Free Nd St PDF Template

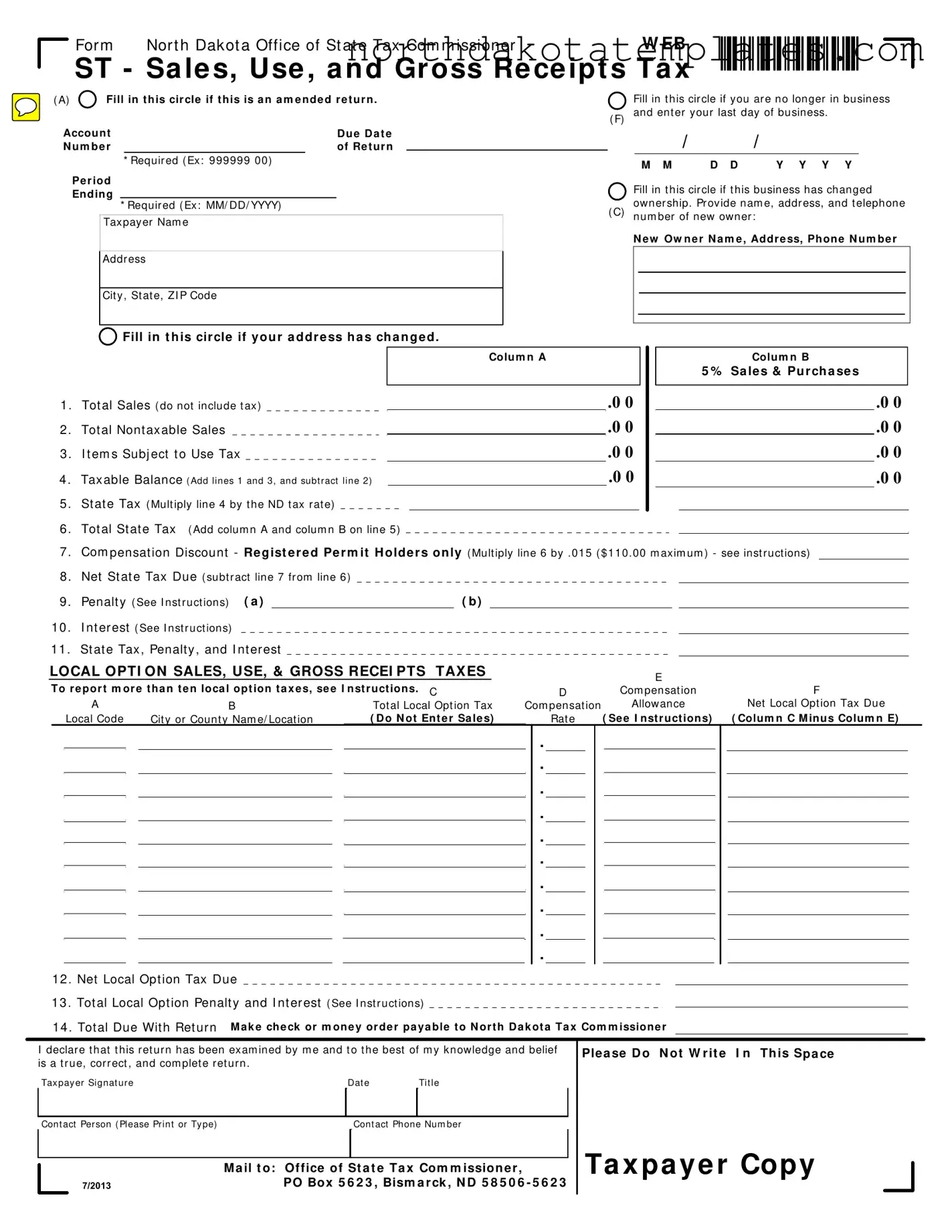

The North Dakota Sales, Use, and Gross Receipts Tax Form, commonly referred to as the Nd St form, serves as a critical tool for businesses operating within the state. This form is essential for reporting sales and use tax obligations, ensuring compliance with state tax laws. It requires businesses to detail their total sales, including both taxable and nontaxable sales, and calculate the corresponding tax due. The form also addresses situations such as ownership changes or business closures, prompting users to provide updated information where necessary. Additionally, it includes sections for local option taxes, which vary by jurisdiction and may have different compensation rates. Completing the Nd St form accurately is vital, as it directly impacts the amount of tax owed and any potential penalties for late submission. To aid in this process, the form comes with specific instructions that guide users through each line item, making it easier to navigate the complexities of tax reporting. Understanding and correctly filling out the Nd St form can help businesses avoid costly mistakes and maintain good standing with the North Dakota Tax Commissioner.

