Free Nd 1 PDF Template

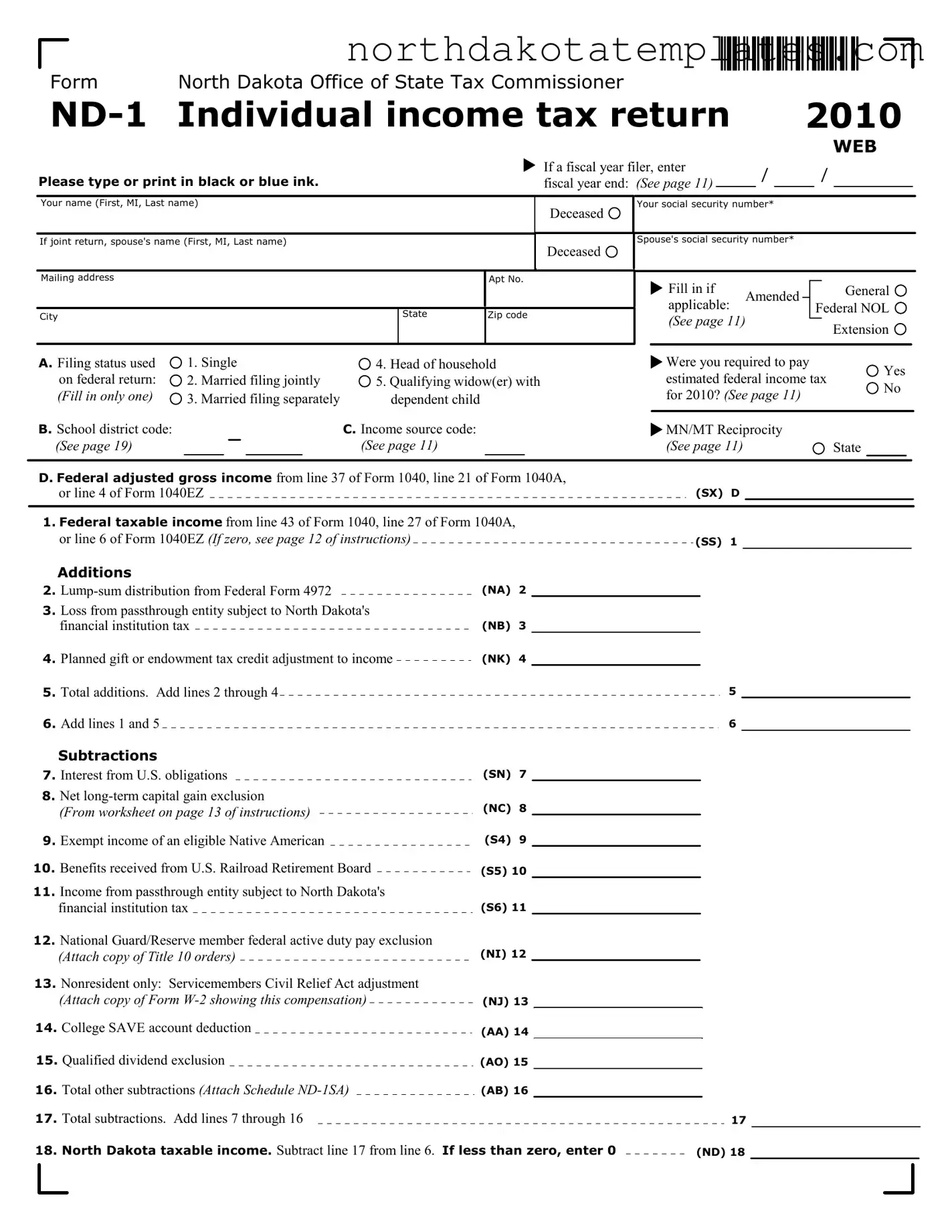

The ND-1 form is a critical document for residents of North Dakota filing their individual income tax returns. This form allows taxpayers to report their income, claim deductions, and determine their tax liabilities for the year. It includes essential sections that require personal information, such as the taxpayer's name, social security number, and filing status, which can range from single to married filing jointly. Additionally, the form accommodates various income sources, including wages, interest, and capital gains, while also providing space for tax credits and adjustments. Taxpayers must indicate whether they are claiming any subtractions, such as interest from U.S. obligations or benefits received from the U.S. Railroad Retirement Board. The ND-1 form also incorporates calculations for total income, tax owed, and potential refunds. Furthermore, it allows for the inclusion of contributions to specific funds, such as the Wildlife Fund. Understanding the ND-1 form is essential for ensuring compliance with state tax laws and maximizing potential tax benefits.

