Blank North Dakota Promissory Note Template

The North Dakota Promissory Note form serves as a crucial financial instrument in various lending scenarios, facilitating agreements between borrowers and lenders. This legally binding document outlines the terms under which a borrower agrees to repay a specific sum of money to the lender, typically including details such as the principal amount, interest rate, repayment schedule, and any applicable late fees. Additionally, the form may specify the consequences of default, providing clarity on the rights and obligations of both parties involved. In North Dakota, the use of this form is governed by state laws, ensuring that the document meets necessary legal standards and protects the interests of both lenders and borrowers. Understanding the key components of the Promissory Note is essential for anyone engaging in financial transactions, as it establishes a clear framework for repayment and helps prevent disputes. By adhering to the guidelines set forth in this form, parties can create a transparent and enforceable agreement that fosters trust and accountability in their financial dealings.

Browse More Templates for North Dakota

North Dakota Trailer Registration Fees - Assures both parties have a copy for their records after the sale.

Landlords in Arizona must be familiar with the Notice to Quit form, as it is essential for properly managing tenancy issues and safeguards their rights during the eviction process. For those looking to access important legal documents related to tenancy, All Arizona Forms is a valuable resource that provides all necessary information and forms needed to navigate these situations effectively.

Nd Vehicle Bill of Sale - The Bill of Sale outlines the agreed purchase price for the mobile home.

Similar forms

- Loan Agreement: A loan agreement outlines the terms and conditions of a loan, similar to a promissory note. Both documents specify the amount borrowed, interest rates, and repayment schedules.

- Mortgage: A mortgage secures a loan with real property. Like a promissory note, it includes repayment terms but also details the collateral backing the loan.

- Installment Agreement: This document allows for payments to be made over time. It shares similarities with a promissory note in that it details payment amounts and due dates.

- Secured Note: A secured note is a promissory note backed by collateral. Both documents outline the borrower's promise to repay but differ in the presence of security.

- Personal Guarantee: A personal guarantee involves an individual promising to repay a debt if the primary borrower defaults. It functions similarly to a promissory note in establishing responsibility for repayment.

- Credit Agreement: A credit agreement outlines the terms under which credit is extended. Like a promissory note, it details the obligations of the borrower and lender.

- Lease Agreement: A lease agreement specifies the terms for renting property. It shares characteristics with a promissory note in that it requires regular payments and outlines penalties for non-payment.

- Bond: A bond is a debt security where the issuer promises to pay back borrowed funds with interest. Both bonds and promissory notes establish a clear repayment obligation.

- Bill of Exchange: A bill of exchange is a written order to pay a specific amount at a future date. It resembles a promissory note in its function as a financial instrument for payment.

- Employment Verification Form: The California Employment Verification form is critical for confirming an employee's eligibility to work. It serves as a vital legal document that employers must fill out for new hires. Including necessary documentation like a Proof of Income Letter can enhance the verification process.

- Debt Settlement Agreement: This document outlines the terms for settling a debt for less than the full amount owed. It shares similarities with a promissory note by specifying repayment terms, albeit for a reduced amount.

How to Use North Dakota Promissory Note

Filling out the North Dakota Promissory Note form is a straightforward process. Once completed, the document will serve as a formal agreement between the lender and borrower, outlining the terms of the loan. Follow these steps carefully to ensure accuracy.

- Obtain the form: Download the North Dakota Promissory Note form from a reliable source or acquire a physical copy.

- Enter the date: Write the date on which the note is being executed at the top of the form.

- Identify the parties: Clearly print the full name and address of the borrower and the lender. Make sure to include any necessary titles or designations.

- Specify the loan amount: Indicate the total amount of money being borrowed. This should be written in both numeric and written form to avoid any confusion.

- Outline the interest rate: State the interest rate applicable to the loan. If the loan is interest-free, clearly indicate that as well.

- Detail the repayment terms: Describe how and when the borrower will repay the loan. Include information on payment frequency (e.g., monthly, quarterly) and the final due date.

- Include any late fees: If applicable, outline any penalties for late payments. Specify the amount or percentage that will be charged if payments are not made on time.

- Signatures: Both the borrower and lender must sign and date the form. Ensure that the signatures are legible and that both parties retain a copy for their records.

Dos and Don'ts

When filling out the North Dakota Promissory Note form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are some things to do and not do:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate information regarding the borrower and lender.

- Do clearly state the loan amount and interest rate.

- Do include the repayment terms, such as the payment schedule and due dates.

- Do sign and date the form once all information is complete.

- Don't leave any sections blank unless instructed to do so.

- Don't use abbreviations or shorthand that could lead to confusion.

- Don't alter the form or use correction fluid on it.

