Free F10 North Dakota PDF Template

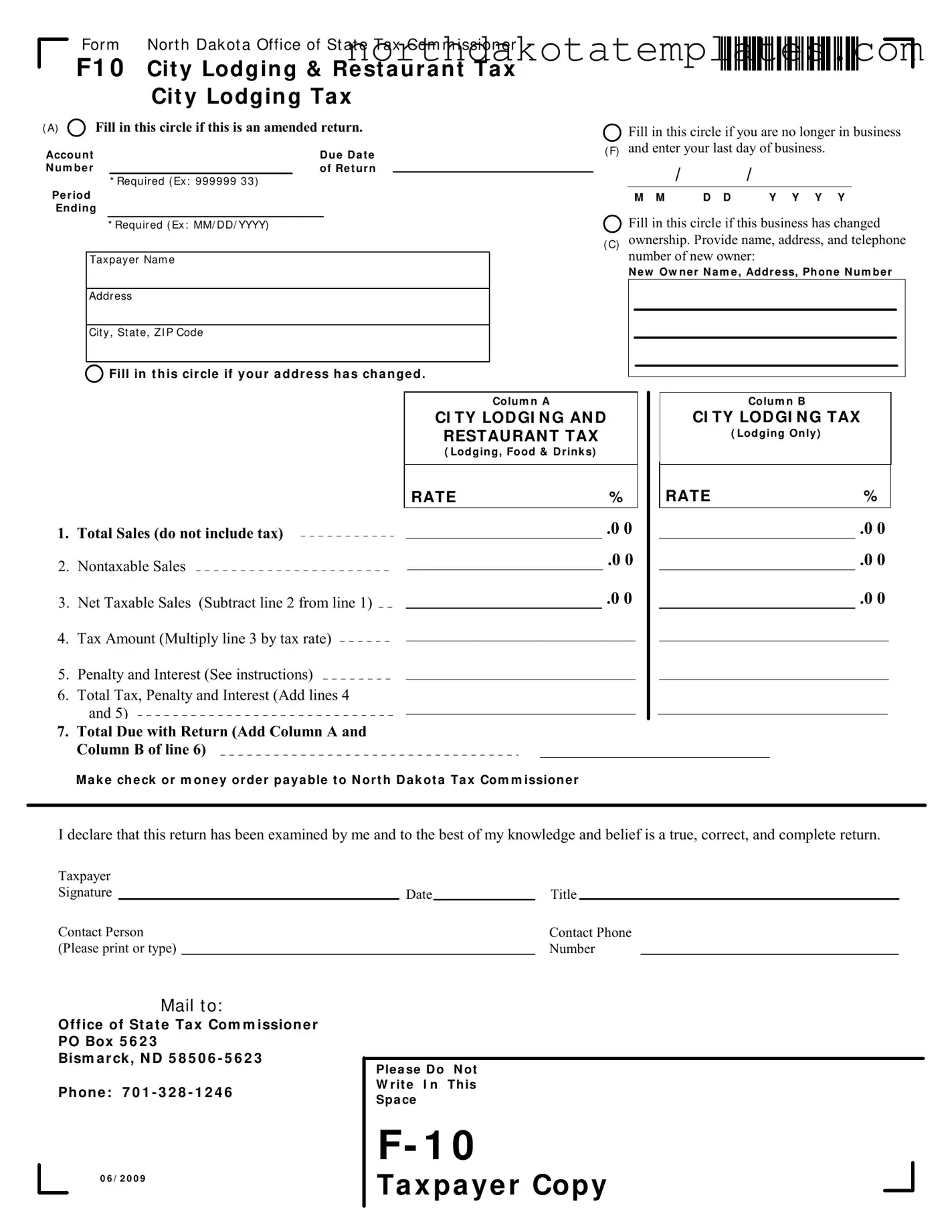

The F10 North Dakota form is an essential document for businesses operating within the state that deal with lodging and restaurant services. It serves as a means to report and remit city lodging and restaurant taxes, ensuring compliance with state tax regulations. This form requires businesses to detail their total sales, distinguishing between taxable and nontaxable sales, and calculate the appropriate tax amounts owed. Notably, the F10 form allows for the reporting of amended returns, providing flexibility for businesses that may need to correct previous submissions. Additionally, it includes sections for indicating changes in business ownership or address, which are crucial for maintaining accurate records. Understanding the nuances of this form is vital, as it encompasses various tax rates and potential penalties for late submissions. Completing the F10 accurately not only helps avoid unnecessary fees but also contributes to the overall fiscal responsibility of the business. Timeliness is key; missing deadlines can lead to penalties and interest that could significantly impact your bottom line. Therefore, familiarizing yourself with the F10 North Dakota form is not just advisable, it is imperative for any business engaged in these sectors.

