Free North Dakota 38 PDF Template

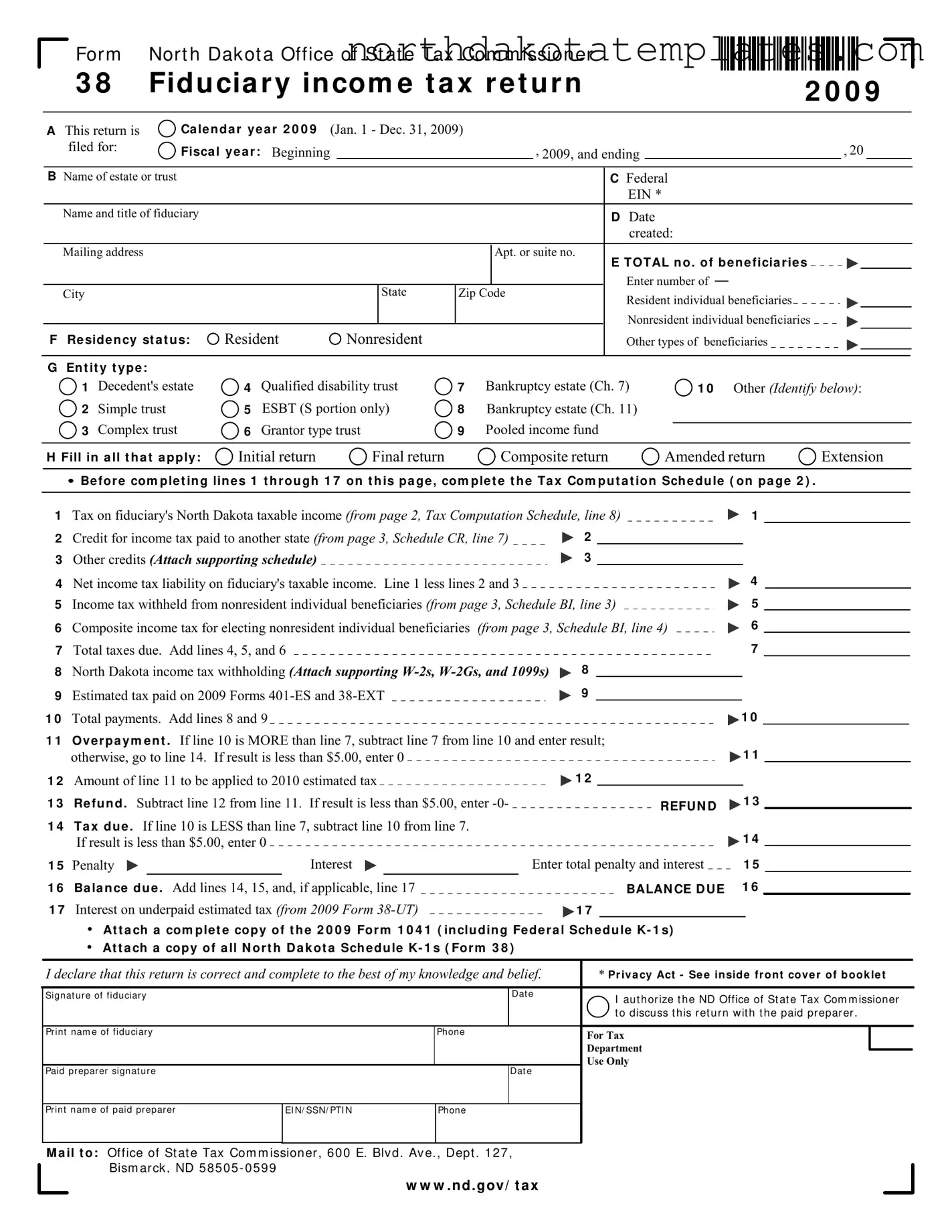

The North Dakota 38 form is a crucial document for fiduciaries managing estates and trusts in North Dakota. This form serves as the fiduciary income tax return, allowing the fiduciary to report the income, deductions, and credits associated with the estate or trust for the calendar year. It includes essential sections such as the identification of the estate or trust, the federal Employer Identification Number (EIN), and the residency status of beneficiaries. The form also requires fiduciaries to disclose the total number of beneficiaries, distinguishing between resident and non-resident individuals. Additionally, it outlines various entity types, including decedent's estates, simple trusts, complex trusts, and more. Completing the North Dakota 38 form involves careful calculations of taxable income, tax liabilities, and potential credits for taxes paid to other states. The form is not just a tax obligation; it also ensures that fiduciaries fulfill their responsibilities in managing the financial aspects of the estates or trusts they oversee. Properly filing this form is essential for compliance with state tax laws and for the accurate distribution of income to beneficiaries.

Common PDF Documents

Sfn 50645 - The form must be filled out by the registrant only.

To enhance your understanding and usage of the ADP Pay Stub form, it can be beneficial to explore resources available at smarttemplates.net, where further insights and templates may aid both employees and employers in managing their payroll documentation effectively.

Sfn 508 - It is imperative for applicants to remain truthful to safeguard children's welfare.

Neuroscience Conference 2023 - The form allows for the inclusion of contact details for acknowledgment purposes.

Similar forms

Form 1041: This is the U.S. Income Tax Return for Estates and Trusts. Like the North Dakota 38 form, it reports income, deductions, and credits for estates and trusts. Both forms require information about beneficiaries and tax calculations.

Form 1041-QFT: This form is for Qualified Funeral Trusts. Similar to the North Dakota 38, it deals with fiduciary income tax but is specifically for trusts set up to pay for funeral expenses.

Form 706: The U.S. Estate (and Generation-Skipping Transfer) Tax Return. While the North Dakota 38 focuses on income tax, both forms require information about the estate or trust and its beneficiaries.

