Blank North Dakota Last Will and Testament Template

Creating a Last Will and Testament is an essential step for individuals in North Dakota who wish to ensure that their assets are distributed according to their wishes after their passing. This legal document serves as a formal declaration of a person's intentions regarding the management of their estate, guardianship of minor children, and other critical decisions. The North Dakota Last Will and Testament form includes various components, such as the appointment of an executor, who is responsible for carrying out the terms of the will, and specific bequests, which outline how particular items or sums of money will be allocated. Additionally, the form allows for the designation of guardians for dependents, providing peace of mind for parents. Properly completing and executing this document is vital, as it can help avoid potential disputes among heirs and ensure a smoother transition of assets. By understanding the key elements of the North Dakota Last Will and Testament form, individuals can take proactive steps to secure their legacy and provide for their loved ones in the future.

Browse More Templates for North Dakota

How to Create an Employee Handbook - Find the process for submitting ideas or suggestions for workplace improvements.

For those looking to understand the process of asset transfer, the Alabama bill of sale form serves as a vital tool. This document outlines the specifics of the transaction, ensuring both parties have a clear record of the agreement. To learn more about creating an effective template, visit this comprehensive Alabama bill of sale form.

North Dakota Sales Contract for a House - The agreement may detail who will pay closing costs.

Similar forms

- Living Will: A living will outlines your preferences regarding medical treatment in case you become unable to communicate your wishes. Like a Last Will and Testament, it provides guidance, but it focuses on health care decisions rather than asset distribution.

- Durable Power of Attorney: This document allows you to appoint someone to manage your financial affairs if you become incapacitated. Similar to a will, it designates authority but is concerned with financial matters rather than post-death asset distribution.

- Health Care Proxy: A health care proxy designates a person to make medical decisions on your behalf if you cannot do so. While a will deals with your estate after death, a health care proxy is active during your lifetime, focusing on health-related choices.

- Trust: A trust can hold and manage assets during your lifetime and after your death. Like a will, it dictates how your assets are distributed, but it can also help avoid probate and provide for ongoing management of your assets.

- Living Trust: This is a type of trust that you create during your lifetime. It allows you to manage your assets while you are alive and specifies how they will be distributed after your death, similar to a will but with added benefits of avoiding probate.

- Codicil: A codicil is an amendment to an existing will. It allows you to make changes or updates without creating an entirely new document, similar in purpose to a will but specifically for modifications.

- Beneficiary Designation Forms: These forms are used for accounts like life insurance or retirement plans to specify who will receive benefits upon your death. While a will covers your entire estate, these forms address specific assets directly.

- Asurion F-017-08 MEN Form: For timely processing of insurance claims, use the essential Asurion F-017-08 MEN form for filing to ensure your requests are handled efficiently.

- Letter of Intent: A letter of intent is a non-legal document that provides guidance to your loved ones about your wishes, including funeral arrangements and care for dependents. It complements a will by providing additional context but does not have the same legal weight.

How to Use North Dakota Last Will and Testament

Completing the North Dakota Last Will and Testament form is an important step in ensuring that your wishes are honored after your passing. This document allows you to specify how your assets will be distributed and who will be responsible for carrying out your wishes. The following steps will guide you through the process of filling out the form accurately.

- Begin by gathering necessary information, including your full name, address, and date of birth.

- Clearly state that this document is your Last Will and Testament.

- Designate an executor, the person responsible for managing your estate after your death. Include their full name and contact information.

- List your beneficiaries. Specify who will inherit your assets, including family members, friends, or charitable organizations. Be clear about what each beneficiary will receive.

- If you have minor children, designate a guardian for them. Provide the guardian’s name and relationship to your children.

- Include any specific bequests. If you want to leave particular items or sums of money to specific individuals, detail those here.

- Sign the document in the presence of at least two witnesses. Ensure that they also sign the form, confirming that they witnessed your signature.

- Consider having the will notarized for added legal protection, although this is not a requirement in North Dakota.

