Blank North Dakota Real Estate Purchase Agreement Template

When buying or selling property in North Dakota, having a solid understanding of the Real Estate Purchase Agreement form is essential. This document serves as a crucial tool that outlines the terms and conditions of the sale, ensuring that both parties are on the same page. Key aspects of the agreement include the purchase price, financing details, and closing date. It also addresses contingencies, which are conditions that must be met for the sale to proceed, such as inspections or financing approvals. Additionally, the form covers the responsibilities of both the buyer and seller, including disclosures about the property's condition. By clearly detailing these elements, the agreement helps to protect the interests of everyone involved and facilitates a smoother transaction process.

Browse More Templates for North Dakota

Power of Attorney North Dakota - Designate a representative for important legal affairs with a Power of Attorney.

Quick Claim Deed Form North Dakota - An individual can execute a Quitclaim Deed on their own without the need for professional help, though caution is advised.

Understanding the importance of the ADP Pay Stub form is essential for both employers and employees, and resources like OnlineLawDocs.com can provide valuable insights into its usage and significance in maintaining transparent financial practices within the workplace.

North Dakota Divorce - May include terms for future negotiations and communications.

Similar forms

- Lease Agreement: This document outlines the terms under which a tenant can occupy a property. Like a purchase agreement, it specifies the parties involved, property details, and terms of payment, but it typically covers a rental arrangement rather than a sale.

Bill of Sale Form: To ensure proper ownership transfer, refer to our clear Florida bill of sale form guidelines for effective documentation.

- Option to Purchase Agreement: This agreement gives a tenant the right to buy the property at a later date. Similar to a purchase agreement, it includes property details and the purchase price, but it allows for a future transaction instead of an immediate sale.

- Purchase and Sale Agreement: Often used interchangeably with the Real Estate Purchase Agreement, this document also sets forth the terms of a property sale, including price, contingencies, and closing details. It serves the same purpose in formalizing the sale process.

- Real Estate Listing Agreement: This document is between a seller and a real estate agent, authorizing the agent to market the property. While it does not finalize a sale, it shares similarities in detailing the property and the terms of engagement.

- Escrow Agreement: This document outlines the terms under which an escrow agent holds funds during the transaction. Like a purchase agreement, it protects the interests of both buyer and seller, ensuring that conditions are met before the sale is finalized.

- Title Insurance Policy: This document protects the buyer against any title issues that may arise after the purchase. It is related to the purchase agreement in that it addresses the buyer’s rights and ensures a clear title to the property.

- Disclosure Statement: This document provides essential information about the property’s condition and any known issues. It complements the Real Estate Purchase Agreement by ensuring that buyers are fully informed before making a commitment.

How to Use North Dakota Real Estate Purchase Agreement

Once you have the North Dakota Real Estate Purchase Agreement form in hand, it's time to fill it out carefully. This document requires specific information about the property, the buyer, and the seller. Accurate completion is essential to ensure a smooth transaction.

- Start with the date at the top of the form. Write the current date.

- Fill in the names and addresses of the buyer(s) in the designated section.

- Provide the seller(s) names and addresses in the next section.

- Enter the legal description of the property. This can usually be found on the property deed or tax records.

- Specify the purchase price of the property. Ensure this matches the agreed-upon amount.

- Detail the earnest money deposit amount and how it will be paid.

- Indicate the closing date. This is when the property transfer will occur.

- Include any contingencies, such as financing or inspection requirements, if applicable.

- Sign and date the agreement. Both buyer and seller must do this.

After completing the form, review it for accuracy. Ensure all parties have a copy of the signed agreement for their records. This step is crucial for a successful real estate transaction.

Dos and Don'ts

When filling out the North Dakota Real Estate Purchase Agreement form, it’s crucial to approach the task with care. Here are seven essential do's and don'ts to keep in mind:

- Do read the entire agreement thoroughly before starting to fill it out.

- Do ensure all names are spelled correctly and match legal documents.

- Do provide accurate property details, including the address and legal description.

- Do clearly outline any contingencies, such as financing or inspections.

- Don't leave any sections blank; if a section does not apply, indicate it clearly.

- Don't rush through the process; take your time to avoid mistakes.

- Don't forget to sign and date the agreement before submitting it.

By following these guidelines, you can help ensure that your real estate transaction proceeds smoothly and efficiently.

