Free Nd 306 PDF Template

Understanding the Nd 306 form is crucial for employers operating in North Dakota. This form, officially known as the Income Tax Withholding Return, is a key document that every employer must file, regardless of whether they paid compensation during the reporting period. The form serves several important functions, including reporting the total income tax withheld for each quarter and ensuring compliance with state tax regulations. Employers must pay close attention to specific details, such as whether they need to file an amended return if previous reports contained errors. Additionally, the Nd 306 form includes sections for ownership information, payment details, and necessary declarations that affirm the accuracy of the information provided. Timely submission is essential, with deadlines set for each calendar quarter, and an annual filing option available. Understanding the nuances of this form can help avoid penalties and ensure that your business remains in good standing with the North Dakota Office of State Tax Commissioner.

Common PDF Documents

North Dakota Nonresident Filing Requirements - There are optional contributions to wildlife and program trust funds that can be included on the form.

When engaging in a transaction involving significant assets, it is essential to utilize a Bill of Sale form to formalize the exchange. This document ensures clarity and protects the interests of both the buyer and seller. For those looking to create a comprehensive and legally binding Bill of Sale, resources can be found at smarttemplates.net, which offers templates tailored for various asset types.

51/50 Law - The petition can ultimately lead to judicial control over the respondent’s treatment.

Similar forms

The ND 306 form, which is the North Dakota Income Tax Withholding Return, shares similarities with several other tax-related documents. Here are eight documents that are comparable to the ND 306 form, along with explanations of how they are similar:

- Form W-2: This form is used by employers to report wages paid and taxes withheld from employees. Like the ND 306, it is essential for accurate reporting of income tax obligations.

- Form 941: Employers use this federal form to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Both forms require detailed reporting of withheld taxes for compliance purposes.

- Form 1040: This is the individual income tax return form for U.S. citizens and residents. Similar to the ND 306, it requires individuals to report their income and calculate tax liabilities based on withheld amounts.

- Form 1065: Partnerships use this form to report income, deductions, gains, and losses. Both the ND 306 and Form 1065 involve reporting tax-related information to state or federal authorities.

- California ATV Bill of Sale - This document is essential for recording the sale of an All-Terrain Vehicle in California, ensuring both buyer and seller are clear on the transaction, similar to the importance of the ND 306. For more information, check the Bill of Sale for a Four Wheeler.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. Similar to the ND 306, it is crucial for reporting income and ensuring tax compliance.

- Form 940: This is the Employer's Annual Federal Unemployment (FUTA) Tax Return. Both forms deal with employer obligations and tax withholdings, although they focus on different types of taxes.

- State Income Tax Return: Each state has its own income tax return form for individuals and businesses. Like the ND 306, these forms require accurate reporting of income and tax withholdings specific to the state.

- Form 1041: This form is used for income tax returns for estates and trusts. Both the ND 306 and Form 1041 involve reporting tax withholdings and ensuring compliance with tax laws.

How to Use Nd 306

Completing the ND 306 form is an important step in fulfilling your tax obligations in North Dakota. After gathering the necessary information, you will be ready to fill out the form accurately. Follow these steps to ensure that you complete the ND 306 form correctly.

- Obtain a blank ND 306 form from the North Dakota Office of State Tax Commissioner's website.

- Fill in the circle (A) if you are submitting an amended return.

- Provide your business name, address, account number, and the period being amended in the designated fields.

- Complete Part I - Ownership Information only if this is a final return. Indicate if you are no longer in business and provide your last day of business if applicable.

- In Part II - Return Information, enter the total North Dakota income tax withheld for the period on line 1.

- If you are filing an amended return, enter the amount of tax originally reported on line 1a.

- Subtract line 1a from line 1 and enter the result on line 2, indicating the amount of refund or tax due.

- Complete lines 3 and 4 to calculate any penalties or interest, and the total amount due with the return.

- Sign the form, providing your title and the date.

- Print or type the contact person's name and phone number for any inquiries.

- Complete Part III - Payment Information, including the amount of payment by check.

- Mail the entire completed form to the North Dakota Office of State Tax Commissioner at the address provided on the form.

Once you have submitted the ND 306 form, ensure that you keep a copy for your records. This will help you track your submissions and maintain accurate financial records for your business.

Dos and Don'ts

When filling out the Nd 306 form, there are specific actions you should take and others you should avoid to ensure a smooth process. Below is a list of recommendations:

- Do double-check all entries for accuracy before submission.