Common PDF Documents

North Dakota Nonresident Filing Requirements - The North Dakota 38 form is an important element of tax compliance for anyone managing an estate or trust.

When engaging in transactions involving personal property in Arizona, utilizing the Arizona Bill of Sale form is essential for safeguarding both the buyer's and seller's interests. This legal document captures all the critical details of the sale, creating a binding record that can prevent future disputes. For additional resources, you can visit All Arizona Forms to find more information on the necessary documentation required for your sales transactions.

Sfn 12012 - Limited liability partnerships must include information for all managing partners.

North Dakota Use Tax - Partnerships should ensure accuracy when listing partner names and addresses to avoid errors.

Similar forms

- Form 1040: The federal individual income tax return form, used by taxpayers to report their annual income, claim deductions, and calculate tax liability. Similar to ND-1, it requires personal information, filing status, and income details.

- Form 1040A: A simplified version of the 1040 form, it allows for certain adjustments and credits. Like ND-1, it includes sections for income reporting and deductions.

- Bill of Sale Form: When finalizing transactions, refer to our comprehensive Alabama bill of sale form guide to ensure all legal details are documented properly.

- Form 1040EZ: This is the simplest federal tax return form, designed for individuals with straightforward tax situations. ND-1 shares the need for basic personal information and income reporting.

- Form 1040X: This is used to amend a previously filed tax return. Similar to ND-1's amended option, it allows taxpayers to correct errors or make changes to their filings.

- Form W-2: This form reports wages paid and taxes withheld by employers. ND-1 requires similar income verification, including attachments of W-2s for income reporting.

- Form 1099: Used to report various types of income other than wages, salaries, and tips. Like ND-1, it requires accurate reporting of income sources.

- Schedule A: This form allows taxpayers to itemize deductions on their federal tax return. ND-1 includes sections for various deductions and credits, paralleling the need for detailed financial information.

- Schedule C: For sole proprietors, this form reports income and expenses from business operations. ND-1 similarly allows for reporting of business income and adjustments.

How to Use Nd 1

Completing the ND-1 form is a straightforward process that requires careful attention to detail. It is essential to provide accurate information to ensure the correct calculation of your tax obligations or potential refunds. Follow the steps outlined below to fill out the form properly.

- Begin by entering your name in the designated fields. Include your first name, middle initial, and last name. If filing jointly, also provide your spouse's name.

- Fill in your social security number and your spouse's social security number if applicable.

- Provide your mailing address, including the city, apartment number (if applicable), state, and zip code.

- If you are filing an amended return, check the appropriate box.

- Select your filing status from the options provided. Choose only one: Single, Married filing jointly, Married filing separately, Head of household, or Qualifying widow(er).

- Enter the school district code and income source code as required.

- Indicate whether you were required to pay estimated federal income tax for the year.

- Report your federal adjusted gross income as indicated on the federal tax forms.

- List any additions to your income, including lump-sum distributions or losses from passthrough entities.

- Calculate the total additions and add them to your federal taxable income.

- Identify and report any subtractions from your income, such as interest from U.S. obligations or exempt income for eligible Native Americans.

- Calculate the total subtractions and subtract this from your total income to determine your North Dakota taxable income.

- Enter your North Dakota taxable income on the appropriate line.