After completing the form, keep it in a safe place and inform your executor and family members of its location. Regularly review and update the will as necessary, especially after major life events such as marriage, divorce, or the birth of a child.

Dos and Don'ts

When filling out the North Dakota Last Will and Testament form, there are important guidelines to follow. Here are five things to do and five things to avoid:

Things You Should Do:

- Clearly state your full name and address at the beginning of the document.

- Designate an executor who will manage your estate after your passing.

- Specify your beneficiaries and what each will receive from your estate.

- Sign the document in the presence of at least two witnesses.

- Review the will periodically to ensure it reflects your current wishes.

Things You Shouldn't Do:

- Do not use vague language that could lead to confusion about your intentions.

- Avoid leaving out critical information, such as debts or specific bequests.

- Do not sign the will without witnesses present, as this can invalidate it.

- Refrain from making changes without properly documenting them.

- Do not assume that verbal agreements will be honored; always document your wishes in writing.

Document Example

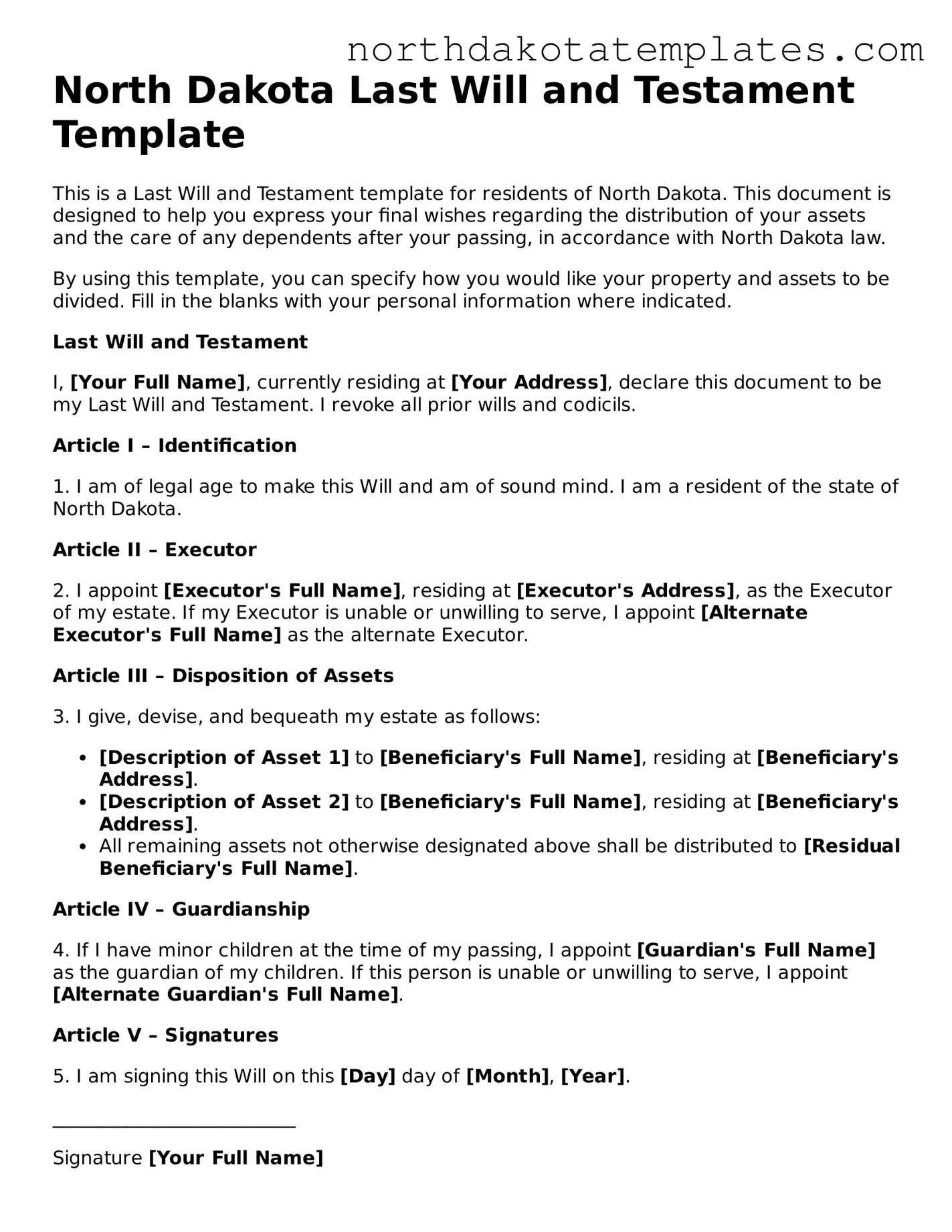

North Dakota Last Will and Testament Template

This is a Last Will and Testament template for residents of North Dakota. This document is designed to help you express your final wishes regarding the distribution of your assets and the care of any dependents after your passing, in accordance with North Dakota law.

By using this template, you can specify how you would like your property and assets to be divided. Fill in the blanks with your personal information where indicated.

Last Will and Testament

I, [Your Full Name], currently residing at [Your Address], declare this document to be my Last Will and Testament. I revoke all prior wills and codicils.

Article I – Identification

1. I am of legal age to make this Will and am of sound mind. I am a resident of the state of North Dakota.

Article II – Executor

2. I appoint [Executor's Full Name], residing at [Executor's Address], as the Executor of my estate. If my Executor is unable or unwilling to serve, I appoint [Alternate Executor's Full Name] as the alternate Executor.

Article III – Disposition of Assets

3. I give, devise, and bequeath my estate as follows:

- [Description of Asset 1] to [Beneficiary's Full Name], residing at [Beneficiary's Address].

- [Description of Asset 2] to [Beneficiary's Full Name], residing at [Beneficiary's Address].

- All remaining assets not otherwise designated above shall be distributed to [Residual Beneficiary's Full Name].

Article IV – Guardianship

