Free Sfn 1078 PDF Template

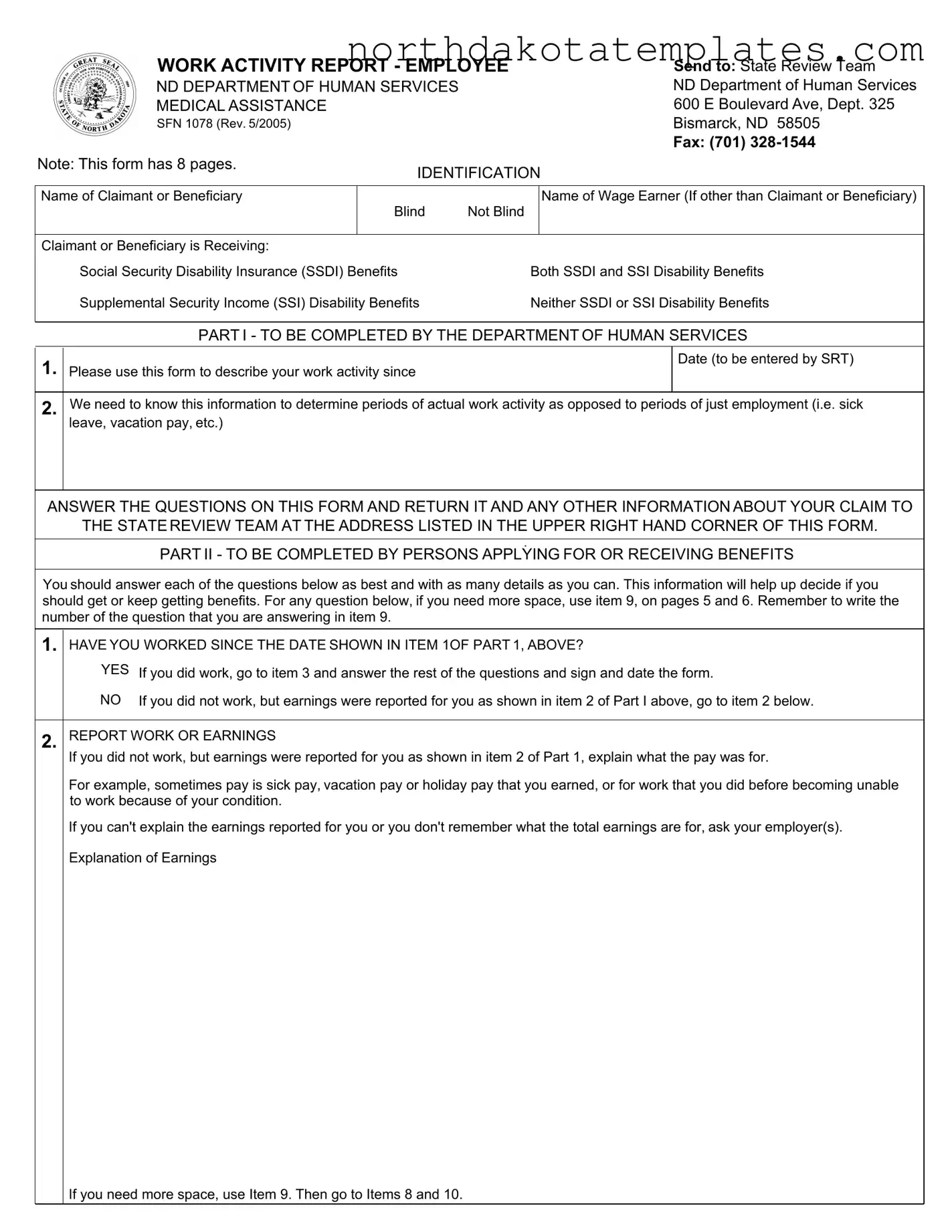

The SFN 1078 form, known as the Work Activity Report, is a crucial document for individuals applying for or receiving benefits from the North Dakota Department of Human Services. This form consists of eight pages and serves to collect detailed information regarding a claimant's work activities. It is essential for determining eligibility for Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) benefits. The form requires individuals to provide personal identification details, including their status as blind or not blind, and specify the type of disability benefits they are receiving. Additionally, it includes sections for the Department of Human Services to assess periods of actual work activity versus periods of leave, such as sick or vacation pay. Claimants must answer a series of questions about their work history, including the dates of employment, pay rates, and the average number of hours worked. The form also addresses any special work conditions that may have influenced their ability to work due to medical issues. Accurate completion of the SFN 1078 is vital for ensuring that benefits are appropriately awarded and maintained.

