Blank North Dakota Articles of Incorporation Template

When starting a business in North Dakota, one of the essential steps is filing the Articles of Incorporation. This document serves as the foundation for your corporation, outlining its basic structure and purpose. Key elements included in the form are the corporation's name, which must be unique and comply with state regulations, and the designated registered agent, responsible for receiving legal documents on behalf of the corporation. Additionally, the Articles of Incorporation require information about the corporation's duration, which can be perpetual or for a specified term, as well as the number of shares the corporation is authorized to issue. It is also important to include the names and addresses of the incorporators, who are responsible for setting up the corporation. Filing this form correctly is crucial, as it ensures compliance with state laws and provides the legal recognition needed to operate as a corporation in North Dakota.

Browse More Templates for North Dakota

Can You Sell a Car You Just Bought - The form often indicates whether the sale is final or if it has contingencies.

A California Boat Bill of Sale form is a crucial document used to document the sale and transfer of ownership of a boat. It serves as a legal receipt, providing proof of purchase for the buyer and evidence of the sale for the seller. This form is essential for both parties to ensure a smooth and legally-binding transaction. For more information, you can refer to the Bill of Sale for a Vessel.

North Dakota Living Will - A means of stating your preferences clearly to medical staff.

North Dakota Lease Application - State any other relevant circumstances impacting your application.

Similar forms

The Articles of Incorporation form serves as a foundational document for establishing a corporation. It shares similarities with several other legal documents. Below are four such documents, each with a brief explanation of how they relate to the Articles of Incorporation.

- Bylaws: Bylaws outline the internal rules and regulations governing a corporation's operations. Like the Articles of Incorporation, they are essential for the corporation's formation, providing a framework for management and decision-making processes.

- Operating Agreement: This document is used primarily by limited liability companies (LLCs). It details the management structure and operational procedures. Similar to the Articles of Incorporation, it formalizes the entity's structure and defines the roles of members and managers.

- Certificate of Formation: This document is often used interchangeably with the Articles of Incorporation in certain jurisdictions. It serves the same purpose of legally establishing a corporation and includes essential information such as the company name and registered agent.

- Bill of Sale: This legal document records the transfer of ownership of an asset, serving as evidence of a transaction. It is essential for providing proof of purchase and includes details of the asset, with templates available at smarttemplates.net.

- Partnership Agreement: In the case of partnerships, this document outlines the terms of the partnership, including profit sharing and responsibilities. While it differs in structure, like the Articles of Incorporation, it is fundamental in defining the relationship and governance of the business entity.

How to Use North Dakota Articles of Incorporation

Once you have the North Dakota Articles of Incorporation form ready, you'll need to complete it accurately to move forward with establishing your corporation. This form is crucial for officially registering your business in the state. Follow these steps to fill it out correctly.

- Start with the name of your corporation. Ensure it meets North Dakota naming requirements and is unique.

- Provide the principal office address. This should be a physical address, not a P.O. Box.

- Enter the name and address of the registered agent. This person or business will receive legal documents on behalf of your corporation.

- Specify the purpose of your corporation. A brief statement about what your business will do is sufficient.

- Indicate the number of shares your corporation is authorized to issue. If applicable, include information about different classes of shares.

- List the names and addresses of the incorporators. These individuals are responsible for filing the Articles of Incorporation.

- Include the date of incorporation. This is the date you want your corporation to officially begin operations.

- Sign and date the form. The incorporators must sign to validate the document.

After completing the form, you will need to submit it to the North Dakota Secretary of State along with the required filing fee. Make sure to keep a copy for your records.

Dos and Don'ts

When filling out the North Dakota Articles of Incorporation form, consider the following guidelines:

- Do ensure that the name of the corporation is unique and complies with state requirements.

- Do provide a valid business address for the corporation.

- Do include the names and addresses of the initial directors.

- Do specify the purpose of the corporation clearly.

- Do sign the form in the appropriate section.

- Don't use abbreviations or informal names for the corporation.

- Don't forget to check for any additional requirements specific to your business type.

- Don't leave any required fields blank; all information must be complete.

- Don't submit the form without reviewing it for accuracy.