4. If I have minor children at the time of my passing, I appoint [Guardian's Full Name] as the guardian of my children. If this person is unable or unwilling to serve, I appoint [Alternate Guardian's Full Name].

Article V – Signatures

5. I am signing this Will on this [Day] day of [Month], [Year].

__________________________

Signature [Your Full Name]

Witnesses

We, the undersigned, do hereby certify that on the day and date above written, [Your Full Name] signed this Last Will and Testament in our presence and declared it to be their Last Will. We, at the request of the Testator, and in their presence, hereunto subscribe our names as witnesses.

__________________________

Signature [Witness 1's Full Name]

__________________________

Signature [Witness 2's Full Name]

This document should be stored in a safe place and updated as necessary to reflect any changes in your circumstances or wishes.

Document Specifics

| Fact Name | Description |

|---|---|

| Governing Law | The North Dakota Last Will and Testament form is governed by North Dakota Century Code Chapter 30.1, which outlines the requirements for creating a valid will. |

| Age Requirement | In North Dakota, individuals must be at least 18 years old to create a valid Last Will and Testament. |

| Testamentary Capacity | The person creating the will must be of sound mind, meaning they understand the nature of their actions and the consequences of making a will. |

| Witness Requirement | North Dakota law requires that the will be signed by at least two witnesses, who must also be present when the testator signs the document. |

| Signature | The testator must sign the will at the end of the document. If the testator is unable to sign, they may direct another person to sign on their behalf in their presence. |

| Revocation | A will can be revoked by creating a new will or by physically destroying the original document, such as tearing it up or burning it. |

| Holographic Wills | North Dakota recognizes holographic wills, which are handwritten and signed by the testator, even if they are not witnessed. |

| Self-Proving Wills | Testators can make their wills self-proving by including a notarized affidavit from the witnesses, simplifying the probate process. |

| Probate Process | Once a will is filed for probate, it becomes a public document, allowing interested parties to view its contents and contest it if necessary. |

Common mistakes

Filling out a Last Will and Testament form can be a daunting task. Many people make mistakes that can lead to confusion or even legal issues down the line. One common mistake is not being specific about beneficiaries. It’s essential to clearly identify who will inherit your assets. Simply stating “my children” without names can create disputes among family members.