Common PDF Documents

How Do I Get My 1099-g Online California - The SFN 41216 form includes questions about whether the business provides temporary or leased workers.

When engaging in a transaction, having a reliable document ensures clarity. One such vital resource is the effective Alabama bill of sale form that outlines the necessary details of the exchange, ensuring all parties are informed and protected. For more information, visit the fillable Bill of Sale page.

How to Sell a Car in North Dakota - BOS SFN 2888 helps in managing and organizing workflow efficiently.

Similar forms

- Form ST-1: Similar to the Nd St form, Form ST-1 is used for reporting sales and use tax in North Dakota. Both forms require detailed sales data and tax calculations.

- Form ST-2: This form is for claiming a refund of sales tax. Like the Nd St form, it involves reporting sales data, but focuses on refunds instead of payments.

- Florida Bill of Sale Form: To ensure a smooth transfer of ownership, refer to our comprehensive Florida bill of sale form guide for legal documentation of transactions.

- Form ST-3: Used for exempt sales, Form ST-3 allows businesses to report transactions that are not subject to sales tax, similar to how the Nd St form accounts for nontaxable sales.

- Form ST-4: This is a resale certificate. It shares similarities with the Nd St form in that both require accurate identification of the seller and buyer, along with the nature of the transaction.

- Form ST-5: This form is used for claiming a sales tax exemption for specific types of purchases. It parallels the Nd St form by requiring detailed justification for tax exemptions.

- Form ST-6: This is a tax return for local option sales tax. Similar to the Nd St form, it requires local sales data and tax calculations specific to local jurisdictions.

- Form ST-7: This form is for reporting the use tax due on items purchased out of state. It resembles the Nd St form by requiring reporting of taxable purchases.

- Form ST-8: This is a form for the annual reconciliation of sales tax. It shares the same purpose of summarizing tax obligations over a period, akin to the Nd St form's reporting function.

- Form ST-9: Used for reporting and paying the hotel occupancy tax, this form is similar to the Nd St form in its structure and requirement for detailed reporting of taxable amounts.

- Form ST-10: This is a form for filing an amended sales tax return. It is similar to the Nd St form in that it requires the same basic information but is used to correct previous filings.

How to Use Nd St

Completing the ND ST form requires careful attention to detail to ensure accuracy and compliance with state tax regulations. The following steps outline the process for filling out the form correctly. After completing the form, it is essential to submit it by the due date to avoid penalties.

- Begin by indicating whether this is an amended return by filling in the appropriate circle.

- Enter your account number as shown on your preprinted form in the designated space.

- Provide the period ending date in the format MM/DD/YYYY.

- If applicable, fill in the circle indicating you are no longer in business and provide your last day of business.

- Indicate if the business has changed ownership and provide the new owner's name, address, and phone number.

- If your address has changed, fill in the corresponding circle.

- In Column A, enter the total sales for the reporting period (do not include tax).

- In Column A, enter the total nontaxable sales.

- In Column A, enter the items subject to use tax.

- Calculate the taxable balance by adding lines 1 and 3, then subtracting line 2. Enter this in Column A.

- Multiply the taxable balance by the applicable tax rate and enter the result in Column A.

- For total state tax, add the amounts in Column A and Column B on line 5.

- Registered permit holders can enter the compensation discount on line 7, calculated as 1.5% of the total state tax, with a maximum of $110.

- Calculate the net state tax due by subtracting the compensation discount from the total state tax.

- Calculate the penalty for late filing and enter the amount on line 9.

- Enter any interest due on line 10 if applicable.

