Free North Dakota 58 PDF Template

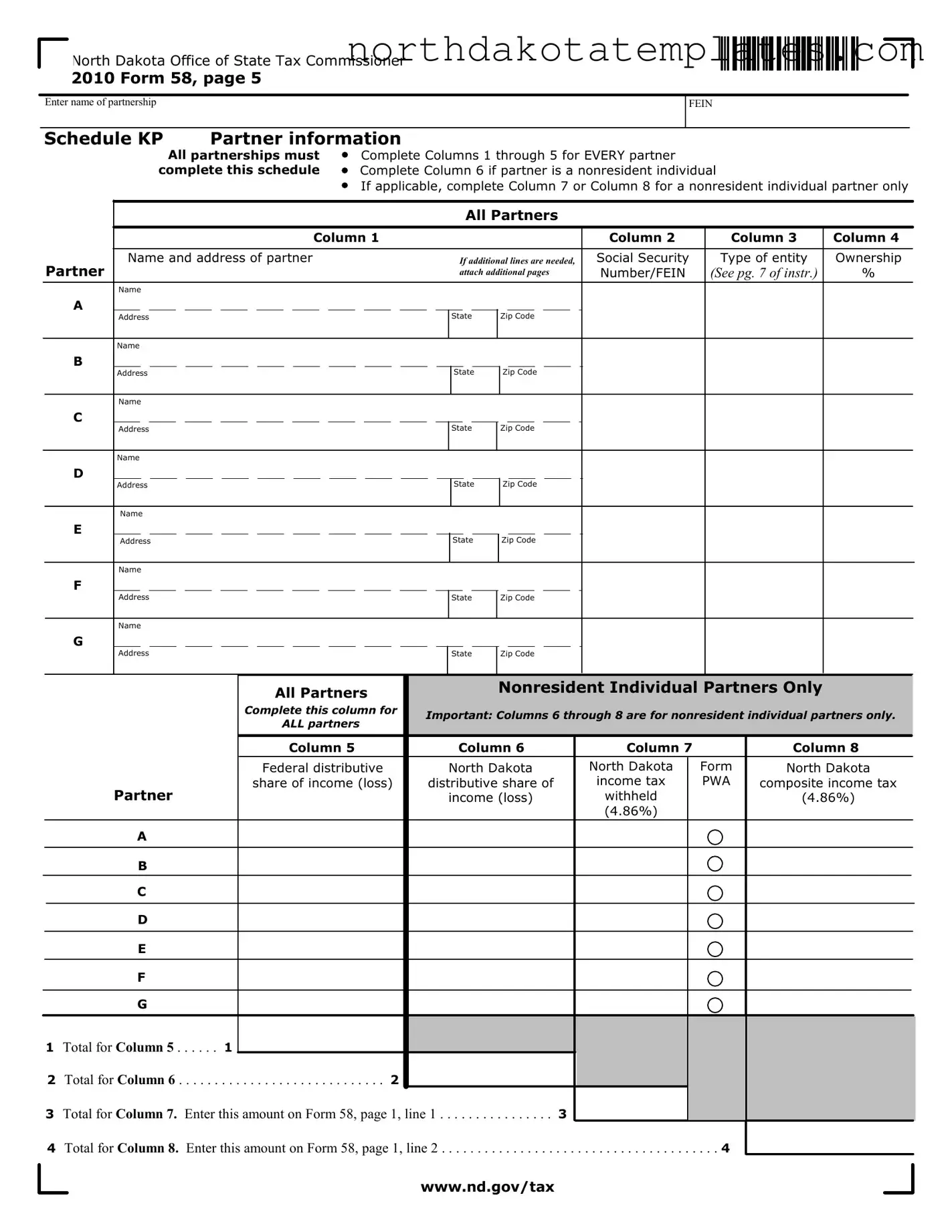

The North Dakota Form 58 is a crucial document for partnerships operating within the state, serving as a means to report income and tax liabilities. Each partnership must accurately complete this form to provide essential details about its partners. The form requires information such as the name, address, and federal identification number of each partner, along with their respective ownership percentages. Additionally, specific columns cater to nonresident individual partners, ensuring that their distributive shares of income and tax withholdings are properly documented. This includes reporting any applicable North Dakota income tax withheld at a rate of 4.86%. The form is structured to facilitate the reporting process, with clear sections for all partners and additional requirements for nonresident individuals. Accurate completion of Form 58 is vital, as it impacts the overall tax obligations of the partnership and ensures compliance with state tax regulations.

Common PDF Documents

Sfn 12011 - Ensure that the web address for the Secretary of State’s office is noted for reference.

The Florida Articles of Incorporation form is a crucial document for anyone looking to establish a corporation within the state, as it outlines essential information needed to register with the Florida Department of State. This includes details such as the corporation’s name, address, and the names of its directors. To learn more about the specific requirements and to access the form, visit floridaforms.net/blank-articles-of-incorporation-form/, making it the first official step in creating a recognized business entity in Florida.

