Free North Dakota T 12 PDF Template

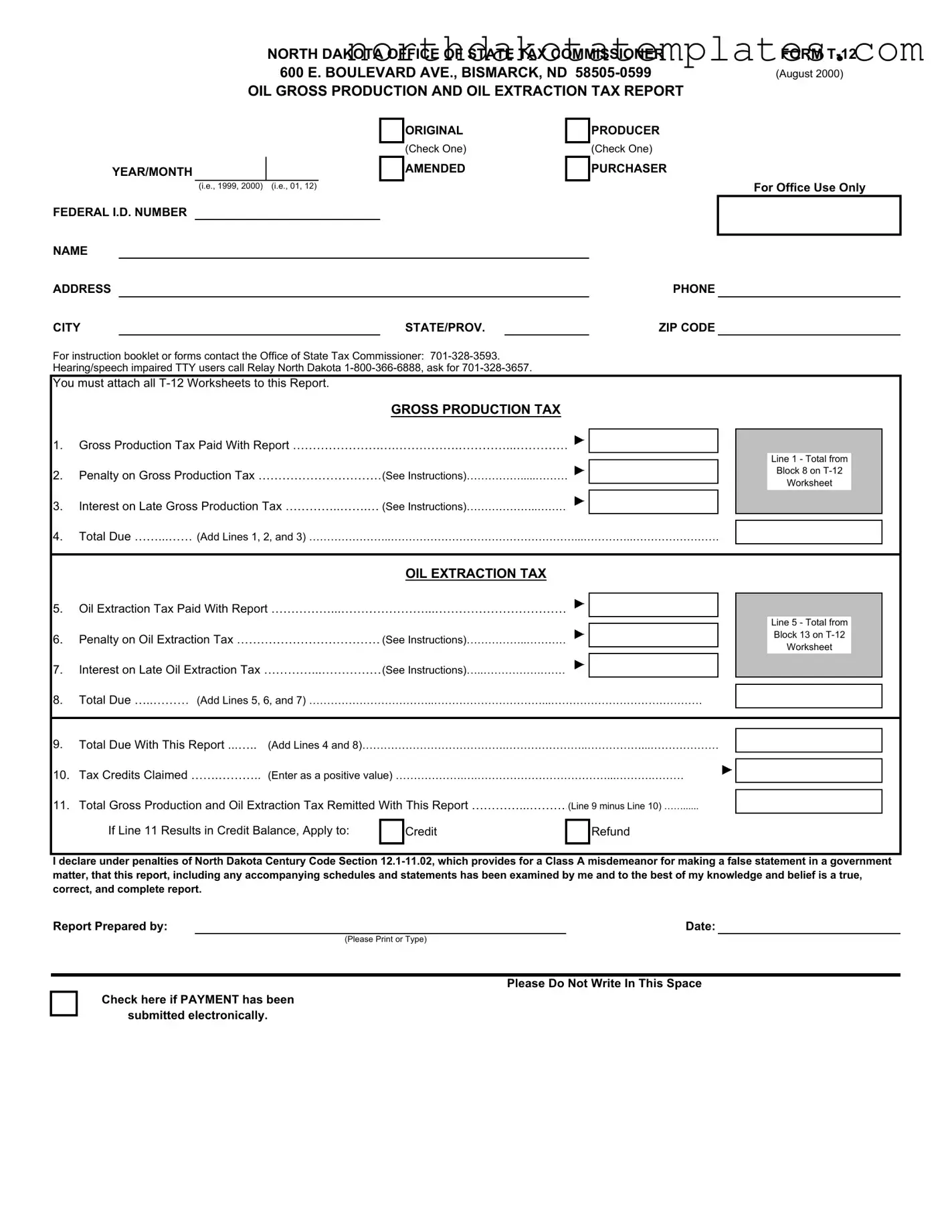

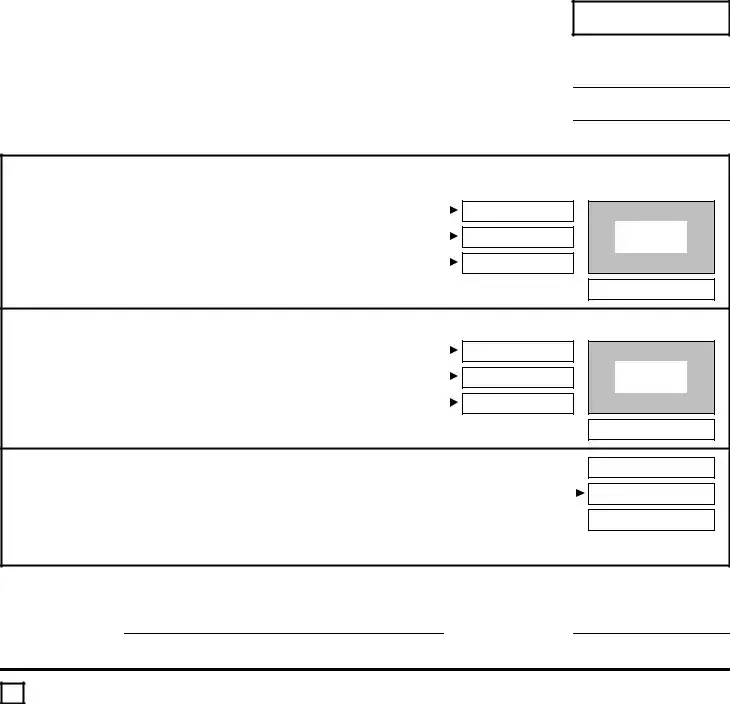

The North Dakota T 12 form is essential for oil producers and purchasers, as it serves to report both gross production and oil extraction taxes. This form is submitted to the North Dakota Office of State Tax Commissioner and must be completed accurately to ensure compliance with state tax laws. It requires information such as the federal identification number, the name and address of the producer or purchaser, and the specific year and month of reporting. The T 12 form includes sections for reporting gross production tax and oil extraction tax, along with penalties and interest for late payments. Taxpayers must also calculate the total amounts due, including any tax credits claimed. Additionally, the form necessitates the attachment of all relevant T 12 Worksheets, which provide detailed calculations of oil production and sales. A declaration statement at the end of the form affirms the accuracy of the information provided, emphasizing the importance of honesty in reporting. Completing the T 12 accurately is crucial for avoiding penalties and ensuring that all tax obligations are met.

Common PDF Documents

Does a Small Estate Affidavit Need to Be Filed With the Court in California - Organizations must not email sensitive documents due to privacy and security concerns.

Sfn 12011 - Liability insurance certificates must be current to process the renewal.

When engaging in the sale or purchase of personal property in Arizona, it is essential to utilize proper documentation, like the Arizona Bill of Sale form, to prevent any potential disputes. By having a formal record of the transaction, both parties can ensure clarity and accountability. For additional resources and essential documentation, visit All Arizona Forms to assist with your needs.

North Dakota Duplicate Title Application - Ensure that all information is accurate to prevent delays in processing.

Similar forms

- North Dakota T-1 Form: Similar to the T-12, the T-1 form is used for reporting various types of taxes in North Dakota. Both forms require detailed information about the taxpayer and the taxes owed.