- Add lines 8, 9, and 10 to determine the total amount due and enter it on line 11.

- For local option taxes, report all local tax amounts in the designated section, ensuring to follow the specific instructions provided.

- Complete the declaration statement, sign, and date the return.

- Print or type the name, title, and contact information of a person who can answer questions about the return.

- Mail the completed form to the Office of State Tax Commissioner at the address provided.

Dos and Don'ts

- Do complete and return original forms provided by the Tax Commissioner.

- Do print in blue or black ink.

- Do print neatly within the designated spaces.

- Do round all values in lines 1 through 4 to the nearest whole dollar.

- Do enter dollars and cents in lines 5 through 14 and for all local tax data.

- Don’t enter dollar signs ($), commas (,), or decimal points (.).

- Don’t use dashes or other symbols to indicate you do not have an entry.

- Don’t use pencil or light colored ink.

- Don’t use Column A unless reporting a state tax rate other than 5%.

Document Example

Form Nort h Dakot a Office of St at e Tax Com m issionerW EB

ST - Sa le s, Use , a nd Gr oss Re ce ipt s Ta x

(A)  Fill in this cir cle if this is a n a m e nde d r e tur n.

Fill in this cir cle if this is a n a m e nde d r e tur n.

Account |

|

Due Da t e |

N um be r |

|

of Re t ur n |

* Requir ed ( Ex: 999999 00)

Pe r iod

Ending

* Required ( Ex: MM/ DD/ YYYY) |

( F)

Fill in t his cir cle if you are no longer in business and ent er your last day of business.

/ |

|

/ |

M M |

D D |

Y Y Y Y |

Fill in t his cir cle if t his business has changed owner ship. Pr ovide nam e, addr ess, and t elephone

Taxpayer Nam e |

Address

( C) num ber of new owner :

N ew Ow ner N am e, Address, Phone N um ber

Cit y, St at e, ZI P Code

Fill in t h is circle if you r a ddress h a s ch a n ged .

Fill in t h is circle if you r a ddress h a s ch a n ged .

|

|

|

|

|

Colum n A |

|

|

|

|

|

Colum n B |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

5 % |

Sa les & Pu rch a ses |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 . |

Tot al Sales ( do not include t ax) |

|

|

|

.0 0 |

|

|

|

|

|

|

|

.0 0 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

2 . |

Tot al Nont axable Sales |

|

|

|

.0 0 |

|

|

|

|

|

|

|

.0 0 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

3 . |

I t em s Subj ect t o Use Tax |

|

|

|

.0 0 |

|

|

|

|

|

|

|

.0 0 |

|||||

4 . |

Taxable Balance ( Add lines 1 and 3, and subt ract line 2) |

|

.0 0 |

|

|

|

|

|

.0 0 |

|||||||||

5 . |

St at e Tax ( Mult iply line 4 by t he ND t ax rat e) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

6 . |

Tot al St at e Tax ( Add colum n A and colum n B on line 5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

7 . |

Com pensat ion Discount - Regist ered Perm it H olders only ( Mult iply line 6 by . 015 ( $ 110. 00 m axim um ) - see inst ruct ions) |

|||||||||||||||||

8 . Net St at e Tax Due ( subt r act line 7 from line 6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

9 . |

Penalt y ( See I nst ruct ions) ( a ) |

|

( b) |

|

|

|

|

|

|

|

||||||||

10 . |

I nt er est ( See I nst r uct ions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

11 . |

St at e Tax, Penalty , and I nt erest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

LOCAL OPTI ON SALES, USE, & GROSS RECEI PTS TAXES |

|

|

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

||||||||||||||||

|

|

To re por t m or e t ha n te n loca l opt ion ta x e s, se e I nst ruct ions. C |

|

|

|

|

|

|

|

|

F |

|||||||||||||||||||||||

|

|

|

|

|

D |

|

|

|

Com pensat ion |

|||||||||||||||||||||||||

|

|

|

|

|

A |

|

B |

|

|

|

|

|

Tot al Local Opt ion Tax |

Com pensat ion |

Allowance |

Net Local Opt ion Tax Due |

||||||||||||||||||

|

|

|

|

Local Code |

Cit y or Count y Nam e/ Locat ion |

( Do N ot Ent e r Sa le s) |

|

|

|

Rat e |

|

|

|

( Se e I nstr uctions) |

( Colum n C M inus Colum n E) |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 . Net Local Opt ion Tax Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