Mandated Reporter Ny Statute of Limitations - Reporters are vital in connecting at-risk children with supportive services.

Similar forms

The North Dakota Form 58 is primarily used for reporting partnership income and partner information. Below is a list of ten documents that share similarities with Form 58, each serving distinct but related purposes in the realm of tax reporting and partnership disclosures.

- IRS Form 1065: This form is used for reporting income, deductions, gains, and losses from partnerships. Like Form 58, it requires detailed information about each partner's share of income and losses.

- Schedule K-1 (Form 1065): Issued to each partner, this document reports their share of the partnership’s income, deductions, and credits. It complements Form 58 by providing specific partner information.

- IRS Form 1120S: This form is for S corporations to report income, deductions, and credits. Similar to Form 58, it includes details on shareholders and their respective shares of income.

- Schedule K-1 (Form 1120S): This document provides shareholders with information about their share of the S corporation's income, deductions, and credits, paralleling the partner information required in Form 58.

- North Dakota Form 37: This form is used for reporting corporate income tax. It requires detailed income reporting similar to that required in Form 58, though it is for corporations instead of partnerships.

- California Bill of Sale form: This legal document is essential for transferring ownership of items or property in California. It provides a clear record of the transaction, capturing details such as the item's description and sale amount, and serves as a vital reference for both the buyer and seller. For further resources, you can find All California Forms that assist in this process.

- North Dakota Form 38: This is a tax return for partnerships and LLCs. It shares the objective of reporting partnership income and partner details, akin to Form 58.

- IRS Form 1040 Schedule E: This form is for reporting supplemental income and loss, including income from partnerships. It requires similar income reporting as Form 58.

- IRS Form 8865: Used for reporting information related to foreign partnerships, this form shares the requirement of detailing partner income and ownership percentages, similar to Form 58.

- North Dakota Form 2: This is the individual income tax return form for residents. It may include income reported from partnerships, similar to the reporting requirements of Form 58.

- IRS Form 990: This form is for tax-exempt organizations to report income and expenses. While it serves a different purpose, it also requires detailed financial disclosures akin to those found in Form 58.

How to Use North Dakota 58

Filling out the North Dakota 58 form requires attention to detail, especially when it comes to listing partnership information accurately. After completing the form, you will submit it to the North Dakota Office of State Tax Commissioner. This process ensures that all partners are accounted for, including any necessary tax information for nonresident individuals.

- Obtain the North Dakota 58 form from the official website or your tax advisor.

- Begin by entering the name of the partnership at the top of the form.

- Provide the Federal Employer Identification Number (FEIN) for the partnership.

- Complete the Schedule KP section by filling out Columns 1 through 5 for every partner.

- In Column 1, list the name and address of each partner. If more space is needed, attach additional pages.

- In Column 2, enter the Social Security Number or FEIN for each partner.

- Indicate the type of entity in Column 3 for each partner.

- In Column 4, specify the ownership percentage for each partner.

- If any partners are nonresident individuals, complete Column 6 for their federal distributive share of income (loss).

- For nonresident individual partners, complete Column 7 for the North Dakota distributive share of income tax withheld.

- Also, complete Column 8 for the North Dakota PWA composite income tax for nonresident individual partners.

- At the end of the form, calculate the totals for Columns 5, 6, 7, and 8.

- Transfer the total from Column 7 to Form 58, page 1, line 1.

- Transfer the total from Column 8 to Form 58, page 1, line 2.

Dos and Don'ts

When filling out the North Dakota 58 form, attention to detail is crucial. Here are some important do's and don'ts to consider:

- Do enter the name of each partner accurately, including their full address.

- Do provide the correct Social Security Number or FEIN for each partner.

- Do complete Columns 1 through 5 for every partner listed.

- Do ensure that the ownership percentage is correctly calculated and entered.

- Don't forget to fill out Columns 6, 7, and 8 if any partners are nonresident individuals.

- Don't leave any columns blank; if additional space is needed, attach extra pages.

- Don't mix up the totals for each column; double-check your calculations.

- Don't ignore the instructions provided on page 7 of the form for specific guidance.

Document Example

North Dakota Office of State Tax Commissioner

2010 Form 58, page 5

Enter name of partnership

FEIN

|

Schedule KP |

Partner information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

All partnerships must |

Complete Columns 1 through 5 for EVERY partner |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

complete this schedule |

Complete Column 6 if partner is a nonresident individual |

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

If applicable, complete Column 7 or Column 8 for a nonresident individual partner only |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All Partners |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Column 1 |

|

|

|

|

|

Column 2 |

|

Column 3 |

Column 4 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and address of partner |

|

|

|

If additional lines are needed, |

Social Security |

|

Type of entity |

Ownership |

|||||||||

|

|

Partner |

|

|

|

|

|

|

attach additional pages |

Number/FEIN |

|

(See pg. 7 of instr.) |

% |

|

|

|||||||

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

Address |

|

|

|

|

|

State |

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

State |

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

State |

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

State |

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

Address |

|

|

|

|

|

State |

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

State |

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

State |

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All Partners |

|

|

|

Nonresident Individual Partners Only |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Complete this column for |