Common PDF Documents

Does a Small Estate Affidavit Need to Be Filed With the Court in California - The Secretary of State’s office is available to provide guidance if any assistance is needed during the application process.

Although the content of the ADP Pay Stub form is currently unavailable, employees can find useful resources related to fillable forms at smarttemplates.net, which may aid in personal financial management and understanding payroll documentation better.

North Dakota Duplicate Title Application - This document is important for reclaiming legal rights to a repossessed vehicle.

Nd Ems Association - The form includes a section for billing information to facilitate the reimbursement process.

Similar forms

- Form I-765: This form is used to apply for employment authorization in the United States. Like the SFN 1078, it collects information about an individual's work history and current employment status to determine eligibility for benefits.

- California Articles of Incorporation - This document plays a crucial role in establishing a corporation in the state, outlining essential details such as the corporation's name, purpose, and structure, making it a vital starting point for any business. For more information, visit toptemplates.info/articles-of-incorporation/california-articles-of-incorporation/.

- Form SSA-16: This application for Social Security Disability Insurance (SSDI) benefits requires similar information about work activity and earnings to assess eligibility. Both forms aim to gather details about work history and income.

- Form SSA-827: This authorization form allows the Social Security Administration to obtain medical records. It complements the SFN 1078 by linking work activity to medical conditions affecting employment.

- Form 1040: The individual income tax return collects information about income and employment. Both forms require detailed reporting of earnings and can impact eligibility for various benefits.

- Form 1099: This form reports non-employment income, such as freelance or contract work. It shares the focus on income reporting found in the SFN 1078, especially regarding earnings that might affect benefits.

- Form W-2: This form reports wages paid to employees and taxes withheld. Like the SFN 1078, it provides a snapshot of an individual's earnings, which is crucial for determining benefit eligibility.

- Form 4506-T: This form allows individuals to request a transcript of their tax return. Similar to the SFN 1078, it helps verify income and employment history for benefit assessments.

- Form 8862: This form is used to claim the Earned Income Tax Credit after it has been disallowed. Both forms require detailed reporting of work history and earnings to establish eligibility for benefits.

- Form DS-2019: This document is for exchange visitors applying for a visa, requiring information about work and study. It parallels the SFN 1078 in its focus on an individual’s work-related circumstances.

- Form N-400: This application for naturalization requires applicants to disclose their employment history. Like the SFN 1078, it assesses how work activity relates to an individual's status and benefits.

How to Use Sfn 1078

Completing the SFN 1078 form is an essential step for individuals applying for or receiving benefits. This process requires careful attention to detail to ensure all relevant information is provided accurately. After filling out the form, it should be returned to the State Review Team at the designated address or fax number.

- Obtain the SFN 1078 form. You can find it online or request a copy from your local Department of Human Services.

- Identify yourself. Fill in your name and indicate if you are blind or not. If applicable, provide the name of the wage earner.

- Check your benefits. Indicate whether you are receiving SSDI, SSI, both, or neither.

- Complete Part I. This section will be filled out by the Department of Human Services, so you can skip it for now.

- Answer the work-related questions in Part II. Start with the first question about whether you have worked since the date in Part I.

- If you worked, proceed to item 3 and provide details about your work, including employer information, dates of employment, pay rates, and hours worked.

- If you did not work, but earnings were reported, explain the nature of those earnings in item 2.

- Provide additional details. Use item 9 on pages 5 and 6 if you need more space to elaborate on any questions.

- Report any months with earnings over the specified amounts. Fill in the relevant months and amounts in item 4.

- Indicate any special work conditions. If applicable, check the boxes in item 5 to describe any special assistance or conditions related to your work.

- Review your form. Ensure all sections are completed accurately and clearly.

- Submit the form. Send the completed SFN 1078 form to the State Review Team at the address provided or fax it to the designated number.