Form 990: This is the Return of Organization Exempt from Income Tax. Nonprofits file this form, and it shares similarities with the North Dakota 38 in terms of reporting income and expenses, although it focuses on tax-exempt entities.

Schedule K-1 (Form 1065): This is used to report income, deductions, and credits from partnerships. Similar to the North Dakota 38, it provides details about distributions to beneficiaries or partners.

Schedule K-1 (Form 1041): This is used to report income from estates and trusts to beneficiaries. It aligns closely with the North Dakota 38 as both provide information about the income distributed to beneficiaries.

Form 990-T: This is the Exempt Organization Business Income Tax Return. Like the North Dakota 38, it addresses income tax but is specifically for tax-exempt organizations with unrelated business income.

-

Arizona Bill of Sale: This form is crucial for recording the sale of personal properties in Arizona, ensuring all transaction details are meticulously documented. For more information and to complete the form, visit arizonapdf.com/bill-of-sale/.

Form 1065: This is the U.S. Return of Partnership Income. It shares similarities with the North Dakota 38 in that both require reporting of income, deductions, and distributions to partners or beneficiaries.

Form 1040: The U.S. Individual Income Tax Return. While it is for individual taxpayers, it has similar components regarding income reporting and tax calculations as the North Dakota 38.

How to Use North Dakota 38

Filling out the North Dakota 38 form is an important step in ensuring compliance with state tax regulations for estates and trusts. After completing the form, you will need to submit it to the North Dakota Office of State Tax Commissioner along with any necessary attachments. This process ensures that all required information is accurately reported and that any taxes owed or refunds due are properly calculated.

- Identify the correct year: Confirm that you are filling out the form for the calendar year 2009.

- Complete the header: Fill in the name of the estate or trust, the Federal EIN, and the name and title of the fiduciary.

- Provide the date created: Enter the date the estate or trust was created.

- Mailing address: Write the complete mailing address, including apartment or suite number, city, state, and zip code.

