Free North Dakota 307 PDF Template

The North Dakota 307 form plays a crucial role in the state's income tax system, specifically for employers and individuals who have withheld North Dakota income tax from wages or payments. This form serves as a transmittal of wage and tax statements, ensuring that the North Dakota Office of State Tax Commissioner receives accurate information regarding tax withholdings. Employers must complete this form when submitting paper copies of W-2 and 1099 forms, detailing the total amount of state income tax withheld. Notably, if an employer no longer has North Dakota employees, they must indicate this on the form and provide the date of their final payroll period. The form requires basic information such as the employer's name, address, and account number, along with the total income tax withheld as reported on the W-2s and 1099s. Additionally, it includes instructions for those who need to file electronically or on magnetic media, particularly if they are submitting 250 or more forms. Importantly, the 307 form must be submitted by February 28 of the following year for those still in business, while those who are out of business must file it alongside their final Federal Forms W-3 and W-2. The guidance provided with the form helps ensure compliance with state regulations, making it an essential document for employers navigating their tax obligations in North Dakota.

Common PDF Documents

North Dakota Filing Requirements - Each return period has a set due date—January 31, April 30, July 31, and October 31—depending on the quarter.

The importance of the ADP Pay Stub form extends beyond mere documentation; it plays a vital role in enhancing financial literacy among employees. By providing a detailed overview of earnings and deductions, it empowers individuals to make informed decisions about budgeting and savings. For further assistance with understanding pay stubs, you can visit OnlineLawDocs.com for helpful resources and guidance.

Sfn 829 - The form serves as a health and safety checklist for early childhood programs.

Nd Tax Forms - Understand the differences between city lodging tax and city lodging and restaurant tax.

Similar forms

The North Dakota 307 form, used for transmitting wage and tax information, shares similarities with several other important tax documents. Each of these forms serves a specific purpose related to income reporting and tax withholding. Below are four documents that are similar to the North Dakota 307 form:

- W-2 Form: The W-2 form is issued by employers to report annual wages and the amount of taxes withheld from employee paychecks. Like the North Dakota 307 form, it provides crucial information for state tax purposes and must be submitted to the state if North Dakota income tax was withheld.

- 1099 Form: The 1099 form is used to report income received by individuals who are not classified as employees, such as independent contractors. Similar to the North Dakota 307, it requires reporting of any state tax withheld, ensuring compliance with state income tax laws.

- W-3 Form: The W-3 form serves as a summary of all W-2 forms issued by an employer. It is submitted to the Social Security Administration and, like the North Dakota 307, helps reconcile the total wages and taxes reported for the year, facilitating accurate tax processing.

Arizona Hold Harmless Agreement: For those looking to protect themselves from potential liabilities, completing the Hold Harmless Agreement form is an essential step to ensure legal safety and clarity in transactions and agreements.

- Form W-2C: This form is used to correct errors on previously filed W-2 forms. If an employer needs to amend wage information, they must submit a W-2C along with the North Dakota 307 when applicable, ensuring that state tax records remain accurate and up to date.

How to Use North Dakota 307

Completing the North Dakota 307 form is essential for employers who need to report state income tax withheld from employee wages or other payments. Follow these steps to ensure accurate submission.

- Obtain the North Dakota 307 form from the official website or your local tax office.

- Fill in the Account Number at the top of the form.

- Enter the Period Ending date for which you are reporting.

- If you no longer have North Dakota employees, check the circle indicating this and provide the last day of your final payroll period.

- Report the total North Dakota income tax withheld as shown on your W-2s and 1099s in the designated box.

- Provide your Name, Address, City, State, and Zip Code in the appropriate fields.

- If your address or zip code is incorrect, make the necessary changes directly on the form.

- Copy the information from the completed Form 307 to the Taxpayer’s Copy section for your records.

- Detach the top portion of Form 307 and prepare to mail it with your W-2s or 1099s.

- Do not submit any payments with Form 307 or your information returns.

- Mail the completed Form 307 and the state copies of your W-2s or 1099s to the Office of State Tax Commissioner at the specified address.

Dos and Don'ts

Do's

- Fill in all required fields accurately, including your name, address, and account number.