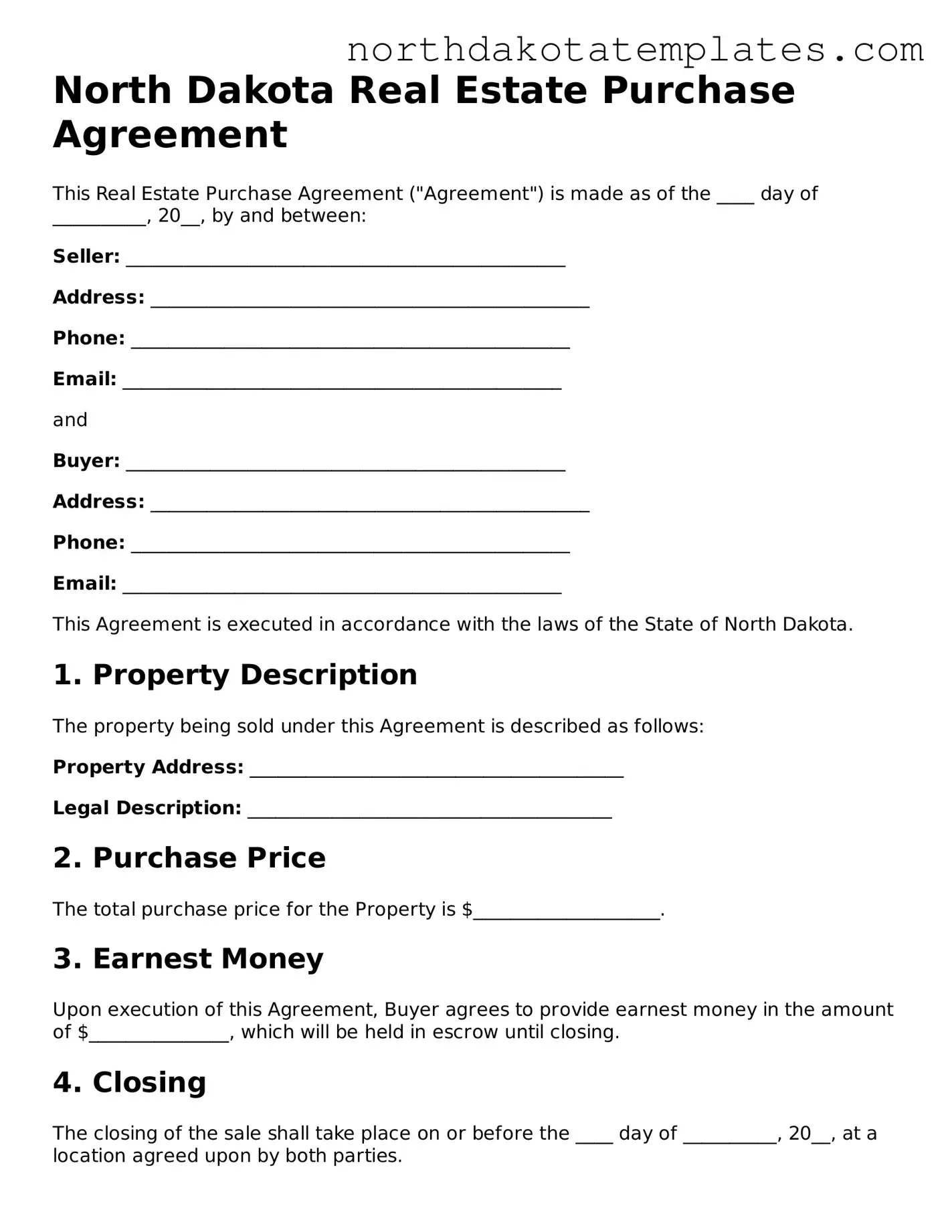

Document Example

North Dakota Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made as of the ____ day of __________, 20__, by and between:

Seller: _______________________________________________

Address: _______________________________________________

Phone: _______________________________________________

Email: _______________________________________________

and

Buyer: _______________________________________________

Address: _______________________________________________

Phone: _______________________________________________

Email: _______________________________________________

This Agreement is executed in accordance with the laws of the State of North Dakota.

1. Property Description

The property being sold under this Agreement is described as follows:

Property Address: ________________________________________

Legal Description: _______________________________________

2. Purchase Price

The total purchase price for the Property is $____________________.

3. Earnest Money

Upon execution of this Agreement, Buyer agrees to provide earnest money in the amount of $_______________, which will be held in escrow until closing.

4. Closing

The closing of the sale shall take place on or before the ____ day of __________, 20__, at a location agreed upon by both parties.

5. Contingencies

This Agreement is contingent upon:

- Buyer obtaining financing for the purchase.

- Inspection of the Property satisfied by Buyer.

- Any other conditions agreed by both the Seller and the Buyer.

6. Disclosure

Seller certifies that, to the best of Seller’s knowledge, all information regarding the Property is accurate and that Seller has disclosed any known material defects.

7. Signatures

By signing below, the parties agree to the terms of this Real Estate Purchase Agreement.

Seller's Signature: _______________________________ Date: ____________

Buyer's Signature: _______________________________ Date: ____________

8. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of North Dakota.