- Do fill in the appropriate circles to indicate if the return is amended or if your address has changed.

- Do ensure that you complete all required sections, especially if this is a final return.

- Do submit the form by the due date to avoid penalties and interest.

- Don't leave any sections blank; incomplete forms may lead to processing delays.

- Don't forget to sign the form; an unsigned return will not be accepted.

- Don't use a previous version of the form; always use the most current version available.

- Don't ignore the payment instructions; ensure your payment method is clearly indicated.

Document Example

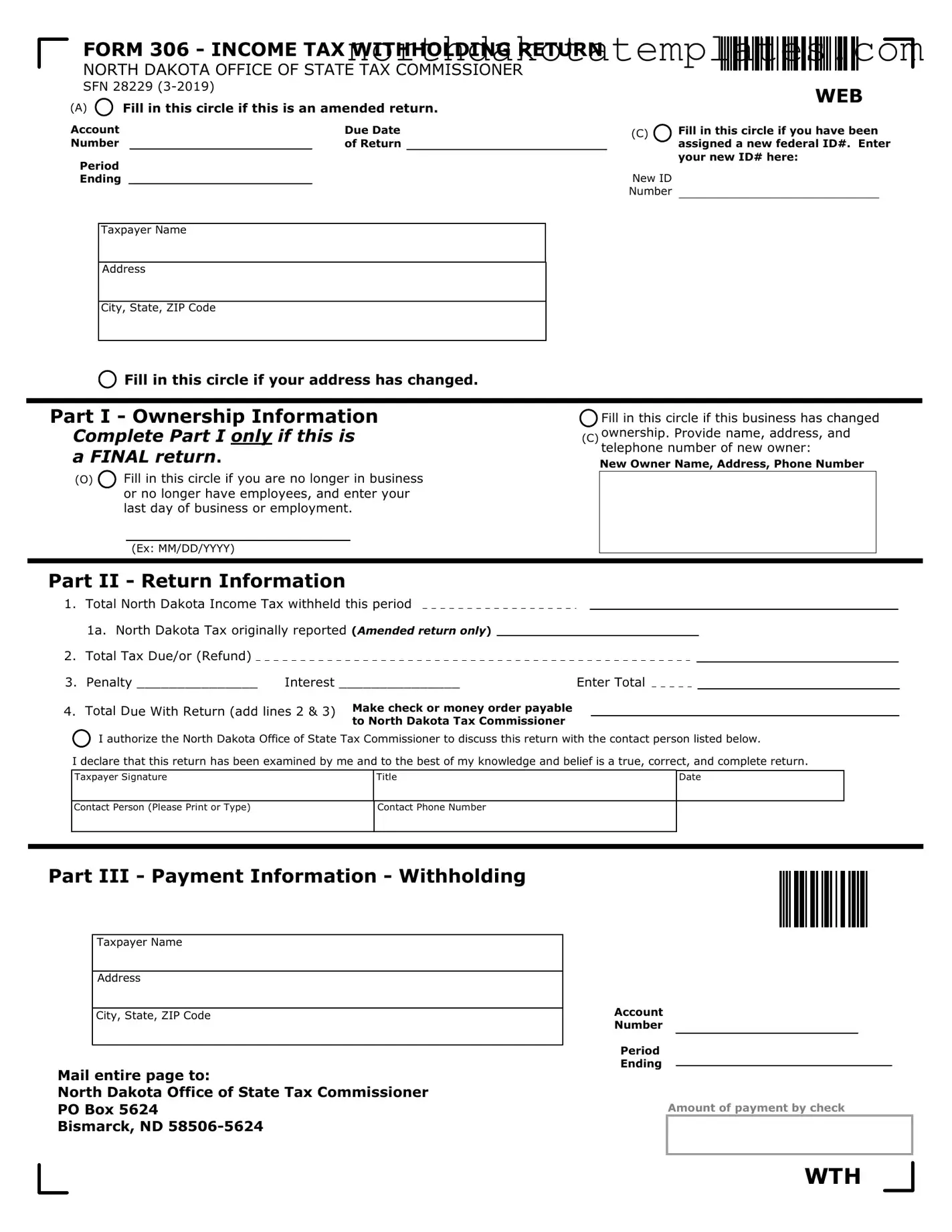

FORM 306 - INCOME TAX WITHHOLDING RETURN

NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER

SFN 28229

(A) Fill in this circle if this is an amended return.

