Blank North Dakota Deed Template

When it comes to transferring property ownership in North Dakota, understanding the North Dakota Deed form is essential. This document serves as a legal instrument that formalizes the transfer of real estate from one party to another. Whether you are buying a home, selling land, or gifting property, the deed outlines critical details such as the names of the buyer and seller, a description of the property, and the terms of the transfer. In North Dakota, various types of deeds exist, including warranty deeds and quitclaim deeds, each serving different purposes and offering varying levels of protection to the buyer. Additionally, the form must be properly executed, which includes signatures and notarization, to ensure its validity. Familiarizing yourself with the requirements and components of the North Dakota Deed form can simplify the process and safeguard your interests in real estate transactions.

Browse More Templates for North Dakota

North Dakota Trailer Registration Fees - Indicates whether the trailer is being sold as-is or with warranties.

For individuals looking to secure their final wishes, understanding the implications of a thorough Last Will and Testament document is vital. It ensures that one’s assets are distributed according to their desires, providing both clarity and assurance during difficult times. For guidance on creating a reliable version, refer to this comprehensive Last Will and Testament resource.

North Dakota Weapon Bill of Sale - The Firearm Bill of Sale includes information about the firearm being sold.

Similar forms

- Contract: A contract is a mutual agreement between parties that outlines specific terms and conditions. Like a deed, it requires the signatures of the parties involved and establishes legal obligations.

- Lease Agreement: A lease agreement allows one party to use another party's property for a specified time in exchange for payment. Similar to a deed, it must be in writing and signed to be enforceable.

- Bill of Sale: A bill of sale is a document that transfers ownership of personal property from one party to another. Both a bill of sale and a deed serve to formalize the transfer of ownership.

- Articles of Incorporation: This essential document is required for establishing a corporation in Florida. It specifies crucial details such as the corporation's name, address, and directors. For more information, refer to All Florida Forms.

- Power of Attorney: A power of attorney grants one person the authority to act on behalf of another. Like a deed, it must be executed with specific formalities to be valid.

- Trust Agreement: A trust agreement outlines the terms under which property is held for the benefit of another party. Both documents create binding legal relationships and specify the rights of the involved parties.

- Warranty Deed: A warranty deed guarantees that the grantor holds clear title to the property and has the right to sell it. This type of deed, like other deeds, must be executed and delivered to be effective.

- Quitclaim Deed: A quitclaim deed transfers whatever interest the grantor has in a property without guaranteeing clear title. It is similar to a deed in that it must be signed and delivered to be valid.

- Assignment Agreement: An assignment agreement allows one party to transfer their rights and obligations under a contract to another party. Like a deed, it requires the signatures of the involved parties to be legally binding.

How to Use North Dakota Deed

After obtaining the North Dakota Deed form, you are ready to fill it out accurately. Completing this form is essential for transferring property ownership. Follow the steps below to ensure you provide all necessary information correctly.

- Begin by entering the date at the top of the form. Make sure to use the full date format.

- Identify the grantor (the person transferring the property). Provide their full name and address.

- Next, list the grantee (the person receiving the property). Include their full name and address as well.

- Describe the property being transferred. Include the legal description, which can usually be found in the property’s current deed or tax records.

- Indicate the consideration amount, which is the price paid for the property. If the transfer is a gift, you can state "gift" instead of a monetary amount.

- Have the grantor sign the form. The signature must be notarized to validate the deed.

- Include the notary’s information and signature in the designated area. This step is crucial for the deed’s legal standing.

- Finally, submit the completed deed to the appropriate county recorder’s office for filing. Ensure you keep a copy for your records.

Dos and Don'ts

When filling out the North Dakota Deed form, it’s important to keep a few key points in mind. Here’s a list of things you should and shouldn’t do:

- Do ensure that all information is accurate and complete.

- Do include the legal description of the property.

- Do sign the form in front of a notary public.

- Don't use abbreviations or shorthand in the property description.

- Don't forget to check for any required signatures from all parties involved.

- Don't submit the form without making a copy for your records.