- Don't forget to keep a copy of the completed form for your records.

Document Example

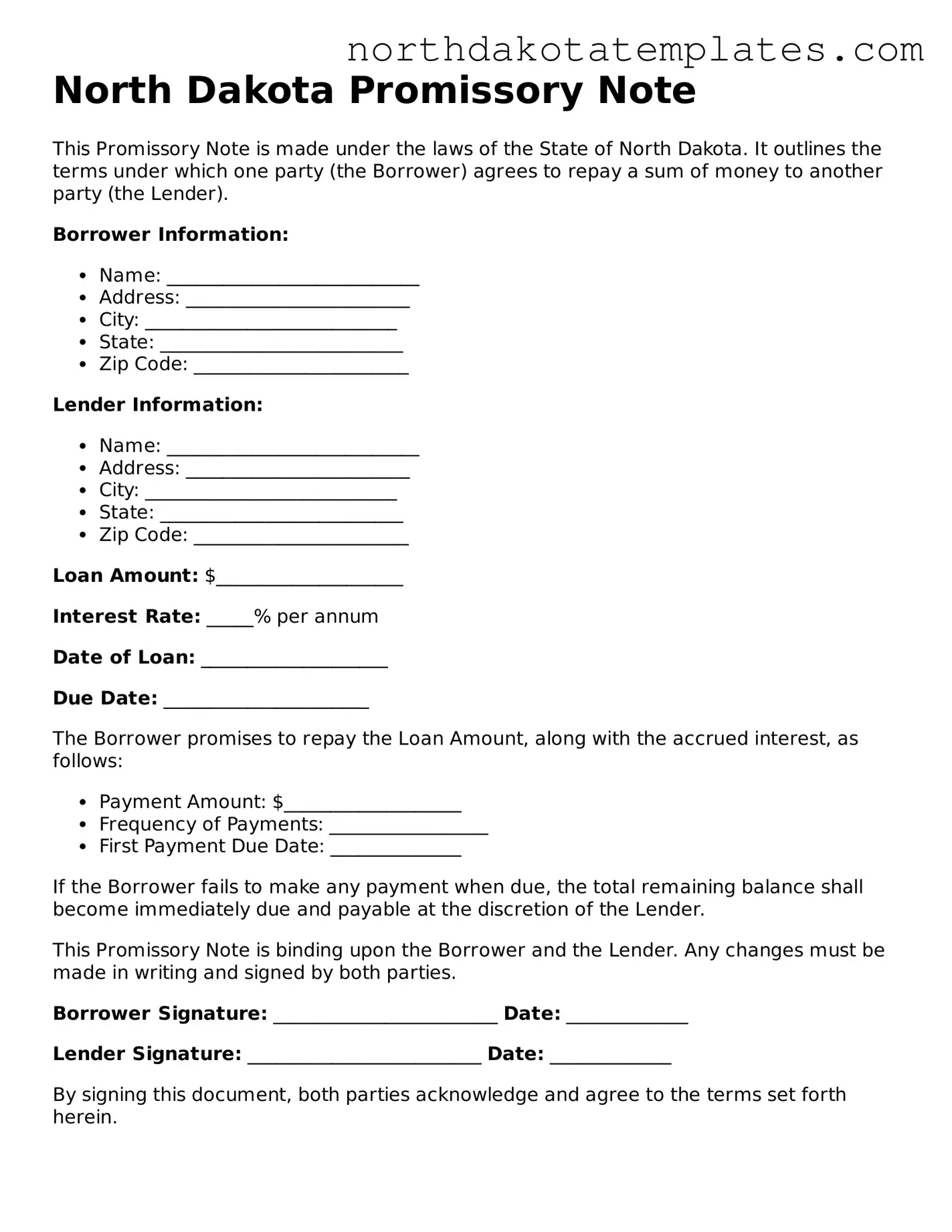

North Dakota Promissory Note

This Promissory Note is made under the laws of the State of North Dakota. It outlines the terms under which one party (the Borrower) agrees to repay a sum of money to another party (the Lender).

Borrower Information:

- Name: ___________________________

- Address: ________________________

- City: ___________________________

- State: __________________________

- Zip Code: _______________________

Lender Information:

- Name: ___________________________

- Address: ________________________

- City: ___________________________

- State: __________________________

- Zip Code: _______________________

Loan Amount: $____________________

Interest Rate: _____% per annum

Date of Loan: ____________________

Due Date: ______________________

The Borrower promises to repay the Loan Amount, along with the accrued interest, as follows:

- Payment Amount: $___________________

- Frequency of Payments: _________________

- First Payment Due Date: ______________

If the Borrower fails to make any payment when due, the total remaining balance shall become immediately due and payable at the discretion of the Lender.