13 . Tot al Local Opt ion Penalt y and I nt erest ( See I nst r uct ions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

14 . Tot al Due Wit h Ret urn |

M a k e che ck or m one y or de r pa ya ble to N or th Da k ot a Ta x Com m issione r |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I declare t hat t his ret urn has been exam ined by m e and t o t he best of m y knowledge and belief |

Plea se D o N ot W rit e |

I n Th is Spa ce |

|||||||||||||||||||||||||||||||

|

is a t r ue, corr ect , and com plet e ret urn . |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Tax pay er Signat ure |

|

|

|

|

|

Dat e |

|

Tit le |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Cont act Person ( Please Print or Ty pe) |

|

|

|

|

|

Cont act Phone Num ber |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ta x pa ye r Copy |

|

|

||||||||||||||

|

|

|

|

|

|

|

|

M a il t o: |

Office of St a t e Ta x Com m ission er, |

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

7/2013 |

|

|

|

PO Box 5 6 2 3 , Bism a rck , N D 5 8 5 0 6 - 5 6 2 3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

For m ST - Sa le s, Use , a nd Gr oss Re ce ipt s Ta x Re t ur n inst r uct ions

General and specifi c line inst ruct ions for Form ST

Ge ne r a l inst r uct ions

Eve r y pe r m it holde r m ust fi le a

r e t ur n for e a ch r e por t ing pe r iod e ve n if no sa le s w e r e m a de or no t a x is due .

A preprinted return, instructions, and return envelope are mailed in the final week of the reporting period to every registered permit holder that fi les a paper return. DO NOT mail a paper return if you

file electronically. For information about electronic filing see www.nd.gov/tax.

Please review the preprinted copy of your return before completing it. The original return has been preprinted specifically for your business.

All r e t ur ns a r e due t he la st da y of t he m ont h follow ing t he r e por t ing pe r iod .

To avoid penalty, the return must be postmarked by the US Postal Service on or before the due date and paid in full with a valid check or money order.

For be st r e sult s, com ple t e t he

or igina l cust om ize d for m a nd m a il it in t he r e t ur n e nve lope pr ovide d .

DO NOT send photocopies. Returns generated from a software package are acceptable if the Tax Commissioner has

I f you use a n a ppr ove d soft w a r e pa ck a ge t o pr e pa r e your r e t ur n it is e sse nt ia l t o e nt e r t he follow ing ide nt ifying infor m a t ion pr ope r ly:

• Account number. Enter the account number as shown on your preprinted form.

• Period ending. Enter the last day of the

• Name and Address. Enter the taxpayer name and address.

Line inst r uct ions - St a t e Ta x e s

Line 1 - Enter the total sales for the reporting period. Do not include the sales tax in this amount.

Line 2 - Enter the total nontaxable sales. Nontaxable sales include:

•Sales to federal, state, and local governments.

•Sales to nursing homes, hospitals, intermediate/basic care facilities, emergency medical services providers licensed by North Dakota Dept.

of Health, assisted living facilities licensed by the North Dakota Dept. of

For m ST

D o’s a nd D on’t s

Do

• Complete and return original forms provided by the Tax Commissioner.

• Print in blue or black ink.

• Print neatly within the designated spaces.

• Round all values in lines 1 through 4 to the nearest whole dollar.

• Enter dollars and cents in lines 5 through 14 and for all local tax data.

Don’t

• Don’t enter dollar signs ($), commas (,), or decimal points (.).

• Don’t use dashes or other symbols to indicate you do not have an entry.

• Don’t use pencil or light colored ink.

• Don’t use Column A unless reporting a state tax rate other than 5%.

Human Services, and voluntary health associations.

•Sales of food and food ingredients for humans excluding prepared food, candy, soft drinks, and dietary supplements.