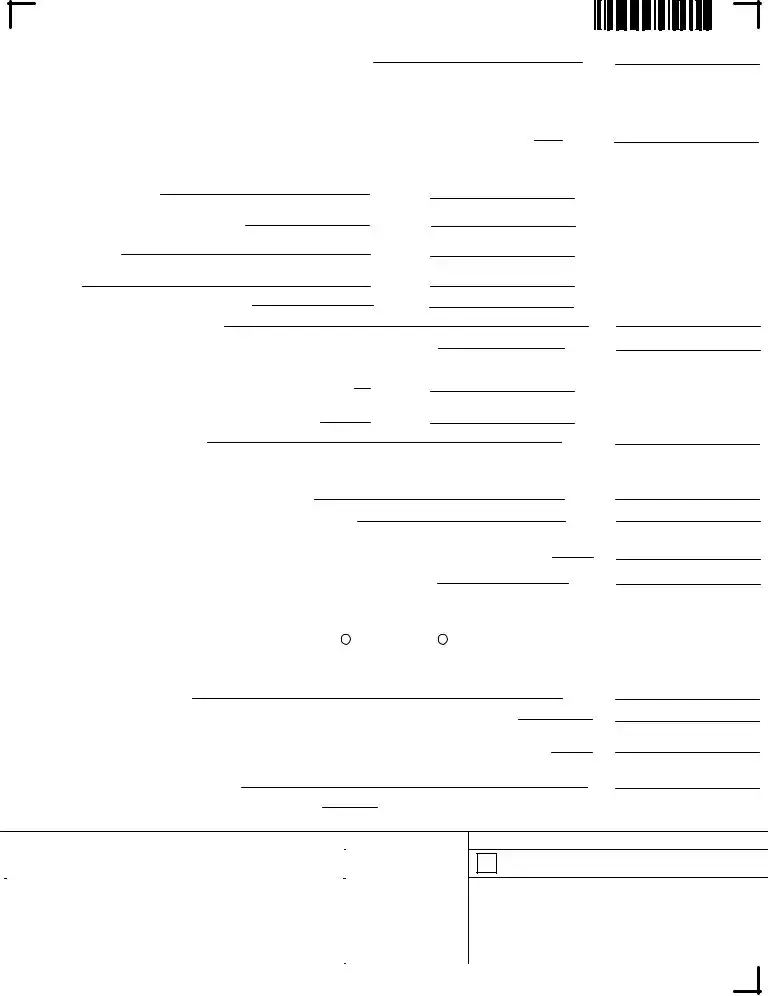

- Calculate your tax based on the provided tax tables or instructions based on your residency status.

- List any credits you are eligible for, including credits for taxes paid to another state or marriage penalty credits.

- Calculate your net tax liability by subtracting total credits from your tax amount.

- Report any North Dakota withholding and estimated tax payments made during the year.

- Determine if you have an overpayment or tax due by comparing total payments to net tax liability.

- If applicable, fill in your direct deposit information for any refund.

- Sign and date the form, and include your phone number. If filing jointly, have your spouse sign as well.

- If a paid preparer assisted you, ensure they sign and provide their information.

- Attach a copy of your federal income tax return and mail the completed form to the address specified.

Dos and Don'ts

When filling out the ND-1 form, there are several important dos and don'ts to keep in mind. These tips can help ensure that your submission is accurate and complete.

- Do type or print your information clearly using black or blue ink.

- Do double-check your social security number and your spouse's number if applicable.

- Do fill in all required fields, including your filing status and income sources.

- Do attach any necessary schedules or documentation, such as W-2s or 1099s.

- Don't leave any fields blank unless they are marked as optional.

- Don't forget to sign and date your return before submitting it.

- Don't use correction fluid or tape to fix mistakes; instead, cross out the error and write the correct information.

- Don't ignore the instructions provided; they contain valuable information specific to your situation.

Document Example

Form |

North Dakota Office of State Tax Commissioner |

|

Individual income tax return |

2010 |

Please type or print in black or blue ink.

Your name (First, MI, Last name)

If joint return, spouse's name (First, MI, Last name)

WEB

If a fiscal year filer, enter |

/ |

|

/ |

|

|

|||

|

fiscal year end: (See page 11) |

|

|

|

||||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Deceased |

Your social security number* |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse's social security number* |

|

|

|

|||

|

Deceased |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address

City

|

Apt No. |

|

|

|

|

State |

Zip code |

|

|

|

|

Fill in if

applicable: Amended (See page 11)

General

Federal NOL

Extension

A. Filing status used |

1. Single |

4. Head of household |

|||||||

on federal return: |

2. Married filing jointly |

5. Qualifying widow(er) with |

|||||||

(Fill in only one) |

3. Married filing separately |

dependent child |

|||||||

B. School district code: |

|

|

|

|

|

|

C. Income source code: |

||

(See page 19) |

|

|

|

|

|

|

(See page 11) |

|

|

|

|

|

|

|

|

||||

Were you required to pay |

Yes |

|

|

estimated federal income tax |

|

|

No |

|

|

for 2010? (See page 11) |

|

|

|

|

|

|

|

MN/MT Reciprocity

(See page 11) |

State |

D. Federal adjusted gross income from line 37 of Form 1040, line 21 of Form 1040A, |

|

or line 4 of Form 1040EZ |

(SX) D |

1.Federal taxable income from line 43 of Form 1040, line 27 of Form 1040A, or line 6 of Form 1040EZ (If zero, see page 12 of instructions)