Another frequent error is failing to update the will after major life events. Life changes such as marriage, divorce, or the birth of a child should prompt a review of your will. If you don’t update your will, it may not reflect your current wishes, which can lead to unintended consequences.

People often overlook the importance of having witnesses. Most states, including North Dakota, require that a will be signed in the presence of at least two witnesses. If this step is neglected, the will may be deemed invalid. Ensure that your witnesses are not beneficiaries to avoid potential conflicts of interest.

Additionally, using vague language can create ambiguity. Phrases like “my possessions” can lead to confusion about what exactly is meant. It’s better to be as detailed as possible, specifying items or amounts to eliminate uncertainty.

Some individuals mistakenly assume that a handwritten will is automatically valid. While North Dakota does allow handwritten wills, they must still meet specific criteria. It’s advisable to follow the formal requirements of a typed will to avoid complications.

Another pitfall is neglecting to consider tax implications. Failing to address potential estate taxes can lead to unexpected burdens on your beneficiaries. Consulting with a financial advisor can provide clarity on how to structure your will to minimize tax liabilities.

People sometimes forget to include a clause for the appointment of an executor. An executor is responsible for managing your estate after your passing. Without naming someone for this role, the court may appoint an administrator, which may not align with your wishes.

Finally, many individuals do not keep their will in a safe yet accessible location. Storing the will in a safe deposit box can be problematic if your family cannot access it quickly. Instead, consider keeping it in a secure place at home or with a trusted attorney, ensuring that your loved ones can find it when needed.

FAQ

What is a Last Will and Testament in North Dakota?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. In North Dakota, this document allows individuals to specify beneficiaries, appoint guardians for minor children, and designate an executor to manage the estate. It serves to ensure that a person's wishes are honored and can help prevent disputes among family members.

Who can create a Last Will and Testament in North Dakota?

In North Dakota, any person who is at least 18 years old and of sound mind can create a Last Will and Testament. This means they must understand the nature of the document and the implications of their decisions. There are no special requirements regarding legal training or background.

What are the requirements for a valid Last Will and Testament in North Dakota?

To be valid in North Dakota, a Last Will and Testament must be in writing and signed by the testator (the person making the will). Additionally, it must be witnessed by at least two individuals who are present at the same time. These witnesses should not be beneficiaries of the will to avoid any potential conflicts of interest.

Can I change my Last Will and Testament once it is created?

Yes, you can change your Last Will and Testament at any time while you are alive and of sound mind. This can be done by creating a new will or by making a codicil, which is an amendment to the existing will. It is important to follow the same formalities for signing and witnessing when making changes to ensure the validity of the document.

What happens if I die without a Last Will and Testament in North Dakota?

If you die without a Last Will and Testament, you are considered to have died "intestate." In this case, North Dakota's intestacy laws will determine how your assets are distributed. Typically, your estate will be divided among your closest relatives, such as a spouse, children, or parents, according to state law. This may not align with your personal wishes.

Can I use a template for my Last Will and Testament in North Dakota?

Yes, many people choose to use templates for creating their Last Will and Testament. However, it is crucial to ensure that the template complies with North Dakota laws. While templates can provide a helpful starting point, it is advisable to review the document carefully or consult with a legal professional to ensure it meets all requirements.

How can I revoke my Last Will and Testament in North Dakota?

You can revoke your Last Will and Testament in several ways. The most straightforward method is to create a new will that explicitly states that all previous wills are revoked. Alternatively, you can physically destroy the existing will or create a written statement declaring its revocation. It is important to follow legal procedures to avoid any confusion about your intentions.

Is it necessary to have an attorney to create a Last Will and Testament in North Dakota?

While it is not legally required to have an attorney to create a Last Will and Testament in North Dakota, consulting with one can be beneficial. An attorney can help ensure that your will complies with state laws, address any complex issues, and provide guidance on how to best protect your assets and wishes.