Common PDF Documents

North Dakota Charitable Registration - Any organization that fails to file on time may request an extension from the Secretary of State.

Understanding the significance of the ADP Pay Stub form, which acts as a crucial record for tracking earnings and deductions, is essential for effective financial management. For those looking to create or access this important document, visiting smarttemplates.net may provide invaluable resources and templates to facilitate the process.

Society for Neuroscience - The form acts as a formal request to begin the enrollment procedure for eligible providers.

Similar forms

- Form 1040: This is the standard individual income tax return used by taxpayers in the United States. Like the F10 form, it requires detailed reporting of income, deductions, and tax liability. Both forms aim to ensure compliance with tax laws and provide a means for taxpayers to report their financial activities accurately.

- Form 1065: This form is used for reporting income, deductions, gains, and losses from partnerships. Similar to the F10, it gathers information about financial performance over a specific period and requires signatures to verify the accuracy of the information provided.

- Articles of Incorporation - Essential for businesses looking to establish themselves as corporations in California, this form officially marks the creation of a corporation by detailing its name, purpose, and structure. For more information, visit https://toptemplates.info/articles-of-incorporation/california-articles-of-incorporation.

- Sales Tax Return: This document is filed by businesses to report sales tax collected from customers. Like the F10, it involves calculating total sales, exempt sales, and tax due, ensuring that businesses comply with state tax regulations.

- Form 941: This is the Employer's Quarterly Federal Tax Return. It is similar to the F10 in that it requires businesses to report taxes withheld from employee wages. Both forms emphasize the importance of accurate reporting and timely submission to avoid penalties.

How to Use F10 North Dakota

Filling out the F10 North Dakota form requires careful attention to detail. Ensure that all information is accurate and complete to avoid delays in processing. Follow these steps to successfully complete the form.

- Indicate if this is an amended return by filling in the circle next to the appropriate option.

- Enter the account due date number of your return in the specified format (e.g., 999999333).

- Provide the period ending date in the format MM/DD/YYYY.

- Fill in your taxpayer name, address, city, state, and ZIP code.

- If applicable, mark the circle indicating you are no longer in business and enter your last day of business (MM/DD/YYYY).

- Indicate if there has been a change in ownership by marking the circle and providing the new owner's name, address, and phone number.

- Mark the circle if your address has changed.

- Complete the sales sections:

- Line 1: Enter your total sales (excluding tax).

- Line 2: Enter all nontaxable sales from line 1.

- Line 3: Calculate net taxable sales by subtracting line 2 from line 1.

- Line 4: Multiply line 3 by the tax rate to find the tax amount.

- Line 5: Calculate any penalty and interest applicable.

- Line 6: Add lines 4 and 5 to find the total tax, penalty, and interest.

- Line 7: Add the totals from Column A and Column B of line 6 to find the total due with the return.

- Make your check or money order payable to North Dakota Tax Commissioner.

- Sign the return, confirming that it has been examined and is accurate.

- Print or type the name and contact phone number of a person who can answer questions about the return.

- Mail the completed form to the Office of State Tax Commissioner at the provided address.

Dos and Don'ts

When filling out the F10 North Dakota form, there are several important guidelines to follow. Here’s a list of things you should and shouldn’t do:

- Do fill in the required fields completely, including the account number and period ending.

- Do indicate if this is an amended return by filling in the appropriate circle.

- Do provide accurate sales figures, ensuring that total sales do not include tax.

- Do include all necessary contact information for a person who can answer questions about the return.

- Don't forget to check if your business has changed ownership or if your address has changed.

- Don't include any tax collections in the total sales figure reported on line 1.

- Don't ignore the penalties and interest that may apply if the return is filed late.

- Don't forget to sign the return before submitting it.

Following these guidelines will help ensure that your F10 form is completed accurately and efficiently.

Document Example

For m Nor t h Dak ot a Office of St at e Tax Com m issioner

F1 0 Cit y Lodgin g & Re st a u r a n t Ta x Cit y Lodgin g Ta x

( A)  Fill in this circle if this is an amended return.

Fill in this circle if this is an amended return.