Document Example

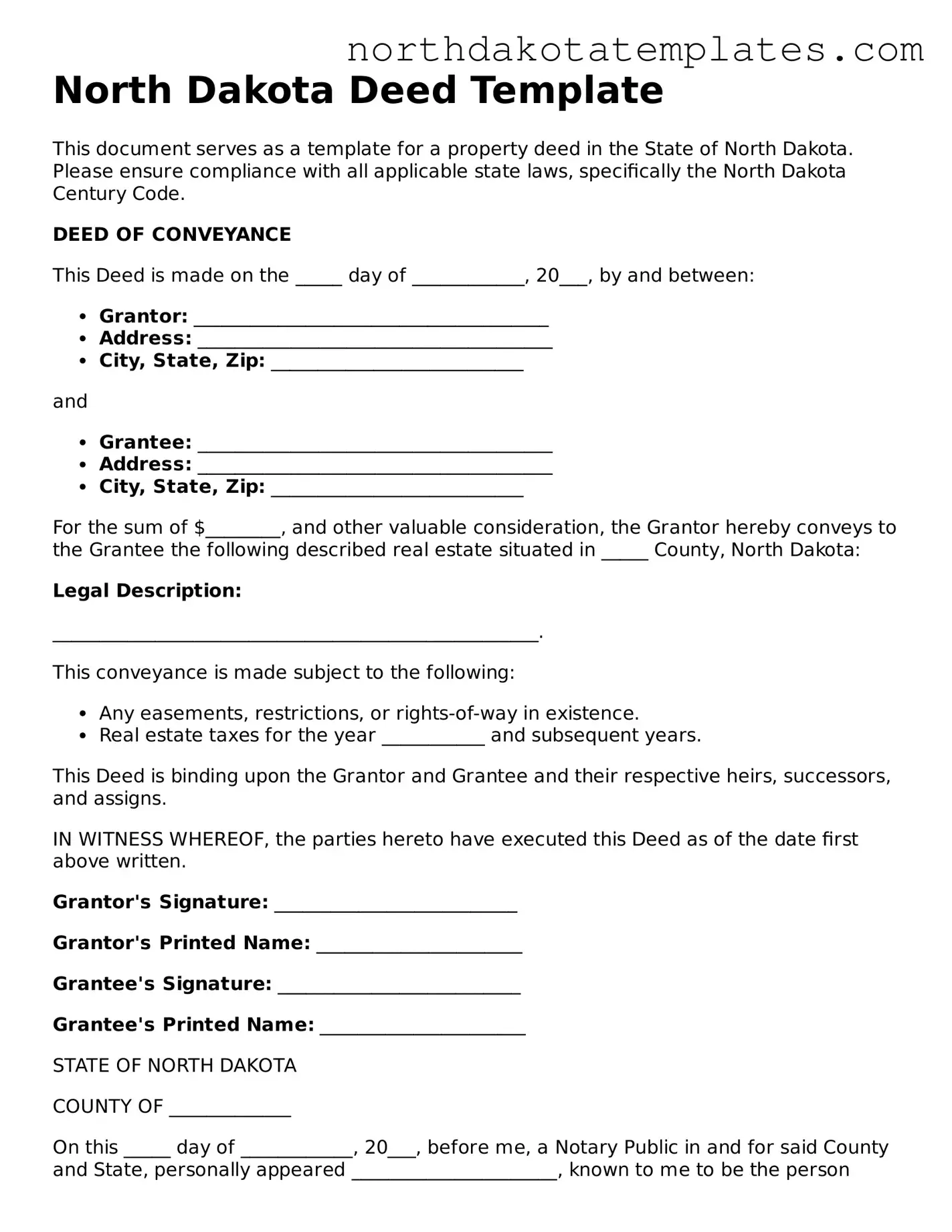

North Dakota Deed Template

This document serves as a template for a property deed in the State of North Dakota. Please ensure compliance with all applicable state laws, specifically the North Dakota Century Code.

DEED OF CONVEYANCE

This Deed is made on the _____ day of ____________, 20___, by and between:

- Grantor: ______________________________________

- Address: ______________________________________

- City, State, Zip: ___________________________

and

- Grantee: ______________________________________

- Address: ______________________________________

- City, State, Zip: ___________________________

For the sum of $________, and other valuable consideration, the Grantor hereby conveys to the Grantee the following described real estate situated in _____ County, North Dakota:

Legal Description:

____________________________________________________.

This conveyance is made subject to the following:

- Any easements, restrictions, or rights-of-way in existence.

- Real estate taxes for the year ___________ and subsequent years.

This Deed is binding upon the Grantor and Grantee and their respective heirs, successors, and assigns.

IN WITNESS WHEREOF, the parties hereto have executed this Deed as of the date first above written.

Grantor's Signature: __________________________

Grantor's Printed Name: ______________________

Grantee's Signature: __________________________

Grantee's Printed Name: ______________________

STATE OF NORTH DAKOTA

COUNTY OF _____________

On this _____ day of ____________, 20___, before me, a Notary Public in and for said County and State, personally appeared ______________________, known to me to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same.

Witness my hand and official seal.