Dos and Don'ts

When filling out the SFN 1078 form, it is important to follow specific guidelines to ensure accuracy and completeness. Below is a list of things to do and avoid.

- Do provide accurate personal information, including your name and contact details.

- Do answer all questions to the best of your ability.

- Do include details about your work history, including dates and pay rates.

- Do clarify any earnings that were reported on your behalf.

- Do seek assistance from your employer if you are unsure about any information.

- Don't leave any sections blank unless instructed to do so.

- Don't provide false or misleading information.

- Don't forget to sign and date the form before submission.

- Don't submit the form without reviewing it for accuracy.

- Don't ignore the instructions regarding additional information if needed.

Document Example

WORK ACTIVITY REPORT - EMPLOYEE

ND DEPARTMENT OF HUMAN SERVICES

MEDICAL ASSISTANCE

SFN 1078 (Rev. 5/2005)

Note: This form has 8 pages.

IDENTIFICATION

Send to: State Review Team

ND Department of Human Services

600 E Boulevard Ave, Dept. 325

Bismarck, ND 58505

Fax: (701)

Name of Claimant or Beneficiary

Blind |

Not Blind |

Name of Wage Earner (If other than Claimant or Beneficiary)

Claimant or Beneficiary is Receiving: |

|

Social Security Disability Insurance (SSDI) Benefits |

Both SSDI and SSI Disability Benefits |

Supplemental Security Income (SSI) Disability Benefits |

Neither SSDI or SSI Disability Benefits |

|

PART I - TO BE COMPLETED BY THE DEPARTMENT OF HUMAN SERVICES |

|

|

|

|

1. |

Please use this form to describe your work activity since |

Date (to be entered by SRT) |

|

||

|

|

|

2. |

We need to know this information to determine periods of actual work activity as opposed to periods of just employment (i.e. sick |

|

|

leave, vacation pay, etc.) |

|

|

|

|

ANSWER THE QUESTIONS ON THIS FORM AND RETURN IT AND ANY OTHER INFORMATION ABOUT YOUR CLAIM TO

THE STATEREVIEW TEAM AT THE ADDRESS LISTED IN THE UPPER RIGHT HAND CORNER OF THIS FORM.

.

PART II - TO BE COMPLETED BY PERSONS APPLYING FOR OR RECEIVING BENEFITS

You should answer each of the questions below as best and with as many details as you can. This information will help up decide if you should get or keep getting benefits. For any question below, if you need more space, use item 9, on pages 5 and 6. Remember to write the number of the question that you are answering in item 9.

1.HAVE YOU WORKED SINCE THE DATE SHOWN IN ITEM 1OF PART 1, ABOVE?

YES If you did work, go to item 3 and answer the rest of the questions and sign and date the form.

NO If you did not work, but earnings were reported for you as shown in item 2 of Part I above, go to item 2 below.

2.REPORT WORK OR EARNINGS

If you did not work, but earnings were reported for you as shown in item 2 of Part 1, explain what the pay was for.

For example, sometimes pay is sick pay, vacation pay or holiday pay that you earned, or for work that you did before becoming unable to work because of your condition.

If you can't explain the earnings reported for you or you don't remember what the total earnings are for, ask your employer(s). Explanation of Earnings

If you need more space, use Item 9. Then go to Items 8 and 10.

SFN 1078

Page 2

3. |

TELL US ABOUT YOUR WORK SINCE THE DATE IN ITEM 1 OF PART 1 ABOVE. |

(If you are not sure about some things, ask your employer to help you. If you need more space, use item 9, on Pages 5 and 6. |

|

|

Remember to write the number of the question that you are answering in Item 9.) |

Employer's Address (Include street, city, state and zip code)

A.