Fill in this circle if this is an amended return.

Account |

|

Due Date |

|

Number |

|

of Return |

|

Period |

|

|

|

Ending |

|

|

|

Taxpayer Name

Address

City, State, ZIP Code

WEB

(C)Fill in this circle if you have been assigned a new federal ID#. Enter your new ID# here:

New ID

Number

Fill in this circle if your address has changed.

Fill in this circle if your address has changed.

Part I - Ownership Information

Complete Part I only if this is

aFINAL return.

(O) Fill in this circle if you are no longer in business or no longer have employees, and enter your last day of business or employment.

Fill in this circle if you are no longer in business or no longer have employees, and enter your last day of business or employment.

Fill in this circle if this business has changed

(C)ownership. Provide name, address, and telephone number of new owner:

New Owner Name, Address, Phone Number

(Ex: MM/DD/YYYY)

Part II - Return Information

1.Total North Dakota Income Tax withheld this period

1a. North Dakota Tax originally reported (Amended return only)

2.Total Tax Due/or (Refund)

3. |

Penalty _______________ |

Interest _______________ |

Enter Total |

||

4. |

Total Due With Return (add lines 2 & 3) Make check or money order payable |

|

|

|

|

|

|

to North Dakota Tax Commissioner |

|

|

|

I authorize the North Dakota Office of State Tax Commissioner to discuss this return with the contact person listed below.

I authorize the North Dakota Office of State Tax Commissioner to discuss this return with the contact person listed below.

I declare that this return has been examined by me and to the best of my knowledge and belief is a true, correct, and complete return.

Taxpayer Signature

Title

Date

Contact Person (Please Print or Type)

Contact Phone Number

Part III - Payment Information - Withholding

Taxpayer Name

Address

City, State, ZIP Code

Mail entire page to:

North Dakota Office of State Tax Commissioner PO Box 5624

Bismarck, ND

Account

Number

Period

Ending

Amount of payment by check

WTH

Instructions for Form 306 - Income Tax Withholding Return

Page 2

Who Must File

The Form 306, North Dakota Income

Tax Withholding return must be filed by every employer, even if compensation was not paid during the period covered by this return.

When To File

Except as provided below under “Annual filing,” the Form 306 must be filed for each calendar quarter on or before the following due dates:

Quarter Covered |

Due on or before |

Jan., Feb., March |

April 30 |

April, May, June |

July 31 |

July, Aug., Sept. |

October 31 |

Oct., Nov., Dec. |

January 31 |

Annual filing. Annual filers must file Form 306 for the entire year on or before January 31 following the end of the calendar year.

Part I - Owner Information

Final Returns

If you are out of business, complete Part I of the return. This will enable the Office of State Tax Commissioner to close your account. The

Form 307 and

Part II - Return

Information

Complete lines 1 through 4 to report amount of tax withheld.

Amended Returns

If you incorrectly reported North Dakota income tax withheld in a prior period, you will need to file

an amended return to correct the information.

1.Obtain a blank Form 306 from our website.

2.Fill in the circle (A) indicating this is an amended return.

3.Enter your business name,

address, account number, and the period being amended.

4.Complete Part II - Return Information

a.Enter the correct amount of tax withheld for the period on line 1.

b.Enter the amount of tax paid with the original return (if any) on line 1a.

c.Subtract line 1a from line 1

and enter on line 2. This is the amount of the refund or tax due.

d.Complete lines 3 and 4 to

calculate the total due including any penalty and/or interest.

Penalty And Interest

Provisions

Returns must be filed and the full amount of tax must be paid by the due date of the return. If a return is not filed or if full payment is not made on or before the due date, the law provides for penalty and interest

charges as outlined in our income tax withholding guideline. North Dakota Century Code (N.D.C.C.)

§

Disclosure Authorization

By filling in the circle, you authorize the North Dakota Office of State Tax Commissioner (Tax Department) to discuss matters pertaining to this Form 306 with the contact person

listed.

Part III - Payment

Information

Electronic payments may be made at www.nd.gov/tax/payment. If you are paying by check, complete Part III of Form 306 and make your check payable to North Dakota Tax Commissioner.

For Assistance

Email withhold@nd.gov or call 701.328.1248 or fax 701.328.0146.

Electronic Filing and Payment

Options are available to file and pay electronically through Taxpayer Access Point (TAP). Please go to www.nd.gov/tax/tap for more information.

