding this date can lead to incorrect reporting and potential compliance issues.

People often overlook the importance of itemizing revenue and expenditures. When you report financial information, it should be detailed and specific. For example, instead of just stating total contributions, break it down into categories like gifts, grants, and other sources. This level of detail not only provides clarity but also helps in building trust with the authorities reviewing your report.

Additionally, some individuals forget to attach the necessary supporting documents. If your organization has used professional fundraisers or has been involved in litigation, relevant details must be included as attachments. Not providing these documents can lead to questions or even a rejection of your application.

Another area where mistakes commonly occur is in the financial section. It’s vital to ensure that the total revenue and total expenditures match the itemized amounts listed. Double-checking your calculations can prevent discrepancies that may raise red flags during the review process.

Many also fail to keep a copy of the completed form for their records. Keeping a copy is not just good practice; it’s essential for future reference. If questions arise later, having a record of what was submitted can be invaluable.

Lastly, missing the filing deadline is a common pitfall. The form must be submitted by September 4, 2012, in this instance. If you find that you cannot meet this deadline, it’s important to seek an extension as soon as possible. Waiting until the last minute can lead to unnecessary stress and complications.

By being aware of these common mistakes, organizations can navigate the SFN 11302 form more effectively. Taking the time to review each section and ensuring that all information is accurate and complete can make a significant difference in the outcome of your submission.

FAQ

What is the SFN 11302 form?

The SFN 11302 form is an annual report required for charitable organizations operating in North Dakota. It provides essential information about the organization’s financial activities, fundraising methods, and compliance with state regulations. This report ensures transparency and accountability in the solicitation of funds from the public.

When is the deadline for submitting the SFN 11302 form?

The completed SFN 11302 form must be submitted by September 4, 2012. It’s crucial to adhere to this deadline to maintain your organization’s ability to solicit contributions in the upcoming year.

What is the filing fee for the SFN 11302 form?

A filing fee of $10.00 is required when submitting the SFN 11302 form. This fee is necessary to process your annual report and maintain your organization’s registration status.

What information is required on the SFN 11302 form?

The form requires detailed information, including the legal name of the organization, contact information, methods of solicitation, financial data regarding revenue and expenditures, and a list of directors and officers. Additionally, any involvement in litigation or denial of solicitation rights must be disclosed.

Can an organization request an extension for filing the SFN 11302 form?

Yes, if your organization cannot compile the report by the deadline, you may request an extension from the Secretary of State. Specific instructions for obtaining an extension are provided in the accompanying letter with the form.

What should be included in the financial statements on the SFN 11302 form?

The financial statements should include itemized revenue sources such as contributions, grants, and program service revenue, as well as detailed expenditures like program services, solicitation expenses, and salaries. If precise figures are not available, an estimate may be submitted with prior approval from the Secretary of State.

What happens if an organization fails to submit the SFN 11302 form?

Failure to submit the SFN 11302 form by the deadline may result in the organization losing its ability to solicit contributions in North Dakota. It is essential to file on time to avoid any disruptions to your fundraising activities.

Where can I find more information about the SFN 11302 form?

For additional information, you can visit the North Dakota Secretary of State's website at www.nd.gov/sos. You can also contact their office directly at 701-328-3665 or toll-free at 800-352-0867 for any specific inquiries regarding the form or the filing process.