Document Example

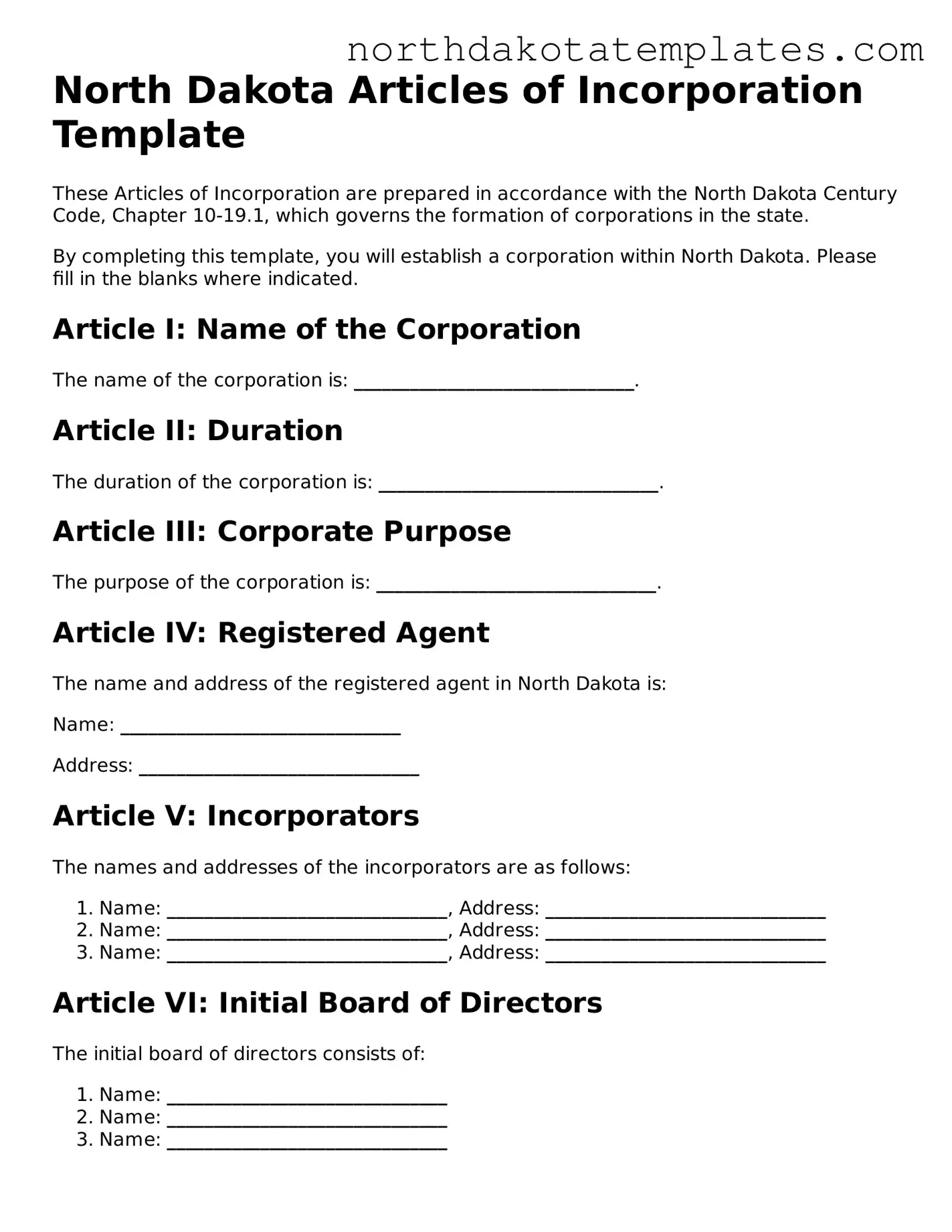

North Dakota Articles of Incorporation Template

These Articles of Incorporation are prepared in accordance with the North Dakota Century Code, Chapter 10-19.1, which governs the formation of corporations in the state.

By completing this template, you will establish a corporation within North Dakota. Please fill in the blanks where indicated.

Article I: Name of the Corporation

The name of the corporation is: ______________________________.

Article II: Duration

The duration of the corporation is: ______________________________.

Article III: Corporate Purpose

The purpose of the corporation is: ______________________________.

Article IV: Registered Agent

The name and address of the registered agent in North Dakota is:

Name: ______________________________

Address: ______________________________

Article V: Incorporators

The names and addresses of the incorporators are as follows:

- Name: ______________________________, Address: ______________________________

- Name: ______________________________, Address: ______________________________

- Name: ______________________________, Address: ______________________________

Article VI: Initial Board of Directors

The initial board of directors consists of:

- Name: ______________________________

- Name: ______________________________

- Name: ______________________________

Article VII: Stock Information

The total number of shares the corporation is authorized to issue is: ______________________________.