Both parties acknowledge that they have read this Agreement, understand it, and agree to be bound by its terms.

Document Specifics

| Fact Name | Description |

|---|---|

| Governing Law | The North Dakota Real Estate Purchase Agreement is governed by North Dakota Century Code, Title 47. |

| Parties Involved | The agreement typically involves a buyer and a seller, each of whom must be clearly identified. |

| Property Description | A detailed description of the property being sold is required, including address and legal description. |

| Purchase Price | The total purchase price must be stated, along with any deposits or earnest money involved. |

| Contingencies | Buyers can include contingencies, such as financing or inspection, which must be clearly outlined. |

| Closing Date | The agreement should specify the closing date, which is when the property transfer takes place. |

Common mistakes

Filling out the North Dakota Real Estate Purchase Agreement can seem straightforward, but many people stumble over common pitfalls. One significant mistake is failing to provide accurate property details. Buyers and sellers must ensure that the legal description of the property is correct. Omitting or misidentifying the property can lead to confusion and legal issues down the line.

Another frequent error involves the purchase price. It’s essential to clearly state the agreed-upon price in the designated section. Miscommunication regarding the price can result in disputes. Additionally, buyers often forget to include earnest money details. This deposit shows the seller that the buyer is serious, and not specifying the amount can weaken the offer.

People also overlook the importance of deadlines. The agreement typically includes various timelines for inspections, financing, and closing. Missing these dates can jeopardize the transaction. Similarly, neglecting to include contingencies can be detrimental. Buyers should consider including clauses that allow them to back out if certain conditions aren’t met, such as failing an inspection or not securing financing.

Another common mistake is not addressing the closing costs. Both parties should clarify who is responsible for these expenses. If this is left vague, it can lead to misunderstandings and disputes later on. Furthermore, some individuals forget to include personal property items in the agreement. If specific appliances or fixtures are part of the sale, they should be explicitly listed to avoid any surprises.

People often make assumptions about the terms of the agreement. It’s crucial to read each section carefully. Misunderstanding terms like “as-is” can lead to unintended consequences, especially regarding repairs. Additionally, failing to include the seller’s disclosures can be a significant oversight. Sellers are required to disclose known issues with the property, and neglecting this can lead to legal ramifications.

Lastly, many individuals forget to sign the agreement or to have it witnessed when required. An unsigned agreement holds no legal weight. It’s a simple yet critical step that can derail the entire process. By avoiding these mistakes, buyers and sellers can navigate the North Dakota Real Estate Purchase Agreement with greater confidence and clarity.

FAQ

What is a North Dakota Real Estate Purchase Agreement?

The North Dakota Real Estate Purchase Agreement is a legal document used to outline the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement includes details such as the purchase price, financing terms, and the responsibilities of both parties. It serves as a binding contract once both parties sign it, ensuring that the transaction follows the agreed-upon terms.

What are the key components of the agreement?

Key components of the North Dakota Real Estate Purchase Agreement typically include the following: the names of the buyer and seller, a description of the property, the purchase price, earnest money details, contingencies (like financing or inspections), closing date, and any additional terms or conditions. Each of these elements plays a crucial role in defining the rights and obligations of both parties involved in the transaction.

How does earnest money work in this agreement?

Earnest money is a deposit made by the buyer to demonstrate their commitment to purchasing the property. In the North Dakota Real Estate Purchase Agreement, this amount is specified and typically held in escrow until closing. If the deal goes through, the earnest money is applied to the purchase price. However, if the buyer backs out without a valid reason outlined in the agreement, they may lose this deposit.

What contingencies can be included in the agreement?

Contingencies are conditions that must be met for the sale to proceed. Common contingencies in a North Dakota Real Estate Purchase Agreement include financing contingencies, which ensure the buyer secures a mortgage; inspection contingencies, allowing the buyer to have the property inspected; and appraisal contingencies, ensuring the property's appraised value meets or exceeds the purchase price. These contingencies protect the buyer's interests and can provide an exit strategy if issues arise.

What happens if either party breaches the agreement?

If either party fails to uphold their end of the agreement, it may be considered a breach of contract. The non-breaching party may have several options, including seeking damages or enforcing the contract through legal means. In many cases, the specific remedies available will be outlined within the agreement itself, so it’s important for both parties to understand their rights and obligations.

Is it necessary to have a real estate agent when using this agreement?

While it is not legally required to have a real estate agent to use the North Dakota Real Estate Purchase Agreement, having one can be beneficial. Real estate agents bring expertise to the transaction, helping both buyers and sellers navigate the complexities of the agreement. They can provide valuable insights, ensure compliance with local laws, and assist in negotiations, making the process smoother for all parties involved.