- Enter the total North Dakota state income tax withheld as shown on your W-2s and 1099s.

- Mail Form 307 with paper information returns to the correct address.

- Retain a copy of the completed Form 307 for your records.

Don'ts

- Do not submit payments with Form 307 or information returns.

- Do not forget to indicate if you no longer have North Dakota employees.

- Do not mix W-2 and 1099 forms when submitting paper returns.

- Do not file Form 307 if you are submitting your information returns electronically or on magnetic media.

Document Example

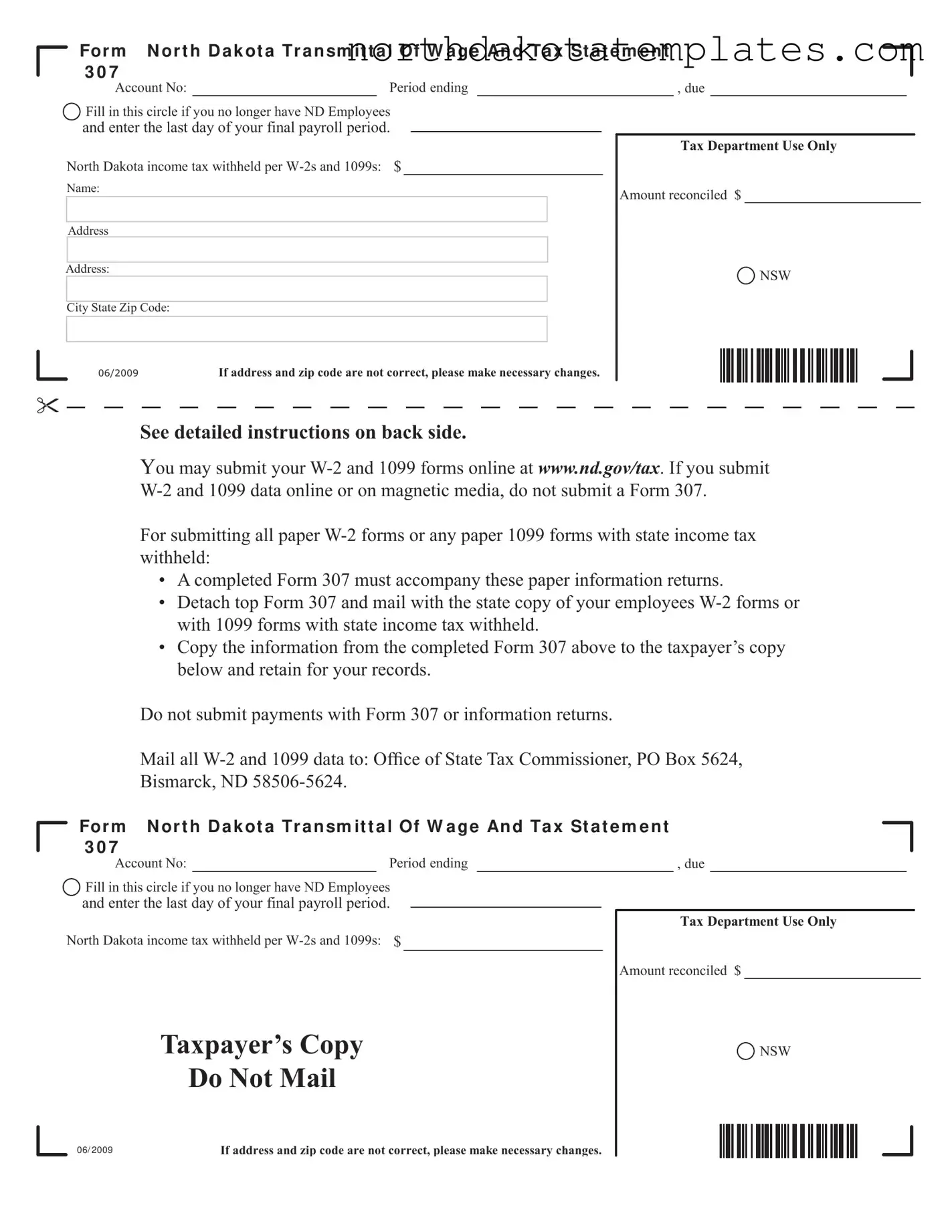

For m N or t h D a k ot a Tr a n sm it t a l Of W a g e An d Ta x St a t e m e n t 3 0 7

Account No: |

|

Period ending |

Fill in this circle if you no longer have ND Employees

Fill in this circle if you no longer have ND Employees

and enter the last day of your final payroll period.