File Breakdown

| Fact Name | Description |

|---|---|

| Form Title | FORM 306 - Income Tax Withholding Return |

| Governing Law | North Dakota Century Code (N.D.C.C.) §57-38-45(2b) |

| Filing Requirement | Every employer must file Form 306, even if no compensation was paid during the period. |

| Quarterly Due Dates | Returns are due on April 30, July 31, October 31, and January 31 for the respective quarters. |

| Amended Returns | To correct prior reporting errors, an amended return must be filed with the appropriate corrections. |

| Payment Information | Payments can be made electronically or by check, payable to the North Dakota Tax Commissioner. |

| Final Returns | Part I must be completed if the business is out of operation to close the account with the Tax Commissioner. |

Common mistakes

Filling out the ND 306 form can be straightforward, but many people make common mistakes that can lead to delays or issues with their tax filings. One frequent error is failing to indicate whether the return is amended. If you are correcting a previous submission, it’s crucial to fill in the circle marked (A). Omitting this step can result in confusion and may delay the processing of your return.

Another mistake involves not providing accurate ownership information. Part I of the form must be completed if this is a final return. If you are no longer in business or have changed ownership, it is essential to fill in the appropriate circles and provide the new owner's details. Neglecting this can lead to your account remaining open longer than necessary, creating additional paperwork down the line.

Many individuals also overlook the importance of correctly calculating the total tax due. In Part II, you must report the total North Dakota income tax withheld. Errors in these calculations can result in underpayment or overpayment, both of which can have consequences. Always double-check your figures and ensure that you have completed lines 1 through 4 accurately.

Lastly, some filers forget to include their payment information or fail to sign the form. Part III requires you to provide the amount of payment if applicable. If you are paying by check, ensure that you complete this section and make your check payable to the North Dakota Tax Commissioner. Additionally, a signature is necessary to validate your return. A missing signature can lead to the return being deemed incomplete, which may result in penalties or further inquiries.

FAQ

What is the ND 306 form?

The ND 306 form, officially known as the Income Tax Withholding Return, is a document that employers in North Dakota must file. It reports the amount of state income tax withheld from employees' wages during a specific period. This form is crucial for ensuring compliance with state tax laws.

Who is required to file the ND 306 form?

Every employer in North Dakota must file the ND 306 form, regardless of whether any compensation was paid during the reporting period. This requirement ensures that all employers remain compliant with state withholding tax regulations.

When should the ND 306 form be filed?

The ND 306 form must be filed quarterly by the following due dates: April 30 for the first quarter (January to March), July 31 for the second quarter (April to June), October 31 for the third quarter (July to September), and January 31 for the fourth quarter (October to December). Annual filers must submit the form by January 31 of the following year.

What if I need to amend my ND 306 form?

If you discover an error in a previously filed ND 306 form, you must file an amended return. To do this, obtain a blank ND 306 form, indicate that it is an amended return, and provide the correct information for the period in question. Be sure to follow the specific instructions for completing the amended return.

What information is required in Part I of the ND 306 form?

Part I of the ND 306 form requires ownership information. If this is a final return, you must indicate if you are no longer in business or if there has been a change in ownership. Provide the last day of business or the new owner's contact information as necessary.

How do I calculate the total tax due on the ND 306 form?

To calculate the total tax due, complete lines 1 through 4 in Part II of the form. Line 1 reports the total North Dakota income tax withheld, while line 1a is used for the amount originally reported if this is an amended return. Subtract line 1a from line 1 to determine the tax due or refund on line 2. Add any penalties or interest to calculate the total amount due on line 4.

What are the penalties for late filing or payment?

Penalties and interest may apply if the ND 306 form is not filed or if the full tax payment is not made by the due date. The law outlines specific charges for late filings, and it is essential to adhere to deadlines to avoid these additional costs.

How can I make a payment for the ND 306 form?

Payments for the ND 306 form can be made electronically at the North Dakota Tax Department's website. If you prefer to pay by check, complete Part III of the form and make your check payable to the North Dakota Tax Commissioner. Ensure to mail the entire page to the appropriate address listed on the form.

Where can I find assistance regarding the ND 306 form?

If you have questions or need assistance with the ND 306 form, you can email withhold@nd.gov or call 701.328.1248. Additionally, fax inquiries can be sent to 701.328.0146. Resources are also available online for electronic filing and payment options.