|

|

Date Work Started |

Date Work Ended |

|

Starting Hourly Pay |

|

Current or Ending Pay |

|

|

|

|

|

|

|

|

|

|

|

|

Number of Hours Worked (on average) |

|

Supervisor's Name |

|

Supervisor's Telephone Number |

||

|

|

|

|

PER DAY |

PER WEEK |

|

|

(Include area code) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Check each block below that is true for this work: |

|

|

|

|

||

|

|

I stopped working within 6 months, or I reduced my work hours and earnings within 6 months, or within 6 months I had to change the |

||||||

|

|

type of work I was doing (i.e. You were a plumber and changed to lighter work.) because |

|

|

||||

|

|

of my medical condition. |

|

|

|

|

|

|

|

|

special conditions at work related to my medical condition that allowed me to work were removed. |

|

|

||||

|

|

I stopped working or changed the type of work I was doing for other reasons. (Tell us what the other reasons were below.) |

||||||

|

|

|

|

|

|

|

|

|

|

|

Employer's Address (Include street, city, state and zip code) |

|

|

||||

B. |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Date Work Started |

|

Date Work Ended |

|

Starting Hourly Pay |

Current or Ending Pay |

|

|

|

|

|

|

|

|

|

|

|

|

Number of Hours Worked (on average) |

|

Supervisor's Name |

|

Supervisor's Telephone Number |

||

|

|

|

|

PER DAY |

PER WEEK |

|

|

(Include area code) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Check each block below that is true for this work:

I stopped working within 6 months, or I reduced my work hours and earnings within 6 months, or within 6 months I had to change the type of work I was doing (i.e. You were a plumber and changed to lighter work.) because

of my medical condition.

special conditions at work related to my medical condition that allowed me to work were removed.

I stopped working or changed the type of work I was doing for other reasons. (Tell us what the other reasons were below.)

SFN 1078

Page 3

3. |

|

TELL US ABOUT YOUR WORK SINCE THE DATE IN ITEM 1 OF PART 1 ABOVE. |

|

|

||||

|

(If you are not sure about some things, ask your employer to help you. If you need more space, use item 9, on Pages 5 and 6. |

|||||||

|

|

Remember to write the number of the question that you are answering in Item 9.) |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

Employer's Address (Include street, city, state and zip code) |

|

|

||||

C. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date Work Started |

Date Work Ended |

|

Starting Hourly Pay |

|

Current or Ending Pay |

|

|

|

|

|

|

|

|

|

|

|

|

Number of Hours Worked (on average) |

|

Supervisor's Name |

|

Supervisor's Telephone Number |

||

|

|

|

|

PER DAY |

PER WEEK |

|

|

(Include area code) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Check each block below that is true for this work: |

|

|

|

|

||

|

|

I stopped working within 6 months, or I reduced my work hours and earnings within 6 months, or within 6 months I had to change the |

||||||

|

|

type of work I was doing (i.e. You were a plumber and changed to lighter work.) because |

|

|

||||

|

|

of my medical condition. |

|

|

|

|

|

|

|

|

special conditions at work related to my medical condition that allowed me to work were removed. |

|

|

||||

|

|

I stopped working or changed the type of work I was doing for other reasons. (Tell us what the other reasons were below.) |

||||||

|

|

|

|

|

|

|

|

|

|

|

Employer's Address (Include street, city, state and zip code) |

|

|

||||

D. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date Work Started |

|

Date Work Ended |

|

Starting Hourly Pay |

Current or Ending Pay |

|

|

|

|

|

|

|

|

|

|

|

|

Number of Hours Worked (on average) |

|

Supervisor's Name |

|

Supervisor's Telephone Number |

||

|

|

|

|

PER DAY |

PER WEEK |

|

|

(Include area code) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

Check each block below that is true for this work: |

|

|

|

|

||

|

|

I stopped working within 6 months, or I reduced my work hours and earnings within 6 months, or within 6 months I had to change the |

||||||

|

|

type of work I was doing (i.e. You were a plumber and changed to lighter work.) because |

|

|

||||

|

|

of my medical condition. |

|

|

|

|

|

|

special conditions at work related to my medical condition that allowed me to work were removed.

I stopped working or changed the type of work I was doing for other reasons. (Tell us what the other reasons were below.)