North Dakota income tax withheld per

Name:

Address

Address:

City State Zip Code:

, due

T x Dep rtment UVe Only

Amount reconciled $

NSW

NSW

|

If ddreVV nd zip code re not correct, ple Ve m ke neceVV ry ch nJeV. |

See detailed instructions on back side.

You may submit your

For submitting all paper

•A completed Form 307 must accompany these paper information returns.

•Detach top Form 307 and mail with the state copy of your employees

•Copy the information from the completed Form 307 above to the taxpayer’s copy below and retain for your records.

Do not submit payments with Form 307 or information returns.

Mail all

Bismarck, ND

Fo r m N or t h D a k ot a Tr a n sm it t a l Of W a g e An d Ta x St a t e m e n t 3 0 7

Account No: |

|

Period ending |

Fill in this circle if you no longer have ND Employees

Fill in this circle if you no longer have ND Employees

and enter the last day of your final payroll period.

North Dakota income tax withheld per

Taxpayer’s Copy

Do Not Mail

, due

Tax Department Use Only

Amount reconciled $

NSW

NSW

06/ 2009 |

If address and zip code are not correct, please make necessary changes. |

Instructions

Who Must File Information Returns with Form 307

•An employer subject to North Dakota’s income tax withholding law, whether or not the employer withheld North Dakota income tax. The employer must submit a copy of each

•Any person who voluntarily withheld North Dakota income tax from a payment for which the person is required to fi le a Form 1099 with the Internal Revenue Service. The person must submit a copy of each Form 1099 reporting a payment from which North Dakota income tax was withheld.

•Paper Form 307 must be completed and returned to the Offi ce of State Tax Commissioner even though you may have closed your account during the tax year.

•Corrections to

at

Requirement to File Electronically or on Magnetic Media

You must submit the

How to Complete Form 307

Form 307 is mailed to all employers registered to withhold North Dakota state income tax from wages or other payments and to employers that are not required to register but have previously submitted information returns as required by law. Form 307 is not required to be filed if information returns are submitted electronically or on magnetic media. When submitting all paper

•If you no longer have employees and do not have information returns to submit, fi ll in the circle indicating you do not have employees, enter the date of your last payroll, and mail the Form 307 to the Tax Commissioner.

•If you submit your information returns on paper, you must complete and submit a Form 307 and a copy of all

•If you fi led and submitted North Dakota income tax withholding under more than one identifi cation number during the reporting year, please submit a letter with this information.

•Mail magnetic media to: Offi ce of State Tax Commissioner, 600 E. Boulevard Ave., Dept. 127, Bismarck, ND

•Mail Form 307 with paper information returns to: Offi ce of State Tax Commissioner, PO Box 5624, Bismarck, ND

When to File

If Still in Business:

If Out of Business:

Forms and Assistance

If you have questions or need forms, you may contact the Income Tax Withholding Section at

www.nd.gov/tax or by writing to our offi ce at the above address. |

I N ST R U CT ION S REV ISED 1 0 / 2 0 0 9 |

File Breakdown

| Fact Name | Details |

|---|---|

| Purpose of Form 307 | Form 307 is used to transmit wage and tax statements, specifically W-2 and 1099 forms, to the North Dakota Office of State Tax Commissioner. |

| Filing Requirement | Employers who are subject to North Dakota's income tax withholding law must file Form 307, even if they did not withhold any state income tax. |

| Submission Methods | Form 307 can be submitted with paper W-2 and 1099 forms. If filing electronically or on magnetic media, Form 307 is not required. |

| Deadline for Filing | W-2 and 1099 data must be filed with Form 307 by February 28 of the following year if still in business. If out of business, file with the final Federal Forms W-3 and W-2. |

| Governing Law | North Dakota Century Code, Chapter 57-38, governs the requirements for income tax withholding and the submission of Form 307. |

Common mistakes

Filling out the North Dakota 307 form can be straightforward, but many people make common mistakes that can lead to complications. One frequent error is failing to provide the correct account number. This number is crucial for the tax department to identify your submission. Double-check that it matches the number assigned to your business. If it’s incorrect, it could delay processing.