•Sales of feed, seed, and chemicals used for agricultural purposes.

•Sales of used farm machinery and farm machinery repair parts used exclusively for agricultural purposes (applicable for Farm Machinery Gross Receipts Tax only); electricity; water; steam for ag processing; motor and heating fuel.

•Sales of oxygen, prescription drugs, durable medical equipment for home use,

•Sales to Montana residents who complete a Certifi cate of Purchase on purchases of goods in excess of fifty dollars.

•Sales in interstate commerce (delivered outside North Dakota).

•Sales of nontaxable service.

•Sales for resale or processing.

•

Line 3 – Enter the cost of taxable goods and equipment consumed or used by you that was purchased without tax. For example, items removed from inventory and used by you.

Line 4 – Add lines 1 and 3, and subtract line 2. Enter the result on line 4.

Line 5 – Multiply line 4 by the applicable tax rate and enter the result on line 5.

Line 6 – Add column A and B on line 5 and enter a ount on line 6.

Line 7 – All registered permit holders regardless of fi ling frequency, will receive compensation on each properly filed return. The amount of compensation your company will receive is computed by multiplying the total state tax on line 6 times 1½ percent (.015) and enter the result on line 7. Effective with the

July 1, 2013 return, the compensation may not exceed $110.00 per return. Compensation may not be deducted if the return is fi led after the due date or is not paid in full. Penalty and interest will be assessed on tax due resulting from compensation deduction on a late filed or underpaid return. Please contact our offi ce if a return needs to be amended to ensure the proper vendor compensation rate is used.

Line 8 – Subtract total compensation on line 7 from line 6 and enter the result on line 8.

Line 9 – Calculate penalty if fi ling a late return.

•For the fi rst month the return is late, the penalty is 5 percent of the state tax on line 5 or $5, whichever is greater.

•For each additional month or fraction of a month the return is late, add an additional penalty of 5 percent of the state tax on line 5 up to a maximum of 25 percent.

If items (a) and (b) of line 9 are filled with XXXs, calculate penalty on the total state tax (line 6) and enter in line 9, column B. If items (a) and (b) are blank, calculate penalty on the state tax (line 5) separately for each column, enter the penalty amounts in items

(a)and (b), and enter the total penalty in line 9, column B.

Line 10 – If fi ling a late return, enter the amount of interest due. Interest does not apply to the fi rst month a return is late, but applies at a rate of 1 percent each month or fraction of a month the return remains late or unpaid.

Line 11 – Add lines 8, 9, and 10. Enter the result on line 11.

Loca l opt ion sa le s, use , a nd gr oss r e ce ipt s t a x e s

If you reported more than ten local taxes in the past year, use the Schedule

The Schedule

Inst r uct ions for r e por t ing loca l opt ion t a x e s:

• Report all local tax amounts in dollars and cents.

• Report all local taxes in one place. Do not report some local taxes on Form ST and other local taxes on Schedule

• If you use Schedule

• If you report local taxes in the Local Option Tax section on Form ST, and you are reporting a local tax for the fi rst time, enter the local tax code, name of the city or county, and compensation rate from the list at the bottom of these instructions.

Colum n

Enter the total amount of tax due for each city or county. The tax due is equal to the correct amount of local sales or use tax you should have charged on sales made within the local jurisdiction plus any local use tax due on untaxed goods or services subject to use tax because they were stored, used or consumed within the local jurisdiction.

Colum n

Some local jurisdictions provide compensation to permit holders for collecting and remitting local tax. Multiply the tax in column C times the compensation rate in column D. Compensation may not exceed the maximum amount listed below and is not allowed if the return is late or underpaid. Note: If amount in column C is

negative, enter zero in column E.

Colum n

Subtract the compensation in column E from the total local tax in column C and enter the result.

Line 1 2

Add all of the amounts in column F and enter the result. This is the total amount of local tax due with the return.

Line 1 3

If the return is unpaid or fi led after the due date, a local penalty is due. Penalty and interest, including the minimum $5 penalty, applies separately to each jurisdiction with local tax due. On line 13, enter the total amount of all penalty and interest due on local taxes.