- Number of beneficiaries: Indicate the total number of beneficiaries, separating them into resident and nonresident individual beneficiaries.

- Residency status: Check the appropriate box to indicate the residency status (Resident, Nonresident, or Other).

- Entity type: Select the type of entity by checking the appropriate box (e.g., Decedent's estate, Simple trust, etc.).

- Return type: Check all that apply (Initial return, Final return, Composite return, Amended return, Extension).

- Complete the Tax Computation Schedule: Refer to page 2 and fill out the tax on fiduciary's North Dakota taxable income and any applicable credits.

- Calculate net income tax liability: Subtract any credits from the tax on fiduciary's taxable income.

- Determine taxes due: Add any income tax withheld and composite income tax for electing nonresident individual beneficiaries.

- Calculate total payments: Add any North Dakota income tax withholding and estimated tax paid.

- Overpayment or tax due: Determine if there is an overpayment or balance due and calculate accordingly.

- Sign and date: The fiduciary must sign and date the form, confirming the information is accurate.

- Submit the form: Mail the completed form to the Office of State Tax Commissioner at the specified address.

Dos and Don'ts

When filling out the North Dakota 38 form, it is essential to approach the task with care and attention to detail. Here are some helpful tips to guide you:

- Do read the instructions thoroughly before starting. Understanding the requirements can save you time and prevent errors.

- Do ensure that all information is accurate and complete. Double-check names, addresses, and identification numbers.

- Do use black or blue ink when filling out the form. This ensures that your information is clear and legible.

- Do attach all necessary supporting documents, such as W-2s and 1099s, as required by the form.

- Don't leave any required fields blank. If a section does not apply, indicate that it is not applicable.

- Don't forget to sign and date the form. An unsigned form may be considered incomplete and could delay processing.

- Don't wait until the last minute to file. Allow yourself ample time to gather documents and review the form for accuracy.

Document Example

For m Nor t h Dak ot a Office of St at e Tax Com m issioner

3 8 |

Fid u cia r y in com e t a x r e t u r n |

2 0 0 9 |

|||||

|

|

|

|

|

|||

|

|

|

|

|

|

||

A This return is |

Ca le n d a r y e a r 2 0 0 9 |

(Jan. 1 - Dec. 31, 2009) |

|

|

|

||

filed for: |

Fisca l y e a r : Beginning |

|

|

, 2009, and ending |

|

, 20 |

|

|

|

|

|

|

|||

B Name of estate or trust |

|

|

|

C Federal |

|

|

|

|

|

|

EIN * |

|

Name and title of fiduciary |

|

|

|

D Date |

|

|

|

|

|

created: |

|

Mailing address |

|

|

Apt. or suite no. |

E TOTAL n o . of b e n e ficia r i e s |

|

|

|

|

|

|

|

|

|

State |

|

Enter number of |

|

City |

|

Zip Code |

Resident individual beneficiaries |

|

|

|

|

|

|

|

|

|

|

|

|

Nonresident individual beneficiaries |

F |

Re sid e n cy st a t u s: |

Resident |

Nonresident |

|

Other types of beneficiaries |

G En t it y t y p e :

1 Decedent's estate

1 Decedent's estate

2 Simple trust

2 Simple trust  3 Complex trust

3 Complex trust

4 |

Qualified disability trust |

7 |

Bankruptcy estate (Ch. 7) |

1 0 Other (Identify below): |

5 |

ESBT (S portion only) |

8 |

Bankruptcy estate (Ch. 11) |

|

6 |

Grantor type trust |

9 |

Pooled income fund |

|

|

H Fill in a ll t h a t a pp ly : |

Initial return |

Final return |

Composite return |

Amended return |

Extension |

|||||

|

|

|

||||||||

|

Be for e com ple t in g lin e s 1 t h r ou gh 1 7 on t h is pa g e , com p le t e t h e Ta x Com p u t a t ion Sch e du le ( on p a ge 2 ) . |