SFN 1078

Page 4

3. |

|

TELL US ABOUT YOUR WORK SINCE THE DATE IN ITEM 1 OF PART 1 ABOVE. |

|

|

||||

|

(If you are not sure about some things, ask your employer to help you. If you need more space, use item 9, on Pages 5 and 6. |

|||||||

|

|

Remember to write the number of the question that you are answering in Item 9.) |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

Employer's Address (Include street, city, state and zip code) |

|

|

||||

E. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date Work Started |

Date Work Ended |

|

Starting Hourly Pay |

|

Current or Ending Pay |

|

|

|

|

|

|

|

|

|

|

|

|

Number of Hours Worked (on average) |

|

Supervisor's Name |

|

Supervisor's Telephone Number |

||

|

|

|

|

PER DAY |

PER WEEK |

|

|

(Include area code) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Check each block below that is true for this work: |

|

|

|

|

||

|

|

I stopped working within 6 months, or I reduced my work hours and earnings within 6 months, or within 6 months I had to change the |

||||||

|

|

type of work I was doing (i.e. You were a plumber and changed to lighter work.) because |

|

|

||||

|

|

of my medical condition. |

|

|

|

|

|

|

|

|

special conditions at work related to my medical condition that allowed me to work were removed. |

|

|

||||

|

|

I stopped working or changed the type of work I was doing for other reasons. (Tell us what the other reasons were below.) |

||||||

|

|

|

|

|

|

|

|

|

|

|

Employer's Address (Include street, city, state and zip code) |

|

|

||||

F. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date Work Started |

|

Date Work Ended |

|

Starting Hourly Pay |

Current or Ending Pay |

|

|

|

|

|

|

|

|

|

|

|

|

Number of Hours Worked (on average) |

|

Supervisor's Name |

|

Supervisor's Telephone Number |

||

|

|

|

|

PER DAY |

PER WEEK |

|

|

(Include area code) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

Check each block below that is true for this work: |

|

|

|

|

||

|

|

I stopped working within 6 months, or I reduced my work hours and earnings within 6 months, or within 6 months I had to change the |

||||||

|

|

type of work I was doing (i.e. You were a plumber and changed to lighter work.) because |

|

|

||||

|

|

of my medical condition. |

|

|

|

|

|

|

special conditions at work related to my medical condition that allowed me to work were removed.

I stopped working or changed the type of work I was doing for other reasons. (Tell us what the other reasons were below.)

SFN 1078

Page 5

3. |

|

TELL US ABOUT YOUR WORK SINCE THE DATE IN ITEM 1 OF PART 1 ABOVE. |

|

|

|

|

|

||||||

|

(If you are not sure about some things, ask your employer to help you. If you need more space, use item 9, on Pages 5 and 6. |

||||||||||||

|

|

Remember to write the number of the question that you are answering in Item 9.) |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Employer's Address (Include street, city, state and zip code) |

|

|

|

|

|

|

|||||

G. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Date Work Started |

|

Date Work Ended |

Starting Hourly Pay |

|

Current or Ending Pay |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Number of Hours Worked (on average) |

|

Supervisor's Name |

|

Supervisor's Telephone Number |

|||||||

|

|

|

|

|

PER DAY |

PER WEEK |

|

|

(Include area code) |

||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Check each block below that is true for this work: |

|

|

|

|

|

|

|||||

|

|

I stopped working within 6 months, or I reduced my work hours and earnings within 6 months, or within 6 months I had to change the |

|||||||||||

|

|

type of work I was doing (i.e. You were a plumber and changed to lighter work.) because |

|

|

|

|

|

||||||

|

|

of my medical condition. |

|

|

|

|

|

|

|

||||

|

|

special conditions at work related to my medical condition that allowed me to work were removed. |

|

|

|||||||||

|

|

I stopped working or changed the type of work I was doing for other reasons. (Tell us what the other reasons were below.) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||

4. |

|

Since the date you started working on or after the date shown in item 1of Part 1, above, have there been any months during which |

|||||||||||

|

you earned over $200 per month through 12/2000 or over $530 beginning 01/2001 (before anything was withheld; e.g., taxes)? |

||||||||||||

|

|

No |

(Go to Item 5.) |

|

|

|

|

|

|

|

|||

|

|

Yes |

(Tell us which month and year and the amount you earned that month in the chart below. If you need more space, use |

||||||||||

|

|

|

Item 9, on pages 5 and 6. Remember to write the number of the question that you are answering in Item 9.) |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MONTH/YEAR |

AMOUNT |

|

MONTH/YEAR |

AMOUNT |

MONTH/YEAR |

|

AMOUNT |

||||

|

|

|

|

$ |

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.SPECIAL WORK CONDITIONS - Do (Did) you get special help

NO (Go to Item 6.)