Line 1 4

Add lines 11, 12, and 13 to calculate the total amount due with the return.

M a k e your che ck pa ya ble t o N or t h D a k ot a Ta x Com m issione r .

The taxpayer or taxpayer’s agent must sign the return. Please PRINT the name, title and phone number of a contact person who can answer questions about this return.

Offi ce of St a t e Ta x Com m issione r PO Box 5 6 2 3

Bism a r ck , N D 5 8 5 0 6 - 5 6 2 3 Phone : 7 0 1 .3 2 8 .1 2 4 6

w w w .nd .gov/ t a x

Loca l Opt ion Ta x e s: Code / Jur isdict ion N a m e / Com pe nsa t ion Ra t e / Ta x Ra t e

237 |

Alexander0 |

2% |

106 |

Dickinson0 |

1½% |

143 |

Halliday0 |

1% |

236 |

Lignite0 |

2% |

145 |

New Rockford0 |

.......2% |

223 |

Streeter0 |

1% |

220 |

Anamoose0 |

1% |

209 |

Drake0 |

2% |

158 |

Hankinson4 |

2% |

121 |

Linton2 |

2% |

217 |

New Salem0 |

1% |

231 |

Surrey0 |

2% |

203 |

Aneta0 |

1% |

157 |

Drayton0 |

1½% |

202 |

Hannaford0 |

1% |

136 |

Lisbon0 |

2% |

197 |

Northwood0 |

1½% |

132 |

Tioga0 |

2½% |

162 |

Ashley1 |

1% |

204 |

Dunseith0 |

1% |

112 |

Harvey3 |

2% |

193 |

Maddock0 |

2% |

146 |

Oakes3 |

2% |

195 |

Tower City0 |

2% |

156 |

Beach0 |

1% |

148 |

Edgeley2 |

2% |

222 |

Harwood0 |

1% |

108 |

Mandan3 |

1¾% |

189 |

Oxbow0 |

1% |

170 |

Towner2 |

1% |

133 |

Belfield0 |

2% |

176 |

Edinburg0 |

1% |

164 |

Hatton0 |

2% |

218 |

Mapleton0 |

1½% |

208 |

Page0 |

1% |

182 |

Turtle Lake0 |

2% |

138 |

Berthold0 |

1% |

179 |

Elgin0 |

1% |

180 |

Hazelton2 |

2% |

227 |

Max0 |

1% |

130 |

Park River0 |

2% |

211 |

Underwood0 |

2% |

200 |

Beulah2 |

2% |

131 |

Ellendale2 |

1% |

134 |

Hazen3 |

1½% |

150 |

Mayville0 |

2% |

119 |

Pembina0 |

2½% |

113 |

Valley City0 |

2½% |

229 |

Bisbee2 |

2% |

166 |

Enderlin0 |

2% |

142 |

Hettinger0 |

1½% |

140 |

McClusky0 |

1% |

151 |

Portland0 |

2% |

175 |

Velva0 |

2% |

102 |

Bismarck3 |

1% |

206 |

Fairmount0 |

2% |

168 |

Hillsboro0 |

2% |

188 |

McVille0 |

2% |

154 |

Powers Lake3 |

1% |

111 |

Wahpeton6 |

2% |

122 |

Bottineau2 |

2% |

105 |

Fargo0 |

2% |

172 |

Hoople3 |

1% |

178 |

Medora0 |

2½% |

232 |

Ray0 |

2% |

160 |

Walhalla0 |

2% |

126 |

Bowman0 |

1% |

167 |

Finley0 |

2% |

185 |

Hope0 |

2% |

187 |

Michigan0 |

2% |

198 |

Reeder0 |

1% |

502 |

Walsh Co.0 ............¼% |

|

196 |

Buffalo3 |

2% |

221 |

Forman0 |

1½% |

110 |

Jamestown0 |

2% |

169 |

Milnor0 |

1½% |

152 |

Regent0 |

2% |

505 |

Ward County 0 |

½% |

506 |