|

Important: Columns 6 through 8 are for nonresident individual partners only. |

|||||||||||||

|

|

|

|

|

|

|

ALL partners |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Column 5 |

|

|

|

Column 6 |

|

Column 7 |

|

|

Column 8 |

||||||

|

|

|

|

|

|

|

Federal distributive |

|

|

North Dakota |

|

North Dakota |

|

Form |

North Dakota |

|||||||

|

|

|

|

|

Partner |

share of income (loss) |

|

distributive share of |

|

income tax |

|

PWA |

composite income tax |

|||||||||

|

|

|

|

|

|

|

|

|

income (loss) |

|

withheld |

|

|

|

(4.86%) |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4.86%) |

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

1 Total for COLUMN 5 . . . . . . 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

2 Total for COLUMN 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

3 Total for COLUMN 7. Enter this amount on Form 58, page 1, line 1 . . . . . . . . . . . . . . . . 3 |

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

4 Total for COLUMN 8. Enter this amount on Form 58, page 1, line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 |

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

www.nd.gov/tax |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

File Breakdown

| Fact Name | Details |

|---|---|

| Purpose | The North Dakota Form 58 is used by partnerships to report partner information and income distributions for tax purposes. |

| Required Completion | All partnerships must complete Columns 1 through 5 for every partner listed on the form. |

| Nonresident Partners | If a partner is a nonresident individual, Columns 6, 7, and 8 must be filled out to report specific income details. |

| Governing Laws | This form is governed by North Dakota Century Code, Chapter 57-38, which outlines the state's tax laws. |

| Submission | Totals from Columns 7 and 8 must be transferred to Form 58, page 1, for accurate reporting of income and tax withheld. |

Common mistakes

Filling out the North Dakota 58 form can be straightforward, but many make common mistakes that can lead to delays or complications. One frequent error is failing to complete all required columns for every partner. Columns 1 through 5 must be filled out for all partners, regardless of their residency status. Omitting information can result in the form being returned for corrections.

Another common mistake is neglecting to provide accurate Social Security Numbers or Federal Employer Identification Numbers (FEIN). Each partner's identification number is crucial for proper tax reporting. Errors in these numbers can cause significant issues with the tax authorities.

Many individuals also overlook the importance of indicating the type of entity in Column 3. Whether the partner is an individual, corporation, or another entity type must be clearly stated. Misclassification can lead to incorrect tax calculations and potential penalties.

In addition, some people mistakenly complete Columns 6 through 8 for partners who are not nonresident individuals. These columns are specifically for nonresident partners, and filling them out for others can create confusion and inaccuracies in the tax return.

Another error involves incorrectly calculating the federal distributive share of income or loss in Column 5. This number should reflect each partner's share accurately. Miscalculations can affect the overall tax liability and lead to further complications down the line.

It is also important to ensure that all partner names and addresses are complete and correct. Missing or incorrect information can delay processing and may lead to issues with communication from the tax office.

Some filers forget to total the amounts in Columns 5, 6, 7, and 8 correctly. Each total must be accurate, as these figures are necessary for completing the rest of the tax return. Double-checking these totals can help avoid errors.

Lastly, failing to attach additional pages when needed can be a significant oversight. If there are more partners than the form allows space for, additional pages must be included. Not doing so can lead to incomplete submissions and subsequent delays in processing.

FAQ

What is the North Dakota 58 form used for?

The North Dakota 58 form is used by partnerships to report the income, losses, and distributions of each partner. This form helps the North Dakota Office of State Tax Commissioner track the tax obligations of partnerships and their individual partners.

Who needs to complete the North Dakota 58 form?

All partnerships operating in North Dakota must complete the North Dakota 58 form. This includes partnerships with resident and nonresident partners. Each partner's information must be reported on the form, ensuring accurate tax reporting for the state.

What information is required for each partner on the form?

For each partner, you need to provide their name, address, and either their Social Security Number or Federal Employer Identification Number (FEIN). Additionally, you must indicate the type of entity and the ownership percentage for each partner.

What if a partner is a nonresident individual?

If a partner is a nonresident individual, you must complete additional columns specifically for them. This includes reporting their distributive share of income or loss, as well as any North Dakota income tax withheld. Columns 6 through 8 on the form are designated for nonresident partners only.

How do I report the total amounts for each column?

Is there a specific format for entering partner information?

Yes, you should enter the partner's name and address clearly. If there are more partners than can fit in the provided space, attach additional pages with the same format. Ensure that all required columns are filled out accurately for each partner listed.

Where can I find additional instructions for completing the form?

Additional instructions for completing the North Dakota 58 form can be found on the North Dakota Office of State Tax Commissioner's website. It is important to review these instructions to ensure compliance and accuracy in your filing.