|

||||||||

|

|

|

|

|

|

|

||||

1 |

Tax on fiduciary's North Dakota taxable income (from page 2, Tax Computation Schedule, line 8) |

|

1 |

|

|

|||||

2 |

Credit for income tax paid to another state (from page 3, Schedule CR, line 7) |

2 |

|

|

|

|

|

|||

3 |

Other credits (Attach supporting schedule) |

|

|

3 |

|

|

4 |

|

|

|

4 |

Net income tax liability on fiduciary's taxable income. Line 1 less lines 2 and 3 |

|

|

|

|

|

||||

5 |

Income tax withheld from nonresident individual beneficiaries (from page 3, Schedule BI, line 3) |

|

5 |

|

|

|||||

6 |

Composite income tax for electing nonresident individual beneficiaries |

(from page 3, Schedule BI, line 4) |

6 |

|

|

|||||

7 |

Total taxes due. Add lines 4, 5, and 6 |

|

|

|

|

|

7 |

|

|

|

8North Dakota income tax withholding (Attach supporting  8

8

9 Estimated tax paid on 2009 Forms |

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|||||||

1 0 |

Total payments. Add lines 8 and 9 |

|

|

|

|

|

|

|

1 0 |

|

|

|

|

|

|||||||

1 1 |

Ov e r p a y m e n t . If line 10 is MORE than line 7, subtract line 7 from line 10 and enter result; |

|

|

|

|

|

|

|

|

||||||||||||

|

otherwise, go to line 14. |

If result is less than $5.00, enter 0 |

|

|

|

1 2 |

|

|

1 1 |

|

|

|

|

|

|||||||

1 2 Amount of line 11 to be applied to 2010 estimated tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

1 3 |

Re fu n d . Subtract line 12 from line 11. If result is less than $5.00, enter |

|

|

|

REFU N D |

1 3 |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||

1 4 |

Ta x d u e . If line 10 is LESS than line 7, subtract line 10 from line 7. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

If result is less than $5.00, enter 0 |

|

|

|

|

|

|

|

1 4 |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

1 5 |

Penalty |

|

Interest |

|

|

Enter total penalty and interest |

1 5 |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 6 |

|

|

|

|

|

||

1 6 |

Ba la n ce d u e . Add lines 14, 15, and, if applicable, line 17 |

|

|

|

|

|

|

BALAN CE D U E |

|

|

|

|

|

||||||||

1 7 Interest on underpaid estimated tax (from 2009 Form |

|

|

|

1 7 |

|

|

|

|

|

|

|

|

|

|

|||||||

|

• |

At t a ch a com ple t e cop y of t h e 2 0 0 9 Fo r m 1 0 4 1 ( in clu din g Fe d e r a l Sch e d u le K- 1 s) |

|

|

|

|

|

|

|

|

|||||||||||

|

• |

At t a ch a cop y of a ll N or t h D a k ot a Sch e d u le K- 1 s ( For m 3 8 ) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

I declare that this return is correct and complete to the best of my knowledge and belief. |

|

|

* Pr iv a cy Act - Se e in side fr ont cov e r of b ook le t |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Signat u r e of fidu ciar y |

|

|

|

|

Dat e |

|

|

|

I aut hor ize t he ND Office of St at e Tax Com m issioner |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

t o discu ss t his r et u r n wit h t he paid pr epar er . |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Pr int nam e of fidu ciar y |

|

|

|

Phone |

|

For Tax |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Department |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Use Only |

|

|

|

|

|

|

|

|

||

Paid pr epar er sign at u r e |

|

|

|

|

Dat e |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pr in t n am e of paid pr epar er |

|

EI N/ SSN/ PTI N |

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

M a il t o: |

Office of St at e Tax Com m issioner , 6 0 0 E. Blv d . Av e. , Dept . 1 2 7 , |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Bism ar ck , ND 5 8 5 0 5 - 0 5 9 9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