Burleigh County3... |

½% |

177 |

Fort Ransom0 |

2% |

117 |

Kenmare0 |

2% |

214 |

Minnewaukan0 |

2% |

159 |

Richardton0 |

2% |

183 |

Washburn3 |

2% |

161 |

Cando2 |

2% |

235 |

Fredonia0 |

2% |

135 |

Killdeer0 |

2% |

103 |

Minot0 |

2% |

199 |

Rolette0 |

2% |

171 |

Watford City3 |

1½% |

124 |

Carrington0 |

2% |

210 |

Gackle0 |

1% |

230 |

Kindred0 |

2% |

216 |

Minto3 |

1% |

125 |

Rolla0 |

2% |

129 |

West Fargo0 |

2% |

191 |

Carson0 |

1% |

139 |

Garrison0 |

2% |

165 |

Kulm0 |

2% |

114 |

Mohall0 |

1% |

118 |

Rugby2 |

2% |

226 |

Westhope0 |

1% |

501 |

Cass County0 |

½% |

219 |

Glenburn0 |

2% |

213 |

Lakota0 |

1% |

507 |

Morton County3 |

½% |

190 |

Scranton0 |

1% |

504 |

Williams County0 |

... 1% |

163 |

Casselton0 |

1% |

212 |

Glen Ullin0 |

1% |

149 |

LaMoure0 |

2% |

153 |

Mott0 |

2% |

233 |

South Heart0 |

2% |

109 |

Williston3 |

2% |

127 |

Cavalier0 |

2% |

107 |

Grafton3 |

2½% |

123 |

Langdon3 |

2% |

173 |

Munich2 |

1% |

186 |

St. John3 |

1% |

184 |

Wilton3 |

2% |

238 |

Center |

2% |

101 |

Grand Forks5 |

1¾% |

128 |

Larimore0 |

1% |

144 |

Napoleon2 |

2% |

137 |

Stanley3 |

1½% |

205 |

Wimbledon0 |

1% |

141 |

Cooperstown0 |

1½% |

225 |

Granville0 |

2% |

234 |

Leeds0 |

2% |

201 |

Neche0 |

2% |

147 |

Steele0 |

2% |

155 |

Wishek3 |

1½% |

116 |

Crosby0 |

3% |

192 |

Grenora0 |

1% |

215 |

Leonard0 |

2% |

194 |

New England0 |

2% |

503 |

Steele County0 |

1% |

224 |

Woodworth0 |

1% |

104 |

Devils Lake3 |

2% |

207 |

Gwinner0 |

2% |

181 |

Lidgerwood0 |

2% |

174 |

New Leipzig0 |

1% |

120 |

Strasburg2 |

2% |

228 |

Wyndmere0 |

2% |

0

1

2

3

4

5

6

The Local tax ordinance does not provide for permit holder compensation.

Compensation rate is 3% up to a maximum amount of $33.33 on a monthly return or $100 on a quarterly return. Compensation rate is 3% up to a maximum amount of $50 on a monthly return or $150 on a quarterly return. Compensation rate is 3% up to a maximum amount of $83.33 on a monthly return or $250 on a quarterly return. Compensation rate is 3% with no maximum.

Compensation rate is 5% up to a maximum amount of $166.67 on a monthly return or $500 on a quarterly return. Compensation rate is 3% up to a maximum of $37.50 per month.

Offi ce of St a t e Ta x Com m issione r , PO Box 5 6 2 3 , Bism a r ck , N or t h D a k ot a 5 8 5 0 6 - 5 6 2 3

Phone : 7 0 1 .3 2 8 .1 2 4 6 , w w w .nd .gov/ t a x

2 1 9 9 7

( I nst r uct ions r e vise d 4 / 1 6 )