Additions

2. |

(NA) 2 |

3.Loss from passthrough entity subject to North Dakota's

financial institution tax |

(NB) |

3 |

4. Planned gift or endowment tax credit adjustment to income |

(NK) |

4 |

5.Total additions. Add lines 2 through 4

6.Add lines 1 and 5

|

Subtractions |

|

7. Interest from U.S. obligations |

(SN) 7 |

|

8. |

Net |

|

|

(From worksheet on page 13 of instructions) |

(NC) 8 |

|

|

|

9. Exempt income of an eligible Native American |

(S4) 9 |

|

10. |

Benefits received from U.S. Railroad Retirement Board |

(S5) 10 |

11.Income from passthrough entity subject to North Dakota's

financial institution tax |

(S6) 11 |

12.National Guard/Reserve member federal active duty pay exclusion

(Attach copy of Title 10 orders) |

(NI) 12 |

13.Nonresident only: Servicemembers Civil Relief Act adjustment

(Attach copy of Form |

(NJ) 13 |

14. College SAVE account deduction |

(AA) 14 |

|

|

15. Qualified dividend exclusion |

(AO) 15 |

16. Total other subtractions (Attach Schedule |

(AB) 16 |

17.Total subtractions. Add lines 7 through 16

18.North Dakota taxable income. Subtract line 17 from line 6. If less than zero, enter 0

(SS) 1

5

6

17

(ND) 18

North Dakota Office of State Tax Commissioner

2010 Form

19.Enter your North Dakota taxable income from line 18 of page 1

Tax calculation

20.Tax - If a

If a

Credits |

|

21. Credit for income tax paid to another state |

|

(Attach Schedule |

(SD) 21 |

22. Marriage penalty credit for joint filers |

|

(From worksheet on page 14 of instructions) |

(AC) 22 |

23. Carryover of unused 2007 or 2008 residential/agricultural |

|

property tax credit |

(AM) 23 |

24. Carryover of unused 2007 or 2008 commercial property |

|

tax credit |

(AN) 24 |

25. Total other credits (Attach Schedule |

(AE) 25 |

26. Total credits. Add lines 21 through 25 |

|

27. Net tax liability. Subtract line 26 from line 20. |

IF LESS THAN ZERO, ENTER 0 |

28. North Dakota withholding (Attach |

(SF) 28 |

|

|

||||

29. Estimated tax paid on 2010 Forms |

|

|

|

||||

|

plus an overpayment, if any, applied from your 2009 return |

(S&) 29 |

|

|

|||

30. Total payments. Add lines 28 and 29 |

|

|

|

|

|

||

|

Refund |

|

|

|

|

|

|

31. |

Overpayment - If line 30 is MORE than line 27, subtract line 27 from line 30; |

|

|

||||

|

otherwise, go to line 35. IF LESS THAN $5.00, ENTER 0 |

|

|

|

|||

32. |

Amount of line 31 that you want applied to your 2011 estimated tax |

|

|

|

|||

33. |

Voluntary |

Watchable |

|

Trees For ND |

|

|

Enter |

|

contribution to: |

Wildlife Fund (SP) |

|

Program Trust Fund (SW) |

|

total |

|

34.Refund. Subtract lines 32 and 33 from line 31. IF LESS THAN $5.00, ENTER 0

To direct deposit your refund, |

a. Routing number: |

|

|

|

|

complete items a, b, and c. |

b. Account number: |

|

|

|

|

(See page 15) |

|

|

|

||

c. Type of account: |

Checking |

Savings |

|||

|

|||||

Tax Due |

|

|

|

|

|

19

(SB) 20

26

(SE) 27

(AJ) 30

(SG) 31

(SQ) 32

33

(SR) 34

35.Tax due - If line 30 is LESS than line 27, subtract line 30 from line 27.