Accou nt |

|

|

D u e D a t e |

|

N u m b e r |

|

|

of Re t ur n |

|

|

* Requir ed ( Ex : 9 999 99 3 3) |

|||

Pe r iod |

|

|

|

|

End ing |

|

|

|

|

*Requ ir ed ( Ex : MM/ DD/ YYYY)

Tax pay er Nam e

Addr ess

Cit y , St at e, Z I P Code

Fill in this circle if you are no longer in business ( F) and enter your last day of business.

/ |

|

/ |

M M |

D D |

Y Y Y Y |

Fill in this circle if this business has changed

Fill in this circle if this business has changed

( C) ownership. Provide name, address, and telephone number of new owner:

N e w Ow n e r N a m e , Addr e ss, Ph on e N u m be r

Fill in t h is cir cle if y ou r a dd r e ss h a s ch a n ge d .

1.Total Sales (do not include tax)

2.Nontaxable Sales

3.Net Taxable Sales (Subtract line 2 from line 1)

4.Tax Amount (Multiply line 3 by tax rate)

5.Penalty and Interest (See instructions)

6.Total Tax, Penalty and Interest (Add lines 4 and 5)

7.Total Due with Return (Add Column A and Column B of line 6)

Colum n A

CI TY LOD GI N G AN D RESTAURAN T TAX

( Lodgin g, Food & D r ink s)

RATE |

% |

.0 0

.0 0

.0 0

Colu m n B

CI TY LOD GI N G TAX

( Lod ging On ly )

RATE |

% |

.0 0

.0 0

.0 0

M a k e ch e ck or m on e y or de r p a y a ble t o N or t h D a k ot a Ta x Com m ission e r

I declare that this return has been examined by me and to the best of my knowledge and belief is a true, correct, and complete return.

Taxpayer |

|

|

|

|

|

||

Signature |

|

|

Date |

|

Title |

|

|

Contact Person |

|

|

Contact Phone |

Revised 07/01/2002 |

|||

(Please print or type) |

|

|

|

Number |

|||

|

|

|

|

||||

Mail t o:

Of f ice of St a t e Ta x Com m ission e r PO Box 5 6 2 3

Bism a r ck , N D 5 8 5 0 6 - 5 6 2 3

Ph on e : 7 0 1 - 3 2 8 - 1 2 4 6

0 6 / 2 0 0 9

Ple a se D o N ot

W r it e I n Th is

Spa ce

F- 1 0

Ta x pa y e r Copy

Instructions

Line 1 – Total Sales. Enter on line 1, your gross sales for the period including lodging receipts, bar and lounge receipts, restaurant receipts, and all other sales and service charges for the period. This figure should not include any tax collections.

Line 2 - Nontaxable Sales. Enter all sales included in line 1 that are not subject to tax. Nontaxable sales include:

•In Column A and Column B: all sales exempt from North Dakota sales tax including sales to exempt entities, sales of nontaxable service, sales for resale, sales delivered outside of state. Also include bad debts originally reported as a taxable sale with the tax remitted, but written off during this period as uncollectible.

•In Column A: sales subject to state sales tax but not subject to city lodging and restaurant tax. The imposition of city lodging and restaurant taxes varies from city to city. Please contact the Office of State Tax Commissioner if you need additional information.

•In Column B: sales subject to state sales tax but not subject to city lodging tax. City lodging tax applies only to the gross receipts from leasing or renting hotel, motel, or tourist court accommodations within the city for periods of less than thirty consecutive days or one month. It does not apply to food, alcoholic beverages, phone service, durable goods, etc.

Line 3 - Net Taxable Sales. Subtract line 2 from line 1.

Line 4 – Tax Amount. Multiply line 3 by the tax rates printed in the column headings.

Line 5 – Penalty and Interest. Penalty and interest apply to all returns paid or filed after the due date. Penalty and Interest are calculated separately for Column A and Column B. For the first month the return is late, the penalty is 5 percent of the tax due on line 4 or $5, whichever is greater. For each additional month or fraction of a month the return is late, add an additional penalty of 5 percent of the tax on line 4 up to a maximum of 25 percent. Interest does not apply to the first month a return is late, but applies at a rate of 1 percent each month or fraction of a month the return remains late or unpaid.

Line 6 – Total Tax, Penalty, and Interest. Enter the total of line 4 and line 5.

Line 7 – Total Due with Return. Enter the total of line 6, Column A and Column B.

Make your check payable to North Dakota Tax Commissioner. The taxpayer or taxpayer’s agent must sign the return. Please PRINT the name and phone number of a contact person who can answer questions about this return.