w w w . n d . g ov / t a x

Nor t h Dak ot a Office of St at e Tax Com m issioner

2 0 0 9 For m 3 8 , pa ge 2

Enter name of estate or trust

FEIN

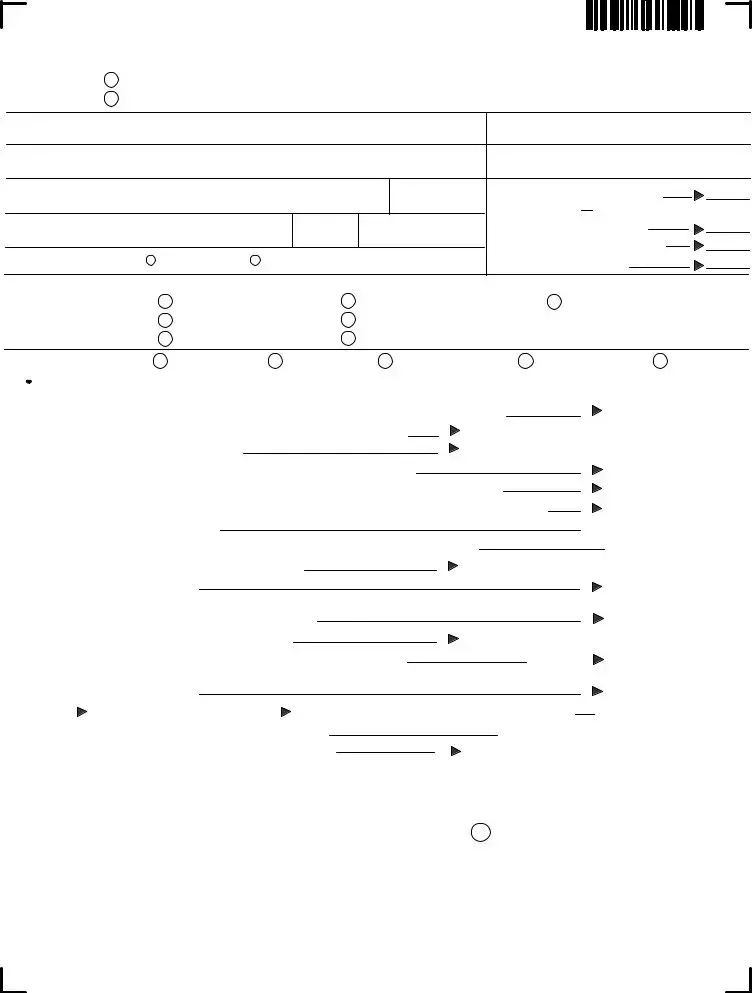

Ta x Com p u t a t ion Sch e d u le : Ta x on f id u cia r y ' s t a x a b le in com e

Pa r t 1 - Ca lcu la t ion of t a x

1 Fe d e r a l t a x a b le in com e

2Additions (See instructions) (Attach supporting statement)

3Add lines 1 and 2

4a Interest from U.S. obligations

4 a

4 a

bNet

4 b

4 b

cQualified dividend exclusion

4 c

4 c

d Other subtractions (See instructions) (Attach supporting statement) |

4 d |

eTotal subtractions. Add lines 4a through 4d

5North Dakota taxable income of fiduciary. Subtract line 4e from line 3

6 Tax on amount on line 5 using the 2 0 0 9 Ta x Ra t e Sch e d u le below

•If r e side n t estate or trust, enter amount from line 6 on line 8. Do not complete lines 7a, 7b, and 7c.

•If n on r e sid e n t estate or trust, complete lines 7a, 7b, and 7c.