- North Dakota T-2 Form: This form is also a tax report, focusing on different tax categories. Like the T-12, it requires information about penalties and interest related to late payments.

- North Dakota T-3 Form: The T-3 form is for businesses to report their sales tax. It shares similarities with the T-12 in terms of structure and the need for accurate reporting of taxes due.

- North Dakota T-4 Form: This form is used for corporate income tax reporting. Both the T-4 and T-12 require detailed calculations of taxes owed, including penalties and interest.

- North Dakota T-5 Form: The T-5 form is for reporting property taxes. Similar to the T-12, it includes sections for total taxes due and any applicable credits.

- North Dakota T-6 Form: This form is for reporting franchise taxes. It mirrors the T-12 in requiring comprehensive data on tax liabilities and any penalties for late submissions.

-

Florida Articles of Incorporation: Essential for establishing a corporation in Florida, this form requires basic information such as the corporation’s name, address, and directors. More details can be found at floridaforms.net/blank-articles-of-incorporation-form/.

- North Dakota T-7 Form: The T-7 form is used for income tax withholding. It shares the same reporting structure as the T-12, emphasizing the importance of accurate and timely tax reporting.

How to Use North Dakota T 12

Completing the North Dakota T 12 form requires careful attention to detail. This form is essential for reporting oil gross production and oil extraction taxes. Below are the steps to help you accurately fill out the form.

- Obtain the North Dakota T 12 form from the Office of State Tax Commissioner or their website.

- Identify whether you are the original producer or a purchaser by checking the appropriate box at the top of the form.

- Enter the year and month for which you are reporting in the designated fields.

- Fill in your Federal I.D. number, name, address, phone number, city, state, and ZIP code in the corresponding sections.