Office of State Tax Commissioner

PO Box 5623

Bismarck, ND

Phone 701.328.1246

www.nd.gov/tax

File Breakdown

| Fact Name | Details |

|---|---|

| Form Purpose | The F10 form is used for reporting city lodging and restaurant taxes in North Dakota. |

| Governing Law | This form is governed by North Dakota Century Code Chapter 40-05.1. |

| Amended Returns | Taxpayers can indicate if the return is amended by filling in the designated circle on the form. |

| Due Date | The account due date must be filled in, ensuring timely submission of the return. |

| Sales Reporting | Taxpayers must report total sales, including lodging and restaurant receipts, excluding tax. |

| Nontaxable Sales | Nontaxable sales must be identified and subtracted from total sales to calculate net taxable sales. |

| Penalty and Interest | Late submissions incur penalties and interest, calculated based on the tax due and the duration of delay. |

| Signature Requirement | The return must be signed by the taxpayer or their agent, confirming its accuracy. |

| Submission Address | Completed forms should be mailed to the Office of State Tax Commissioner, PO Box 5623, Bismarck, ND 58506-5623. |

Common mistakes

Filling out the F10 North Dakota form can be straightforward, but many people make common mistakes that can lead to delays or complications. One frequent error is neglecting to provide accurate sales figures. When entering total sales, it’s crucial to include all gross sales for the period, but remember that this amount should not include any tax collections. If you mistakenly add tax to your total sales, it can throw off your calculations and lead to discrepancies.

Another common mistake is failing to correctly identify nontaxable sales. It's essential to understand what qualifies as nontaxable. This can include sales to exempt entities or sales delivered outside of North Dakota. If you overlook these details, you might end up reporting a higher taxable amount than necessary, which can result in overpayment of taxes.

Many individuals also forget to sign the return. This might seem minor, but without a signature, the form is incomplete. The taxpayer or their agent must sign the return, affirming that the information provided is true and correct. If this step is missed, the form could be rejected, leading to further delays in processing.

Lastly, not updating business information can be a significant oversight. If your business has changed ownership or if your address has changed, it’s vital to indicate this on the form. Failing to do so can cause confusion and may result in important communications being sent to the wrong address. Always double-check that your information is current and accurate before submitting the form.

FAQ

What is the F10 North Dakota form used for?

The F10 form is utilized for reporting city lodging and restaurant taxes in North Dakota. Businesses that provide lodging services or operate restaurants within city limits must complete this form to report their sales and calculate the taxes owed to the state. It ensures compliance with local tax regulations and helps maintain accurate records for tax purposes.

Who needs to file the F10 form?

Any business that offers lodging or restaurant services in North Dakota is required to file the F10 form. This includes hotels, motels, inns, and restaurants that sell food and beverages. If your business has ceased operations or changed ownership, you must still file the form to report final sales and taxes.

What information do I need to provide on the F10 form?

When completing the F10 form, you will need to provide details such as your business name, address, and taxpayer identification number. Additionally, you must report total sales, nontaxable sales, net taxable sales, and the tax amount owed. If applicable, indicate if the return is amended, if the business has changed ownership, or if your address has changed.

How do I calculate the tax amount on the F10 form?

To calculate the tax amount, first determine your net taxable sales by subtracting nontaxable sales from total sales. Then, multiply the net taxable sales by the applicable tax rate, which varies for lodging and restaurant services. Ensure you are using the correct rates as specified in the form's column headings.

What happens if I file the F10 form late?

Filing the F10 form late can result in penalties and interest. For the first month your return is late, a penalty of 5% of the tax due is applied, or a minimum of $5. For each additional month, an extra 5% penalty is added, capping at 25%. Interest accrues at a rate of 1% per month on unpaid amounts after the first month. Timely filing is crucial to avoid these additional costs.

Where do I send the completed F10 form?

Once you have completed the F10 form, mail it to the Office of State Tax Commissioner at PO Box 5623, Bismarck, ND 58506-5623. Make sure to include any payment due with your return and ensure that the form is signed by the taxpayer or their authorized agent.

Can I amend my F10 form after submission?

Yes, you can amend your F10 form if you discover an error after submission. To do this, check the box indicating that this is an amended return and provide the correct information. It’s important to amend your return promptly to avoid additional penalties and ensure accurate tax reporting.

How can I get assistance with the F10 form?

If you have questions or need assistance while completing the F10 form, you can contact the Office of State Tax Commissioner at 701-328-1246. They can provide guidance on filling out the form, understanding tax rates, and addressing any other concerns related to lodging and restaurant taxes.