YES Check all of the boxes that are true for you and tell us for which job(s) you received that help and tell us about any other special condition(s) or help that you got on a job.

I needed and got special help from other workers |

I was given a job based on my past services |

in doing my job. |

to an employer. |

I was given special equiment or was given work |

I worked irregular hours or took frequent rest periods. |

that was suited to my condition. |

|

I was allowed to work at a lower standard of |

I worked in a sheltered work center. |

productivity. |

|

I worked for a relative or friend. |

I was hired through a special program for training or therapy |

|

(e.g., vocational rehabilitation, supported employment.) |

|

|

SFN 1078

Page 6

5.SPECIAL WORK CONDITIONS - Continued

Check all of the boxes that are true for you and tell us for which job(s) you received that help and tell us about any other special condition(s) or help that you got on a job.

My job duties were different than other workers' job duties doing the same work because:

I worked fewer hours. |

I got different pay. |

I had different duties; fewer or easier duties. |

I had extra help, extra supervision, or a job coach. |

I was given special transportation to and from work. |

I got special help getting ready for work. |

I was paid extra rest periods at work or extra time off from work and other workers were not.

Other special help. (Explain below.)

In the spce below, tell us for which job(s) you received the special help. If you need more space, use Item 9.

6.OTHER/SPECIAL PAYMENTS- Do (Did) you get any payment(s) from an employer in addition to regular pay? For example, did you get any tips, bonuses, sick or disability pay, vacation pay, meals, room or rent, transportation or use of a car or vehicle, or childcare?

|

No |

(Go to Item 7.) |

|

|

|

|

Yes |

Tell us below what these payments were. If you need more space, use Item 9. |

|

||

|

|

|

|

|

|

|

|

EMPLOYER |

TYPE OF PAYMENT |

AMOUNT OR ESTIMATE |

MONTH & YEAR |

|

|

OF THE DOLLAR VALUE |

|||

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

7. |

SPECIAL WORK EXPENSES |

||||

for any things or services related to your condition that allowed you to work and for which you did not get paid back? |

|

||||

For example, medicines, bandages, braces, wheelchair, artificial arm or leg, brialle equipment, special telephone or computer equipment, modifications to home (wider dorrways,

No |

Go to Item 8. |

Yes |

Tell us below about the bills, or part of the bills, that you paid for things or services related to your medical condition |

|

that you needed in order to work. (Upon review, you may be required to provide proof of these expenses.) Do not |

|

show any bills or amounts paid by an insurance company or any other organization or person or paid to you by an |

|

insurance company or other organization or person. (Example: An insurance company might pay all or part of the bill |

|

at a later time.) |

SFN 1078

Page 7

7.SPECIAL WORK EXPENSES

|

ITEM OR SERVICE |

COST |

DATE(S) PAID (MONTH & YEAR) |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

SPECIAL TRANSPORTATION |

COST |

DATE(S) PAID (MONTH & YEAR) |

|

|

|

|

|

MODIFIED VEHICLE |

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

8.VOCATIONAL REHABILITATION- Are (Were) you getting any help from a vocational rehabilitation or employment services provider to get the services and/or training you need to get ready to start working, find work or keep working?

|

No |

If you answered no, would you like to get these services? |

Yes |

No (Go to Item 10.) |

||

|

Yes |

Tell us the name and address of the people who are (were) giving you vocational rehabilitation or employment |

||||

|

|

services and training. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vocational Rehabilitation/Employment Services Provider |

|

||

|

|

|

|

|

||

|

Name |

|

|

Address (Include street, city, state & zip) |

||

|

|

|

|

|||

|

Counselor's Name |

|

Counselor's Telephone Number (Include area code) |

|||

|

|

|

|

|

|

|

|

|

|

If you need more space, go to Item 9, below. |

|

||

|

|

|||||

9. |

More Space. For any question above, if you need more space, use the space below. Remember to write the number of the question that |

|||||

you are answering before you begin. |

|

|

|

|

||

SFN 1078 Page 8

9.