- Complete the GROSS PRODUCTION TAX section:

- Line 1: Enter the gross production tax paid with the report.

- Line 2: Add any penalty on gross production tax, if applicable.

- Line 3: Include interest on late gross production tax, if applicable.

- Line 4: Calculate the total due by adding Lines 1, 2, and 3.

- Proceed to the OIL EXTRACTION TAX section:

- Line 5: Enter the oil extraction tax paid with the report.

- Line 6: Add any penalty on oil extraction tax, if applicable.

- Line 7: Include interest on late oil extraction tax, if applicable.

- Line 8: Calculate the total due by adding Lines 5, 6, and 7.

- Line 9: Add the totals from Line 4 and Line 8 to determine the total due with this report.

- Line 10: Enter any tax credits claimed as a positive value.

- Line 11: Calculate the total gross production and oil extraction tax remitted by subtracting Line 10 from Line 9.

- Indicate if payment has been submitted electronically by checking the appropriate box.

- Sign and date the form, ensuring that you declare the accuracy of the information provided.

- Attach all T-12 Worksheets to this report before submission.

Once you have completed the form, review it for any errors or omissions. Submitting a complete and accurate T 12 form is crucial for compliance with North Dakota tax regulations.

Dos and Don'ts

When filling out the North Dakota T 12 form, it is important to be thorough and accurate. Here are some key dos and don’ts to keep in mind:

- Do ensure that you check the correct box for "Original Producer" or "Amended Purchaser."

- Do include your Federal I.D. number accurately to avoid processing delays.

- Do attach all T-12 Worksheets to the report as required.

- Do calculate the total due carefully, adding lines accurately for gross production and oil extraction taxes.

- Do declare any tax credits clearly, entering them as positive values.

- Don't forget to sign and date the report, as this is a necessary step for validation.

- Don't leave any sections blank; provide information for all required fields.

- Don't use incorrect or outdated forms; ensure you are using the latest version of the T 12 form.

- Don't submit the form without reviewing it for accuracy, as mistakes can lead to penalties.

By following these guidelines, you can help ensure that your submission is processed smoothly and efficiently.

Document Example

|

|

|

NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER |

|||||||

|

|

|

600 E. BOULEVARD AVE., BISMARCK, ND |

|||||||

|

|

OIL GROSS PRODUCTION AND OIL EXTRACTION TAX REPORT |

||||||||

|

|

|

|

|

|

|

ORIGINAL |

|

PRODUCER |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

(Check One) |

|

(Check One) |

|

|

|

|

|

|

|

|

|

|||

YEAR/MONTH |

|

|

|

|

|

AMENDED |

|

PURCHASER |

||

|

|

|

|

|

|

|

|

|||

|

|

(i.e., 1999, 2000) |

(i.e., 01, 12) |

|

|

|||||

FEDERAL I.D. NUMBER |

|

|

|

|

|

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|

PHONE |

|

CITY |

|

|

|

|

|

STATE/PROV. |

|

|

ZIP CODE |

|

FORM

(August 2000)

For Office Use Only

For instruction booklet or forms contact the Office of State Tax Commissioner:

You must attach all

GROSS PRODUCTION TAX

1. Gross Production Tax Paid With Report ………………….….…………….…………...…………

2. Penalty on Gross Production Tax ………………………… (See Instructions)…………….....………

3. Interest on Late Gross Production Tax …………..…….… (See Instructions)………………..………

4. Total Due ……...…… (Add Lines 1, 2, and 3) …………………..……………………………………………...…………..……………………

Line 1 - Total from

Block 8 on

Worksheet

OIL EXTRACTION TAX

5.Oil Extraction Tax Paid With Report ……………...…………………...……………………………

6.Penalty on Oil Extraction Tax ……………………………… (See Instructions)……………..…………

7.Interest on Late Oil Extraction Tax …………...…………… (See Instructions)…..…………….………

8.Total Due …..……… (Add Lines 5, 6, and 7) ……………………………..…………………………...……………………………………

Line 5 - Total from Block 13 on

9. |

Total Due With This Report ...….. (Add Lines 4 and 8)………………………………….…………………..……………...………………… |

||||

10. |

Tax Credits Claimed …….……….. (Enter as a positive value) ……………….….………………………………...……….……… |

||||

11. |

Total Gross Production and Oil Extraction Tax Remitted With This Report …………...……… (Line 9 minus Line 10) …… |

||||

|

If Line 11 Results in Credit Balance, Apply to: |

|

Credit |

|

Refund |

|

|

|

|||

|

|

|

|

|

|

I declare under penalties of North Dakota Century Code Section

Report Prepared by: |

Date: |

(Please Print or Type)