File Breakdown

| Fact Name | Description |

|---|---|

| Form Purpose | The North Dakota ST form is used for reporting sales, use, and gross receipts tax to the North Dakota Office of State Tax Commissioner. |

| Filing Requirement | Every permit holder must file a return for each reporting period, even if no sales were made or no tax is due. |

| Due Date | Returns are due on the last day of the month following the reporting period. Timely filing is crucial to avoid penalties. |

| Amended Returns | If corrections are needed, taxpayers can indicate that the return is amended by filling in the appropriate circle on the form. |

| Compensation Discount | Registered permit holders may receive a compensation discount for filing correctly, calculated as 1.5% of the total state tax, with a maximum limit of $110.00. |

| Local Option Taxes | Local option taxes must be reported separately, and taxpayers should use the provided schedule if reporting more than ten local taxes. |

| Signature Requirement | The taxpayer or their agent must sign the return, affirming that the information provided is true and complete to the best of their knowledge. |

| Governing Laws | The ST form is governed by North Dakota state tax laws, specifically those pertaining to sales and use tax regulations. |

Common mistakes

Filling out the North Dakota Sales, Use, and Gross Receipts Tax Form can be a straightforward process, but many people make common mistakes that can lead to delays or penalties. Here are nine mistakes to avoid when completing the form.

1. Incorrect Account Number: Always double-check your account number. Entering an incorrect number can result in processing delays or misallocated payments. Ensure that you use the account number as it appears on your preprinted form.

2. Misunderstanding Reporting Period: Ensure that you enter the correct period ending date. This date should reflect the last day of the tax-reporting period. Mistakes here can lead to late penalties or incorrect tax calculations.

3. Failing to Indicate Changes: If there have been changes in ownership or if your business has ceased operations, you must indicate this on the form. Not doing so can cause complications in your tax records and future filings.

4. Not Reporting All Sales: Be thorough when reporting your total sales. Remember, you must not include sales tax in this figure. Failing to accurately report sales can lead to discrepancies and potential audits.

5. Ignoring Nontaxable Sales: Clearly distinguish between taxable and nontaxable sales. Nontaxable sales include certain transactions like sales to government entities or certain healthcare providers. Misclassifying these can result in overpayment of taxes.

6. Inaccurate Tax Calculations: When calculating your taxable balance, ensure that you add and subtract the figures correctly. Mistakes in calculations can lead to incorrect tax amounts owed, resulting in penalties or interest charges.

7. Omitting Signatures and Dates: Always remember to sign and date your return. An unsigned form may be considered incomplete and could delay processing. Also, include the contact information of a person who can answer questions about the return.

8. Using Incorrect Ink: The form must be filled out in blue or black ink only. Using pencil, light ink, or any other color can make your entries unreadable and may result in processing errors.

9. Sending Photocopies: Always use the original form provided by the Tax Commissioner. Photocopies are not accepted and can lead to your return being rejected. If you need to file electronically, do not send a paper return.

By avoiding these common mistakes, you can ensure a smoother filing process and reduce the risk of penalties or audits. Always take the time to review your completed form before submission.

FAQ

What is the purpose of the ND St form?

The ND St form, officially known as the Sales, Use, and Gross Receipts Tax Return, is essential for businesses operating in North Dakota. It serves as a means for registered permit holders to report and remit the sales tax collected from customers. Additionally, it allows businesses to report any taxable purchases made without paying sales tax at the time of purchase. By filing this form, businesses ensure compliance with state tax laws and contribute to the funding of public services.

Who needs to file the ND St form?

Every business in North Dakota that holds a sales tax permit must file the ND St form for each reporting period, regardless of whether any sales were made or taxes are due. This requirement applies to all types of businesses, including retail, service providers, and wholesalers. Even if a business has no sales to report, submitting the form helps maintain good standing with the North Dakota Office of State Tax Commissioner.

What are the key deadlines for filing the ND St form?

Timely filing is crucial to avoid penalties. The ND St form is due on the last day of the month following the reporting period. For instance, if your reporting period ends in January, your form must be submitted by February 28th. To avoid late fees, it is important that the form is postmarked by the due date. If you file electronically, be sure to follow the specific guidelines for electronic submissions to ensure compliance.

What should I do if I need to amend my ND St form?

If you discover an error after submitting your ND St form, you can file an amended return. To do this, check the box indicating that you are submitting an amended return and provide the corrected information. It’s important to submit the amendment as soon as possible to rectify any discrepancies and avoid potential penalties or interest charges. Keep in mind that maintaining accurate records and promptly addressing mistakes will help you stay compliant with tax regulations.