More Space - (Continued) For any question above, if you need more space, use the space below. Remember to write the number of the question that you are answering before you begin.

10.

I authorize any employer, agency or other organization to disclose to the State agency who may determine or review my entitlement to disability benefits any information about my medical condition or my work.

SIGN AND DATE THIS FORM

I certify under penalty of law that the information on this form is true.

Signature of Claimant, Beneficiary or Representative |

Date |

|

|

|

|

Address (Include street, city, state and zip code) |

Telephone Number |

|

|

Witness must sign ONLY if this statement is signed by mark (i.e., X) above. If signed by mark (X), two witnesses to the signing who know the person making the statement must sign below, giving their full addresses and telephone numbers.

1. Signature of Witness |

2. Signature of Witness |

|

|

Address (Include street, city, state and zip code) |

Address (Include street, city, state and zip code) |

|

Telephone Number

Telephone Number

File Breakdown

| Fact Name | Description |

|---|---|

| Form Purpose | The SFN 1078 form is designed to report work activity for individuals applying for or receiving medical assistance benefits in North Dakota. |

| Submission Details | This form must be sent to the State Review Team at the North Dakota Department of Human Services, located at 600 E Boulevard Ave, Dept. 325, Bismarck, ND 58505. |

| Content Length | The SFN 1078 form consists of 8 pages, which provide detailed sections for reporting work activity and earnings. |

| Information Required | Applicants must provide comprehensive details about their work history, including employer information, dates of employment, and earnings. |

| Governing Law | The SFN 1078 form is governed by North Dakota state law regarding medical assistance and disability benefits. |

Common mistakes

When filling out the SFN 1078 form, many individuals make common mistakes that can lead to delays or complications in their benefits process. One frequent error is failing to provide complete information about work history. It's essential to include all relevant details, such as the name and address of employers, dates of employment, and earnings. Incomplete information can create confusion and may result in the form being returned for clarification.

Another mistake often seen is not answering the questions accurately. Some people may misunderstand the questions or provide vague responses. For example, when asked about work since a specific date, it’s crucial to indicate whether any work was performed, even if it was limited. Providing clear and precise answers helps the review team make informed decisions about eligibility for benefits.

Additionally, individuals sometimes overlook the importance of using the additional space provided in Item 9. This section is specifically designed for those who need more room to explain their answers. By neglecting to use this space, claimants may inadvertently leave out important details that could support their case. It’s better to utilize all available space to ensure that the review team has a complete picture of the claimant’s situation.

Lastly, many people fail to double-check their forms before submission. Simple errors, such as typos or incorrect dates, can lead to significant issues. Taking the time to review the form thoroughly can prevent unnecessary complications. A careful review can help ensure that all information is accurate and complete, ultimately facilitating a smoother review process.

FAQ

What is the purpose of the SFN 1078 form?

The SFN 1078 form, also known as the Work Activity Report, is used by the North Dakota Department of Human Services to gather information about an individual's work activities. This form is essential for determining eligibility for various disability benefits, including Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). By providing detailed information about work history and earnings, the form helps the State Review Team assess whether a claimant should continue to receive benefits.

Who needs to fill out the SFN 1078 form?

Individuals who are applying for or currently receiving SSDI or SSI benefits must complete the SFN 1078 form. This includes claimants who have worked since their last report and those who have not but may have had earnings reported. The form requires detailed responses about work history, including employer information, pay rates, and any special work conditions related to the individual's medical situation.

How should the completed SFN 1078 form be submitted?

Once the SFN 1078 form is completed, it should be sent to the State Review Team at the North Dakota Department of Human Services. The address is provided on the form itself. Submissions can be made by mail or fax, with the fax number also listed on the form. It is important to ensure that the form is filled out accurately and completely to avoid delays in processing the benefits claim.

What information is required in the SFN 1078 form?

The SFN 1078 form requires various details, including the claimant's name, the name of any wage earners, and specific information about work activities. Claimants must report their work history since a specified date, including the dates of employment, pay rates, hours worked, and any changes in work conditions due to medical issues. If additional space is needed, claimants can use a designated section on the form to provide further details. Accurate and thorough information is crucial for the evaluation of benefits.