This Promissory Note is binding upon the Borrower and the Lender. Any changes must be made in writing and signed by both parties.

Borrower Signature: ________________________ Date: _____________

Lender Signature: _________________________ Date: _____________

By signing this document, both parties acknowledge and agree to the terms set forth herein.

Document Specifics

| Fact Name | Description |

|---|---|

| Definition | A North Dakota Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a future date or on demand. |

| Governing Law | This form is governed by the North Dakota Century Code, specifically Chapter 41-03, which outlines the laws regarding negotiable instruments. |

| Parties Involved | The note involves two primary parties: the borrower (maker) who promises to pay, and the lender (payee) who receives the payment. |

| Interest Rates | The note may include an interest rate, which specifies how much additional money will be paid on top of the principal amount borrowed. |

| Signatures | Both the borrower and lender must sign the note for it to be legally binding, demonstrating their agreement to the terms outlined. |

Common mistakes

Filling out a North Dakota Promissory Note can be a straightforward process, but it is not without its pitfalls. Many individuals make common mistakes that can lead to confusion or even legal complications down the line. Understanding these mistakes is crucial for ensuring that the document is completed accurately.

One frequent error is neglecting to include all necessary details. A Promissory Note should clearly state the names of both the borrower and the lender. Failing to provide complete names or using nicknames can create ambiguity and may complicate enforcement of the note in the future.

Another common mistake involves inaccurate financial terms. The interest rate, repayment schedule, and total loan amount must be clearly defined. Miscalculating the interest or omitting the repayment schedule can lead to misunderstandings and disputes later on.

Some individuals also forget to date the document. A Promissory Note should include the date it was signed. Without this information, it may be challenging to establish when the obligations began, which is vital for both parties.

Additionally, people often overlook the importance of signatures. Both the borrower and the lender must sign the document for it to be legally binding. A missing signature can render the note unenforceable, leading to potential financial loss.

Another mistake involves not including a witness or notary. While not always required, having a witness or a notary public can add an extra layer of legitimacy to the document. This can be especially important if disputes arise in the future.

Furthermore, some individuals may fail to review the terms before signing. It is essential to read through the entire document carefully. Misunderstanding any term can lead to unexpected obligations or rights that were not intended.

People also sometimes make the mistake of not keeping a copy of the signed note. After the Promissory Note is executed, both parties should retain a copy for their records. This ensures that each party has access to the same information regarding the terms of the loan.

Lastly, individuals may mistakenly assume that verbal agreements are sufficient. A Promissory Note serves as a written record of the agreement and should not be replaced by verbal promises. Relying solely on spoken agreements can lead to significant issues if disagreements arise.

By being aware of these common mistakes, individuals can take steps to ensure that their North Dakota Promissory Note is filled out correctly. This will help protect their interests and facilitate a smoother lending process.

FAQ

What is a North Dakota Promissory Note?

A North Dakota Promissory Note is a legal document that outlines a borrower's promise to repay a specific amount of money to a lender. This note includes details such as the principal amount, interest rate, repayment schedule, and any penalties for late payments. It serves as a formal agreement between the two parties and can be used in various situations, such as personal loans, business financing, or real estate transactions.

What information is typically included in a North Dakota Promissory Note?

Typically, a North Dakota Promissory Note includes the names and addresses of both the borrower and lender, the amount borrowed, the interest rate, the payment schedule, and the maturity date. It may also specify what happens in the event of default, including any late fees or legal actions that may be taken. Additional clauses can be added to address specific needs or circumstances of the parties involved.

Is a North Dakota Promissory Note legally binding?

Yes, a North Dakota Promissory Note is a legally binding document, provided it meets certain requirements. For it to be enforceable, the note must include clear terms and conditions that both parties have agreed upon. It is advisable for both parties to sign the document in the presence of a witness or notary public to further strengthen its legal standing.

Can a North Dakota Promissory Note be modified after it is signed?

Yes, a North Dakota Promissory Note can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the borrower and lender. This helps prevent misunderstandings and ensures that all parties are aware of the new terms.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults on the Promissory Note, the lender has several options. They may pursue legal action to recover the owed amount, which could involve filing a lawsuit. The terms outlined in the note will dictate the specific consequences of default, including any late fees or additional interest that may apply. It is essential for both parties to understand these terms before entering into the agreement.

Do I need an attorney to create a North Dakota Promissory Note?

While it is not legally required to have an attorney draft a North Dakota Promissory Note, consulting with one can be beneficial. An attorney can ensure that the document complies with state laws and adequately protects your interests. If you are unsure about any terms or conditions, seeking legal advice is a prudent step.