7 a |

Fiduciary's share of total income from Part 2, line 11, Column A, |

|

|

less the amount from Part 1, line 4a |

7 a |

b Income (loss) reportable to North Dakota from Part 2, line 11, Column B |

7 b |

|

c |

Divide line 7b by line 7a. Round to the nearest four decimal places |

7 c |

8Tax on fiduciary's North Dakota taxable income: If r e sid e n t estate or trust, enter amount from line 6. If n on r e side n t estate or trust, multiply line 6 by line 7c. Enter this amount on Form 38, page 1, line 1

2 0 0 9 |

I f t he a m oun t on lin e 5 is: |

|

|

|

|

|||

Ta x Ra t e |

Ov e r |

Bu t n ot ov e r |

Th e t a x is: |

|

|

|||

Sch e d u le |

$ |

0 |

$ 2,30 0 |

. . . . . . |

. . . . . . . . . |

. 1 . 84 % of am ount on lin e 5 |

||

|

|

2,30 0 |

5 ,350 . . . $ |

42 |

. 32 |

plus 3 . 44 % |

of t he am ou nt over |

$ 2,3 00 |

|

|

5,35 0 |

8 ,200 |

1 47 . 24 plus 3 . 81% |

of t he am oun t over |

5,35 0 |

||

|

|

8,20 0 |

11 ,15 0 |

255 |

. 83 |

plus 4 . 42 % |

of t he am ou nt over |

8,2 00 |

|

1 1,1 50 . . |

. . . . . . . . . . . . |

3 86 |

. 22 |

plus 4 . 86% |

of t he am oun t ov er |

1 1,1 50 |

|

|

|

|

|

|

|

|

|

|

1

2

3

4 e  5

5  6

6

8

Pa r t 2 - Ca lcu la t ion of fidu cia r y ' s in com e

This par t m ust be com plet ed by all est at es and t r ust s

• Re sid e n t e st a t e or t r u st : Com plet e Colum n A only .

•N on r e sid e n t e st a t e or t r u st : Com plet e Colum ns A, B, and C. See inst r uct ions for how t o com plet e Colum ns B and C.