The par value of each share is: ______________________________.

Article VIII: Additional Provisions

Any other provisions the incorporators wish to include are as follows:

______________________________

Execution

These Articles of Incorporation were executed this ____ day of ____________, 20___.

Incorporator Signature: ______________________________

Incorporator Signature: ______________________________

Incorporator Signature: ______________________________

By using this template, you will have completed the foundational document necessary to create a corporation in North Dakota. Ensure that all information is accurate and complete before submission.

Document Specifics

| Fact Name | Details |

|---|---|

| Governing Law | The North Dakota Articles of Incorporation are governed by the North Dakota Century Code, Chapter 10-19.1. |

| Purpose | The form is used to officially create a corporation in North Dakota. |

| Filing Requirement | Filing the Articles of Incorporation is mandatory for all corporations in North Dakota. |

| Information Required | The form requires details such as the corporation's name, registered agent, and business purpose. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Incorporator | At least one incorporator must sign the Articles of Incorporation to validate the document. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation to the Secretary of State. |

| Effective Date | The corporation can specify an effective date for the Articles of Incorporation, which can be the filing date or a future date. |

Common mistakes

When filling out the North Dakota Articles of Incorporation form, many individuals encounter common pitfalls that can lead to delays or complications. One frequent mistake is failing to provide accurate information about the corporation's name. The name must be unique and not too similar to existing businesses. If the name is not available, the state may reject the application, forcing the applicant to start over.

Another common error is neglecting to include the correct registered agent information. The registered agent serves as the official point of contact for the corporation. If the agent's name or address is incorrect or incomplete, it can cause significant issues in receiving legal documents or official correspondence.

Many people also overlook the importance of specifying the purpose of the corporation. While it may seem straightforward, a vague or overly broad purpose can lead to confusion. The state requires a clear description of what the corporation will do. Failing to articulate this can result in additional scrutiny or rejection of the application.

Lastly, individuals often miscalculate the number of shares to be authorized. The Articles of Incorporation must state how many shares the corporation is authorized to issue. If this number is too low or inaccurately reflects the corporation's needs, it can limit future growth and investment opportunities. It's crucial to consider the long-term vision when determining this figure.

FAQ

What are the Articles of Incorporation in North Dakota?

The Articles of Incorporation are a legal document that establishes a corporation in North Dakota. This form outlines the basic information about the corporation, including its name, purpose, duration, and the number of shares it is authorized to issue. Filing this document with the Secretary of State is essential for creating a legally recognized corporation in the state.

How do I file the Articles of Incorporation in North Dakota?

To file the Articles of Incorporation, you need to complete the form provided by the North Dakota Secretary of State. You can find this form on their official website. After filling it out, submit it online or send a hard copy by mail along with the required filing fee. Ensure that all information is accurate to avoid delays in processing.

What information is required in the Articles of Incorporation?

The form requires several key pieces of information, including the corporation's name, the purpose of the corporation, the address of the registered office, the name and address of the incorporators, and details about the shares the corporation will issue. Providing complete and accurate information is crucial for the successful registration of your corporation.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in North Dakota typically ranges from $50 to $100, depending on the type of corporation you are forming. It's important to check the current fee schedule on the North Dakota Secretary of State's website, as fees may change.

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after they have been filed. To do this, you must prepare and file an amendment form with the Secretary of State. This amendment should include the specific changes you wish to make and may require a filing fee. Always ensure that any amendments comply with state laws.

How long does it take to process the Articles of Incorporation?

The processing time for the Articles of Incorporation can vary. Generally, it takes about 5 to 10 business days for the Secretary of State's office to process your filing. If you choose expedited service, you may receive a faster response, but this option usually comes with an additional fee.

Do I need a lawyer to file the Articles of Incorporation?

While it is not legally required to have a lawyer to file the Articles of Incorporation, consulting with one can be beneficial. A lawyer can help ensure that your form is filled out correctly and that you comply with all legal requirements. This can save you time and potential issues down the line.

What happens after I file the Articles of Incorporation?

Once your Articles of Incorporation are filed and approved, you will receive a certificate of incorporation from the Secretary of State. This document serves as proof that your corporation is officially recognized. After that, you can begin conducting business under your corporation’s name, but remember to adhere to ongoing compliance requirements, such as annual reports and tax filings.