Notary Public: ________________________________

My Commission Expires: ______________________

Document Specifics

| Fact Name | Description |

|---|---|

| Governing Law | The North Dakota Deed form is governed by the North Dakota Century Code, specifically Chapter 47-19. |

| Types of Deeds | North Dakota recognizes various types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds. |

| Signature Requirements | For a deed to be valid in North Dakota, it must be signed by the grantor and acknowledged before a notary public. |

| Recording | Deeds must be recorded in the county where the property is located to provide public notice of ownership. |

| Consideration | The deed must state the consideration, or the value exchanged, though it does not need to be a specific amount. |

Common mistakes

Filling out a deed form in North Dakota may seem straightforward, but many people make common mistakes that can lead to complications later on. One frequent error is not providing complete information about the property. The deed should include a precise legal description of the property, not just a general address. Omitting details can create confusion and may even invalidate the deed.

Another common mistake is failing to include all necessary parties. Both the grantor (the person transferring the property) and the grantee (the person receiving the property) must be clearly identified. If either party's name is misspelled or missing, it can lead to legal disputes or issues with ownership in the future.

Some individuals overlook the importance of signatures. A deed must be signed by the grantor to be valid. If the grantor is married, some states require the spouse's signature as well. Neglecting this step can render the deed ineffective, leaving the property transfer unrecognized.

In addition to signatures, another mistake involves the notarization process. Many people forget to have their deed notarized, which is a critical step in ensuring that the document is legally binding. A notary public verifies the identities of the signers and adds an official seal, lending credibility to the document.

People often forget to check for any outstanding liens or claims against the property before transferring it. Failing to disclose this information can lead to financial liability for the new owner. It is essential to conduct a title search to ensure the property is free of encumbrances.

Another frequent error is not including the correct date of the transfer. The date is significant because it establishes when the ownership officially changes. An incorrect date can create confusion regarding property rights and responsibilities.

Many individuals also neglect to specify the type of ownership being transferred. Whether it is joint tenancy, tenancy in common, or another form of ownership, clarifying this in the deed is crucial. Without this information, future disputes may arise regarding the rights of the owners.

People sometimes forget to include a proper legal description of the property. A simple address is not enough; the deed should contain a detailed description that identifies the boundaries and dimensions of the property. This ensures that everyone knows exactly what is being transferred.

Finally, failing to record the deed with the appropriate county office is a mistake that can have serious consequences. Recording the deed provides public notice of the ownership transfer, protecting the new owner’s rights. Without this step, the transfer may not be recognized by third parties, leading to potential challenges in the future.

FAQ

What is a North Dakota Deed form?

A North Dakota Deed form is a legal document used to transfer ownership of real estate from one party to another. This form outlines the details of the transaction, including the names of the parties involved, a description of the property, and any conditions of the transfer. It serves as an official record of the change in ownership and is filed with the county recorder's office to ensure public notice of the transaction.

What types of deeds are available in North Dakota?

In North Dakota, there are several types of deeds, each serving different purposes. The most common types include warranty deeds, which guarantee that the seller has clear title to the property; quitclaim deeds, which transfer any interest the seller may have without guaranteeing clear title; and special warranty deeds, which provide limited warranties. Understanding the differences can help you choose the right deed for your situation.

How do I fill out a North Dakota Deed form?

Filling out a North Dakota Deed form requires careful attention to detail. Start by entering the names of the grantor (the seller) and grantee (the buyer). Next, provide a legal description of the property, which can typically be found on the current deed or tax records. Be sure to include the property’s address and any relevant parcel numbers. Lastly, sign the document in the presence of a notary public, who will verify your identity and witness the signing.

Is notarization required for a North Dakota Deed?

Yes, notarization is a crucial step in the process. In North Dakota, a deed must be signed in front of a notary public to be considered valid. The notary will confirm the identities of the parties involved and ensure that the signing is done voluntarily. This step helps protect against fraud and ensures that the deed can be properly recorded.

Where do I file a North Dakota Deed after it is completed?

Once the North Dakota Deed is completed and notarized, it must be filed with the county recorder's office in the county where the property is located. This filing creates a public record of the transaction, providing legal notice to anyone who may have an interest in the property. There may be a filing fee, so it’s wise to check with the local recorder’s office for specific requirements and costs.

Are there any taxes associated with transferring property in North Dakota?

Yes, transferring property in North Dakota may involve several taxes. The most common is the transfer tax, which is typically calculated based on the sale price of the property. Additionally, there may be other fees related to the recording of the deed. It’s advisable to consult with a tax professional or legal advisor to understand all potential tax implications before completing the transfer.

Can I use a North Dakota Deed form for any type of property?

Generally, a North Dakota Deed form can be used for most types of real property, including residential homes, commercial properties, and vacant land. However, certain properties, such as those held in a trust or owned by a corporation, may require different forms or additional documentation. Always check the specific requirements for your property type to ensure compliance.

What should I do if I have questions about my North Dakota Deed?

If you have questions or concerns about your North Dakota Deed, it’s best to consult with a legal professional who specializes in real estate law. They can provide guidance tailored to your specific situation and help ensure that all aspects of the deed are handled correctly. Additionally, local county recorder’s offices may offer resources and information to assist you.