1 |

Interest income |

1 |

2 |

Ordinary dividends |

2 |

3 |

Business income or (loss) |

3 |

4 |

Capital gain or (loss) |

4 |

5 |

Rents, royalties, partnerships, other estates and trusts, etc. |

5 |

6 |

Farm income or (loss) |

6 |

7 |

Ordinary gain or (loss) |

7 |

8 |

Other income |

8 |

9 |

Total income. Add lines 1 through 8 |

9 |

1 0 Portion of amount on line 9 distributed to beneficiaries |

1 0 |

|

1 1 Fiduciary's share of total income. Subtract line 10 from line 9 |

1 1 |

|

|

|

N on r e sid e n t e st a t e s or t r u st s on ly |

||

Colum n A |

|

|

|

|

|

Colum n B |

|

Colum n C |

|

Fe d e r a l r e t u r n |

|

N or t h D a k ot a |

|

Ot h e r St a t e s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

w w w . n d . gov / t a x

Nor t h Dak ot a Office of St at e Tax Com m issioner

2 0 0 9 For m 3 8 , pa g e 3

Enter name of estate or trust

FEIN

|

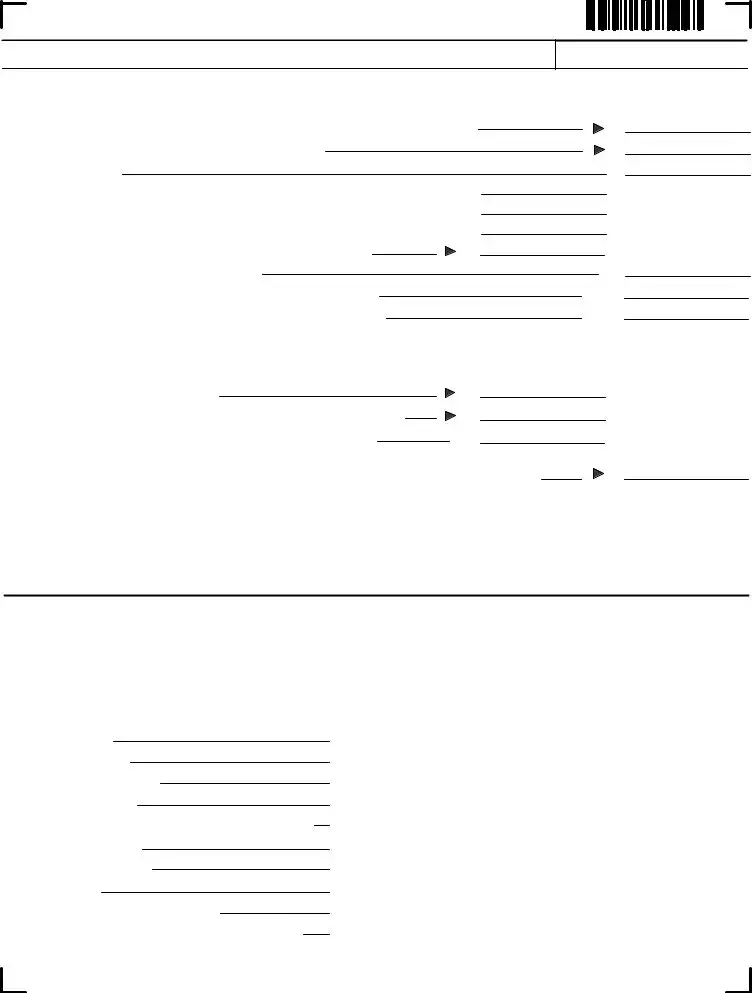

Sch e d u le BI |

Be n e f icia r y in f or m a t ion |

|

|

|

|

|

|

|

||||||

|

|

|

|

All e st a t e s a n d t r u st s m u st |

Com plet e Colum ns 1 t hr ough 4 for EVERY beneficiar y |

|

|

|

|

|

|||||

|

|

|

|

com p le t e t h is sch e d u le |

Com plet e Colum n 5 only if beneficiar y is a nonr esident indiv idual |

|

|

|

|

||||||

|

|

|

|

|

|

|

I f applicable, com plet e Colum n 6 or Colum n 7 for nonr esident indiv idual beneficiar y only |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All Be n e ficia r ie s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Colu m n 1 |

|

|

|

Colu m n 2 |

|

Colu m n 3 |

|

|

|

|

Be n e - |

|

|

|

|

|

|

|

|

|

||||

|

|

|

Nam e and addr ess of beneficiar y |

If additional lines are needed, |

|

Social Secur it y |

|

Ty pe of ent it y |

|

||||||

|

|

ficia r y |

|

|

|

|

attach additional pages |

|

Num ber / FEI N |

|

( SEE IN ST R U CT ION S) |

|

|||

|

|

|

|

Nam e |

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ad dr ess |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nam e |

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ad d r ess |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nam e |

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ad dr ess |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nam e |

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ad d r ess |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

All Be n e f icia r ie s |

N on r e side n t I n div idu a l Be n e ficia r ie s On ly |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Com p le t e t h is co lu m n f o r |

I m p or t a n t : Colu m n s 5 t h r o u g h 7 a r e f or n on r e sid e n t in d iv id u a l b e n e f icia r ie s on ly . |

|

|||||||

|

|

|

|

|

|

ALL b e n e ficia r ie s |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Colu m n 4 |

Colu m n 5 |

Colu m n 6 |

|

Colu m n 7 |

|

||||

|

|

|

|

|

|

Feder al dist r ibut iv e |

Nor t h Dak ot a |

Nor t h Dak ot a |

For m |

|

Nor t h Dak ot a |

|

|||

|

|

|

Be n e ficia r y |

|

shar e of incom e ( loss) |

dist r ibut iv e shar e of |

incom e t ax |

PWA |

com posit e incom e t ax |

|

|||||

|

|

|

|

|

|

incom e ( loss) |

w it hheld |

|

|

( 4 . 8 6 % ) |

|

||||

|

|

|

|

|

|

|

|

|

( 4 . 8 6 % ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

|

|

|

|

|

|

|

|

|

|

|

1Total for Column 4 . . . . . . 1

2Total for Column 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3Total for Column 6. Enter this amount on Form 38, page 1, line 5 . . . . . . . . . . . . . . . . 3