Please Do Not Write In This Space

Check here if PAYMENT has been

submitted electronically.

|

|

|

|

|

|

|

|

North Dakota Statement of Oil Purchases/Sales |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

Gross Production & Oil Extraction Tax |

|

|

|

(August 2000) |

||||

YEAR/MONTH |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

(i.e., 1999, 2000) |

(i.e., 01, 12) |

|

|

|

|

|

|

|

|

|

|

|

||

FEDERAL I.D. NUMBER |

|

|

|

|

|

|

TAXPAYER NAME |

|

|

|

|

Page |

|

of |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Production Tax |

|

|

|

Oil Extraction Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barrels of Oil |

|

|

Value of Oil |

|

Value of Exempt |

Taxable Value of Oil |

Pool |

Well |

|

Taxable Value of Oil |

Other Party |

||||||

Purchased/Sold |

|

|

|

Government |

|

Federal I.D. |

|||||||||||

|

|

Purchased/Sold |

|

(Block 2 - Block 3) |

Code |

Code |

|

(Same as Block 4) |

|||||||||

(Round to two Places) |

|

|

|

Royalties |

|

|

Number |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

2 |

|

|

|

|

3 |

4 |

A |

B |

9 |

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil |

|

Posting |

Additional |

Transportation |

Other |

|

Total Production Tax Due |

5 |

Total Extraction Tax Due |

10 |

|

15 |

|

|

|||

Gravity |

|

Code |

Value |

|

Deduction |

Deductions |

|

(5% of Block 4) |

|

(4% or 6.5% of Block 9) |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

D |

E |

F |

|

|

G |

|

Production Tax |

6 |

Extraction Tax |

11 |

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Previously Paid |

|

Previously Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

API Number: |

|

|

|

|

Sequence # |

Condensate |

|

Production Tax Paid |

7 |

Extraction Tax Paid |

12 |

|

17 |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

33 |

- |

|

|

( |

) |

YES |

|

By Others |

|

By Others |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

Production Tax Paid |

8 |

Extraction Tax Paid |

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Well or Lease Name: |

|

|

|

|

|

|

with Report |

|

with Report |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

2 |

|

|

|

|

3 |

4 |

A |

B |

9 |

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil |

|

Posting |

Additional |

Transportation |

Other |

|

Total Production Tax Due |

5 |

Total Extraction Tax Due |

10 |

|

15 |

|

|

|||

Gravity |

|

Code |

Value |

|

Deduction |

Deductions |

|

(5% of Block 4) |

|

(4% or 6.5% of Block 9) |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

D |

E |

F |

|

|

G |

|

Production Tax |

6 |

Extraction Tax |

11 |

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Previously Paid |

|

Previously Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

API Number: |

|

|

|

|

Sequence # |

Condensate |

|

Production Tax Paid |

7 |

Extraction Tax Paid |

12 |

|

17 |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

33 |

- |

|

|

( |

) |

YES |

|

By Others |

|

By Others |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

Production Tax Paid |

8 |

Extraction Tax Paid |

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Well or Lease Name: |

|

|

|

|

|

|

with Report |

|

with Report |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

2 |

|

|

|

|

3 |

4 |

A |

B |

9 |

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil |

|

Posting |

Additional |

Transportation |

Other |

|

Total Production Tax Due |

5 |

Total Extraction Tax Due |

10 |

|

15 |

|

|

|||

Gravity |

|

Code |

Value |

|

Deduction |

Deductions |

|

(5% of Block 4) |

|

(4% or 6.5% of Block 9) |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

D |

E |

F |

|

|

G |

|

Production Tax |

6 |

Extraction Tax |

11 |

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Previously Paid |

|

Previously Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

API Number: |

|

|

|

|

Sequence # |

Condensate |

|

Production Tax Paid |

7 |

Extraction Tax Paid |

12 |

|

17 |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

33 |

- |

|

|

( |

) |

YES |

|

By Others |

|

By Others |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

Production Tax Paid |

8 |

Extraction Tax Paid |

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Well or Lease Name: |

|

|

|

|

|

|

with Report |

|

with Report |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page Total |

|

Page Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sum of Block 8: |

|

Sum of Block 13: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

File Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The North Dakota T 12 form is used to report oil gross production and oil extraction taxes owed by producers and purchasers of oil in the state. |

| Governing Law | This form is governed by the North Dakota Century Code, specifically under the tax regulations for oil and gas production. |

| Submission Requirements | All T 12 Worksheets must be attached to the report when submitted. Failure to do so may result in processing delays. |

| Tax Calculation | The form requires the calculation of gross production tax and oil extraction tax, including any penalties or interest for late payments. |

| Contact Information | For assistance, individuals can contact the North Dakota Office of State Tax Commissioner at 701-328-3593 or use the TTY service at 1-800-366-6888. |