IF LESS THAN $5.00, ENTER 0 |

(SZ) 35 |

36. Penalty (AK) |

|

|

Interest (AL) |

|

Enter total |

|

36 |

|||

37. Voluntary |

Watchable |

|

Trees For ND |

|

|

Enter |

37 |

|||

contribution to: Wildlife Fund (SU) |

|

|

Program Trust Fund (SY) |

|

|

|

total |

|||

38.Balance due. Add lines 35, 36, 37, and, if applicable, line 39.

Pay to: ND State Tax Commissioner |

38 |

||

39. Interest on underpaid estimated tax from Schedule |

(SO) 39 |

|

|

I declare that this return is correct and complete to the best of my knowledge and belief.

Your signature |

Date |

Phone number (land line) |

|

||

|

|

|

|

|

|

Spouse's signature |

Date |

Cell phone number |

|

||

|

|||||

|

|

|

|

|

|

Paid preparer signature |

|

PTIN |

|

Date |

|

|

|

|

|

|

|

Print name of paid preparer |

|

|

Phone no. |

|

|

i |

|

|

|

|

|

|

|

|

|

|

|

*Privacy Act - See inside front cover of booklet.

I authorize the ND Office of State Tax Commissioner to discuss this return with the paid preparer.

This Space Is For Tax Department Use Only

|

|

|

Attach copy of 2010 |

Mail to: State Tax Commissioner, PO Box 5621, |

|

|

|

||

|

|

|

federal income tax return |

Bismarck, ND |

|

|

|

|

|

File Breakdown

| Fact Name | Description |

|---|---|

| Form Purpose | The ND-1 form is used for filing individual income tax returns in North Dakota for the tax year 2010. |

| Filing Status Options | Taxpayers can select from various filing statuses, including single, married filing jointly, married filing separately, head of household, or qualifying widow(er). |

| Income Reporting | Taxpayers must report their federal adjusted gross income, which is derived from their federal tax return, specifically from Form 1040, 1040A, or 1040EZ. |

| North Dakota Tax Calculation | The tax owed is calculated based on the North Dakota taxable income, which is determined after accounting for allowable additions and subtractions. |

| Filing Instructions | Taxpayers must complete the form using black or blue ink and can file it by mail to the North Dakota Office of State Tax Commissioner. |

Common mistakes

Filling out the ND-1 form can be a daunting task, and it’s easy to make mistakes. One common error is neglecting to provide the correct social security numbers for both the taxpayer and the spouse, if applicable. This information is crucial for the tax authority to process the return accurately. If these numbers are missing or incorrect, it can lead to delays or complications in processing the return.

Another frequent mistake is failing to select the appropriate filing status. Taxpayers often overlook this step, which can significantly impact the overall tax calculation. The form provides multiple options such as single, married filing jointly, or head of household. Choosing the wrong status can result in incorrect tax liabilities.

Many individuals also forget to report all sources of income. It’s important to ensure that all income sources are accounted for, including wages, interest, and any other earnings. Leaving out income can lead to penalties or audits down the line.

Another area where errors often occur is in the additions and subtractions section. Taxpayers sometimes miscalculate these figures or fail to include relevant deductions. It’s essential to carefully review each line to ensure that all calculations are accurate and that all applicable credits and deductions are claimed.

Additionally, some filers may neglect to sign and date the form. This may seem minor, but an unsigned return is considered incomplete and can be rejected. Both the taxpayer and the spouse, if filing jointly, must provide their signatures.

Many people also overlook the requirement to attach necessary documents, such as W-2s or other income statements. Not including these documents can delay processing and may lead to additional inquiries from the tax office.

Another common mistake is not checking the mailing address. If you’ve moved recently, ensure that the address on the form is current. An incorrect address can result in important correspondence being sent to the wrong location, leading to missed deadlines or notices.

Finally, individuals sometimes fail to read the instructions thoroughly. Each section of the ND-1 form has specific guidelines that must be followed. Skipping over these instructions can lead to errors that could have been easily avoided. Taking the time to read and understand the form can save a lot of trouble in the long run.

FAQ

What is the ND-1 form?

The ND-1 form is the individual income tax return used by residents of North Dakota. It is submitted to the North Dakota Office of State Tax Commissioner. This form is essential for reporting income, calculating tax liability, and determining any potential refunds or amounts owed to the state.

Who needs to file the ND-1 form?

What information is required to complete the ND-1 form?

What are the filing statuses available on the ND-1 form?

How do I calculate my North Dakota taxable income?

What should I do if I owe taxes or expect a refund?

Where do I send my completed ND-1 form?