Another mistake is neglecting to indicate whether you still have employees. If you have ceased operations and no longer have North Dakota employees, it’s essential to fill in the circle indicating this. Many forget this step, which can lead to unnecessary follow-ups from the tax department.

Inaccurate reporting of North Dakota income tax withheld is also a common issue. Ensure that the amount you report matches the totals on your W-2s and 1099s. Discrepancies can result in penalties or additional audits, so accuracy is key.

People often overlook the requirement to submit a completed Form 307 alongside any paper W-2 or 1099 forms. Failing to include this form can lead to your submissions being rejected. Make sure to attach it properly and keep a copy for your records.

Many individuals forget to update their address and zip code on the form. If these details are incorrect, it can cause delays in communication from the tax department. Always verify that your contact information is current before mailing the form.

Additionally, some filers mistakenly submit payments with Form 307. This is not allowed. Payments should be sent separately, and confusion in this area can lead to processing delays. Always follow the instructions regarding payment submission carefully.

Another common error involves the timing of filing. Those still in business must submit their forms by February 28 of the following year. If you are out of business, ensure that you file your final forms at the same time as your last Federal Forms W-3 and W-2. Missing these deadlines can result in penalties.

People sometimes forget to separate paper W-2 and 1099 forms before submission. This can create confusion for the tax department and may result in your forms being processed incorrectly. Take the time to organize your paperwork properly.

Lastly, if you have filed under multiple identification numbers during the year, you must include a letter detailing this information. Many forget this step, which can complicate the processing of your forms. Clear communication is vital to avoid any misunderstandings.

FAQ

What is the North Dakota 307 form?

The North Dakota 307 form is a Transmittal of Wage and Tax Statement. Employers use this form to report state income tax withheld from employee wages and payments reported on W-2 and 1099 forms. It is essential for compliance with North Dakota's income tax withholding law.

Who needs to file the North Dakota 307 form?

Any employer subject to North Dakota's income tax withholding law must file this form. This includes employers who may not have withheld state income tax. Additionally, individuals who voluntarily withheld North Dakota income tax from payments reported on Form 1099 must also submit the 307 form.

When is the North Dakota 307 form due?

If you are still in business, the form must be filed by February 28 of the following year. If you are out of business, file the 307 form at the same time you submit your final Federal Forms W-3 and W-2 to the IRS.

How do I complete the North Dakota 307 form?

Fill in your account number, the period ending date, and the total amount of North Dakota income tax withheld as shown on your W-2s and 1099s. If you no longer have employees, mark the appropriate circle and provide the date of your last payroll. Ensure to copy the information to the taxpayer’s copy for your records.

What should I do if I no longer have employees?

If you no longer have employees, fill in the circle on the form indicating this and enter the last day of your final payroll period. You still need to submit the form to the Tax Commissioner even if you do not have any information returns to report.

Can I file the North Dakota 307 form electronically?

Yes, if you have 250 or more forms to file, you must submit them electronically or on magnetic media. If you have fewer than 250 forms, electronic filing is encouraged but not mandatory. Detailed instructions for electronic filing can be found on the North Dakota Tax Department's website.

What if I need to correct a W-2 form?

To correct a W-2 form, you must use the Federal Form W-2C. Submit the corrected form along with the North Dakota 307 form to the Office of State Tax Commissioner. Instructions for completing the W-2C can be found on the Social Security Administration's website.

Where do I mail the North Dakota 307 form?

Mail the completed North Dakota 307 form along with paper W-2 and 1099 forms to the Office of State Tax Commissioner at PO Box 5624, Bismarck, ND 58506-5624. If you are submitting magnetic media, send it to 600 E. Boulevard Ave., Dept. 127, Bismarck, ND 58505-0599.

What happens if I miss the filing deadline?

Missing the filing deadline may result in penalties and interest on any unpaid taxes. It’s crucial to file on time to avoid these additional costs. If you believe you will miss the deadline, it’s best to contact the Tax Department for guidance.