Common mistakes

Filling out the North Dakota T 12 form can be straightforward, but many people make common mistakes that can lead to issues. One frequent error is failing to check the appropriate box for either the original producer or purchaser. This oversight can create confusion and delay processing.

Another mistake is not providing the correct federal I.D. number. This number is crucial for identification purposes. If it’s incorrect, it can lead to miscommunication with tax authorities. Additionally, people often forget to include their contact information, such as a phone number. This omission can hinder any follow-up that might be necessary.

Many individuals also neglect to attach the required T-12 Worksheets to their report. This is a critical step, as the worksheets provide the necessary details to support the figures reported. Without them, the submission may be considered incomplete.

Another common error is miscalculating the total due. When adding lines for gross production tax and oil extraction tax, mistakes can easily happen. Double-checking these calculations can prevent unnecessary penalties or interest charges.

People sometimes forget to include penalties or interest on late payments. These amounts can accumulate quickly, and failing to report them accurately can lead to increased liability. It’s important to review the instructions carefully to ensure all applicable fees are included.

Some filers mistakenly enter tax credits as negative values instead of positive ones. This can drastically alter the total tax remitted and potentially lead to further complications. Always enter tax credits as positive amounts to avoid confusion.

Another issue arises when individuals do not sign and date the form. This step is often overlooked, but without a signature, the report may not be considered valid. It’s essential to confirm that all required signatures are present before submission.

People also occasionally submit the form electronically without checking the box indicating electronic payment. This can lead to misunderstandings about whether payment has been made. Ensuring that this box is checked can help clarify the payment status.

Finally, some individuals fail to keep copies of their submitted forms and worksheets. Retaining these records is vital for future reference and in case of any disputes with tax authorities. Keeping organized records can save time and stress later on.

FAQ

What is the North Dakota T 12 form?

The North Dakota T 12 form is a tax report used for reporting oil gross production and oil extraction taxes. It is essential for oil producers and purchasers in the state to accurately report their production and extraction activities. This form helps ensure compliance with state tax regulations and provides a structured way to calculate and remit taxes owed to the state.

Who needs to file the T 12 form?

Any individual or entity engaged in the production or purchase of oil in North Dakota must file the T 12 form. This includes original producers and purchasers of oil. If you are responsible for reporting oil production or extraction activities, it is important to complete and submit this form to the North Dakota Office of State Tax Commissioner.

When is the T 12 form due?

The T 12 form must be filed by the 20th day of the month following the reporting period. For example, if you are reporting for the month of January, your form is due by February 20th. Timely submission is crucial to avoid penalties and interest on late payments.

What information do I need to complete the T 12 form?

To complete the T 12 form, you will need several pieces of information, including your federal identification number, the name and address of your business, and details about your oil production and extraction activities. You will also need to calculate the gross production tax and oil extraction tax, including any penalties or interest if applicable.

What happens if I make a mistake on the T 12 form?

If you discover an error after submitting your T 12 form, you can file an amended report. It is important to correct any inaccuracies as soon as possible to avoid potential penalties. The amended form should clearly indicate that it is a correction of a previously submitted report.

Are there penalties for late filing or payment?

Yes, there are penalties for late filing and late payment of taxes reported on the T 12 form. If you do not file or pay on time, you may incur penalties and interest based on the amount due. It's best to file and pay by the deadline to avoid these additional costs.

Can I claim tax credits on the T 12 form?

Yes, you can claim tax credits on the T 12 form. If you have eligible tax credits, you should report them in the designated section of the form. This will reduce your total tax liability and may result in a credit balance that can be applied to future tax obligations or refunded.

Where can I get help if I have questions about the T 12 form?

If you have questions about the T 12 form or need assistance, you can contact the North Dakota Office of State Tax Commissioner at 701-328-3593. They can provide guidance on completing the form, understanding tax obligations, and addressing any specific concerns you may have.