4Total for Column 7. Enter this amount on Form 38, page 1, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Sch e d u le CR |

Cr e d it f or in com e t a x p a id t o a n ot h e r st a t e ( r e side n t e st a t e or t r u st on ly ) |

1 |

Fiduciary's share of total income. Enter amount from Tax Computation Schedule, Part 2, line 11, Column A |

||

2 |

Portion of amount on line 1 that has its source in the other state (See instructions) |

|

|

3 |

Credit ratio. Divide line 2 by line 1 and round to the nearest four decimal places |

3 |

|

4Tax on fiduciary's North Dakota taxable income from Form 38, page 1, line 1

5 |

Multiply line 3 by line 4 |

6 |

Amount of income tax paid to the other state (See instructions) |

7Credit for income tax paid to another state. Enter lesser of line 5 or line 6. Enter this amount on page 1, line 2

I m por t a n t : At t a ch a co py of t h e in com e t a x r e t u r n file d w it h t h e ot h e r st a t e

1

2

4

5

6

7

w w w . n d . g ov / t a x

File Breakdown

| Fact Name | Details |

|---|---|

| Form Purpose | The North Dakota 38 form is used for filing fiduciary income tax returns for estates and trusts. |

| Filing Period | This form is specifically for the calendar year 2009, covering January 1 to December 31, 2009. |

| Governing Law | The form is governed by North Dakota Century Code, Chapter 57-38, which outlines the state's income tax laws. |

| Beneficiary Reporting | All estates and trusts must report beneficiary information, including resident and nonresident individuals, on the form. |

Common mistakes

Filling out the North Dakota 38 form can be a complex process, and mistakes can lead to delays or penalties. One common error is failing to provide the correct Federal Employer Identification Number (EIN). This number is crucial for identifying the estate or trust. If the EIN is incorrect or missing, it can complicate the processing of the return and may result in additional inquiries from the state tax office.

Another frequent mistake involves misclassifying the type of entity. The form requires filers to select the correct entity type, such as a decedent's estate or a simple trust. Choosing the wrong classification can lead to inappropriate tax calculations and may cause compliance issues. Each entity type has specific tax implications, and understanding these distinctions is essential for accurate reporting.

Many filers also overlook the residency status of beneficiaries. The form asks for the residency status of individual beneficiaries, and failing to accurately report this can lead to incorrect tax assessments. Nonresident beneficiaries have different tax obligations, and misreporting their status can create complications in tax liability calculations.

Additionally, some people neglect to complete the Tax Computation Schedule before filling out the main return. The instructions clearly state that this schedule must be completed first. Skipping this step can result in incorrect figures being entered on the main form, leading to potential underpayment or overpayment of taxes.

Finally, not attaching the necessary supporting documents is a common oversight. The form requires various attachments, such as copies of W-2s, 1099s, and other relevant tax documents. Failing to include these can result in delays in processing the return and may trigger additional requests for information from the tax office.

FAQ

What is the North Dakota 38 form used for?

The North Dakota 38 form is a fiduciary income tax return. It is specifically designed for estates and trusts to report their income and calculate the tax owed to the state of North Dakota. This form must be filed by fiduciaries, which include executors, administrators, or trustees managing the estate or trust's financial affairs. The form captures essential information such as the estate or trust's name, federal EIN, and the residency status of beneficiaries.

Who needs to file the North Dakota 38 form?

What information is required to complete the North Dakota 38 form?

What are the consequences of failing to file the North Dakota 38 form?